Meta - a unique opportunity for the contrarian long-term value investor

We believe Meta’s current share price offers a generational buying opportunity. And the assumptions required to achieve our hurdle rate of 10.25% return per year are exceptionally low, providing a substantial margin of safety.

We consider three issues are primarily responsible for the company’s 72% share price decline year to date:

1. The introduction of ad tracking transparency or ATT to Apple iOS

2. Competition from TikTok

3. CEO Mark Zuckerberg’s pivot to the metaverse

Our analysis of new information since the start of the year gives us confidence each of these issues are less problematic than they appear, and Meta’s long-term prospects are sound.

1. ATT

ATT has been a material headwind for online advertisers since Apple’s new iOS privacy settings were released in mid 2021. However, as we look ahead, we are confident the changes to ATT will favour Meta in the long run.

Artificial Intelligence

ATT removed advertisers’ capacity to track users and target advertising to those most likely to respond or purchase. Almost overnight, targeting went from being deterministic to probabilistic, and in this environment, companies with the best AI have a competitive advantage.

Meta is spending big on AI. In 2022 its CAPEX spend will top $32 billion, rising to between $34 and $39 billion in 2023. As management stated on the third quarter earnings call,

“we are significantly expanding our AI capacity. These investments are driving substantially all of our capital expenditure growth in 2023.”

In addition to improved targeting and measurement, benefiting advertisers, superior AI enhances content recommendation, content creation and platform safety for users. In turn, these factors increase user retention and engagement, and improve ad load. The overall impact is to improve the return on investment for advertisers and therefore increase the value of advertising.

As a side note, Meta depreciates server and networking equipment over 4 years, despite them having a typical useful life of 7-10 years. This results in higher depreciation expense and lower accounting profits in the near term but potentially large margin expansion 3 - 5 years out.

New ad formats

In response to ATT Meta developed new ad formats within WhatsApp, Facebook and Instagram such as ‘click to message’ and ‘paid messaging’. As these run on Meta-owned properties, the data is first party and therefore bypasses ATT.

These new formats also have significant revenue potential. From the third quarter call,

“(Click to message) is one of our fastest growing ads products, with a $9 billion annual run rate. This revenue is mostly on Click-to-Messenger today since we started there first, but Click-to-WhatsApp just passed a $1.5 billion run rate, growing more than 80% year-over-year.”

WhatsApp boasts more than 2 billion daily active users with North America its fastest growing region. While it has typically been difficult to monetise, new partnerships with Salesforce for paid messaging and JioMart for chat-based commerce are positive signs.

SkAdNetwork 4.0 (SKAN)

Essentially SKAN represents a softening of the ATT restrictions enabling larger ad platforms with more computing capability and capacity to capture more value from an expanded pool of data. Apple announced the change in June and is expected to roll it out later in the year. Having recently lapped the initial roll-out of ATT we expect SKAN to be a tailwind to performance measurement going forward. (We have written about SKAN previously for more detail.)

2. Competition from TikTok

The second issue is the competitive threat from TikTok, which is softening as Meta promotes its TikTok competitor, Reels.

TikTok reflects two broad trends: the shift from long-form to short-form video content; and the shift from content determined by a social graph to content generated by an AI-based recommendation engine. Meta has successfully navigated similar transitions, including the shift from desktop to mobile and from feed to Stories, and is using the same tried and tested playbook with Reels, with early signs of success.

In the last six months daily plays on Reels have grown 50% to 140 billion. Importantly, engagement is high, with people sharing reels 1 billion times a day on Instagram alone. Monetisation is also improving, with annual revenue run rate crossing $3 billion, 3x growth in one quarter. These numbers suggest the Meta playbook is tracking better than expected.

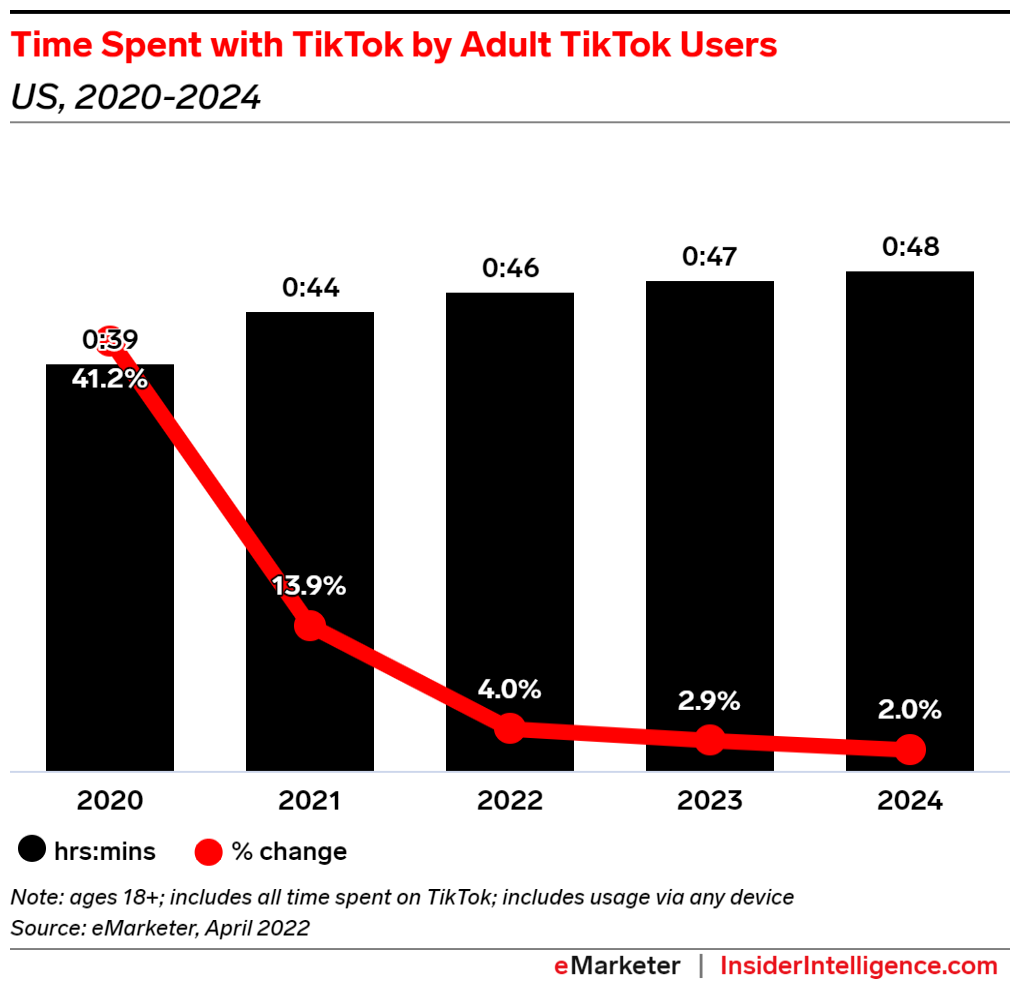

Time spent on both Instagram and Facebook accelerated in the third quarter globally while TikTok’s growth is decelerating. We have also heard from one industry insider responsible for over $500 million in ad spend, that advertisers perceive spending on TikTok to be riskier given its less sophisticated ad tech and the risk of it being banned in certain countries.

.png)

Reels currently monetises at a lower rate than feed and Stories and is therefore cannibalising Instagram’s existing revenue in the short run. However, we see it as short-term pain for long-term gain. Management expects Reels to contribute positively to revenue within the next 12-18 months. To reach a more neutral footing, we estimate Reels needs to generate in the vicinity of $1.25 billion in revenue per quarter. Based on its current quarterly revenue of around $750 million we judge the 12-18 month target is very achievable, if not conservative.

3. The metaverse

The final issue plaguing Meta is the metaverse, a polarising topic driving significant concern for many investors.

Meta will spend around $15 billion on Reality Labs this year, roughly 20% of total expenses, and is likely to allocate a similar portion of total expenses to the metaverse segment next year.

While it may not contribute to significant profits in the near-term it has value. At the Connect 2022 conference held in October management revealed that to date, $1.5 billion has been spent on games and apps in the quest store, up from $1 billion at the start of the year. This in-app revenue is more recurring and higher margin than hardware sales and driven by the install base which we expect to grow significantly over the next 5 years.

There are also opportunities for virtual reality (VR) and mixed reality (MR) hardware sales as we have noted previously and as evidenced by partnerships with Microsoft, Adobe, Autodesk, and Zoom who are each working to bring their software to the Quest platform. If Meta can produce a mixed reality headset to replace your laptop it stands to compete in a market that sells 200 - 300 million units per year.

We have tested the latest device, the Quest Pro, and believe Meta is firmly on the path towards this goal. We expect to see significant progress in the next 5 years. We also believe the market is not pricing in any of this potential at this stage.

Long-term valuation

It can be difficult to remain long-term focused when the near term looks uncertain. However, times like this present opportunities.

Meta’s current share price of $94.75, gives it an EV/EBITDA multiple of around 4x dropping to 1.8x in 5 years based on our forecasts. If it were to trade on the current market multiple of 13x we estimate the 5-year IRR to be 40%. This provides a very generous margin of safety especially if you believe Meta’s future is not so bleak.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

1 stock mentioned