Meet Bryce: The podcaster who has been investing since he was 13

Bryce Leske made his name as the co-host and co-founder of Equity Mates, an investing podcast for millennials, but his investment journey started long before he sat down in front of the mic.

When he was just four years old, his parents started teaching him about the importance of money - with $1.50 in pocket money every fortnight split into three buckets for saving, spending and investing.

By the time he was 13, he had enough to buy into the IPO of Brickworks Investment (ASX: BKI). And the rest is history.

While his Dad initially encouraged him to invest in ETFs and LICs, Bryce - as a bright-eyed and bushy-tailed university student, thought he could do better chasing the next big growth stock.

He had some successes along the way - like Afterpay, which he rode from $2.50, as well as some painful calls. However, it's often an investor's worst positions that will truly teach them something - which is the case for Bryce.

"I ended up with a portfolio of random, small positions, that really didn’t eventuate too much. Over the course of interviewing 450+ experts on Equity Mates Investing, I’ve come to realise that the best strategy for me is the core and satellite approach," Bryce says.

In this Meet the Investor profile, Bryce outlines how his strategy has developed over the past 20 years, his top five positions and why he holds them, as well as the big plans he has for helping educate the next generation of Australian investors.

Investor Profile

- Name: Bryce Leske

- Job: Co-founder Equity Mates Media

- Age: 33

- Years spent investing: Around 20 years

- Biggest investment: Equity Mates Media (and then ETFs)

- Guilty reading or viewing pleasure: I love watching people renovate old chateaus, cabins, and huts in remote areas, like the Italian mountains, Canadian forests etc. There’s something about the process and building things with your hands that I find appealing.

Can you share how you started investing and what your first investment was?

When I was in kindergarten, my parents gave me $1.50 in pocket money every fortnight. It was to be split into three buckets - saving, spending and investing. Once the ‘investing’ bucket reached $500 (which was when I was in year 6) we took that and bought into the IPO for Brickworks Investment (ASX: BKI). ETFs weren’t nearly as popular/prevalent as they are now, so Dad was trying to teach me about diversification through LICs.

How would you describe your strategy and your investment goals?

My investment goal is to grow a portfolio that gives me optionality later in life, whereby I have the financial freedom to pursue interests without feeling like I need a pay cheque from someone to support it.

Once I hit university years, my strategy moved away from the wise words of my Dad, who encouraged me to just keep investing in diversified ETFs and LICs and I started chasing individual stocks and 10-baggers.

I had some success, however, all in all, I ended up with a portfolio of random, small positions, that really didn’t eventuate too much.

Over the course of interviewing 450+ experts on Equity Mates Investing, I’ve come to realise that the best strategy for me is the core and satellite approach - 60-80% of my portfolio is in index funds, and then I’ve got a concentrated satellite portfolio of individual stocks and some thematic ETFs. I dollar-cost-average into the core portfolio every month.

This strategy works for me because it means I’m always invested and I can focus time and energy on growing Equity Mates. Understanding that the long-term average market returns are more than enough for most people and that most active managers struggle to beat the market over the long term has helped solidify this approach.

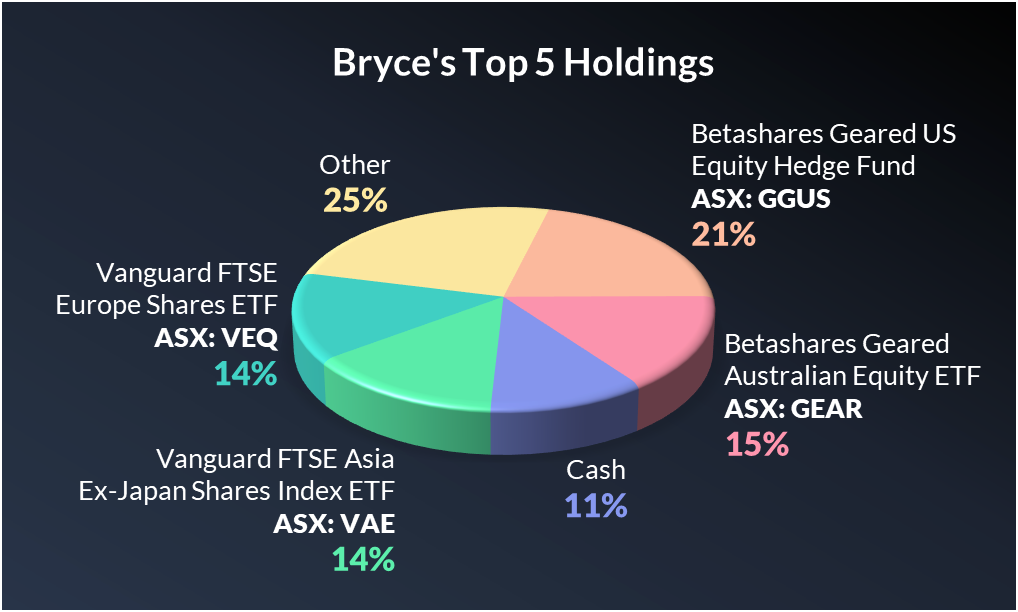

Can you share your top 5 holdings in % terms and why you hold these positions?

While not a listed investment, it’s worth recognising my biggest investment is in Equity Mates Media. If that doesn’t count then:

2. Betashares Geared Australian Equity ETF (ASX: GEAR) - 15% - Similarly, it’s my core exposure to the Australian market, and I like the leverage within the product.

3. Vanguard FTSE Asia Ex-Japan Shares Index ETF (ASX: VAE): 14% - core exposure to Asia.

4. Vanguard FTSE Europe Shares ETF (ASX: VEQ): 14% - core exposure to the UK and Europe.

5. Cash - 11% - I have been in the process of consolidating positions in the portfolio, and have cash sitting in the trading account to be deployed again.

.png)

What investment is on your watchlist? (i.e you don’t currently own it)

I’m currently interested in getting some exposure to private equity. It is a challenge though for retail investors, given the minimums required to access some of the funds. I’m looking at some of the big listed players overseas, but also speaking with a number of managers here in Australia who are bringing new products to market that are semi-liquid and/or have lower minimums.

What has been your worst investment and what has been your best?

My worst investment in percentage terms was a ‘hot tip’ I got - Voltaic Strategic Resources (ASX: VSR). I did no research, paid no attention to it, and lost 86%. Lesson learnt.

My best was Afterpay - we spoke about it on the show in 2017 when it was about $2.50 and I got on the rollercoaster not long after that. For the most part, I held it through until the acquisition by Block (ASX: SQ2).

Are there any lessons you’ve learnt during this journey that could help others?

Of those hundreds of interviews, there are two podcasts that stand out to me. The first is an interview with Emma Fisher. It was such an inspiring interview. Among many great things, she spoke about not needing a degree to get started and her passion really carried through - I remember leaving feeling really inspired about the potential of markets, and how possible it was.

For me, one of the biggest takeaways and lessons for young people is that you don’t need a degree or experience in finance to be an investor and that the market average is more than enough.

You don’t need to beat the market. The average market return is more than enough over the long term to build wealth for 99% of people. Sure, it would be nice to beat the market consistently, but it’s not necessary to build a portfolio that will provide you with a comfortable future. And with the level of information and technology available these days, you don’t need a degree to be able to do it.

Can you share a personal passion or ambition you have for the future?

Only 1 in 10 Australians get financial advice and Australia’s level of financial literacy is going backwards, and more and more young people are feeling despair about their financial position. There’s a sense that the current system is failing them, particularly in capital cities when the cost of housing is out of control.

Want to share your story like Bryce?

Livewire is looking for investors who would like to share their stories and investment journeys with our audience. If you are interested, head over to this link and let us know.

4 topics

7 stocks mentioned

4 funds mentioned