Micro-cap investment quality: Toadfish, seals and anchors

Annapurna Microcap Fund

I love fishing in my tinny around Sydney and Melbourne (salt) waters. The key is to find the good spots and fish with the right gear (right time and right tide et al). If I catch a toadfish or have apex predators (seals/dolphins appear) – I need to pull up anchor and move on. The issue is - when, should an investor pull up the anchor? The good news with micro-cap investing is that there are plenty more opportunities to review (plenty of new sectors and stocks to look at) – you never HAVE to invest. And if you do not want – you simply quietly walk away… so I unveil my toady fish assessment tool for micro-caps.

Let us move to practical investing…

Most professional fund managers market themselves as investing in “good” businesses with “good cash flow”. What does this mean? In fishing terms - they all say that they fish in good spots and catch quality fish.

How do you as an individual investor make this quality assessment about an individual investment? How does the probability of error (and a vast ocean of over ASX 2,000 listings) get reduced to an investible field of researchable companies? We have developed a series of investment “quality questions” that might be relevant to investors working outside the institutional market – perhaps at home with good access to financial information and some quiet time. The checklist uses best endeavours to complete and is not forensic in nature. Concerning answers often (but not always) suggest caution. We also find that simply following the process helps uncover additional information and perhaps new investment angles and ideas.

- Who are the sellers and what is their motivation? Is management selling or is it growth capital? Are the sellers very promotional? This type of seller is not necessarily a problem – but needs to be understood. Write down who the sellers are on a piece of paper – re-read the piece of paper in 24 hours’ time… are you still comfortable?

- Is the business financially complex? Highly geared businesses (and complexity are often bedfellows). Financial services business, high degrees of leasing, long working capital lead times (waiting to be paid) are examples. In a simple sense, investors can look at how many liabilities and assets are held within the business and how complex are the notes attached to them. Look to see if the auditors /directors have to make a going concern comment.

- Very high levels of gearing. If the business has very high levels of gearing (in rough simple terms debt minus cash) – can it trade its way out? Why is the gearing high – has the business simply borrowed money and not got much of a return on it. Does the interest rate look high (net interest costs over net debt)?

- “Under” explained the departure of senior staff. The recent loss of senior staff always needs to be considered. Senior staff can leave often well before major problems float to the surface. I find that LinkedIn for middle-ranking staff/customer endorsements/testimonials is a good way to check – are the staff still working there/what is their role. Why are they at the competitor?

- Overcrowded trades – Watch out for this. Go to the back of the annual report – and in the substantial shareholder's section –read carefully. If a multitude of major quality small cap fund managers owns the stock already – who is the marginal buyer? Sometimes index inclusion provides new buyers or the stock graduates into the top 100 or gets overseas appeal.

- Complex offshore business – What country/jurisdiction are they operating in? As a Microcap investment, the postcode matters. How many geographies is it in? Are the operations able to be visited by investors? Who are the customers? Complex construction in politically unstable jurisdiction(s) is an example – almost always warrants a major discount / or find something else.

- Backers/Management have a history of honesty and a track record in the industry in which they are operating. In this case, a yes is good, and a no is avoided. Hard to assess – however there are many powerful tools at hand. Google/LinkedIn/annual reports/media and board history can help reveal this.

- Clean IPO / vs shell. I always prefer a clean IPO. Mainly because the vetting and due diligence process are more thorough (this has improved for shells as well in recent times). Past distressed investors in the old shell can also sell upon listing (tax and other reasons) and this can make the re-listing disorderly.

- Exogenous variables – could a major change in regulation kill the business. Really hard to tell but general reading and understanding the political landscape can help with this one. Keep up with current affairs. My young son talks about “harshing his vibe” – I think that means I could be annoying him. Is your investment going to have its vibe “harshed” by a change in regulation?

- The final one – does the business have legal disputes. Not in itself a problem. Information on this can be found in the accounts under contingent liabilities or perhaps be public announcements. Again, another cross if the listed entity does have legal disputation. I find that companies that get caught in legal disputes can have other problems (that’s why they got into a dispute in the first place).

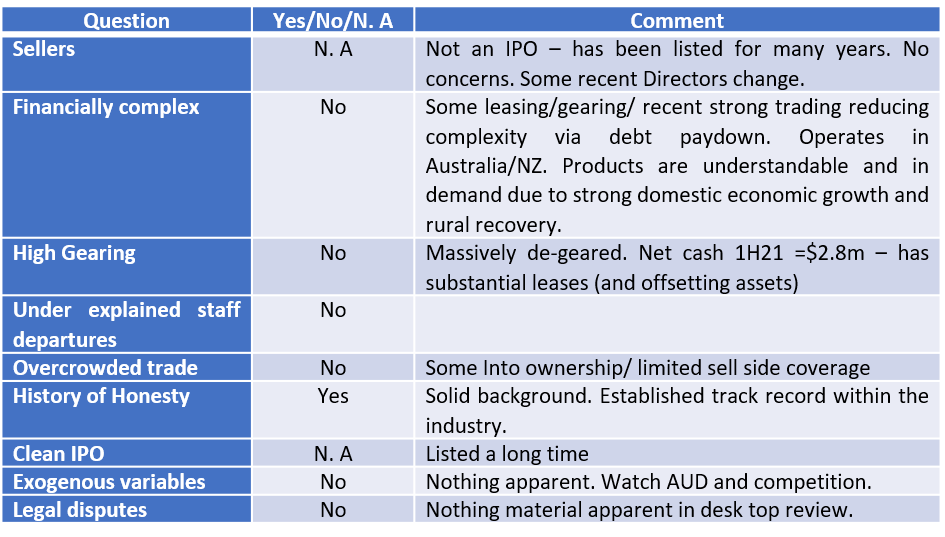

So, we put a stock we own, through this quality assessment list. Maxitrans (MXI) – makes and distributes trailers and truck parts. This is not exhaustive, and we use other processes as well – however, this is a good example of a well-run business that scores highly well in the quality assessment process.

As can be seen in the table below – Maxitrans (MXI) passed this quality assessment and is in the Annapurna Portfolio after financial modelling and other fundamental investment research were done.

Microcap investing differs from the broad cap equity market. It is resource-intensive and requires a proven foundation of successful investing over time. We at Annapurna have been involved in microcap investing for nearly twenty years and have been fortunate to have invested in some of today's leaders from the beginning.

Maxitrans (ASX: MXI) – investment quality

Source: Annapurna Microcap checklist

If you get a lot of crosses and only a few ticks, then take care. You may just want to pull up anchor and change spots. There are many quality stocks in the Ocean, and you just might be in the wrong spot, or you may want to head back to shore and have a quiet beer and fish another day.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Four reasons to register for Livewire’s 100 Top-Rated Funds Series

Livewire's Top-Rated Fund Series gives subscribers exclusive access to data and insights that will help them make more informed decisions.

Click here to view the dedicated website, which includes:

- The full list of Australia’s 100 top-rated funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with expert researchers from Lonsec, Morningstar and Zenith.

- Videos and articles featuring 16 top-rated fund managers.

1 topic

Stephen has over 25 years’ experience as a leading emerging companies / microcap portfolio manager. Stephen has both domestic and global experience having worked in London, New York and Sydney in senior funds management and research roles.

Expertise

Stephen has over 25 years’ experience as a leading emerging companies / microcap portfolio manager. Stephen has both domestic and global experience having worked in London, New York and Sydney in senior funds management and research roles.