Massive ASX mining stocks review: Major brokers update iron ore, copper, nickel, lithium and coal forecasts

It’s not often the major brokers conduct a sweeping review of multiple commodities and therefore their entire ASX commodity stocks coverage. But to have two of them do it on the same day is extraordinary, (and rubbing hands together) for me to snag them both is downright tantalising!

Macquarie’s “Commodities update: Hard Knock Li-Fe” and Morgan Stanley’s “Strategy Q3: Bulks over Base” are extremely interesting reading for Aussie commodities investors.

In each, the respective broker carefully outlines their rationales for changing outlooks on various commodities like iron ore, copper, nickel, aluminium, lithium, coal, and gold and how this will impact each ASX commodity stock within their respective coverage universes.

There are 208 pages of reports to get through, so I’ll break up their findings into a few articles by commodity. Today, let’s kick off with iron ore. Tomorrow, I’ll do Part 2 on base metals (so copper, nickel, aluminium and manganese), and then I’ll finish on Monday with Part 3 on uranium, lithium, gold, and coal.

Iron ore outlook

Macquarie

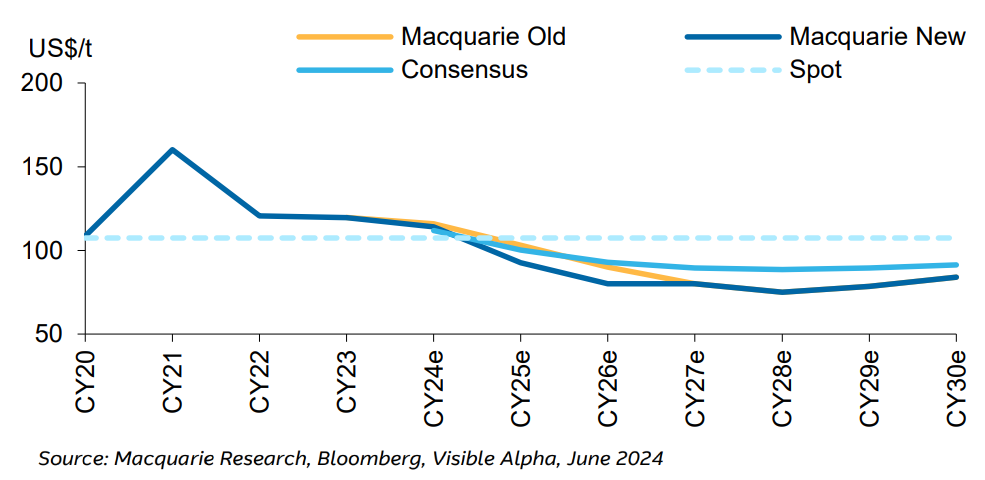

Macquarie’s Economics and Commodities Strategy Team has cut its price forecasts for iron ore by 1% in 2024, 10% in 2025, and 11% in 2026. Their rationale is based upon a double whammy of “stalling demand” against a longer-term backdrop of increasing supply.

In terms of demand, Macquarie’s view is one of “limited structural demand growth”. On the supply side, they noted that there are conflicting short and longer-term factors at play.

In the short term, “current prices arguably already reflect the extent of oversupply in 2024”. Macquarie says that as a result, their Commodities Strategy team “has recently moved to tactically bullish on iron ore in the near-term”.

In the longer term, Macquarie proposes new projects would add tonnes and “push the market into a surplus”. The main two projects the broker anticipates will have the greatest impact are Rio Tinto’s (ASX: RIO) Simandou project in West Africa (first production due next year), and Mineral Resources' (ASX: MIN) Onslow project (first production occurred last month).

Macquarie notes their 2025-2027 iron ore forecasts are now 8%, 14%, and 11% below consensus. Their long-term forecast of US$80/t is unchanged and is around 10-15% below consensus.

Contrasting this, and reflecting their short-term bullish view, their 2024 forecast of US$114/t for +2% above consensus and around 10% above the current iron ore price of US$103/t.

Morgan Stanley

Morgan Stanley also sees the potential for a near-term rebound in iron ore prices:

“Iron ore is soon to pass peak supply growth and the steel cycle typically turns after the summer, while China continues to ramp-up support for manufacturing and property – this could see prices rebounding into 4Q24”

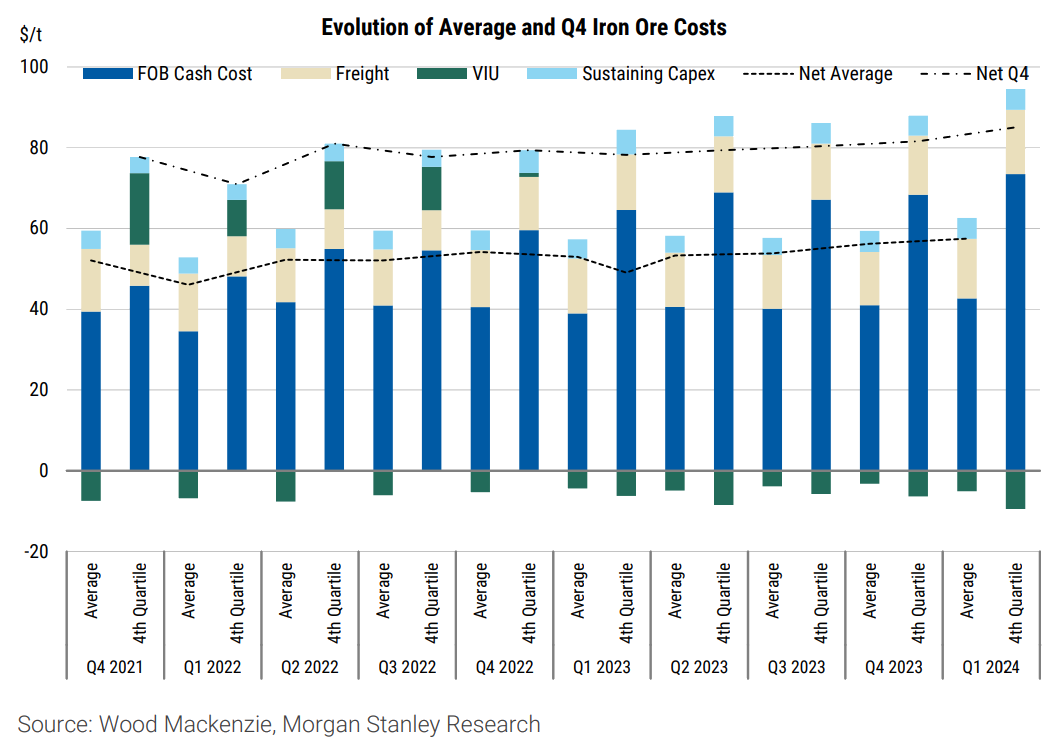

In terms of prices, the recent pullback puts the spot price “near cost support”. This will help keep prices “supported”, believes Morgan Stanley, and provide “scope for an upswing” to their end-of-year target of US$125/t.

Morgan Stanley cut their FY25 iron ore price target “slightly” by 1% to US$114/t and left their FY26 target unchanged at US$103/t.

ASX iron ore stock ratings and price target changes

Macquarie describes their overall view of ASX iron ore stocks as “underweight”. Morgan Stanely did not specify a sector view, but as you will see from their ratings and price targets below, they’re clearly more optimistic than Macquarie.

BHP Group (ASX: BHP)

Macquarie: NEUTRAL | Price Target: $43.00

Broker applies EPS cuts of 7%/9% across FY25/26 driven by “declines in our iron ore prices”

“We forecast little change in the outer years as our key commodity drivers are unchanged”

“BHP still preferred over RIO”

Morgan Stanley: EQUAL-WEIGHT | Price target: $46.65⬇️ vs $46.75

“Higher copper and iron ore price forecasts for the remainder of FY24 drive our FY24e EPS higher, whilst higher copper price forecasts for FY25 outweigh the impact of slightly weaker iron ore prices now forecast, causing our FY25e EPS to rise”

“While BHP has a relatively attractive commodity mix (iron ore, copper, met coal, nickel), resilient FCF and potential for shareholder returns, we see the stock as fairly valued at current price levels.”

Rio Tinto (ASX: RIO)

Macquarie: NEUTRAL | Price Target: $119.00⬇️ vs $123.00

Broker applies EPS cuts of 4%/15% across CY24/25 driven by “declines in our iron ore prices”

Compared to BHP: “RIO carries significantly higher jurisdictional risk, higher capital burden and a lack of differentiated growth driver (outside of the risky Simandou) to validate a premium”

Morgan Stanley: OVERWEIGHT | Price target: $142.00⬆️ vs $137.50

“With little change to our CY24-26 iron ore price forecasts, higher copper price forecasts for CY24-26 drive up our CY24-26e EPS.”

“The company maintains a robust balance sheet, giving flexibility to pursue growth and/or increase cash shareholder returns.”

Fortescue (ASX: FMG)

Macquarie: UNDERPERFORM | Price Target: $12.50⬇️ vs $13.50

Broker applies EPS cuts of 15%/28% across FY25/26

“FMG’s earnings have a heightened sensitivity to iron ore given its higher break-even cost than major peers and low-grade exposure”

[with respect to earnings multiples] “FMG is trading at parity with BHP, which given its higher operational leverage and lack of diversification, represents an overhang.”

Morgan Stanley: UNDERWEIGHT | Price target: $18.70⬇️ vs $18.85

“Slightly higher 4QFY24 iron ore forecasts increase FY24e EPS, while a slightly lower forecast for the FY25e iron ore price drives down FY25e EPS”

“We expect elevated Chinese steel mill margins and low-grade iron ore discounts to persist in the long term. This, together with heavy investments in growth and decarbonisation initiatives should lead to FCF yields dropping.”

Mineral Resources (ASX: MIN)

Macquarie: NEUTRAL⬇️ vs OUTPERFORM | Price Target: $62.00⬇️ vs $75.00

“We downgrade to Neutral on our materially lower earnings outlook, but still remain confident in the company's long run prospects given its tier one Wodgina and services business and its emerging position as a lower cost iron ore producer”

Broker applies EPS cuts of 96%/55% across FY25/26 driven by “hit with lithium and iron ore price cuts at the same time…its higher leveraged balance sheet makes it more sensitive to commodity price declines” and “We have also removed Yilgarn from our earnings”

Morgan Stanley: OVERWEIGHT | Price target: $79.00⬇️ vs $85.50

“Lower Li price forecasts more than outweigh higher iron ore price forecasts for the remainder of FY24, driving down our FY24e EPS. For FY25, slightly (~1%) lower iron ore price forecasts in FY25, combined with lower Li price forecasts, drive our FY25e EPS lower”

“We like MIN's commodity mix, with an improving backdrop for iron ore and lithium likely to benefit the company, especially as the Ashburton iron ore project begins to ramp.”

Champion Iron (ASX: CIA)

Macquarie: OUTPERFORM | Price Target: $7.50⬇️ vs $7.90

We continue to like CIA, despite earnings cuts, driven by high-grade iron ore price differentiation

Deterra Royalties (ASX: DRR)

Macquarie: NEUTRAL | Price Target: $4.00⬇️ vs $4.50

Cites downgraded outlook for iron ore in the medium term which has driven downgrade to DRR’s EPS

Morgan Stanley: UNDERWEIGHT⬇️ vs OVERWEIGHT | Price target: $3.70⬇️ vs $5.60

“We move DRR to EW (from OW) on valuation grounds and after taking into account the recent proposed acquisition of Trident Royalties”

“Higher iron ore prices now forecast for the remainder of FY24 lift our FY24e EPS, whilst slightly weaker FY25 iron ore price forecasts push down our FY25e EPS.”

Mount Gibson Iron (ASX: MGX)

Macquarie: OUTPERFORM | Price Target: $0.50

Cites downgraded outlook for iron ore in the medium term which has driven downgrade to MGX’s EPS

“MGX should generate strong FCF”

This article first appeared on Market Index on Monday 24 June 2024.

5 topics

7 stocks mentioned