Middle East tensions? These are the ASX energy stocks to buy if the oil price spikes

The Middle East conflict shows no signs of easing, and Iran’s large-scale missile attack on Israel on October 1 threatens to escalate the conflict into a dangerous new phase. Immediately after that attack, US President Joe Biden appeared to sanction a retaliation on Iran that could encompass the county’s oil assets – only for him to quickly back away from those comments in the days following.

One thing is for sure, the situation in the Middle East is both dynamic and volatile, and this is having a corresponding impact on the price of crude oil. Iran presently produces around 3% of global oil supply, but this is just the tip of the iceberg of the impact it could have in the region if it felt provoked by Israel or its ally the USA.

There are fears that Iran could strike US military and private sector targets in the Strait of Hormuz or strike out at bitter rival Saudi Arabia as it did as recently as 2019 (also considered a US ally, but simply to wreak havoc on the West via the oil price). Regardless of the possible targets – the potential for major crude oil supply disruptions is real.

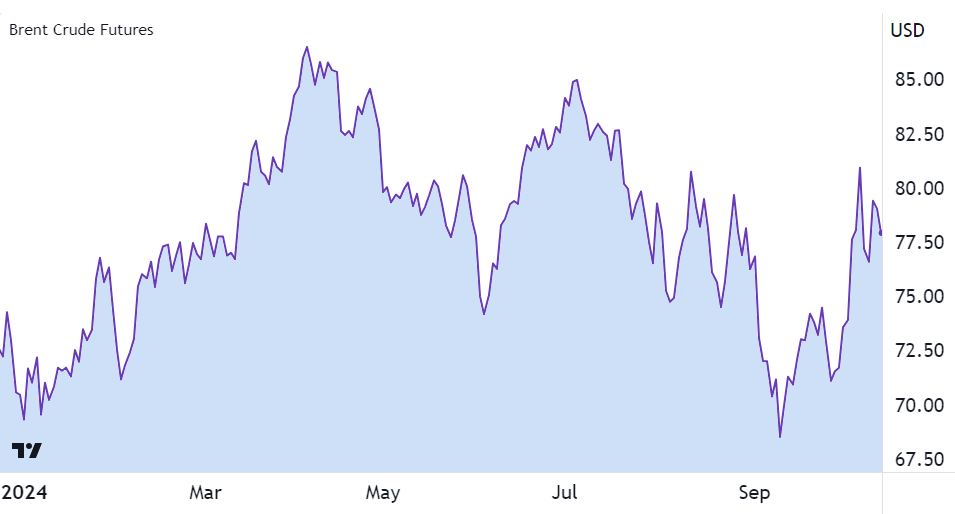

The events of early October triggered a rally in the oil price from under US$72/bbl to over US$81/bbl for Brent Crude oil. The price of Brent has since settled to around US$78/bbl, but is trending towards the top of its 2024 trading range in the short term. The other thing that is apparent in the above chart is the choppiness of the Brent price through the year as the Middle-East conflict has evolved, and in response to generally slower global economic growth readings – particularly in major consumer China.

If we add in the most recent stimulus measures, both announced and promised, in this country, we can see that really anything can happen in this space as we head into 2025. This is the reason for major broker Goldman Sachs publishing a new research report on the ASX energy sector. In this article, we’ll review the key findings of this report, as well as the brokers top ASX energy sector picks.

From worst to best? Should investors keep faith in ASX energy?

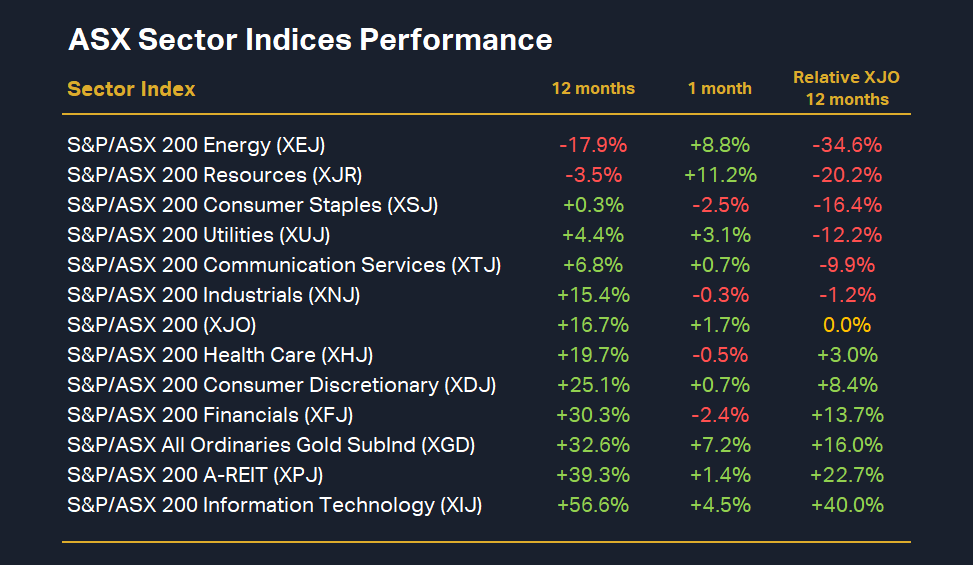

The S&P/200 ASX Energy Sector Index (XEJ) is the worst performing of the 11 major sector indices over the past 12 months. It’s not even a close contest. As a sector, ASX energy has been a terrible place to be invested this year.

The XEJ has underperformed the benchmark S&P/ASX 200 (XJO) index by a whopping 34.6% over the last 12 months, and by 74.6% compared to the best sector index, the S&P/ASX 200 Information Technology Index (XIJ). But a look at the performance over the last month shows the impact of the recent oil price rally and China stimulus news has launched the XEJ back into second place on the sector performance list.

There’s every chance this continues, suggests Goldman Sachs, who believes that the price of Brent crude could continue to rally to as high as US$90/bbl over the next 18 months should the situation in the Middle-East escalate, and assuming OPEC is unable to offset any “potential Iran supply disruptions”. In this scenario, US$90 could represent a “sustained peak”.

However, if the events in the Middle-East fail to impact Iranian crude oil production and supply, Goldman Sachs is relatively neutral on the Brent crude price. In this scenario, the broker sees Brent more likely trading in a range between US$76-78/bbl between now and the end of next year.

Goldman Sachs’ top ASX Energy sector picks

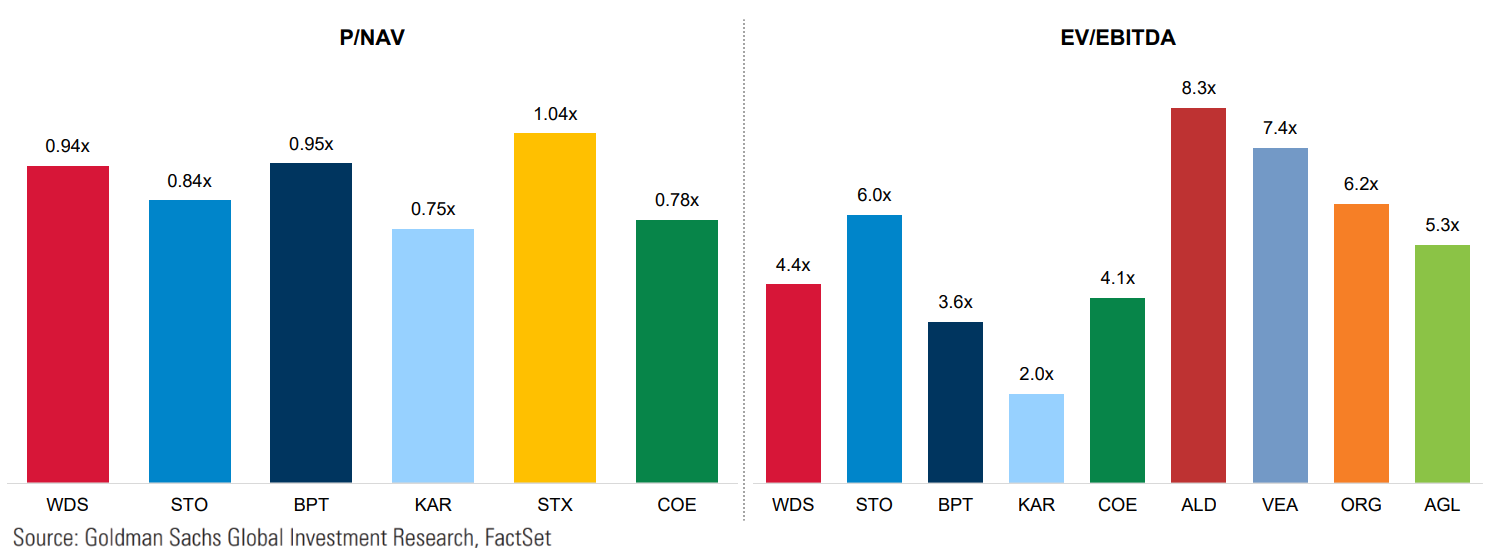

Golman Sachs likes several stocks in the ASX sector, with at total of 5 BUY rated names including Santos (ASX: STO), Karoon Energy (ASX: KAR), Strike Energy (ASX: STX), Viva Energy Group (ASX: VEA), and Origin Energy (ASX: ORG). See below a summary of Goldman's ASX Energy sector positioning.

It’s worth noting here several price targets for ASX energy stocks under Goldman Sachs’ coverage have been cut in this report due to tweaks in the broker’s “near term” Brent price forecasts to US$70-85/bbl from US$75-90/bbl, “largely driven by higher OECD inventories following softer than expected draws through the summer”.

Goldman Sachs sees Karoon Energy as the cheapest ASX energy stock in its coverage, as it’s currently trading at just 75% of the broker’s calculated Net Asset Value (NAV). Karoon is also trading at the lowest Enterprise Value (EV) to Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) of 2 times of any ASX energy stock in the broker’s coverage. The graphics below show both of these metrics for the other stocks in Goldman Sachs’ ASX energy coverage.

This article first appeared on Market Index on Monday 14 October 2024.

5 topics

10 stocks mentioned