Miners are coming in hot but the deals are small: This week in capital markets

It was all about miners this week in capital markets. Ongoing economic uncertainty continues to favour gold while oil/iron are not far behind in terms of popularity. This drove returns at the start of the week and has contributed to the confidence of miners coming back to the markets for much needed capital. Of the 19 placements completed this week, 12 were for the metals & mining sector.

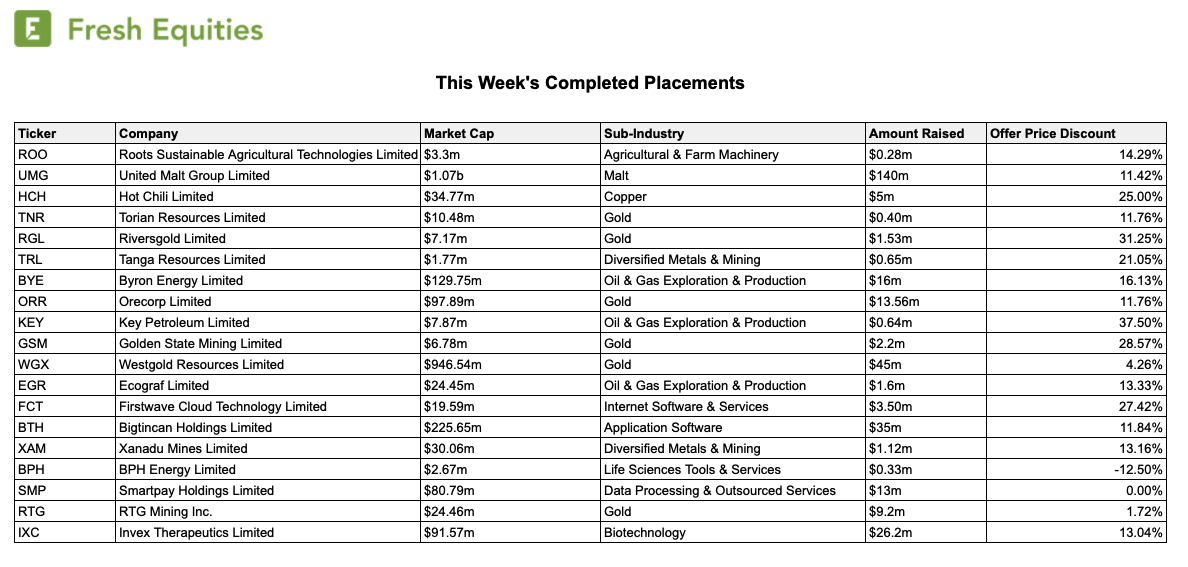

$315m was raised across 19 placements.

When commodities are hot, miners capitalise

Miners, particularly juniors, tend to be quite opportunistic when it comes to raising capital. There is always a need for fresh funds, and when their commodity is running hot miners will seize the opportunity to fill their coffers.

Unsurprisingly, gold and precious metals have been strong during COVID and miners with exposure have frequented capital markets. The looming fear of an inflation boom post COVID has supported the price of gold, and silver to a lesser extent. This week alone there were 5 placements conducted for companies with gold exposure. This will continue as the market recovers, keep an eye on your gold stocks.

Iron ore continues to perform strongly driven by expected Chinese stimulus, Brazilian supply side disruptions, and a restart in global industrial activity. The rapid expansion of central bank balance sheets around the world has also contributed to the value of copper/iron.

Oil has almost doubled in the past fortnight, up from all time lows. OPEC has predictably started curbing production while the relaxation of lockdown measures is also helping. We anticipate that more oil producers will search for capital in the weeks to come. There will no doubt have been some heavy cashflow pain when the oil price crashed in March, leaving some with weaker balance sheet than comfortable. Now that the price is coming back, that opportunistic capital raising reflex will kick in.

A mixed bag this week, not much for fundies to sink their teeth into

16% was the average discount in placements this week, much higher than the 12% rolling average. One possible reason - the high concentration of small cap deals. Deals for smaller companies (<$100m market cap) tend to carry higher risk and so are usually offset with higher discounts, meant to serve as downside protection for investors. Recently we have seen a surprising amount of investor demand for these deals, the discount is hard to ignore. There is money still on the sidelines seeking returns and it's not just fundies, we see plenty of individual investors on the hunt. Unfortunately there were very few large deals this week for fundies to sink their teeth into...maybe the IBs are out of steam?

Two months after de-merging from Graincorp, United Malt made a trip to equity markets and came back with $140m in fresh funds with a further $25m still to come from an SPP. The company has been hit hard by declining revenue as stay at home measures forced the closure of pubs and bars. It's no surprise that the book was declared 'covered' shortly after launching, the raise was attractively priced at an 11.4% discount to the last close and has held since the resumption of trading.

Elsewhere, Bigtincan went out rattling the funding can for a $35m placement with a small $5m SPP to follow. Strangely the SPP was to be capped at $5,000 per shareholder (and subject to scaling), quite unusual to see a modification to the standard $30,000 allowance...

At the small end of town everyone was vying for a piece of Hot Chilli and Riversgold. Both deals were pre-bid heavily by institutions and insiders, and priced generously at >20% discounts.

Get investment ideas from industry insiders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

4 topics

19 stocks mentioned