Mid-Cycle correction or a new bear market?

The question everyone is asking,

Is this a mid-cycle slowdown or have we moved into a new bear market for shares?

We are firmly in the latter camp.

The balance sheet recession that followed the financial crisis was a powerful deflationary force. Households and businesses de-levered while governments exercised fiscal restraint allowing Central banks to reflate without creating inflation. Low growth with deflation was a 'goldilocks' era for risk assets, not too hot and not too cold.

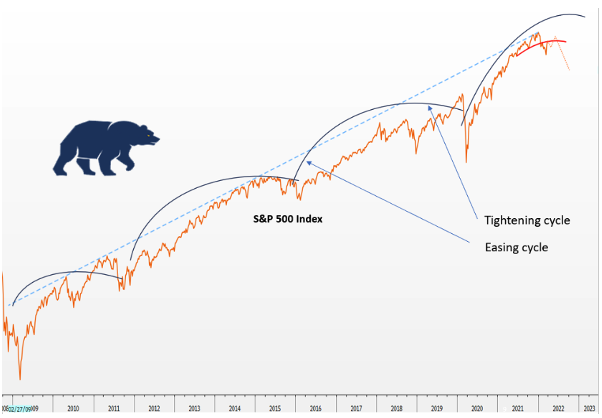

In Fig 1 below, you can see four very clear and discrete mini business cycles of four years each starting in March of 2009, as Central Banks' eased and then tightened policy. Together they make up the 14-year secular bull market in shares.

The cycle has turned, the bear is here

In each reflation episode, real interest rates moved lower and lower and ‘financial assets’ such as shares and bonds, moved higher and higher. At the same time as real interest rates turned negative, capital was re-allocated away from short-duration ‘hard’ assets such as commodities.

The share market has followed each of these business cycles peaking on each occasion at the blue advance line in Fig 1 as it has once again in December of last year. As policy support is once again withdrawn we have moved into the next 'cyclical' bear.

Market bulls will have you believe policymakers can engineer yet another soft landing, pivot, and reflate one more time. It's highly unlikely this time however as we no longer have these deflationary tailwinds, instead, we have inflation at the highest level in 40 years in many western economies.

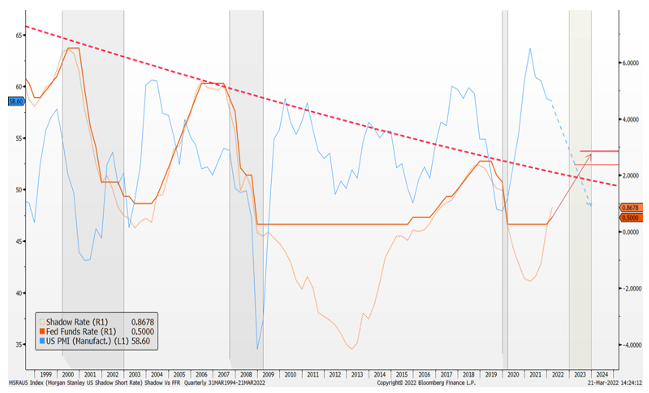

In the last tightening cycle in 2018 (Fig 2), the US Federal Reserve started raising interest rates much earlier while the economy was still expanding rapidly (PMI was rising). They didn’t even reach the neutral interest rate however where policy pivots from accommodative to restrictive (the dotted line) before economic activity fell sharply and they were forced to reverse course and ease rates again. Back then, inflation was barely at 2%, and the Fed was still trying to push inflation higher!

US Federal Reserve Target Interest Rate

This time will be very different, they are late and are tightening as growth slows. Furthermore, to bring inflation back under control, theoretically, policy must ‘overshoot’. They need to move beyond the neutral rate (dotted line) to slow demand enough to stimy inflation. Goldman Sachs have suggested this overshoot may require interest rates as high as 4% or above to curb inflation.

Interest Rate markets are clearly well below this level today and with an inverted yield curve, bond investors are already signalling a recession is ahead.

Given central banks are late and tightening into a slowing economy and the need for a policy overshoot to curb inflation, the prospect of a recession in advanced economies next year is high. A soft landing and another round of asset reflation is equally unlikely.

Not just any bear. A new secular bear.

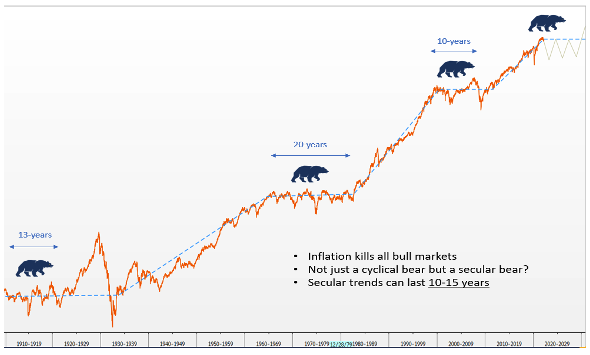

This will not just be a ‘cyclical’ bear market like the four prior episodes but the beginning of a new secular bear where shares move sideways for many years to come. As with secular bulls (the last one lasted 14 years), secular bears typically last 10-15 years

A secular bear market

Strategists often refer to the 1970's secular bear as a precedent for what lies ahead. You can see in Fig 3 above this was not a unique period. Inflation eventually kills most secular bull markets and that should be our base case this time also. It is dangerous to expect this time will be different.

Within this secular bear we will still have the four-year business cycle playing out as shares rise and fall, but within a broadly sideways trend.

A new secular bear for bonds also

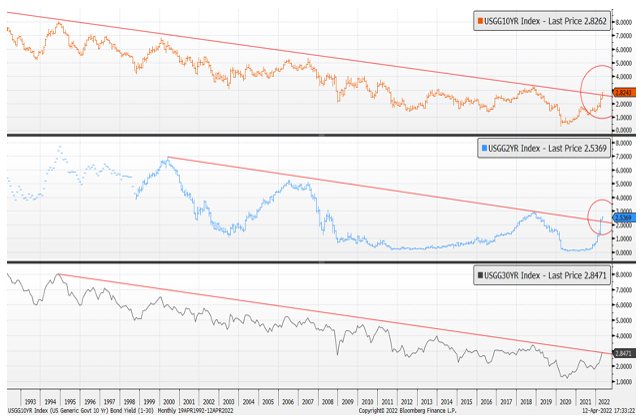

With the return of inflation, it looks like the 31-year secular bull in bonds is also now complete. It is clear from the momentum signal in the bottom panel below the low for bond yields (the high for bond prices) is in.

Most risk assets are priced off the long bond - the very low yield on these securities has led to a re-rate of other long-duration risk assets like shares. The P/E re-rate of shares and for growth shares in particular is an extension of the depths bond yields have fallen too.

As commodities are an inflation hedge, secular trends in commodities have historically been negatively correlated with financial assets. You can see this indicated in red below. A new secular bull market in commodities has probably begun.

Secular bear in bonds/a secular bull in commodities

US Treasury Yield % (10 year)

Further confirmation of a reversal in bond prices is near to hand. In Fig 5 below you can see bond yields across multiple durations are pushing up against the 30-year downtrend as we speak. If yields break through here, we will be at a seminal moment for risk assets. The 30-year tailwind for share market valuations will have reversed.

How it plays out for shares this year

Following the strong bear market rally in March, shares are likely to track sideways in the months ahead but will fall short of prior highs. It is still too early for a major draw, shares still offer decent profit growth this year and analysts are still upgrading profit estimates. Furthermore, with money pouring out of the bond market, investors have few alternatives other than to invest in shares.

The next major drawdown in the share market is likely to occur later in the year as economies slow and the street starts cutting profit estimates. As shares start to move lower and investors come to realise there will be no Central Bank bailout this time around, share markets will fall hard led by mega-cap technology - the last and largest bubble still to burst.

Closer to home, we may well see a replay of the Teck Wreck and the GFC where the lucky country once again misses the recession bullet given our exposure to a resurgent resources sector. Given our markets' heavy weighting to resources, the ASX may still make a new high in the months ahead.

From here, I would advise thinking of the Australian share market as two discrete markets – the All Industrials share market which today is still 7% below the August 2021 high and a resources market which is making new highs as I write this piece. Don’t chase it though, the initial advance in commodities is nearly complete. As late cyclicals, resource shares will also fall in the second half of the year as global growth slows.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors

3 topics