Misleading Narratives

Every stock market boom is precipitated by a fundamental development. Occasionally, bubbles develop from these booms when the dominant narrative assumes, through the optimistic extrapolation of good news that fundamentals will continue to improve and/or that all stocks in the relevant hot sector will inevitably be winners.

The Poseidon boom of 1969/70

Nickel was seen as a “space age” metal after WWII and in 1966 a strike at a large Canadian mine led to a price spike. Western Mining struck nickel at Kambalda in early 1966 and under the brilliant leadership of mine manager Arvi Parbo (later Sir Arvi and Western Mining chairman) managed to develop Australia’s first nickel mine within only 18 months of the ore discovery. This was quick enough to take advantage of the high prices and Western Mining Corporation’s (WMC) share price rose ten-fold in just 1966 and 40-fold by early 1968 – the mine development was a company transforming success.

As Trevor Sykes wrote in “Two Centuries of Panic” (1998),

“it would be hard to overstate the impact of Western Mining’s rags-to-riches saga on the market psyche”.

Dramatic wealth creation plays strongly on human envy and greed and the Australian stock market began a frantic search for the “next Western Mining”. In 1968, the object of speculation was initially Endurance Mining, but nickel IPOs in general multiplied and delivered large stag profits. The boom even spread to overseas markets and the staid London “Economist” advised its readers that Australian miners could not be ignored by “anyone who wants to buy a bit of the future”.

Western Mining’s real success finally inspired the dramatic 1969/70 rise of Poseidon Nickel from a mere $0.33 to a frenzied peak of $280 per share (an 850-fold gain). Poseidon itself failed and was delisted in 1976, and there never was another Western Mining in that boom - the stars align but rarely for a such success. It took another decade before the ASX had sufficiently recovered to stage the next (and more modest) mining boom in 1980 (and that, too, ended in tears).

The Nifty Fifty of the early 70’s

Chronologically, we next come to the IBM inspired US large cap growth boom remembered as the “Nifty Fifty”, during which “Big Blue” was seen as a “one decision stock” – you buy it and it always does well. The “next IBM” failed to emerge in that boom too but IBM peaked at over US$21 per share in 1973, halved over the next two years and traded below the peak 20 years later.

The Dot.Com Bubble of 1999/2000

This was another US large cap growth stock boom, inspired by the remarkable success of Microsoft, which established the global PC operating system standard. This enabled a record-breaking compound rise in earnings over the 15 years to 2000, propelling the stock from US$0.10 in 1985 to US$50 per share (500-fold) at the peak in 2000. As a value manager during this boom, I well recall that any argument about the follies of investing at 60x earnings were met with the phrase: “But Microsoft!”, and it was indeed true that Microsoft would – in retrospect - have easily justified such multiples. The future is not as clear as hindsight, however, and the lessons of history are painfully clear that investing on very optimistic expectations usually leads to very poor results. In the Dot.Com boom, questions about stocks on sales multiples (that is, stocks with no earnings at all) were waved away as being an inevitable part of the immaturity of the internet in the late 1990s. It was all about the glorious future and the fact that the stock in question could be the next Microsoft of the <insert industry here> sector.

There was, alas, no next Microsoft and Microsoft itself fell 75% from its dot.com peak and took 15 years to regain that level.

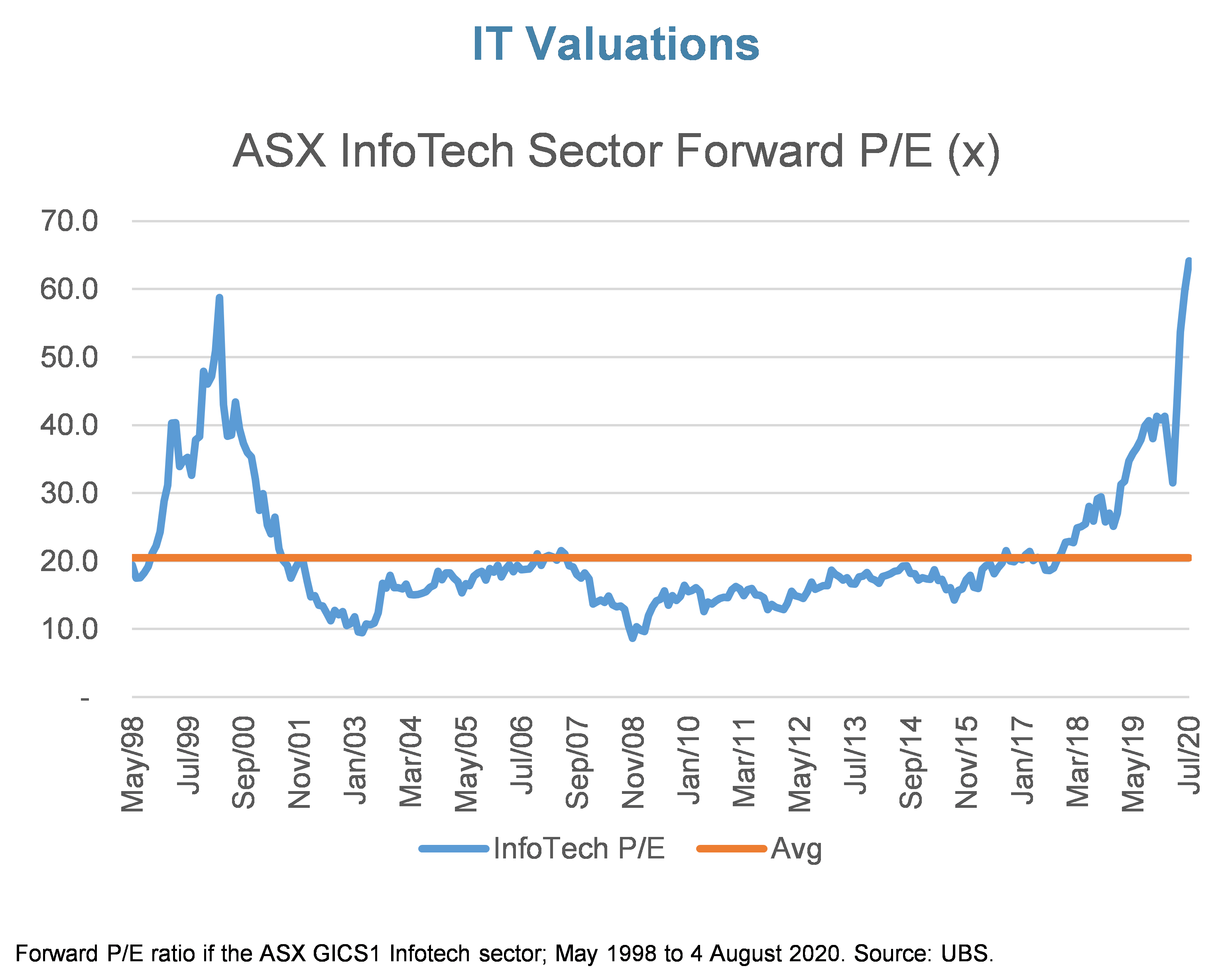

A special mention must be made of the Australian tech sector in 1999/2000. Stocks like Davnet, Sausage Software, Solution 6, One.Tel, Liberty One and Pinapple.com all rose dramatically in value and pretty much all of them failed. In early 2000, there were, for example, plans for no less than eight mobile network roll-outs in Australia - today, we still only have three (although we do now have nine buy-now-pay-later firms !). At least in a mining boom, Australia is ground zero in the sense that we do have good mining companies, but the 1999 ASX tech boom was entirely based on mimicking the US market with lower quality stocks. The NASDAQ famously fell 80%, but our S&P/ASX200 InfoTech sector fell almost 95% (that is, it fell over 70% relative the NASDAQ which itself fell 80%).

The Commmodity Bubble 2005-08

As the NASDAQ bubble was deflating, the listed entity that became Fortescue Metals (FMG) was trading at between 1 and 2c per share. As Australians, we all know the story of how Andrew Forrest built a third Pilbara iron ore major, and how FMG shares hit A$12 in the middle of 2008. Fortescue was the Western Mining of the China mining boom – the dramatic winner, the inspiration for the price rises of countless speculative mining and exploration stocks that typified the excesses of the ASX from 2005 to 2008 (it took the index 12 and half years to recover the peak price level and it is today once more below that Nov 2007 mark).

Many readers will recall the dramatic stories of the “accidental multi-millionaires” created by the ca 800-fold rise of FMG shares and how even the least promising iron ore juniors sported high market caps in those heady days. What was the outcome of this boom in a stock markets sense? There was no second Fortescue, not in Australia, not in Brazil or indeed anywhere. Spectacular success is – almost by definition – very rare and requires very special circumstances.

Today

Today, we are back in a US large cap growth boom, driven by the tech sector and inspired by the dramatic gains of Facebook, Google and Amazon. As in the late 1990s, these spectacular winners have inspired and ignited tech and growth stock rallies around the world, even in places where these sectors or parts of the market are very different to the US. Once more, as 20 years ago, Australian newspapers entertain the public with the fortunes of the newly-rich tech entrepreneurs. As 20 years ago, “old economy” firms are seen as losers and have their prices marked down, while the multiples of the ASX tech sector rise rapidly.

We wish to advance two arguments here, namely:

- That the FANG stocks, too, are quite likely to be one-off examples of success, and

- That the Australian tech sector does not have the special characteristics of the US tech leaders. The two US data quasi-monopolies (Facebook for public data, Google for private data), are capturing the revenues of most of the worldwide-ex-China media industry, and given their lack of competition, are earning much higher margins than traditional media did on those revenues. Since 2010, these two companies have grown earnings by US$45bn (capitalized at ca US$1.6tr), been a significant part of the outperformance of US indexes relative to non-US stock markets, and become the inspiration for the tech boom.

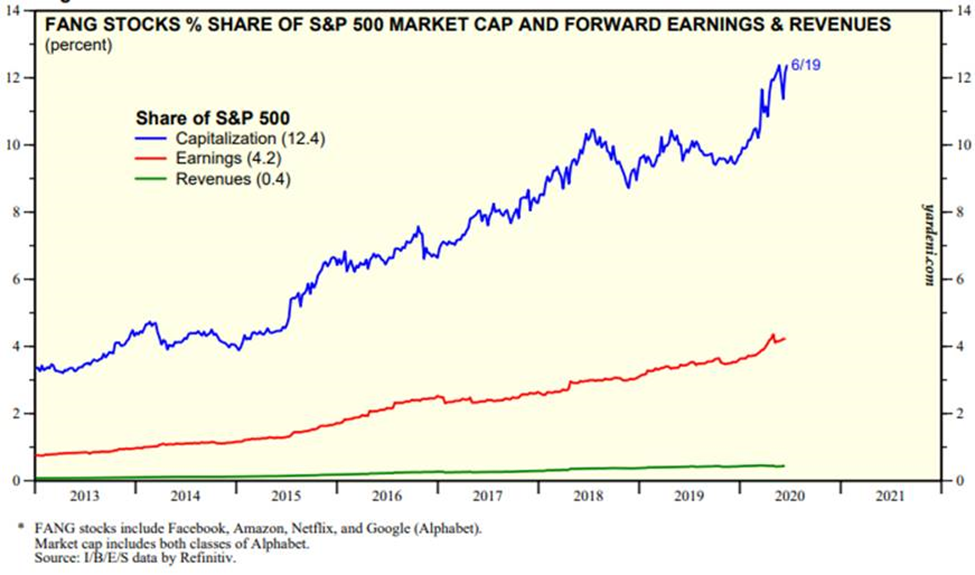

FANG Stocks % Share of S&P 500 Market Cap and Forward Earnings & Revenues

These stocks really are “special”, in the sense that global monopolies are as rare as they are profitable and valuable.

Monopolies are also very difficult to defend from regulatory scrutiny, however - particularly in foreign jurisdictions, which have lost tax revenues and their quality journalism and publishing.

And even in the US, legislators are asking questions. In the past both the railway network monopoly and later the telephone network monopoly were broken up in the US (by Republican presidents in each case) and a similar fate may await Facebook and Google. Whatever the fate of these stocks, the critical point for our market is that monopolies are rare.

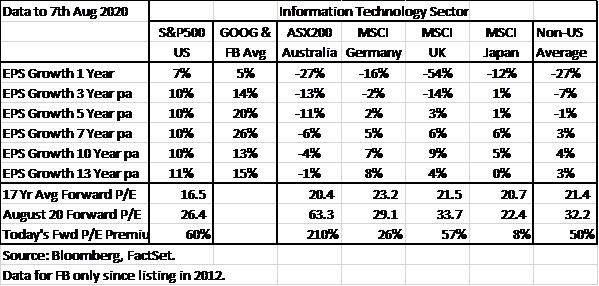

If the thesis outlined above is true, we should be able to see this in the data, not just on the ASX, but in all Western stock markets, from London to Frankfurt and Tokyo. The table below shows the relevant EPS growth and forward P/E ratio data for the Information Technology sectors across various markets.

EPS growth and Forward P/E Ratio Data for the Information Technology

Not all tech stocks are created equal. As these sector EPS growth numbers make clear, the US tech sector has delivered much faster and much more reliable EPS growth than those in other jurisdictions – and within the US tech sector Facebook and Google have stood out. As the data monopolies have increasingly dominated the US InfoTech sector, the EPS growth gap to other markets has widened. The outcomes are consistently different in the non-US tech sectors, however – index earnings growth has been underwhelming. As we observed in a recent wire, earnings growth for the Australian Information technology index has been particularly poor over the long term (and even worse ex-Computershare), particularly cyclical in the current downturn and forward multiples are particularly high (well over 100x ex-Computershare).

Once more, unique circumstances have created spectacular winners and have inspired the hope that many more such successes can be found.

As a consequence, ASX investors are paying high prices based on great expectations.

In past bubbles, not only has the growth of the inspirational stock or sector inevitably slowed, but these unique winners have proved to be just that … unique. The frenzied search for the “next …” ended in disappointment and large losses in 1969, 1973, 2000 and 2008. Is it really “different this time”?

Never miss an insight

Stay up to date with all my latest Livewire content by clicking the follow button below.

1 stock mentioned