Meet Rod: The technical trader who learnt to wire his brain for success

Having purchased his first practice for a lot of money, former veterinary surgeon Rod soon discovered it was making a loss. He had no training in business management, and although he ploughed on, eight years later he was in over a million dollars of debt.

"It nearly killed me—crippling anxiety, rock-bottom self-esteem, and a paralysing fear of failure. Even a near-death experience!" Rod says.

"My breakthrough was a chance gift, a book. I learned you could fundamentally change your negative beliefs, thinking and emotions with a little basic neuroscience and positive psychology. I now call this process 'wiring your brain for success'."

These personal changes fed through to Rod's veterinary practice. His clients and team were happy - and the business saw a 712% jump in profits.

Since retiring, Rod has written a book and runs an online course, helping teach professionals to wire their brains for success. He applies the same thinking to his investments, which he hopes will help fund his and his wife's living expenses, overseas adventures and philanthropy for many years to come.

In this Meet the Investor profile, Rod shares why his investment in himself has been his best yet, outlines his top five holdings (all small-cap growth stocks), and shares eight lessons he has learnt during his 36-year investing journey.

Investor Profile:

- Name: Dr Rod Irwin

- Job: Business Coach

- Age: 70

- Years spent investing: 36

- Biggest investment: Real Estate

- Secret (or not so secret) talent: Skiing downhill too fast!

- Guilty reading or viewing pleasure: My wife is English, and I’m a passionate Anglophile. At lunchtime we watch Escape to the Country, and Location, Location, Location is also a favourite.

Can you share how you started investing and what your first investment was?

My first investment was buying a share in the real estate that housed my practice, so I was both the landlord and tenant. Ultimately, I bought my partners out, and over thirty-six years I focused on incremental improvements to both my practice and the real estate. It compounded very well.

How would you describe your strategy and your investment goals?

I am an active long-side technical trader on the ASX. My investment goal is to generate sufficient cashflow from our trading account to fund our living expenses while preserving our cash reserves.

A technical trader uses only the momentum or trend of a share price to make their buying and selling decisions. Company fundamentals and dividends play no part in the decision-making process. Instead, the technical trader uses charts and analysis of price movements to invest in an uptrend (or a downtrend if they short sell). They sell the share with the trend is broken by a downward movement of the price (or upward movement if they short sell).

I was attracted to this method because I found the returns are better than a more long-term buy-and-hold approach. It does take knowledge and hard work! You also tend to be out of the market during big corrections or bear markets and that is comforting too.

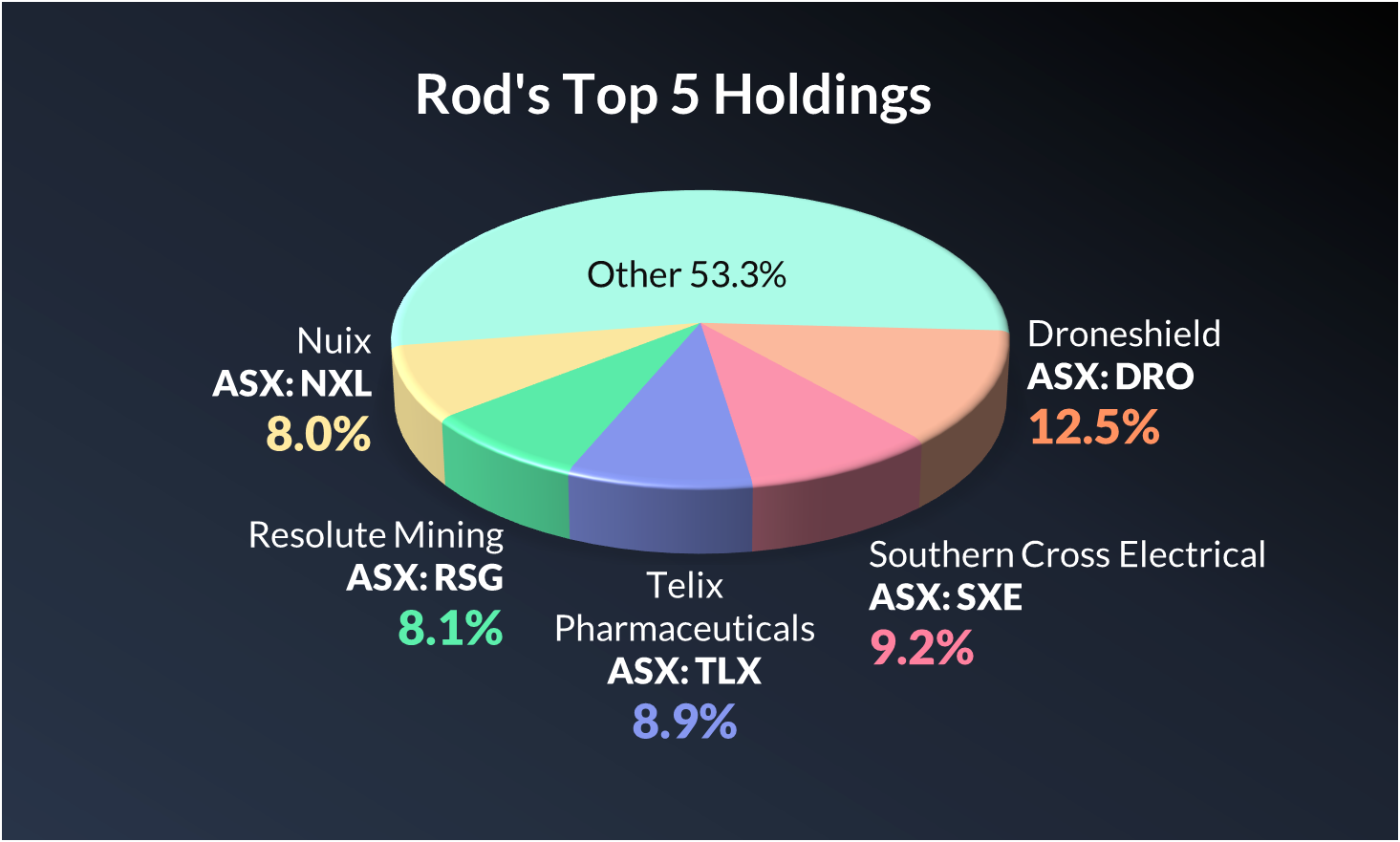

Can you share your top 5 holdings in % terms and why you hold these positions?

- Droneshield (ASX: DRO) - 12.5%

- Southern Cross Electrical (ASX: SXE) - 9.2%

- Telix Pharmaceuticals (ASX: TLX) - 8.9%

- Resolute Mining (ASX: RSG) - 8.1%

- Nuix (ASX: NXL) - 8.0%.

I hold these positions because they have satisfied my criteria on the date of purchase, namely:

They are sufficiently liquid. Their 200-day Simple Moving Average (SMA) is rising. Their 20-day SMA is above their 50-day SMA. On the day prior to purchase, they produced a white candlestick with the close above the 5-day SMA. I will exit the positions when they hit their stop losses. I use a multiple of their Average True Range to calculate their stop losses.

What investment is on your watchlist?

Summit Minerals (ASX: SUM) is on my watchlist. They develop resources for a decarbonised future. Their price has taken off like a rocket, but will it be sustained? Time will tell.

What has been your worst investment and what has been your best?

My worst investment was Liontown Resources (ASX: LTR). The share price tanked 35% in one day with the collapse of its proposed takeover by Albemarle Corporation (NYSE: ALB). Overall, it was a 39% hit.

The best investment has been in my own growth and development.

When I purchased my practice for a lot of money, I soon discovered it was making a loss. With no training in business management, I plunged on, but eight years later I was massively in debt. It nearly killed me—crippling anxiety, rock-bottom self-esteem, and a paralysing fear of failure. Even a near-death experience!

My breakthrough was by way of a chance gift, a book. I learned you could fundamentally change your negative beliefs, thinking and emotions with a little basic neuroscience and positive psychology. I now call this process “wiring your brain for success”.

My personal changes fed through to my practice: happy clients, a highly motivated team, and a 712% jump in profits. I created the business life of my dreams, and it totally transformed my life—to one of calmness, confidence and a love of living.

I continue to apply what I learned to my current investment strategies.

Are there any lessons you’ve learnt during this journey that could help others?

So many lessons!

- It doesn’t matter whether you are a short-term trader or a long-term property investor, compounding is your friend. Learn to stay the distance.

- We all know trading and investing are emotional journeys full of highs and lows. As much as financial literacy is essential, the ability to master our own thinking, beliefs and emotions is a critical skill too. Controlling fear enables you to maximise your analytical skills and rational thinking processes.

- Don’t panic! I learned this lesson the hard way. I suffered a big drawdown in the trading account, panicked and got out. The market bounced back five days later.

- As a technical trader, I set my stop losses, and act on them no matter what.

- Cut your losses. Let your winners run… (until they hit your stops!)

- No one has all the answers or knows what’s going to happen tomorrow. (Think GFC, Covid, or the invasion of Ukraine.) Learn from your lessons, and act on today’s information.

- No matter how tough or bad it seems, the sun will still rise tomorrow. It’s a new day, and a new chance to make a positive difference to someone’s life, and your own.

- Continually invest in yourself – in your education, health, mental well-being, relationships, and lifestyle. It all helps when times are tough, and you have an absolute blast when times are good!

Can you share a personal passion or ambition you have for the future?

The team at the Peter MacCallum Cancer Centre create modern miracles. I’d like to make a significant contribution to their progress in the treatment and prevention of this heartbreaking disease.

Oh, and an African safari and a skiing trip to Canada would be the icing on the cake!

Want to share your story like Rod?

Livewire is looking for investors who would like to share their stories and investment journeys with our audience. If you are interested, head over to this link and let us know.

2 topics

7 stocks mentioned