Momentum is building in aged care stocks

With established investments in both of Australia’s listed residential aged care providers, Estia Health (ASX: EHE) and Regis Healthcare (ASX: REG), our positive outlook for the sector is informed by three factors. Firstly, advanced age is associated with complex and ongoing care needs which Residential Aged Care is uniquely positioned to provide. Secondly, Aged Care operators with established processes to consistently deliver care (meeting ever more demanding standards) have a clear opportunity to consolidate what is currently a fragmented sector. Finally, the demographic tailwind provided by a growing and ageing population supports demand growth for the foreseeable future.

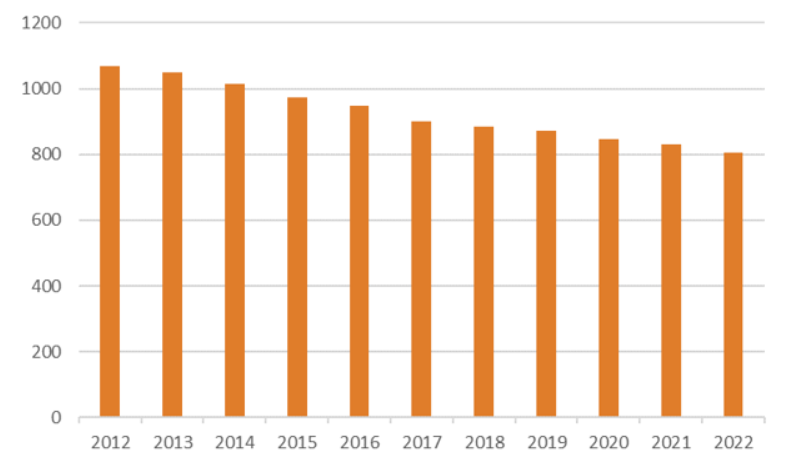

Aged Care Industry Consolidation – Number of Providers

Source: Regis Healthcare

In recent years the sector had to navigate challenges including a squeeze in funding, the Royal Commission and COVID-19; however recent operational updates from the listed providers as well as an announcement from the Federal Government, highlights how positive momentum is building in the sector.

Funding Clarity

On 4th May 23, the Australian Government outlined how it will fund a 15% Aged Care workforce pay increase proposed by the Fair Work Commission. It is offering a meaningful increase in the AN ACC daily funding rate (rising to over $240 per resident) as well as a ‘hotelling supplement’ of $10.80 (per resident per day) to cover increased wages for aligned staff such as chefs.

The funding increase is expected to pass through to workers in the form of higher wages, yet it reflects a positive outcome for the sector overall. It resolves a major uncertainty has dogged the sector since the Fair Work Commission first proposed wage increases for Aged Care employees. It also indicates the current government’s commitment to sustainably reform the sector.

Providing financial incentives for workers to commit to a career in Aged Care should support improved quality of care and customer satisfaction. In the past, low wages have repelled workers from Aged Care and operators became increasingly reliant on temporary employment agencies to fill rosters. The margins charged by these agencies are high, therefore the financial burden of using agency staff has been punitive for operators. Stabilising the workforce represents a meaningful opportunity for Aged Care operators to improve their financial performance.

Operating Metrics Improving

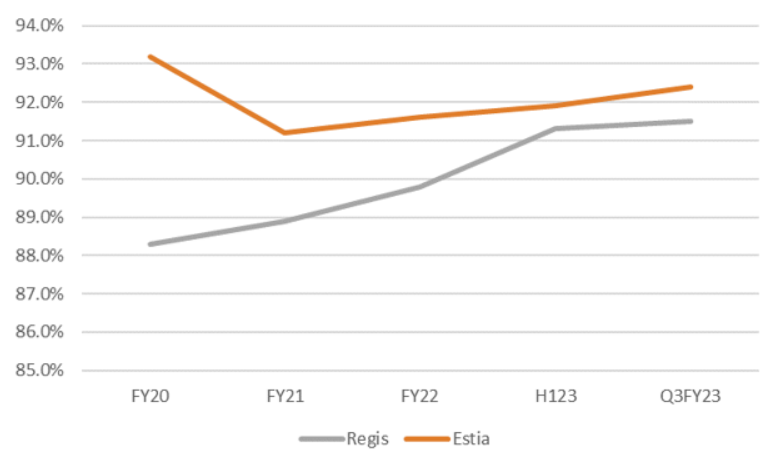

Recent updates from both the listed Aged Care operators shows they have made good progress on driving operational improvement. Occupancy is trending higher following several years disrupted by the Royal Commission and then Covid-19. Higher occupancy drives both revenue and margin.

Source: Regis Healthcare Ltd, Estia Health Ltd

The sector has is also making progress adapting to the AN ACC funding reforms. Following substantial changes to the funding model, Aged Care operators can now refine their operations to ensure they are adequately funded to provide better quality care to residents. Resolving the uncertainty about the funding structure has enabled operators to develop platforms and models to deliver sustainable care.

Want to exploit inefficiencies in the market?

NovaPort Capital focuses on buying ASX-listed small and microcap companies with an improving outlook at a significant discount to valuation. Learn more via the fund profile below.

2 stocks mentioned

2 funds mentioned

1 contributor mentioned