Meet Felicity: The adviser with steady hands and a stomach for volatility

Felicity had a plan. She would study Property Economics at university, find her feet in property development, and eventually, take over the family business.

But a graduate role at BT would lead her astray, convincing Felicity that a career in financial advice could provide her with a purpose - helping Australians build their nest eggs and shape their relationship with money. And eight years later, Felicity is hooked.

She launched her own finance-focused podcast, Talk Money To Me, in September last year, and runs her own business under the Shaw and Partners' umbrella alongside two other talented women.

And while she employs a disciplined approach to portfolio management for her clients - always using "core" and "satellite" managed funds, stocks and ETFs - she admits, with her own portfolio, she chooses to take a different tack.

"I am a high-risk high-return investor with a long time horizon and a stomach to handle extreme volatility. I like to build up key positions over time and find the next exciting company that will change the way we do things," Felicity says.

In this Meet the Adviser profile, Felicity shares five of her favourite funds for clients' portfolios, as well as the small and micro-cap stocks that have piqued her interest. She also discusses some of the conversations she is having with clients right now, as well as some of her personal ambitions for the future.

Financial adviser profile

- Name: Felicity Thomas

- Age: 32

- Current firm: Shaw and Partners

- Years working as an adviser: 8 years

- Investment goals: Continue to build on my existing positions and continue to diversify across asset classes and sectors. I would like to get to a stage where I don’t have to work but I choose to work because I truly enjoy what I do. Ideally investing and advising more in the VC space in companies that are game-changers.

- Products used: I am mostly in the direct equity space with a few fund managers and ETF providers that I really like. I primarily invest for clients via Chess/Praemium/Hub24. I also really like Investment Bonds as a tax-effective vehicle for early retirement and a tax-effective way to invest for children I do this via Generation Life.

- Biggest portfolio holding: Looking at my overall portfolio, my largest holding is my main residence. I know a lot of people don’t look at it as a part of their portfolio, but it’s one of the best investments as its CGT free when you do decide to sell! This is closely followed by what is now an investment property (and was my first home). After that, it would be a holding in an unlisted company called Alta and then the ASX listed Weebit (ASX: WBT). As for my clients, the largest portfolio holdings are Apple (NASDAQ: AAPL) and Dominos (ASX: DMP).

Why did you choose this profession and how did you get started as a financial adviser?

This is an interesting question. I actually started out by completing a bachelor's degree in Property Economics in the hope of following in my family's footsteps and becoming a property developer. I planned to take over their business one day (not sure if mum and dad realised this was the end goal).

After graduating, I applied for a job at BT Financial Group and worked in investments and superannuation. Here, I realised that a lot of Australians need help with their finances and retirement planning and that I could actually help make a difference to people's lives through financial advice.

Growing up, my family had and still has a very open relationship with money, so I learnt a lot from my parents. From my experience, a lot of families aren’t open about money, so children aren’t taught basic principles from a young age. And, of course, we don’t learn what I like to call “real life math” in school either!

I went on to complete a graduate certificate in applied finance and a diploma in financial planning and started a role at BT as a financial adviser whilst completing my master’s in financial planning. Fun fact… I was actually the first person to graduate with a master’s in financial planning from Kaplan and gave a speech at our graduation.

What do you believe makes you different to other advisers in the industry?

I believe that my business partner and I have a true holistic advice offering. We are an all-female team consisting of myself, Candice Bourke and Harsha Saini, who all play an integral part in growing, preserving and protecting the wealth of our clients.

We run our own business, CFT Asset Management Pty Ltd, partnering with Shaw and Partners to provide the best advice outcome for our clients. Our team predominately looks after HNW families, not-for-profits, and professional women.

We look after our families’ wealth, so we treat our clients like family - with honesty. We pride ourselves on transparency and always put our clients' goals and objectives first. I believe that diversification is key, not only in asset class but also in thought, so we like to incorporate managed funds and ETFs in our portfolios.

As an adviser, you do find yourself holding clients’ hands through volatile times and reassuring them that they are on the right track and don’t need to change course. Understanding behavioural finance has been my best friend here!

We believe all problems can be solved by thinking outside the box and exploring all avenues. I like to think of myself as a problem solver - that I can find a solution to my clients’ problems and help them develop a clear strategy moving forward.

Can you share a bit about your process for building portfolios and selecting investment products?

I like to invest using a “core” and “satellite” approach for my clients. I think the right asset allocation for each risk profile is key to long term investment success.

I like to use a combination of direct equities, managed funds and ETFs so that my clients’ portfolios include diversified asset classes but also diversification of thought. As an adviser, I can’t keep on top of all markets and companies, so I have a select “Investment Bible” which is implemented across all clients’ portfolios and we outsource to fund managers in areas that we don’t specialise in.

It also depends on the sophistication of the client and what they are looking for out of an advice relationship and their overall strategy. We have some fantastic managed accounts here at Shaw that our CIO and co-heads of income strategies run that I use as a “core” for my clients’ portfolios. I then build out the “satellite” positions around that, which could be a thematic ETF or a selection of micro-cap and small-cap companies - the higher risk, yet sexier side of investing!

Can you share two of your “go-to” funds with us?

It is a bit hard to choose just two, so I have listed five that I really like for my clients:

- Hyperion Global Growth Companies Fund (ASX: HYGG)

- Metrics Direct Income Fund - MDIF

- Betashares Global Sustainability Leaders ETF (ASX: ETHI)

- Betashares Global Cyber Security ETF – (ASX: HACK)

- ETFS Battery Tech & Lithium ETF – (ASX: ACDC)

How do you discover new managers and investment opportunities in a market saturated with products and issuers? What makes a manager stand out?

Currently, I am looking at managers in the venture capital space as I believe I should allocate some exposure to this area of the market in my clients’ portfolios. A lot of the time, new managers are presented to us by Shaw research or by other advisers who have met with a fund manager and believe it's worthwhile meeting with them.

Additionally, I am keen on thematic investing, to state a few - ESG, electronic vehicles, cybersecurity, cryptocurrencies. That plays an important part as I go about identifying investable opportunities.

I am always on the lookout for funds that have consistently outperformed over a long period (usually 5 to 10 years). The experience of the fund managers in the chosen field, along with the expertise of the core team are critical too.

A pitch deck from a fund manager arrives in your inbox, what happens next?

Honestly, I would rather have a meeting with the fund manager face to face than read a pitch deck that has randomly been emailed. Typically, I organise a meeting to learn more about why I should be investing my client’s money in their fund.

We also have a really great research team here at Shaw that meets with various fund managers. It’s very important that extensive due diligence is done before investing in a fund as they are unlisted investments and at the end of the day it’s on us, as the adviser, to ensure the manager is doing what they say they will do.

How would you describe your personal investment strategy?

My personal investment strategy is very different to most of my clients. I am a high-risk high-return investor with a long time horizon and a stomach to handle extreme volatility.

I like to build up key positions over time and find the next exciting company that will change the way we do things.

That being said, I do have what I consider safer investments in my portfolio, such as Crowdstrike, Apple, SiTime, Berkshire Hathaway, Amazon, Macquarie Bank, BHP, and Aristocrat, as well as Index ETFs tracking the ASX 200 and S&P 500.

What are the top three holdings, in percentage terms, in your personal portfolio and can you tell me a bit about why you hold each of these positions?

Weebit Nano – (ASX: WBT) – This business is in the technology hardware and semiconductor sector. They have developed a new computer memory technology that combines the best of DRAM and Flash Memory. Weebit is getting closer to commercialisation through a commercial agreement with Skywater and is trading significantly lower than its competitor BrainChip (ASX: BRN) whose valuation is ~4x higher than WBT’s.

PlaySide – (ASX: PLY) - PlaySide Studios is one of Australia's largest independent video game developers, with self-published games based on original IP for mobile and PC. Its work-for-hire division also develops games and prototypes in collaboration with major publishers and tech firms (Take-Two Interactive, Facebook Technologies) as well as Hollywood studios including Disney, Warner Bros and Nickelodeon.

Ioneer – (ASX: INR) - Operates as a mineral exploration company, which engages in the development of the Rhyolite Ridge Lithium-Boron deposit. Rhyolite Ridge is a lithium-boron deposit located 25km west of Albermarle's Silver Peak lithium mine, 330km southeast of the Tesla Gigafactory near Reno and 530km north of Los Angeles. The 2021 Mineral Resource is now estimated to contain: 146.5 mt at 1,600 ppm lithium (equivalent to 0.9% lithium carbonate) and 14,200 ppm boron (equivalent to 8.1% boric acid); 1.2 mt of equivalent lithium carbonate and 11.9 mt of equivalent boric acid.

Could you tell me about your worst investment? How did you deal with this falling position or fund?

Two of my worst investments were in two BetaShare's Bear Funds: BBUS and BBOZ. I invested in them under poor advice from a family member. They did well initially but rather than sell the funds completely and take my profits (I was up $17,000 at one point) as a short term trade, I didn’t and left them/forgot about them and the investment slowly dwindled down to around $5,000 before I eventually cut my losses and sold out completely during the last crash.

Sometimes in these types of investments, the loss is just too much that you must write it off (capital loss) with lessons learnt. The lessons were:

- Do not let family members get into your head.

- Over the long run, the market has shown time and time again that it is heading in one direction, so if you want to be bearish it needs to be very short term and you need to be very active.

For some of my long equity positions, I tend to average down the cost when the position has been sold off heavily to reduce my cost base. When the position does rally again, I then tend to reduce my asset allocation or depending on the company fundamentals I retain the larger position.

What conversations are you most frequently having right now with clients? And what is your answer to these questions?

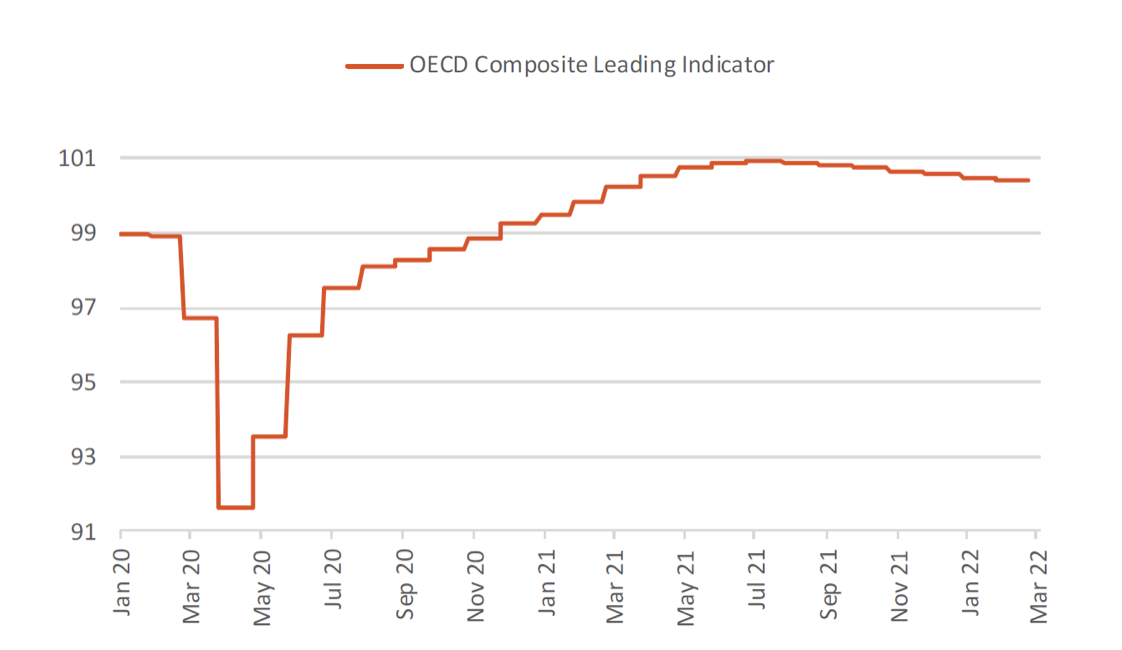

The market has been erratic and unpredictable since the COVID crash of 2020. So, as an adviser, I am continually reminding clients that investing is a long-term game and that you do need to block out the noise and look at the fundamentals of companies when investing.

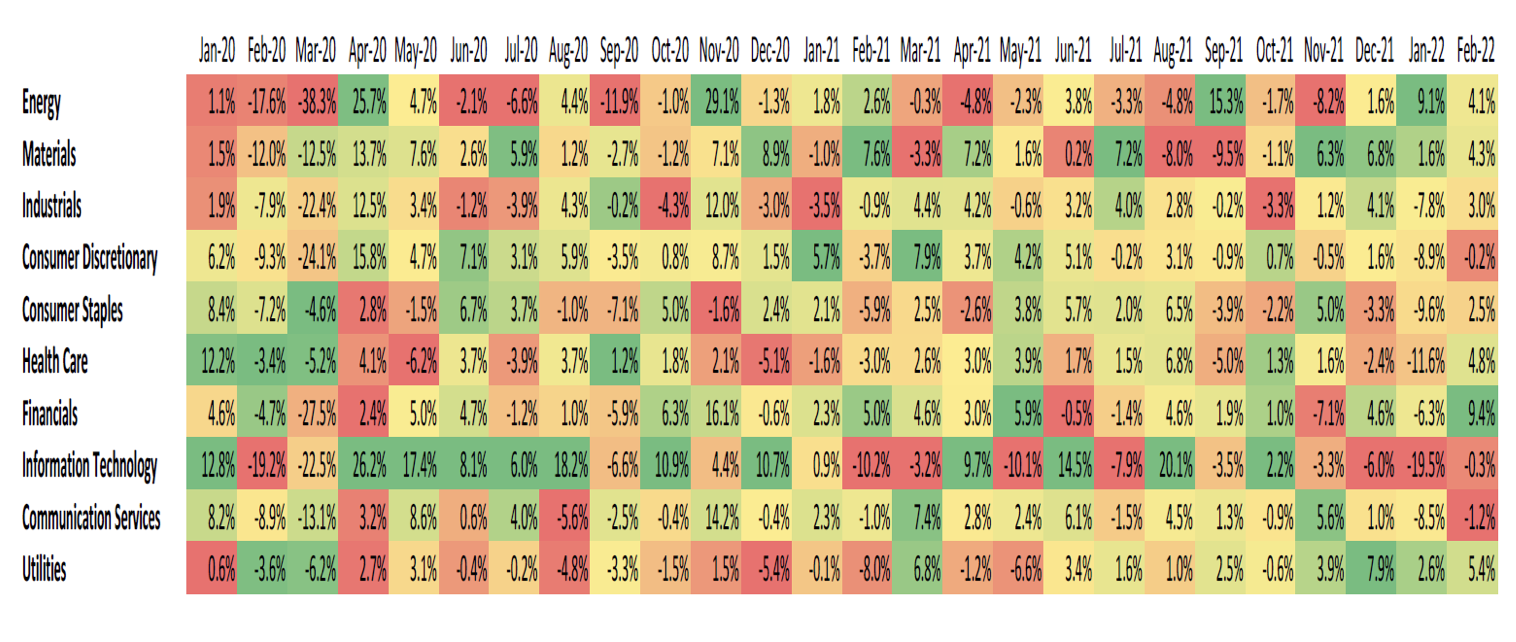

Clients are asking about the macro-economic forces that impact the markets and we are essentially saying that there are three key factors right now which will determine the outcome of equity returns in 2022:

1. Global Growth and GDP is slowing: You can see on the OECD Composite Leading Index (below) that the trend downwards has been set into play since mid-2021.

2. Financial conditions are tightening worldwide, making it harder for consumers and businesses to get easy access to credit. This also contributes to a slowdown in growth and economic activity.

3. We are in a high inflationary and low unemployment environment, with both levels at their historical highs/lows. This is forcing central banks to increase interest rates, which again makes the economic recovery difficult to sustain.

Another question I am getting asked a lot about lately (perhaps it is because we did an episode on it recently on my podcast Talk Money To Me) is investment bonds.

A lot of people are wanting to retire a lot earlier (40 or 50 years) and they want to know the most tax-effective way to do so as the superannuation environment, as you know, isn’t accessible till much later.

There has also been a bit of a COVID baby boom over the last two years, so we are getting a lot of young families asking about the best way to set up investments for their children’s future.

What are the most common mistakes you see in the portfolios that you inherit and how do you go about fixing them?

Clients who “trade” too much and are trying to time the market are the most common mistakes that I see. Recent data from Bank of America, dating back to the 1930s, found that if an investor missed the S&P 500’s 10 best days each decade, the total return would stand at 28%. If on the other hand, the investor held steady through the ups and downs, the return would have been 17,715%.

I think investors' instinct is to sell when shares fall, however the market's best days often follow the biggest drops. So panic selling can significantly lower returns for long term investors.

The best portfolios are the ones that you don’t play around with too much. Investors should buy and hold, taking profits along the way when they present themselves, but not selling out completely unless you no longer want to hold that position anymore!

I also see a lot of portfolios that have way too many positions. I prefer a concentrated portfolio of high conviction ideas being made up of direct equities, ETFs and managed funds.

Once you have your 20-25 positions, in order for a new idea to come into the portfolio, an old position needs to be sold. If you aren’t willing to remove a current position, then there needs to be a very good rationale behind it. This helps to stop FOMO or impulse buying and selling.

How do I fix it? I sit down with the client and go through their risk profile and current asset allocation to determine where the portfolio went wrong and figure out what their goals are for their investment portfolio.

Sometimes you have a client who thinks they are a growth investor and want a growth portfolio but can’t handle the volatilely that a growth portfolio can sometimes bring, nor the investment time horizon. I like to then go through their investment strategy and why they have certain holdings to assess whether it's something they truly want to be invested in long term, as well as what their financial objectives are – whether it is income, growth or a balance of both.

If you could change one thing about the industry so that it can better serve Australians, what would that be?

Making holistic advice affordable for all Australians. Over the last eight years providing financial advice has become harder and harder and more unaffordable for most Australians.

It’s essentially the same amount of time and risk advising a client with $200,000 as it is a client with $2,000,000, so we need to find a happy medium.

Moreover, it is the individuals and families on the lower end of the spectrum that need the most help with financial planning and investments, as often there is a lot of misinformation that can steer their financial well-being off track.

Can you share a personal passion or ambition you have for your future?

My business partner and I released a podcast Talk Money To Me in September last year which was a huge ambition of mine to get off the ground, so I would like to look at really growing our reach and influence in that space. There are a lot of financial podcasts in the market, but we believe we are different because we are not Finfluencers but qualified advisers and are trying to delve deeper into financial concepts and strategies.

I'd also love to set up my own foundation one day where I can support various grassroots charities. It’s so hard to get that initial funding to try and make a difference, so that is one of my goals for the next 10 years.

Hopefully, I can build enough wealth through various VC and listed investment opportunities to make that a reality. I actually have an idea in the works currently in relation to the NFP space and Cryptocurrency/The Metaverse but can’t give too much away just yet!

Did you enjoy Livewire's new Meet the Adviser series?

If you enjoyed hearing about Felicity's investing journey, please give this wire a 'like', and if you know someone who might enjoy the article, why not send them the link.

You can access more of our Meet the Adviser and Meet the Investor interviews by clicking here.

We are looking forward to hearing from more financial advisers in 2022. If you are interested in being profiled in our Meet the Adviser series, contact us using the email address below:

content@livewiremarkets.com

4 topics

12 stocks mentioned