Maximise your winners (and 2 ASX 300 examples that show you how)

Here's a pop quiz for you. What do Dicker Data (ASX: DDR) and Jumbo Interactive (ASX: JIN) have in common?

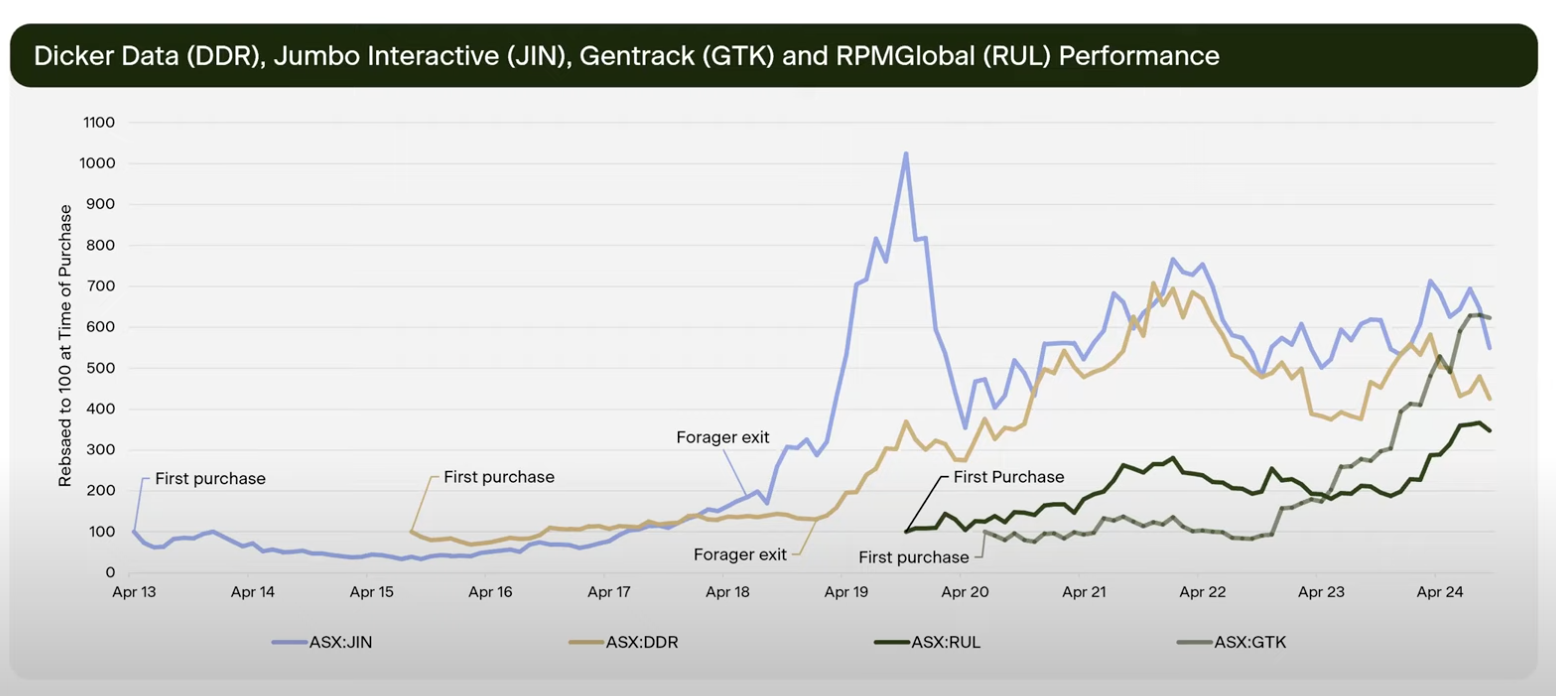

At first, I didn't know either. Until Steve Johnson, Chief Investment Officer and Founder at Forager Funds Management told his audience of investors at the team's recent September quarter webinar: They are both stocks that Forager should have held onto for a lot longer.

JIN was an even more costly exit. They left with a 200% gain but could have had an eight-fold return. Both Dicker Data and Jumbo Interactive also eventually found their way into the ASX 300 - but without Forager Funds Management invested in them. It's a mistake Johnson is determined not to make again.

"We are very cognisant that when we get things right, we need to make more money out of them," Johnson admitted.

And that, in large part, explains why the team haven't sold all of their stakes in software companies RPMGlobal (ASX: RUL) or Gentrack (ASX: GTK) "despite them being up multiples of our initial purchase price." Both have also recently been added to the ASX 300.

In this wire, we'll uncover some more insights from the Forager team, including those from Johnson's colleagues Alex Shevelev and Harvey Migotti.

What the team has done with these winners

Gentrack used to be a business that was earmarked as "too hard" for most investors:

"We were having a look at this business when it had had multiple earnings downgrades. No one really wanted to have anything to do with it," Shevelev, Portfolio Manager of the Forager Australian Shares Fund said.

But now that the business has turned around:

"There's a lot more investor attention, there's a lot more liquidity, and a lot more sell-side coverage," he added.

The share price is up sixfold over the past few years. “We are largely out of that position by this point," Shevelev added. But Forager investors have captured significantly more of the upside.

RPM Global is up fourfold over the past six years but Forager still owns the stock.

Johnson contrasted the technology stocks with the Australian Fund’s investments in the mining services space (Perenti Global (ASX: PRN) and Macmahon Holdings ASX: MAH)).

"They've [PRN and MAH] both turned their minds to generating free cash [flow]... Once you start to temper CAPEX spending expectations, you really can pump out a lot of free cash flow, especially given the valuations involved here," Shevelev noted.

If you add the current and previous financial years together, Shevelev says Perenti should generate “over a third of its [value] in free cashflow”. But it is important to recognise that, unlike RPMGlobal and Gentrack, these are not businesses other investors will ever get too excited about (and for good reason.)

In a quarter where the Forager Australian Shares Fund returned a healthy 6%, Johnson is turning his mind to better managing the next market downturn.

"We want to position ourselves to better take advantage of the next market downturn when it comes along," Johnson said.

"That stock sold off heavily around this time last year, to a point where it was meeting our lower return hurdles to buy those better quality businesses, and giving us an opportunity to add Resmed to the portfolio," he said. While the Forager team recognises they can add the most value at the small end of the market, these larger, better-quality businesses can play an important role in the portfolio, particularly in more buoyant markets.

This principle also applies to overseas investments

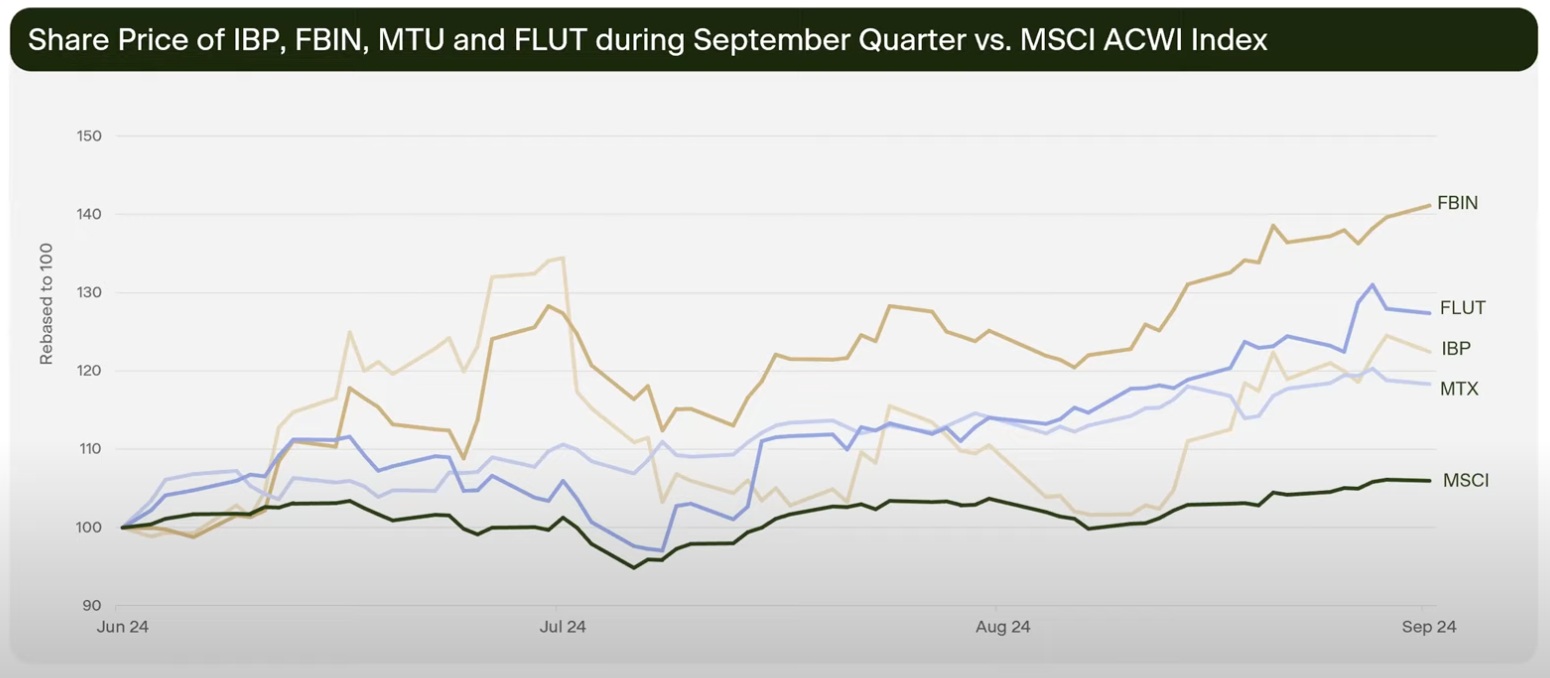

"They're doing what they're designed to do - grind higher and compound. Most of these are relatively resilient businesses that we bought during market selloffs," says Harvey Migotti, Portfolio Manager of the Forager International Shares Fund.

"We have taken some profits in certain cases, but they continue to be decent chunks of our portfolio and exposure and we're always going to have that quality compounder basket in some shape or form," Migotti added.

Those quality compounders have performed well, but where is Migotti finding the next year’s best performers? The land of the rising sun.

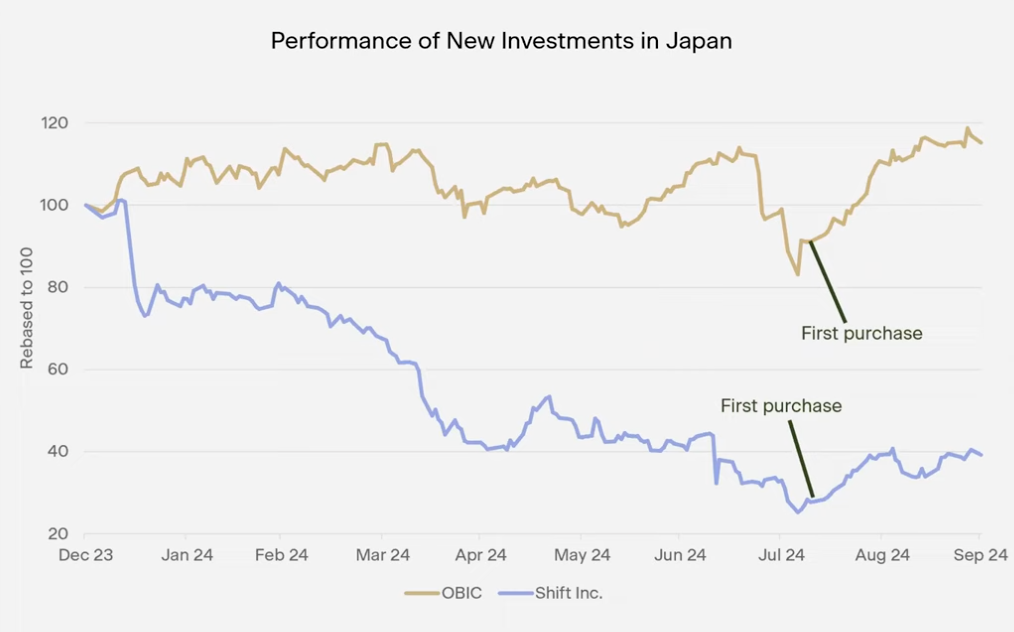

"I don't think it's a massively out-of-consensus call. A lot of people have been talking about Japan more over the past 12, 18, and 24 months. But we've identified some really exciting themes here," Migotti said, adding that one of those is digitisation.

"Cloud spending in Japan is only 10% of total IT spending. That number is 37% around the world. Cashless payments in Japan are only 40%. They're closer to 60%+ or even 80% in some cases in many other countries. The same thing with online purchases, digital shopping, etc. So that's all happening and it's happening very fast," he added.

Two such stocks they are looking at with this theme in mind are Shift Inc. and OBIC Business Consultants. Both have done well since they were first bought in August.

But it's not all been sunshine and roses

The Australian Fund’s investment in Bigtincan Holdings (ASX: BTH) is an example of this:

"In this case, [BTH’s revenue] turned out to be less sticky and recurring than we had initially envisaged," Shevelev said.

A year ago, the share price was 90 cents. With the share price languishing at 12 cents until recently, it has become the subject of two takeover offers - one is a private equity takeover bid where the value is just 20 cents per share and the other is an offer in shares from an investment vehicle already listed on the Nasdaq in the US. The Forager team openly admitted on the webinar that they prefer the first of these two options.

Another company making headlines is Tyro Payments (ASX: TYR). The company is in the middle of a political stoush concerning how people pay for their credit card transactions. But despite the headlines, Shevelev and the team are holding on:

"Tyro is a much broader payments terminal business than just that. We think it's a small part of their business and it can be absorbed in other parts of their business," he said.

While Tyro’s share price is down 30% over the past few months, the Forager team think it can be one of those businesses held in much higher regard a few years down the track.

If you want to catch the entire webinar, you can click here:

3 topics

9 stocks mentioned

1 fund mentioned

2 contributors mentioned