Maximum relative drawdown in fund selection

Introduction

Fund selection is challenging because the amount of data available for performance measurement is small compared to the noise associated with taking risky bets. Even if an investment manager has skill and can earn above-benchmark returns in 60 per cent of years, there is still only a one-in-three chance this happens two years in a row. This makes consideration of multiple quantitative dimensions important for fund selection. I consider recent evidence on alpha and maximum relative drawdown as an indicator of subsequent fund performance. The evidence suggests that consideration of these metrics in tandem can improve the odds of selecting a future high performing fund.

Measurement of maximum relative drawdown

Evidence from the United States suggests that investors should consider alpha and maximum relative drawdown in selecting equity funds. Alpha is risk-adjusted returns over a window of time (24 months in the research paper). Maximum relative drawdown is the worst trailing performance on a rolling basis relative to benchmark within a window of time (12 months in the research paper). The average maximum relative drawdown for funds in the bottom quintile was 5.5 per cent (where “bottom quintile” is the lowest 20 per cent of maximum relative drawdown from within each alpha quintile).

Recent research on U.S. equity funds, published by the CFA Institute, says that in selecting an investment fund, investors should consider two measures of past returns: Alpha and maximum relative drawdown (or simply “drawdown” from this point onwards).[i]

- Alpha. Alpha is risk-adjusted return, which in the simplest measurement is returns relative to benchmark, but which can be measured in more sophisticated ways. The researchers account for risk factors proxied by funds’ exposure to market returns, the relative performance of small market capitalisation stocks versus big market capitalisation stocks, the relative performance of high versus low book-to-market stocks (often referred to as value versus growth stocks), and the relative performance of stocks with high versus low price momentum (measured using returns over 11 prior months).[ii] The researchers measured alpha on a rolling 24-month basis.

- Maximum relative drawdown. Maximum relative drawdown is the worst portfolio returns relative to benchmark within a prior period. It is a measure of risk that places 100 per cent reliance on the worst risk-adjusted outcome in a given timeframe, and can be contrasted with volatility and tracking error, both of which consider all return outcomes in a given timeframe. The reason to consider drawdown in fund selection is that it highlights investment funds that could well generate positive alpha in the majority of future scenarios, but expose the investor to large below-benchmark performance in a handful of cases.

The researchers evaluated around 2,200 U.S. equity mutual funds on a monthly basis over 21 years ending in 2019. They compute style-adjusted drawdown over rolling 12-month periods for each fund, examples of style being income and growth. Style-adjusted drawdown in the paper means the worst of 12 possible trailing annual returns versus a style-adjusted benchmark in the prior 12 months. For some funds, this will actually be a positive return because in all 12 overlapping periods the fund earned returns above its style-adjusted benchmark.

On average, funds in the bottom 20 per cent of drawdown had drawdown of -5.5 per cent while funds in the top 20 per cent of drawdown had drawdown of +4.6 per cent.[iii] High drawdown funds are more volatile than low drawdown funds (average standard deviation of 22 per cent versus 17 per cent), have higher turnover (average annual turnover of 94 per cent versus 62 per cent) and higher fees (average expense ratio of 1.3 per cent versus 1.2 per cent). On average, alpha is -0.9 per cent for the full sample, –2.5 per cent for high drawdown funds and +0.8 per cent for low drawdown funds.

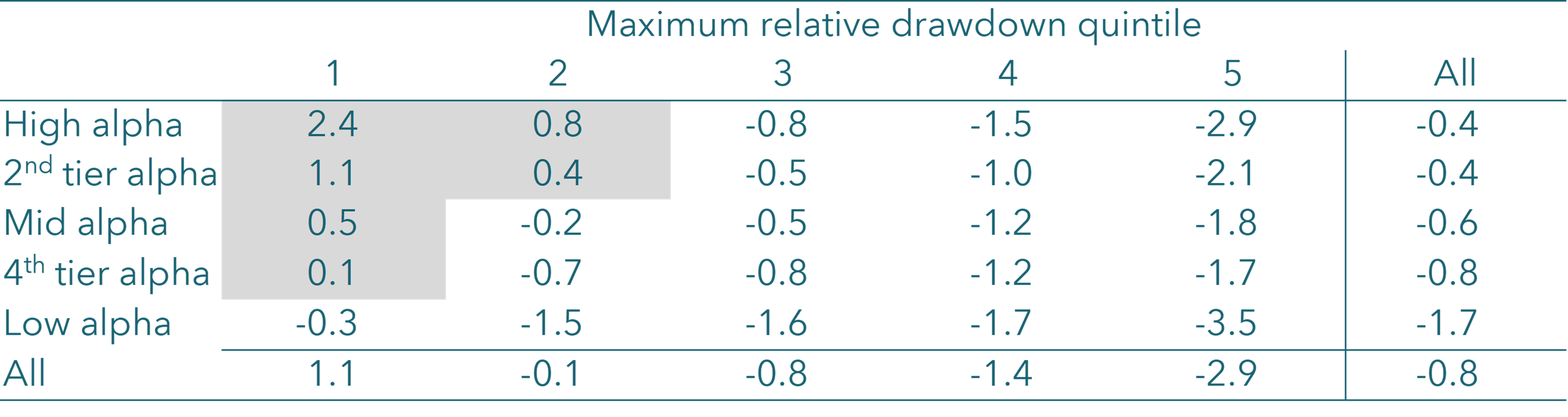

What is the risk and return performance of mutual funds in the year after alpha and drawdown are measured?

Selection of funds just on alpha did not lead to future above-benchmark performance. The top 20 per cent of funds selected purely on alpha earned subsequent alpha of -0.4 per cent on average. But selecting funds with the lowest drawdown within this high return cohort generated subsequent alpha of +2.4 per cent.

Each month the researchers split the sample into 25 cohorts according to alpha measured over the prior two years and then according to drawdown over the prior 12 months. Then they measured the average alpha next month on an annualised basis (Table 1). On average, stocks in the top 20 per cent according to alpha and the bottom 20 per cent according to drawdown earned annual alpha of +2.4 per cent. At the other extreme, stocks in the bottom 20 per cent according to alpha and the top 20 per cent according to drawdown earned annual alpha of ‑3.5 per cent. Investors are unlikely to actually capture returns of this magnitude, either up or down, because investors do not reallocate their wealth every month to a new basket of funds on the basis of past performance. But it does suggest that alpha and drawdown are both metrics that should be considered in fund selection.

In contrast, suppose that investors consider using just alpha in fund selection. The annual alpha from selecting the best 20 per cent of funds according to prior alpha is -0.4 per cent (compared to +2.4 per cent from consideration of alpha and drawdown). This means that using alpha alone, measured over the prior two years, does not lead to selecting a fund that generates positive alpha in a subsequent period. The alpha from selecting the worst 20 per cent of funds according to prior alpha is ‑1.7 per cent (compared to ‑3.5 per cent from consideration of alpha and drawdown). Fund alphas are only positive if the drawdown is in the best 40 per cent and alpha is in the top 40 per cent; or if drawdown is in the best 20 per cent and alpha is in the best 80 per cent.

Recent performance of funds holding Australian equities

We conducted a practical application of the U.S. research for 695 existing funds holding Australian equities. On a monthly basis over 20 years we split the sample into high, medium and low alpha funds on the basis of two-year returns, and within these alpha groups into another three brackets according to maximum relative drawdown. An equal-weighted portfolio of funds in the top alpha cohort and lowest maximum relative drawdown cohort would have earned a return 0.9 per cent above benchmark. In contrast, holding high alpha funds with high maximum relative drawdown would have earned a return 0.7 per cent below benchmark. Further, the probability that a fund with high prior alpha and low maximum relative drawdown generates high alpha in a subsequent two-year period is 44 per cent, versus 40 per cent for high alpha/high drawdown funds. Drawdown did not assist in fund selection for low alpha funds. The implication is that maximum relative drawdown is useful for selection amongst funds with high past returns.

Practical application to Australian equities funds

We measured alpha and drawdown for 695 funds holding Australian equities on a monthly basis over 20 years ending August 2024, for funds where Lipper Global reported the sector to be Equity Australia. Our benchmark was the Vanguard Australia Share Index ETF (VAS), which replicates the S&P/ASX 300, the most common benchmark used by the funds themselves. Our definition of alpha is simply the difference between fund returns and benchmark returns on an annual basis measured over the prior 24 months. Our definition of maximum relative drawdown is the lowest difference between fund returns and benchmark returns on a 12 month basis for each of the prior 12 months. We also compiled next month’s fund return and relative return versus the benchmark for 20 years ending September 2024. We measured whether selecting funds on the basis of drawdown and alpha was associated with higher average relative returns in the following month.

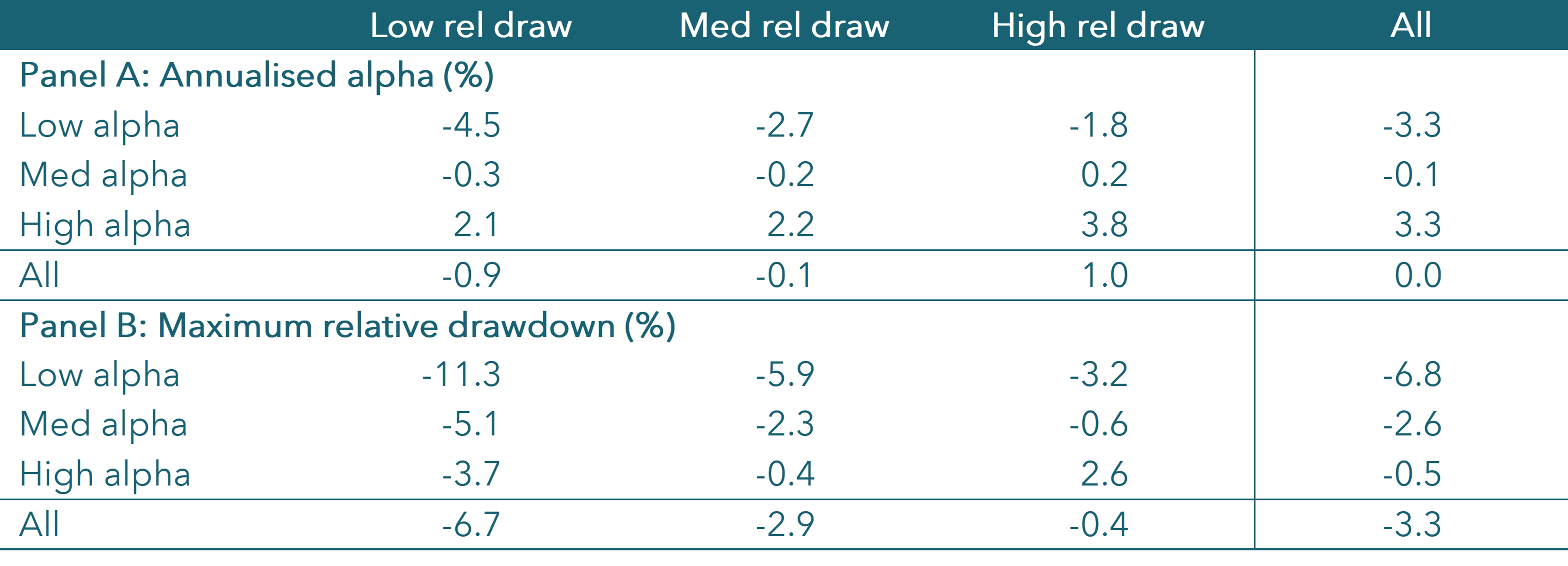

Each month we split the sample into thirds according to whether fund alpha was in the bottom, middle or top third. Then, from within each alpha bracket we split each sub-sample into thirds according to the fund’s drawdown (Table 2).

- On average, each of the nine cohorts comprises 52 funds. An equal-weighted allocation to all funds each month would have earned an annualised pre-tax return of 8.4 per cent, equal to the benchmark return.

- Average alpha in any given month is ‑3.3 per cent for funds in the lower third, ‑0.1 per cent for funds in the middle and +3.3 per cent for funds in the top third.

- Average drawdown in any given month is ‑6.7 per cent for funds in the bottom third, -2.9 per cent for funds in the middle and ‑0.4 per cent for funds in the top third. Of course, drawdown is lower than alpha because drawdown considers the worst outcome within a prior window compared to an average outcome.

Does alpha and drawdown have an association with subsequent returns?

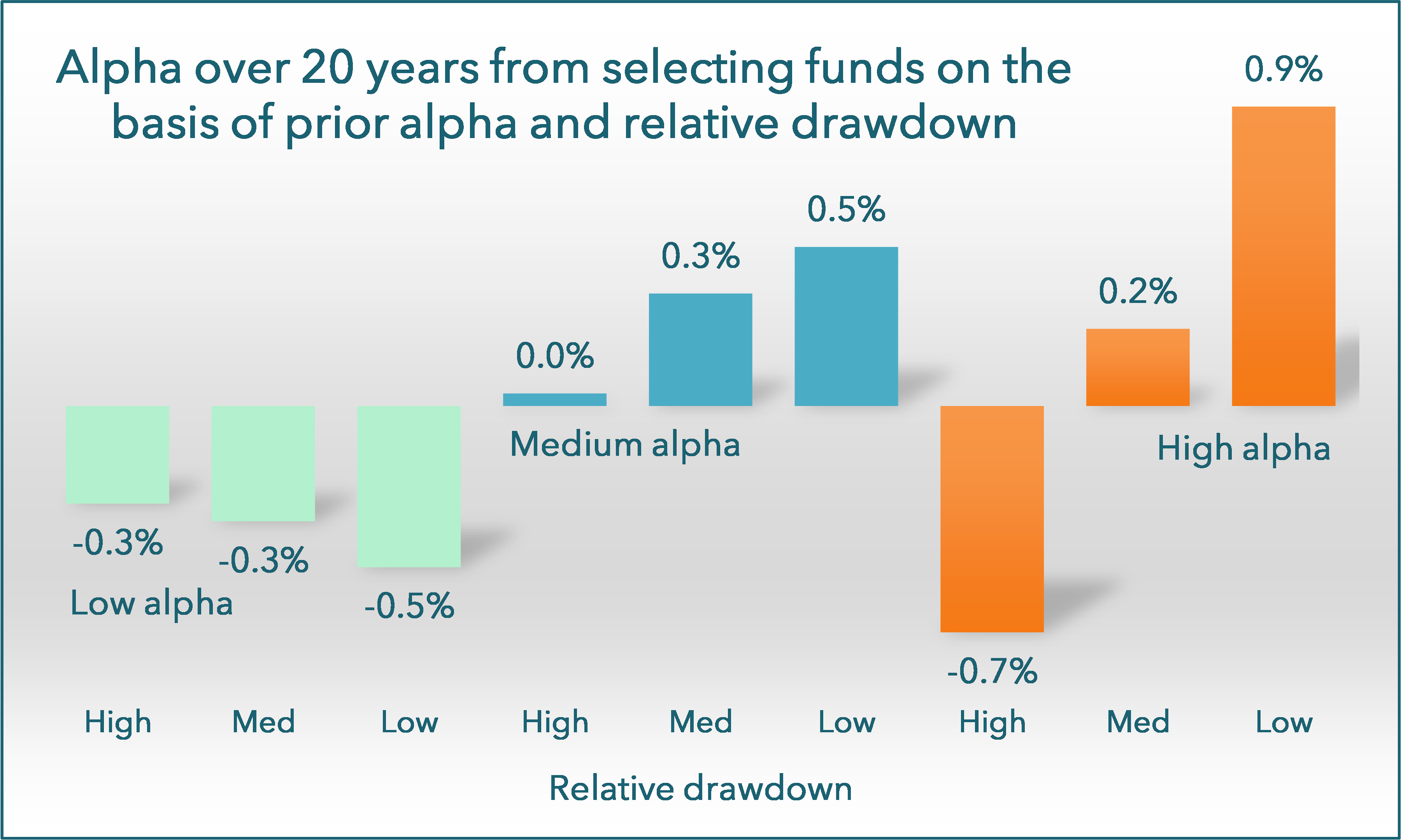

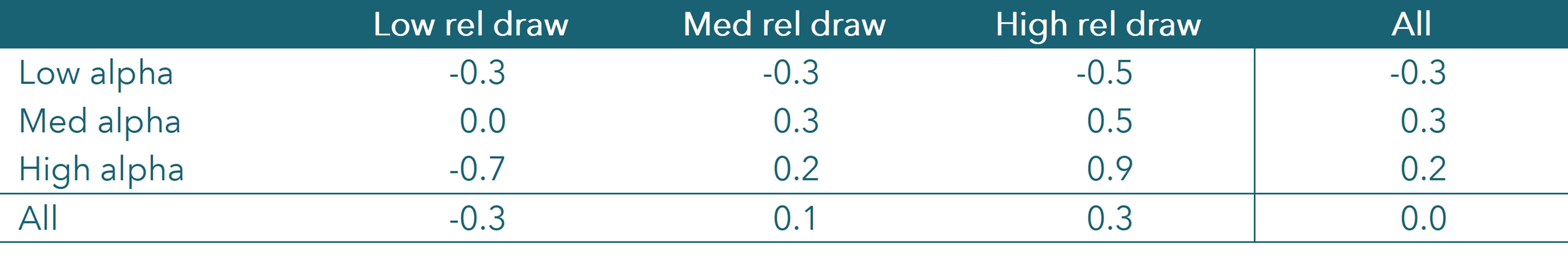

Consistent with the U.S. evidence, there is some ability to identify future high return funds on the basis of alpha and drawdown (Figure 1, Table 3). We compiled annual returns relative to benchmark over 20 years for equal-weighted portfolios of funds formed on the basis of alpha and drawdown, rebalanced monthly. The sub-set of funds exhibiting both high alpha and low drawdown would have earned returns 0.9 per cent above benchmark. In contrast, selection of high alpha funds with high drawdown would have earned returns 0.7 per cent below benchmark. The same relationship between drawdown and returns is observed for medium alpha funds: low drawdown funds had annual returns 0.5 per cent above benchmark, compared to returns equal to benchmark for low drawdown funds. This medium alpha cohort includes funds that are both index funds and active funds with low active share. For low alpha funds, consideration of drawdown does not help in fund selection. Low alpha funds with low drawdown likely take on low active share, meaning there is just not enough exposure to risk to have a meaningful chance of outperforming the benchmark in a subsequent period. This is consistent with prior evidence on the positive relationship between active share and returns.[iv] The relative returns shown in Figure 1 are based upon monthly reallocation of investment funds, which is likely to be much more frequent than occurs in practice. But it does show the returns potential from two easily quantifiable metrics.

This result can be contrasted with simple fund selection on the basis of alpha. An equal-weighted portfolio of funds in the top third according to alpha would have earned an annual return of 0.2 per cent above benchmark versus 0.3 per cent below benchmark if funds in the bottom third were selected. Had only drawdown been used in fund selection, the annual returns relative to benchmark would have been +0.3 per cent for low drawdown funds and ‑0.3 per cent for high drawdown funds.

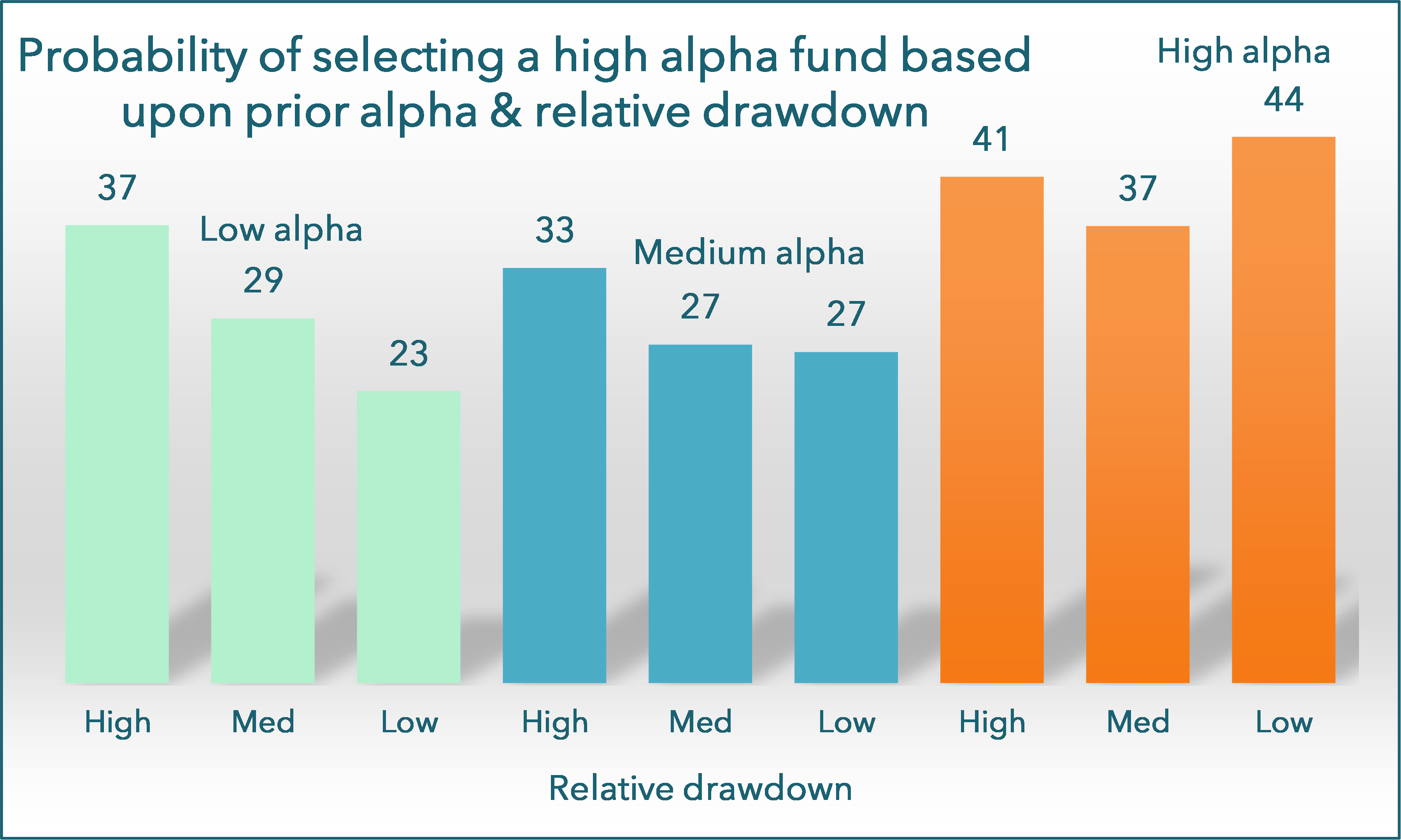

Another metric of fund selection outcomes is the probability of selecting a high performing fund on the basis of past performance. We measured the proportion of funds achieving alpha in the top third in the next two years, based upon consideration of alpha and drawdown (Figure 2). For funds with high alpha and low drawdown, there is a 44 per cent chance the fund generates alpha in the top third over the next two years. The proportion would have been 40 per cent if just alpha had been used in fund selection (not shown in the chart). Selecting low drawdown funds did not help in fund selection for low and medium alpha funds.

Conclusion

Research from the U.S. and our own analysis of Australian equities funds suggests that maximum relative drawdown generates useful information for fund selection amongst high alpha funds. For funds holding Australian equities, selection of low drawdown funds from within high performing funds could generate an annual average return above benchmark of 0.9 per cent. In contrast, amongst high alpha funds, selection of the high drawdown bracket would have led to average annual returns 0.7 per cent below benchmark. Fund selection would not normally happen with monthly frequency. But the evidence does suggest that consideration of drawdown amongst high alpha funds is a relevant metric for fund selection.

References

Carhart, M., 1997. On persistence in mutual fund performance, Journal of Finance, 52, 57–82.

Cremers, K.J.M., 2017. Active share and the three pillars of active management: Skill, conviction, and opportunity, Financial Analysts Journal, 73, 61-79.

Cremers, K.J.M., J.A. Fulkerson and T.B. Riley, 2022. Active share and the predictability of the performance of separate accounts, Financial Analysts Journal, 78, 39-57.

Cremers, K.J.M., and Petajisto, A., 2009. How active is your fund manager? A new measure that predicts performance, Review of Financial Studies, 22, 3329–3365.

Fama, E., and K. French, 1993. Common risk factors in the returns on stocks and bonds, Journal of Financial Economics, 33, 3–56

Riley, T., and Q. Yan, 2022. Mutual fund drawdowns as predictor of mutual fund performance and flows, Financial Analysts Journal, 78, 69-76.

[i] Riley and Yan (2022)

[ii] Fama and French (1993), Carhart (1997).

5 topics