MNF demerger to create significant value

NAOS Asset Management has been an investor in MNF Group (ASX: MNF) for over 5 years through the listed investment companies (LIC’s) we manage, and we remain the largest independent shareholder in MNF today. As such, this opinion piece should be read with the caveat that we have a vested interest in the MNF share price increasing over time.

Today MNF has a market capitalisation of ~$400 million. We believe this can increase to >$750 million in a short period of time if one important structural change is made to the Company.

MNF exhibits several characteristics that fit with the NAOS investment process. Some of these include:

- a highly aligned management team

- clear industry tailwinds

- a very strong competitive advantage

- a strong balance sheet

In recent history, one key criticism of MNF has been the number of arguably poor capital management decisions that have occurred. We believe this has resulted in a business that has several moving parts and therefore takes investors a significant amount of time to fully understand. Recent diversification has resulted in proportionally less earnings being derived from the core growth engine which has therefore resulted in the earnings quality being diluted. This has seen MNF trade at a much lower valuation multiple relative to its global peers.

Taking a step back, it is worth acknowledging the success of MNF which listed back in 2006, raising $2.50 million at just $0.20 per share. Over this period the compound annual return, assuming dividends have been reinvested, is approximately +28% p.a. yet over the past 3 years the return has been minimal.

In today’s environment, if we were to find a business valued at ~$400 million that has over 2/3 of its gross profit as recurring in nature (and growing at ~10% p.a.), together with a client list that includes the likes of Microsoft, Twilio and Zoom, a strong net cash balance sheet and trading for under 10 times EV/EBITDA (IRESS consensus) we would strongly suggest there would be an obvious catch.

Bridging the gap between software and telecommunication

Today MNF is a digital infrastructure company, providing cloud communications software and services. MNF owns and operates cloud-based voice networks in Australia, New Zealand and hopefully at the end of the year, Singapore. It is a little-known fact, but today MNF carries some of the highest volumes of voice minute traffic in Australia.

Put simply, the gap between software and telecommunication is bridged by MNF. This allows technology companies to power cloud communications (i.e. Zoom and Microsoft Teams calls) with additional features such as software integration (API’s), HD Voice quality and advanced routing controls. Unlike traditional telcos, MNF does not own physical infrastructure as its voice networks are all software based. This means that not only does MNF have a very high level of recurring gross profit, it also doesn’t require the same level of high capital expenditure as it expands.

Many people over the last decade expected phone-based voice communication to become obsolete. With the global transition from phone calls occurring over traditional ‘poles & wires’, to phone calls occurring over the internet (VoIP), what we have seen is that voice communication has become more integral in our day to day lives and more widely available across numerous technology platforms.

This ‘digitisation of phone calling’ has in turn led to the creation of new use cases for voice calling through software categories such as UCaaS (Unified Communications as a Service), CPaaS (Communications Platforms as a Service) and CCaaS (Contact Centre as a Service) with companies such as Google, Microsoft, Twilio, Zoom and Cisco making long term strategic investments in the voice offerings.

MNF is made up of two distinct divisions being Wholesale and Direct, both of which have very different economic characteristics. To clarify, all references to ‘Wholesale’ in this article refer to the combined divisions of MNF Domestic Wholesale and MNF Global Wholesale.

Wholesale division

The Wholesale division of MNF is comprised of the ‘digital infrastructure’ that underpins their software voice networks.

A simple analogy to describe this division is to think of it as a toll road. Once a toll road is built, cars pay for their use of that road. MNF builds nationwide networks (toll roads). Using this example, where it differs from a toll road is that users not only pay for the amount of usage (voice traffic) on that network but importantly users also for pay for services on the network. Services such as the right to have access to that network, rental of phone numbers (paying for car hire), guaranteed capacity (paying for a private lane), fraud protection (car insurance) and so on.

As with many infrastructure assets, the return profile is structured around an initial capital outlay followed by a long-term payback. Once the asset is built, any subsequent & incremental capital outlay should in theory provide a very high level of incremental return. In our view, improving incremental return on capital highlights a positive trajectory of a company’s competitive advantage.

MNF sunk their initial capital costs to establish their network infrastructure over the past 20 years. We believe they are now entering the phase of generating very high levels of return on incremental capital.

A recent example of this was highlighted as a result of additional demand during the COVID-19 pandemic, whereby MNF was able to double network capacity with a very low level of incremental CAPEX and OPEX. The available incremental earnings from this doubling could be significant over time. Another example is the establishment of a Singapore network, which is close to completion. Given it is a software network, we believe there should be minimal OPEX to run this network as it can ‘piggyback’ on MNF’s existing network in Australia whilst the business aims to sell services to existing customers in a new geography.

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” - Warren Buffett, 1992 Shareholder Letter

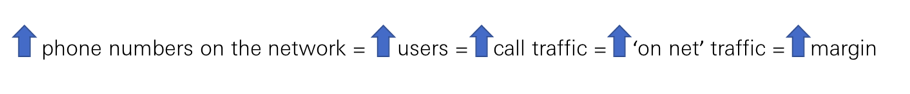

In addition, economies of scale can be a hallmark of infrastructure assets. Within the context of telecommunications, the concept of ‘on-net’ is where a call or message service which originates from a phone number on a particular network, terminates to a phone number on the same network. ‘Off-net’ is where the origination and termination occurs across multiple networks.

With the full transaction remaining on a single network, there is a higher gross margin profile as charges are not paid out to another network provider. For MNF, the economies of scale are:

The Wholesale division of MNF provides cloud-based voice services to large enterprise clients and the revenue from these services is generally recurring in nature. To give an example, when you organise a Zoom meeting, you are provided with a phone number so people can dial in to that meeting from a phone. MNF is the provider of this phone number, which enables the user to dial in. This is a business that at the gross profit level has generally grown in excess of >20% per annum over the past few years.

The hallmark of a quality business is one that is able to grow because their customers grow. This can be seen in many successful enterprise software companies. With reference to MNF, we believe many of their key customers are:

- experiencing increased usage for their existing service offerings

- increasing the number of services that will require some form of cloud-based voice capability

- expanding their service offerings into different countries.

A good example of this is Google. Google has communications requirements which are a bedrock layer for many of its product offerings including Google Meet, Google Analytics, Google Voice and Google AdWords. Many Google users often use multiple communications products within the Google ecosystem. Now if you were to compare Google’s ability to offer these services in Australia to say Japan, the depth of offering is superior in Australia. The reason being, because MNF is able to bundle complex, highly regulated communication products & services into a simple software format and offer direct API integration into companies such as Google.

Based on the market size, there is no doubt the opportunity for Google products with communication requirements in Japan is much larger than in Australia, however there may not yet be a partner who can effectively provide these ‘easy to use’ software communication services. This means Google may not be able to offer the same quality of product suite to customers as they can in Australia, thereby potentially missing out on revenue opportunities. It is worth noting that MNF do not operate in Japan, nor do we profess to know if they ever will, however we use this as an illustration for the customer growth profile that may exist.

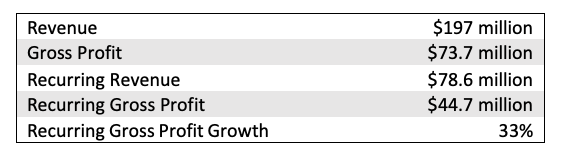

In FY20, the recurring gross profit of the Wholesale division grew by ~35% YOY with gross margins on the recurring side of the business circa ~60%, and in our view is likely to increase further in the coming years. We believe that this momentum will continue into FY21 as more businesses use cloud-based capabilities in a COVID-19 world. In an effort to not just cherry-pick the highlights of the business it is important to note that some $29 million of the total $73.7 million of gross profit was of a variable nature which is generally network usage and minutes trading on the domestic and global networks of MNF. Despite this, the gross margin still increased slightly from FY19 to FY20.

FY20 Financial Metrics – Wholesale

Direct division

The Direct division of MNF is the smaller of the two divisions, however when MNF first listed on the ASX, it was the only division in the company and has helped MNF become what it is today. The direct division is made up of four key offerings:

- Virtual PBX (cloud hosted virtual telephone systems)

- Conference Call International (a teleconferencing services company)

- Enterprise and Government (re-selling offerings such as Microsoft Teams)

- Pennytel (a retail mobile virtual network operator - MVNO)

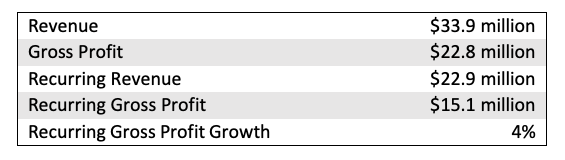

In our view, these businesses differ in quality to that of the Wholesale business, and the divisions have differing headwinds & tailwinds affecting them. Even though 2/3 of the gross profit is considered to be recurring in nature, in our view the Direct business justifies a lower valuation multiple compared to the Wholesale business given the lack of structural tailwinds.

FY 20 Financial Metrics – Direct

A recent transaction example which can be used as a benchmark for MNF’s Wholesale division is the Bandwidth (‘BAND’) takeover of Voxbone.

The Bandwidth takeover of Voxbone

BAND is a ~A$6 billion NASDAQ listed business that we believe is a true comparable of MNF’s Wholesale business. BAND has built a voice over internet protocol (VOIP) network in the US and has recently embarked on a global expansion strategy beginning with Western Europe. It has a similar customer base to MNF, with customers including Cisco-Webex, Google, LogMeIn, Microsoft, and RingCentral.

BAND’s business proposition is based on providing software integration (API’s) via a nationwide network so that customers can provide their clients with the best quality voice, messaging and other unique services. It should also be mentioned that BAND is currently a customer of MNF’s and that BAND does not have its own network in the APAC region as they are focused on the US and Europe.

On the 12th of October, BAND looked to accelerate their global expansion by acquiring the Brussels-based communications business Voxbone for A$736 million. BAND commented that ‘time had become more valuable than money’ and referenced IDC’s forecasts that the global CPaaS market is expected to grow from $4.2 billion in 2019 to $17.7 billion in 2024 (a 33% 5yr CAGR). To summarise the deal justification, in the ‘build vs buy’ debate, buy won out.

From a valuation perspective, BAND paid approximately 6 times revenue for Voxbone, assuming a revenue base for CY20 of US$85m. Just like MNF’s Wholesale business, Voxbone provides similar services to a client base that includes Zoom, Uber and 8x8. Interestingly, BAND commented that the acquisition of Voxbone would be accretive from a gross margin perspective, suggesting it is a higher gross margin business than BAND itself.

The inherent value in splitting the two divisions

Over the past 2-years the MNF share price, excluding dividends, has returned approximately 11% which is well below some of its industry peers both globally and domestically. We believe this is due to a number of factors, some of which have been mentioned previously. We also believe there is significant unappreciated value within the MNF group, but that a simplification of the business is required to facilitate true peer to peer comparisons and allow investors to more easily ascribe a true fair value to each division.

As such, we firmly believe the time for a separation of the Direct and Wholesale businesses is now.

In the sections below we predominately refer to EV/EBITDA multiples to highlight our thesis. We acknowledge there are numerous ways both qualitative & quantitative to assess the underlying value a company, which we undertake as part of the NAOS investment process. EV/EBITDA multiples may not be a relevant valuation tool for all companies and/or all investors.

Direct division value

As mentioned above, the Direct business reported FY20 revenues of $33 million and yet we do not know what the EBITDA of this division was. If we assume it has similar EBITDA margins to other “telco-like” businesses listed in Australia such as 5GN, ST1 and divisions within OTW and MAQ and apply an average 18% EBITDA margin, this would equate to an EBITDA of ~ $6 million.

Using ST1 for a valuation comparison, which we would argue is a very similar business, based on IRESS consensus for FY22, ST1 is forecast to generate $13.50 million of EBITDA and therefore it trades on a EV/EBITDA multiple of 12 times on a 1 year forward multiple.

If we value MNF’s Direct business on a 12 times EV/EBITDA multiple (assuming no debt or cash) today, then it would be worth approximately $72 million or $0.85 per MNF share. It is important to note we have not added in any additional costs for being a standalone listed company into these assumptions and that these assumptions are post AASB16.

When looking at the peers within this industry segment it also worth pointing out that the peers within the direct space such as ST1 have been significant outperformers against the ASX-300 index, as there appears to be significant demand from investors for businesses that can offer a high recurring revenue profile, strong free cash flow generation and acquisition optionality to bring forward profitability growth in the short and medium term.

Wholesale division value

If we then turn our attention to the Wholesale division, consensus expectations for MNF’s FY21 EBITDA is $41 million. If we remove the assumed EBITDA of the Direct business that leaves us an EBITDA for the Wholesale business of approximately $35 million (albeit based on FY20 figures). Again, these figures are post AASB16.

We estimate approximately 50% of the MNF staff cost base is R&D, which represents a R&D to wholesale revenues % of > 10% and highlights the continued reinvestment within the business, akin to that of a software company.

We can see from the historical financials that the recurring gross profit of this division grew at 33% in FY20 and we see no reason as to why this would slow into FY21, especially as demand for cloud-based voice services continues to increase, and the Singapore network also scheduled to open in December 2020.

As BAND is only now just profitable at the EBITDA line it is hard to find a comparison to the MNF Wholesale division that is profitable and therefore can potentially be valued on an EV/EBITDA metric. In our view we believe that a digital infrastructure business with $35 million EBITDA, a high-quality customer base, growing at >20% p.a. and importantly growing domestically and internationally, could easily justify a >16 times EV/EBITDA multiple.

A multiple at this level, is still a substantial discount numerous ASX listed infrastructure assets, digital or physical and it is a substantial discount to ASX-listed software multiples.

At a valuation of 16x EBITDA, it equates to $6.60 per share prior to the estimated net cash position of $30 million. For a point of comparison to Voxbone & BAND only, at $6.60 per share, this equates to a ~3x revenue multiple for MNF, prior to the estimated net cash position of $30 million. Recall Voxbone was acquired on 6x revenue. We do not know the earnings profile (if any) of Voxbone. BAND trades on IRESS consensus of 19x revenue, and it is worth noting that MNF’s wholesale division has a higher proportion of its revenues as recurring than BAND.

For businesses that combine digital infrastructure with software characteristics, investors have been pricing similar operations at significantly higher valuations both in private markets and offshore public markets, where the characteristics of these companies are able to be better understood.

Conclusion

In summary, we firmly believe that there is a substantial amount of inherent value that can be realised within MNF if the Direct and Wholesale divisions can be separated via a divestment or demerger of the Direct business. Based on the different market dynamics for both divisions, we believe the time to do so is now.

In our view, this would allow each division to not only be valued more appropriately by the market, but also to be run by separate management teams with strategies that would allow them to grow regardless of the other division’s needs (i.e. a highly accretive acquisition for the Direct business would not be an ideal fit for the Wholesale business but as separate entities, this might not be the case).

Based on our assessment, in our view the total value created by this process could easily yield a valuation of >$7.50 or >50% higher than the current share price, with relatively low execution, operational or valuation risk.

Value with long-term growth

NAOS Asset Management is a specialist fund manager providing genuine long-term, concentrated exposure to Australian Listed Industrial Companies outside of the ASX-50.

To find more, click the 'CONTACT' button below.

1 stock mentioned