Morgan Stanley: Investors are still "vulnerable to disappointment"

Every January, Wall Street analysts release their forecasts for where they believe equity indices and fixed income yields will finish by December of the same year. Sometimes, they're pretty close to accurate given a couple of adjustments throughout the year. But 2022 decided otherwise. The S&P 500 finished last calendar year at 3,839. Morgan Stanley's Mike Wilson was the closest of all of Wall Street... at 4,400.

In other words, not a single forecaster saw the collapse coming in risk assets - let alone the magnitude of the declines. But Wilson's colleague on the buy side believes more pain could be on the horizon.

"With the directional basics of the Fed policy pivot behind us, the fog has thickened," Lisa Shalett, Morgan Stanley Wealth Management Chief Investment Officer wrote in a recent research note.

In this wire, I'll take you through some of the key highlights from Shalett's most recent note and share how that is affecting the team's asset allocation recommendations.

Shalett's View

Shalett's (and, for that matter, Wilson's) 2022 view was predicated on something simple - the consensus view was too textbook and too bullish. While few could have foreseen the ongoing Russian invasion of Ukraine or the Democratic Party's upset in the midterm elections, no one realised just how much those events would impact financial markets.

But it was inflation's persistence that really caught Shalett and Wilson's attention. While most of Wall Street believed inflation was transitory, they had a contrarian view that proved correct.

Shalett believes the investment consensus is still too bullish for 2023. Many participants believe the US Federal Reserve will attain that all-important soft landing (bringing inflation down without bursting the labour market). Should a soft landing happen, the theory is that corporates will still be able to deliver marginal earnings growth. But Shalett doesn't buy either of these scenarios:

Do you agree with Shalett's bearish view of asset market returns in 2023? Let us know in the comments below.

Asset class implications

Before I dig into these allocations, it should be noted that Shalett and her team invest at the high net worth-end of the market. That is, these allocations are recommended for people with seven-figure pay cheques and up to $25 million in investable assets.

Equities: Overweight emerging markets, equal-weight US stocks

"While recession risks for the broad [US] economy remain low, prospects for negative earnings revisions are rising as are headwinds to valuation multiples."

China: This time is (finally) different

Bonds: Don't fight the Federal Reserve

"After seven Fed rate hikes, equity investors have been eagerly awaiting an end to the increases. Given the inverted US Treasury yield curve, however, such a “Fed pause” might not spark a rebound."

Commodities: Are the best times over?

As you'd expect, investors with a conservative approach are recommended to put more than two-thirds of their model portfolios into fixed income. In the most conservative portfolio, just 13% of the allocation is geared towards equities.

For those with a much more bullish or opportunistic bias, more than 60% of the portfolio is geared towards equities with most of that money still invested in the US. In contrast, just 17% of that model portfolio is in bonds.

Interestingly, across all five model portfolios, commodities are only two percent of the recommended allocation. Imagine an Australian firm getting away with a two percent allocation to commodities!

One last note

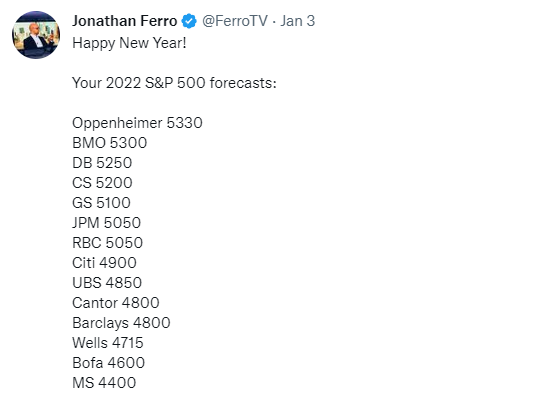

Back on the point of forecasts, I thought I'd share with you this great tweet from Jonathan Ferro (Anchor at Bloomberg Media, New York):

As I am sure you've worked out, these are the 2022 forecasts for the S&P 500. And as we mentioned at the beginning, Morgan Stanley was way off but somehow also the closest to the real thing.

Now, let's take a look at the 2023 forecasts for the S&P 500.

Who will be closest to the mark by the end of December 2023? And could the S&P 500 actually finish way down two years in a row? I guess we'll all find out in due course.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

1 topic