Microcaps Stellar Quarter: 8.9% vs. Large Caps 1.0%

While FY18 is barely underway the microcap and small caps indexes have got off to a flyer, significantly outperforming large caps indexes. Although most microcap managers have made a good start, they have lagged the index performance a bit but as the old adage goes “A good start is half the battle” so hopefully they can catch up a bit of performance later in the year.

There has been a noticeable rebound in the performance of microcaps and small caps versus large caps. The ASX All Ordinaries Accumulation Index returned a minuscule 1.0% for the quarter. In stark contrast, the ASX Emerging Companies Index posted a robust 8.9% return for the quarter. A bit of mean reversion appears to be happening as the large caps handily outperformed the smaller end of the market in FY17, so we will see if FY18 continues to be a year for the little guys.

Fund Closures and New Additions

In the first quarter of FY18 we saw the closure of the Schroders Microcap Fund. This was primarily a result of key staff leaving the Schroder’s asset management team for pastures new in recent times. The fund had performed admirably since its launch in 2006 and handily out performed its benchmark during its lifetime. Given it is was one of the few funds that had a 10year+ track record it provided strong evidence of the alpha that can be generated in the microcap sector for investors. So, our microcap managed fund list is now down to 18 funds, still a healthy sized cohort to review. Nonetheless, the closure is still a loss to the sector and it’s a pity alternative managers could not be found to keep the fund going.

We have also added Acorn’s LIC offering to the LIC group which is in addition to Acorn’s microcap managed fund. We omitted the LIC in error in our FY17 review. Given the two vehicles are running very similar strategies it will be interesting to track the performance differential over time given they are from the same provider and an investor could choose either one or both to invest in!

On that note, Spheria are launching an IPO process for a microcap/small cap LIC so hopefully, that gets away. We will then have an additional situation of similar strategies being offered in different vehicles by the same product provider.

Stand Out Manager Performances

Stand out performances from the active managers in the quarter came from some of the newer funds like Perennial and Eley Griffiths Group. 5 managers managed to produce double digit returns for the quarter. Most fund managers easily outperformed both the All Ords and the ASX 200 indexes, which are two of the most widely tracked indexes by ETF’s. The Boat Fund and 8IP continue to have a period of challenging performance and were the laggards in Q1 FY18.

Not a single LIC’s was able to outperform the ASX Emerging Companies Accumulation Index in the quarter however a minority managed funds did manage to outperform the index. Now it must be noted we are only 3 months into the year so there is a long way to go in FY18 and no investor should judge a manager on a single quarter performance.

The table provided gives both the 3 month and 3 year returns for fund managers who have such track records. This gives some perspective on their longer-term performance and serves as a reminder to guard against reading too much into short term performance.

A cursory glance, down through the list of the 3 year returns in the table below shows the majority of fund managers have outperformed both large and small cap benchmarks and by virtue of this, the ETF’s that track them and by a comfortable margin. This longer-term performance is something potential investors should be mindful of in assessing the recent performance of any particular manager and when making asset allocation decisions.

Over the 3-year time horizon, active microcap managers generally have an excellent track record of delivering alpha to their investors and of delivering superior returns to that of index funds and ETF’s. All but 2 active microcap managers were able to provide index beating returns. Thus, this evidence should be factored into an investor’s overall asset allocation decision.

Stand out performers over 3 years included Cyan, Perpetual and BT but many more managers likewise had excellent returns by any relative or absolute measure.

|

MicroCap Managed Funds |

APIR Code |

3M |

3Y |

|

Acorn Capital Microcap Fund |

AUS0108AU |

6.5% |

0.7% |

|

Ausbil Microcap Fund |

AAP0007AU |

11.2% |

16.8% |

|

BT Wholesale Microcap Opportunities Fund |

RFA0061AU |

7.1% |

18.9% |

|

Cromwell Phoenix Opportunities Fund |

CRM0028AU |

6.4% |

18.7% |

|

Eley Griffiths Grp Emerging Companies Fund |

PIM5346AU |

11.7% |

N/A |

|

NovaPort Wholesale Microcap Fund |

HOW0027AU |

7.5% |

10.4% |

|

OC Micro-Cap Fund |

OPS0004AU |

10.7% |

15.2% |

|

Perpetual Pure Microcap Fund |

PER0704AU |

5.1% |

25.3% |

|

Spheria Australian Microcap Fund |

SCH0033AU |

10.2% |

N/A |

|

UBS Microcap Fund |

UBS0057AU |

5.9% |

14.8% |

|

Terra Capital New Horizons |

TCN0001AU |

4.2% |

N/A |

|

Microequities Deep Value |

MIC0001AU |

0.9% |

17.4% |

|

Microequities High Income Value |

MIC0002AU |

2.7% |

10.7% |

|

DMX Capital Partners Ltd |

N/A |

3.0% |

N/A |

|

Cyan C3G Fund |

CIM0001AU |

9.3% |

27.2% |

|

Australian Ethical Emerging Companies |

AUG0027AU |

2.6% |

N/A |

|

Perennial Value Microcap Opportunities |

WPC3982AU |

11.3% |

N/A |

|

The Boat Fund |

LAM0040AU |

0.2% |

5.9% |

|

MicroCap LICs |

ASX Ticker |

3M |

3Y |

|

NAOS Emerging Opportunities |

NCC |

5.3% |

13.5% |

|

Glennon Small Companies |

GC1 |

4.7% |

N/A |

|

Contango Microcap |

CTN |

2.8% |

N/A |

|

WAM Microcap |

WMI |

7.5% |

N/A |

|

8IP Emerging Companies |

8EC |

-1.2% |

N/A |

|

Forager Australian Share Fund |

FOR |

4.1% |

16.9% |

|

Monash Absolute Investment Company |

MA1 |

4.8% |

N/A |

|

Acorn Capital Investment Fund |

ACQ |

4.5% |

N/A |

|

ASX Index |

ASX Ticker |

3M |

3Y |

|

ASX Emerging Companies Accum Index |

XECAI |

8.9% |

7.5% |

|

ASX Small Ords Accum Index |

XSOAI |

4.4% |

8.2% |

|

ASX All Ords Accum Index |

XAOAI |

1.0% |

7.3% |

|

ASX 300 Accum Index |

XKOAI |

0.8% |

7.1% |

|

ASX 200 Accum Index |

XJOAI |

0.7% |

7.1% |

Microcap IPO’s

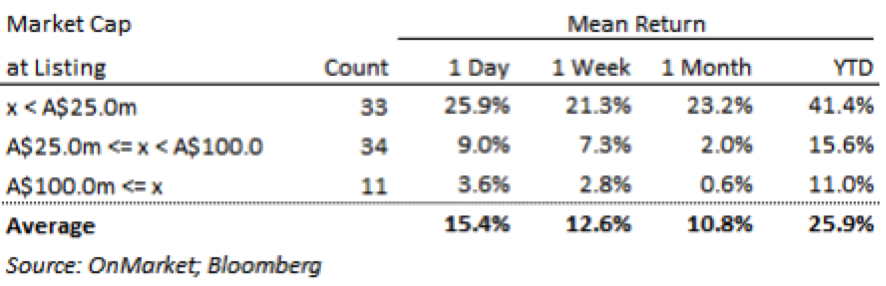

OnMarket BookBuilds do some great work in the IPO and capital raising space and they recently released their latest quarterly performance report for IPO’s on the ASX. In total in there have been 78 IPO year to date on the ASX. Of those 67 had a market cap at listing of less than $100mil so the majority of IPO’s on the ASX this year have been in the microcap space or even nanocap some would say.

Excellent Microcap IPO Performance

The most astounding thing from the analysis is that the returns actually increase as the market capitalisation decreases. This can be clearly seen from data in the table below. Now, one would be foolish to draw an inference of simple correlation from this evidence. As we all know correlation does not necessarily mean causation. However, what is clear that in 2017 microcap IPO’s have done very well.

Obviously, there is a lot more slicing and dicing that can be done to the underlining numbers to interrogate the data more comprehensively which may be the subject of a future article. In the interim, this analysis is simply provided to highlight some interesting evidence to investors potentially looking at microcap IPO’s opportunities.

The top IPO’s of 2017 as at 30th Sept 2017 close from the OnMarket BookBuilds report are detailed in the following table with their respective year to date returns.

|

Alderan Resource (685%) |

Titomic (122%) |

|

Wattle Health Australia (360%) |

G Medical Innovations (115%) |

|

Ardea Resources (342%) |

Winha Commerce & Trade (94%) |

|

Cann Group (296%) |

Doreimus (92%) |

|

Moelis Australia (131%) |

Zoono Group (77%) |

4 stocks mentioned