More positive or less negative?

The first quarter has come and gone, and despite a few bumps on descent, it appears markets are still preparing for a soft landing. While a soft landing remains our base case, the outlook for the global economy, and more precisely markets, remains delicately poised.

Our view

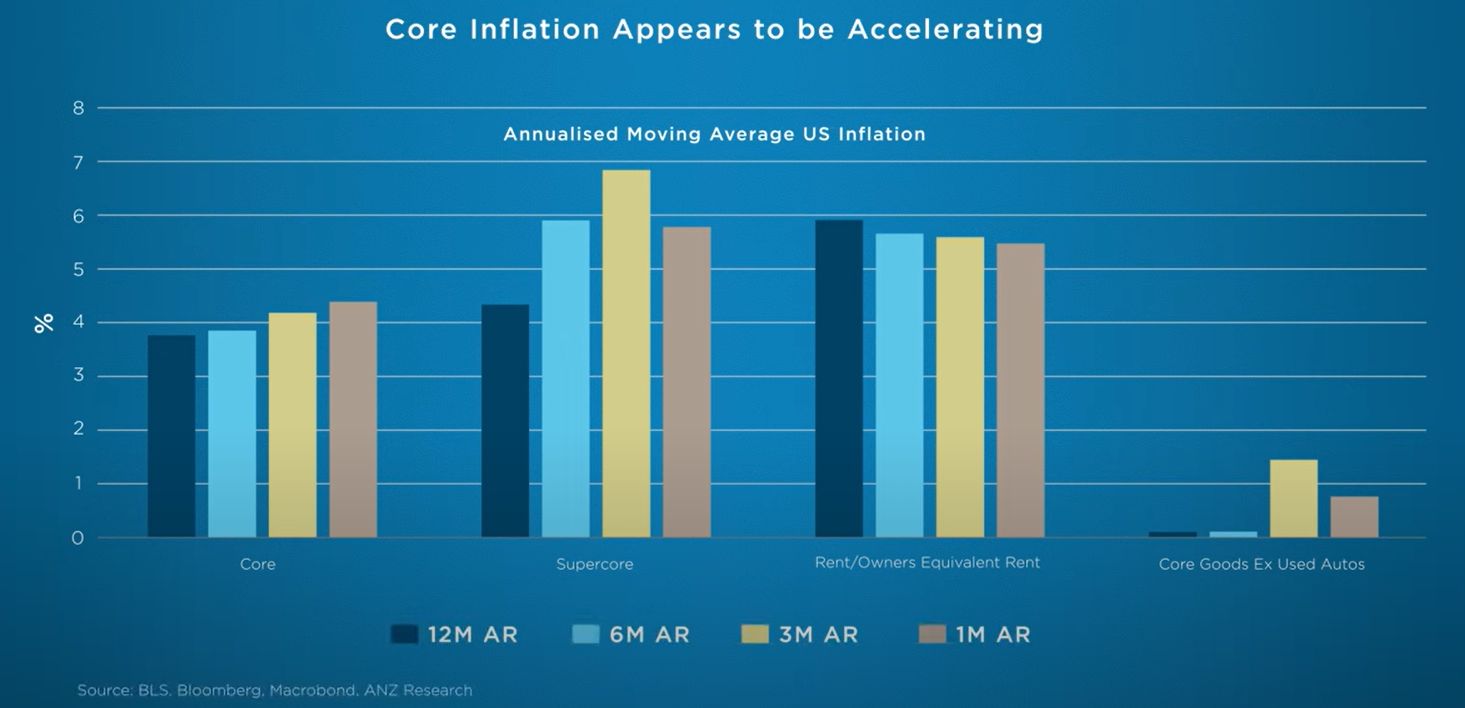

Inflation has broadly moderated but remains persistently stubborn. US core inflation rose 0.4% month-on-month in February, above consensus expectations. Indeed, the annualised three-and six-month moving average of core inflation shows an acceleration in inflation pressures, with both sitting above the year-on-year rate.

Alongside waning disinflation, softer retail sales, and gradual signs of labour market weakness, the word stagflation should not be removed from one’s vocabulary just yet

Still, even with inflation pressures remaining strong, it appears the US Federal Reserve is intent on cutting interest rates, and equity markets remain enthused by this prospect. The Fed’s recent economic projections saw GDP growth for this year revised upwards to 2.1% from 1.4%, and core PCE projections increase from 2.4% to 2.6%. All the while, expectations for easing remained unchanged, with three rate cuts pencilled in for 2024.

We noted that market pricing for US rate cuts at the start of this year seemed optimistic and at odds with the Fed. So, it’s worthwhile highlighting that rates markets, rather than the Fed, have since recalibrated expectations. Indeed, the 150-odd basis points of easing that was being priced by the market in January has since been halved.

So, while we were hardly shocked by the removal of rate cuts from forward curves, the response of equity markets has left us pleasantly surprised. Even though the US earnings season was better-than-expected, results were mixed, and broad market valuations remain challenged, both from an outright historical perspective and on a relative basis when considering where risk-free rates stand today. Indeed, fundamentals have hardly improved over the first quarter, rather it has been momentum that has continued to drive equity markets to record highs.

Despite equity markets brushing aside the lowering of rate cut expectations, we still expect inflation and the reaction function of the Fed to be the primary watch point for markets in the months ahead. And while our base case is for an easing cycle to commence in the US from July, there is no shortage of potential scenarios for the Fed to contemplate before making such a move.

Financial conditions have continued to loosen in the US, hitting a two-year low in mid-March. This is in stark contrast to inflation expectations that remain above the Fed’s 2% inflation target. Rate cuts rarely transpire while equity markets are at all-time highs, and with credit spreads tight and liquidity abundant, easing policy with these conditions in place would risk stoking inflationary pressures; never mind that economic growth remains solid and the US Leading Economic Indicator has just risen for the first time in almost two years.

Of course, US growth remaining reasonable is hardly to be frowned upon, indeed this resilience suggests a soft landing may now be in sight. Even for those economies that have already entered technical recession, including Japan, the UK and New Zealand, the decline in activity more closely resembles a mid-cycle slowdown than anything more sinister.

The global easing cycle is unlikely to be as correlated as the tightening cycle that preceded it, but aside from a few exceptions, central banks across the globe have turned more dovish over the first quarter.

While not our base case, we remain alert to the possibility that if rate cuts are ultimately pushed further out, a no landing scenario — where monetary policy and inflation remain above trend — risks a sharper correction for markets in the medium-term. And this is a key factor in our positioning as the second quarter gets underway.

What this means for our diversified portfolios

After holding portfolios steady at our initial investment committee meeting in January, we made tactical changes over February and March; remaining defensively positioned overall, while increasing our exposure to higher quality risk assets at the expense of those we believe offer less potential upside and appear most vulnerable in the event of a more systemic shock.

With spreads continuing to tighten over the start of the year and following the strong performance over 2023, high yield valuations have become less attractive on a risk/reward basis. In light of this, we have trimmed exposure to high yield credit, increasing our underweight to the asset class.

Conversely, we increased our allocation to Australian shares, taking the position back to benchmark. Half this move was implemented via a discrete allocation to the Materials sector. Materials were downtrodden over the first two months of the year as the price of iron ore slumped, partly on demand concerns emanating from the Chinese slowdown. This underperformance was in addition to the broader Australian market lagging global peers over the period. Given the underperformance of the Australian market over the past 12 months, the position should offer more limited downside in the event of a pullback, but equally allow us to participate in a rising market if the rally broadens. Furthermore, the position provides less volatile exposure to a Chinese recovery should this emanate later this year.

The move has seen portfolios shift to benchmark to shares overall. Within this segment of portfolios, we maintain a mild preference for European shares and US tech-related securities while remaining underweight the broader US market on valuation concerns. Elsewhere, we continue to watch small caps and the Japanese market with interest. In the case of the latter, lofty gains have at least in part been supported by positive earnings revisions and we look for pullbacks as a potential opportunity to increase our exposure.

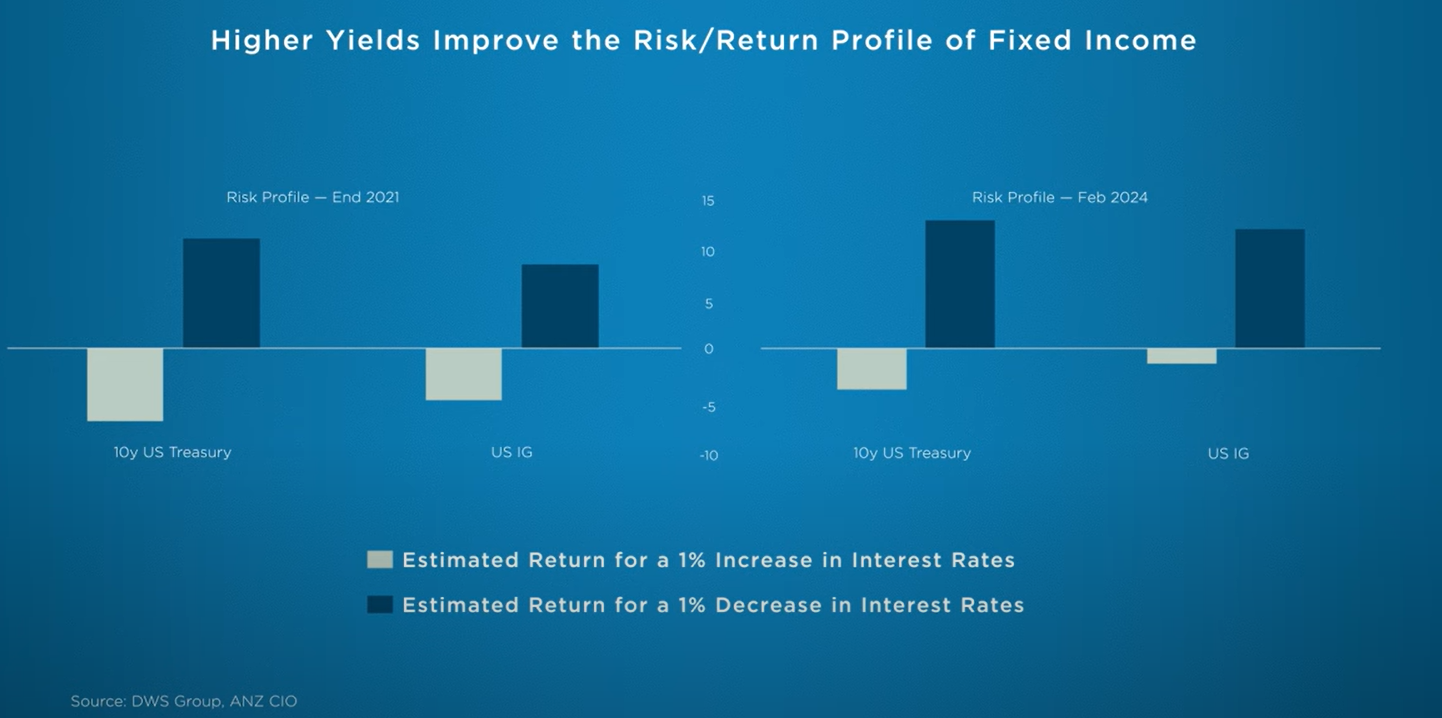

While at benchmark to shares, we remain positioned defensively overall with overweights to global and domestic investment grade credit and sovereign bonds. Yields on high quality bonds are commensurate with those available across the broad equity market; and with equity valuations remaining uncompelling and fundamentals weak, we continue to believe bonds provide the opportunity for better risk-adjusted returns and a defensive ballast for portfolios in the event of a broader market pullback.

Indeed, the sharp rise in yields has seen the risk profile of high-quality bonds improve markedly over the past two years. At current interest rate levels, price gains from a fall in rates can add to the expected return from higher coupons. Just as importantly, in the event of rising interest rates, price losses should be better absorbed by higher coupons, adding stability to a portfolio while offsetting potentially deeper losses across risk assets.

And with markets remaining finely balanced, alongside tactical portfolio positioning, this stability may prove critical for investors in the period ahead. After-all, ensuring you’re able to remain invested throughout the full market cycle is the most critical factor for compounding returns and long-term wealth creation.

5 topics