Mind the squeeze, silver is the new green!

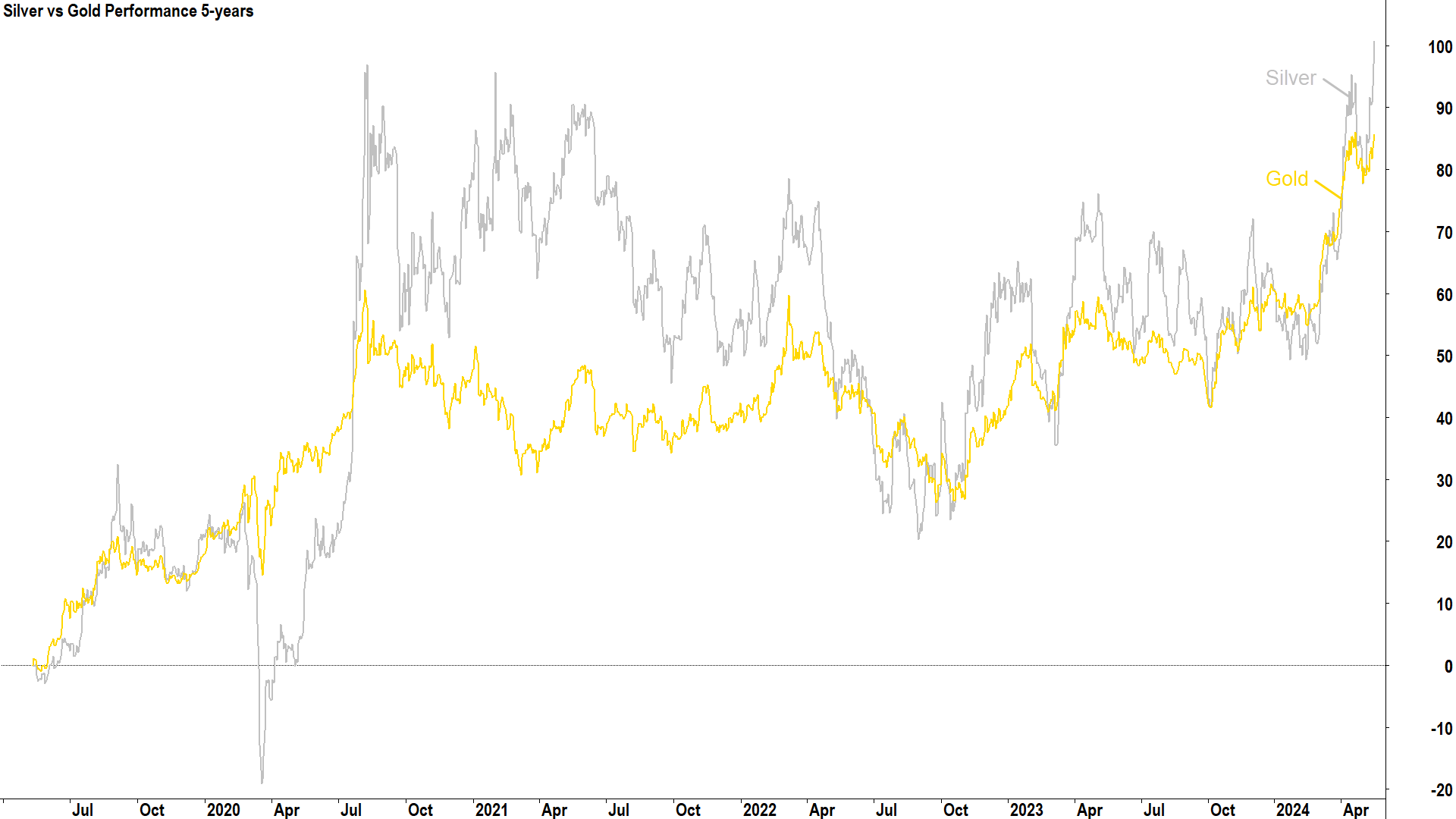

Ironically, silver often takes second place to gold when it comes to headlines in the financial press, but it regularly outperforms its yellow counterpart when macroeconomic and geopolitical factors combine to drive elevated demand for gold – similar to the prevailing backdrop.

There’s a key difference between the two precious metals which could further push the performance equation further into silver’s favour. Where gold is still mainly used for jewellery and as a store of value, silver has substantial and increasing industrial applications.

Silver is the new green

The energy transition from fossil fuels to renewable sources is perhaps the greatest challenge and opportunity facing science and industry, as well as the financial markets which fund them, in our generation.

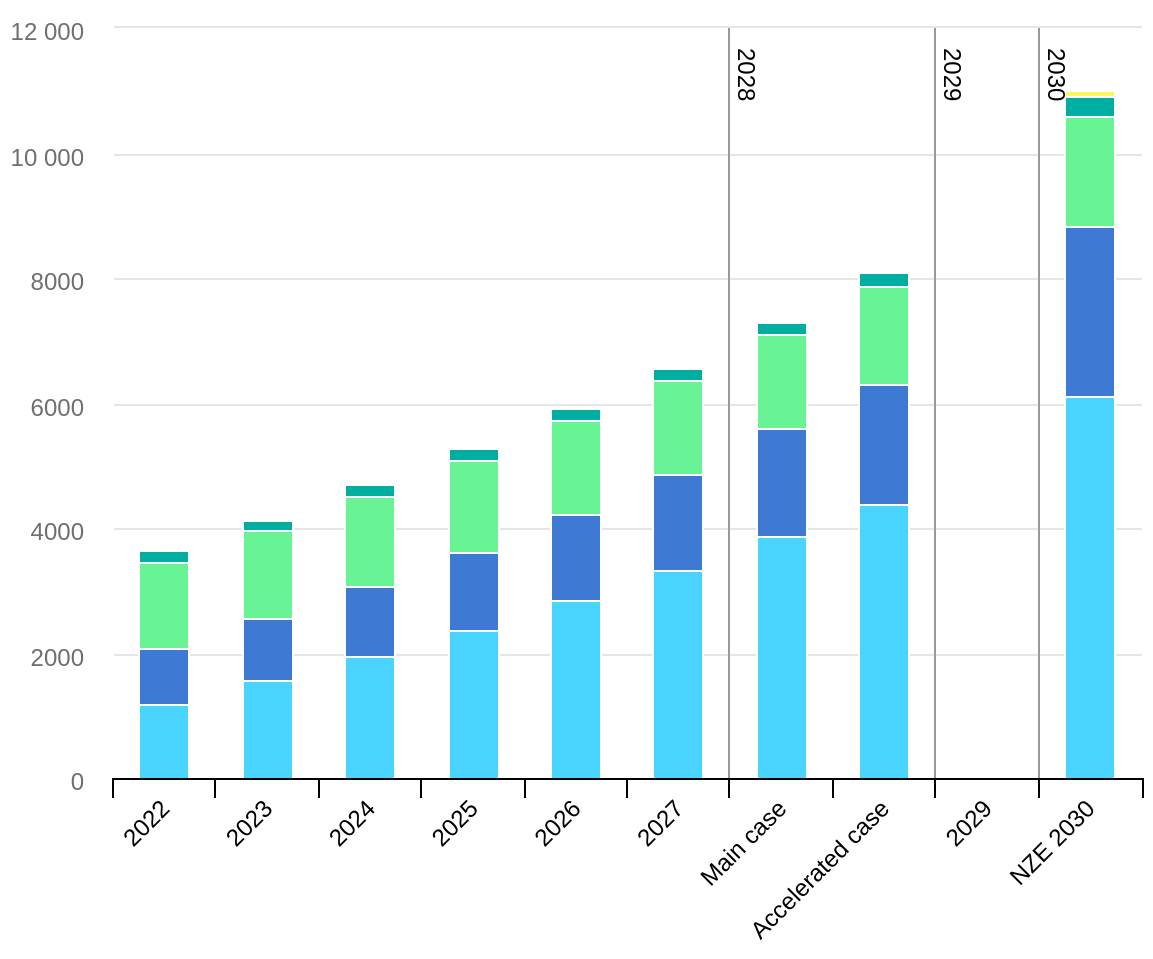

According to the International Energy Agency (IEA), installed power capacity from solar photovoltaic (PV) sources is set to surpass that of coal by 2027, which would make it the largest contributor to the world's energy mix.

The average solar panel produced today uses about 20 grams or roughly 0.64 ounces of silver. Millions of panels are constructed each year, but to illustrate recent growth trends one must consider data on solar PV capacity produced, measured in gigawatts (GW). In 2023, global installed solar PV capacity increased by 375GW or 31.8% to 1,552.3GW. The IEA is forecasting similar capacity growth each year for the rest of the decade.

As we know in markets, demand is only one side of the price equation. All the demand in the world cannot move the dial on price if supply is sufficient to meet it. On this point, there are also some interesting developing trends which may further support the price of silver in the future.

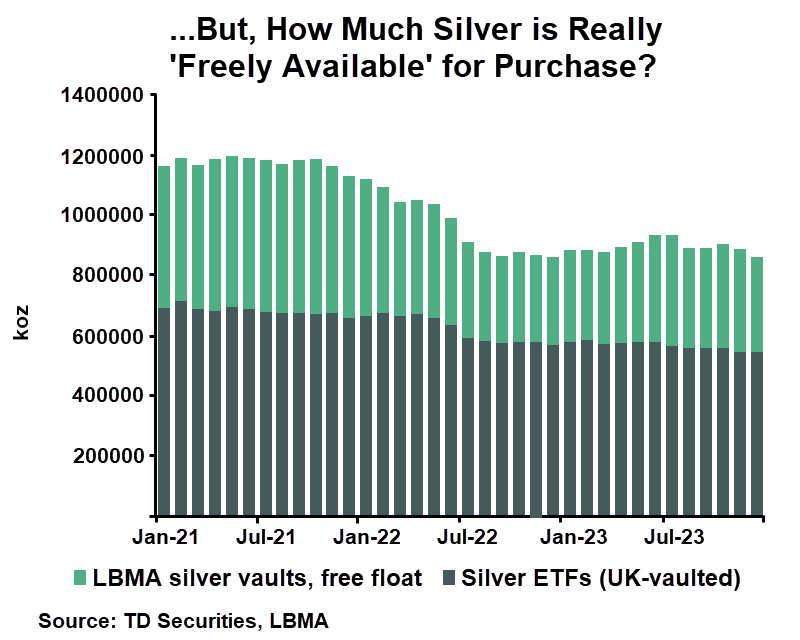

According to a TD Securities research report titled “A #SilverSqueeze You Can Buy Into”, the availability of silver may soon take a sharp downward turn. TD concedes there are substantial reserves of silver held in both private and government vaults – as silver has historically also been used as a store of value, like gold.

There is “more than 810 million ounces” of silver held in vaults, contends the broker, which represents around three-quarters of global silver inventories. “However, as time progresses, the structural deficit we expect will continue to chip away from this stockpile”, predicts TD.

Silver inventories peaked in late-2020 and have been declining steadily ever since. TD Securities cites analysis from independent precious metals research consultancy Metals Focus which suggests that global inventories of silver will have declined by as much as 770 million ounces from that peak by the end of 2024.

By this time, TD extrapolates that the ‘free float’ of copper inventories, that is silver actually likely to be available for purchase at any time, would have “wound down to just above 311 million ounces of silver”. The broker argues that such a level of availability would be “critically low” compared to the structural deficit in the market (demand versus mine supply) of 140 million ounces per year since the pandemic.

Did someone mention #SilverSqueeze!?

A short squeeze occurs when those who have short sold an asset must quickly purchase the asset at market prices. Scarcity of the asset in the market causes its price to rise rapidly, dragging in speculative buying and triggering further short covering.

A short squeeze can become a chain reaction of buying which can send the price of an asset exponentially higher.

It has happened before on silver. In 1979 two brothers, Nelson and William Hunt, accumulated a large position in silver, effectively cornering the market. In a short space of time, buying from other traders and a wave of short covering caused the silver price to skyrocket from around $6/oz in early 1979 to nearly $50/oz by January 1980.

“Two. Years. To. Depletion”. -TD securities

Quite colourfully put! “At the current pace of demand growth”, notes the broker, “based upon its 3 year CAGR, would deplete our estimates of the LBMA’s free float in only two years”. If the US Federal Reserve commences a rate cutting cycle, the buying activity typically associated with this could cut the time to depletion to one year.

“This poses a significant liquidity risk for silver markets, and makes a legitimate case for a potential squeeze in silver markets on the horizon.” -TD Securities

Stay tuned for Part 2

Regardless of what you think about TD’s arguments, the silver price is presently rising, and this is possibly evidence enough of at least perceived favourable future demand-supply dynamics. One must assume that investors are acting rationally based upon the evidence they have, and are investing accordingly by buying silver and at the same time withholding its supply. The result is an environment of excess demand and rising prices.

No doubt, however, some of this is already factored into the price. You’re not the first person to take an interest in silver! Still, it’s better to have the facts on a potential ‘next big thing’ so you too can make a rational decision, than not to have them.

As a trend follower, you can guess my interest in silver has been piqued by its recent price action. So, perhaps take a leaf out of my book: know what the fundamentals are, but invest based upon the prevailing trend. It’s up for now.

In Part 2, we’ll take the next logical step and investigate the Top 6 ASX Silver Stocks. Stay tuned!

This article first appeared on Market Index on Thursday 16 May 2024.

5 topics

9 stocks mentioned