Morgan Stanley: Nickel likely troughed, Lithium closer to a floor

Lithium bulls are all too aware there’s finally a decent rally going on in lithium minerals, and in most cases, ASX lithium stocks.

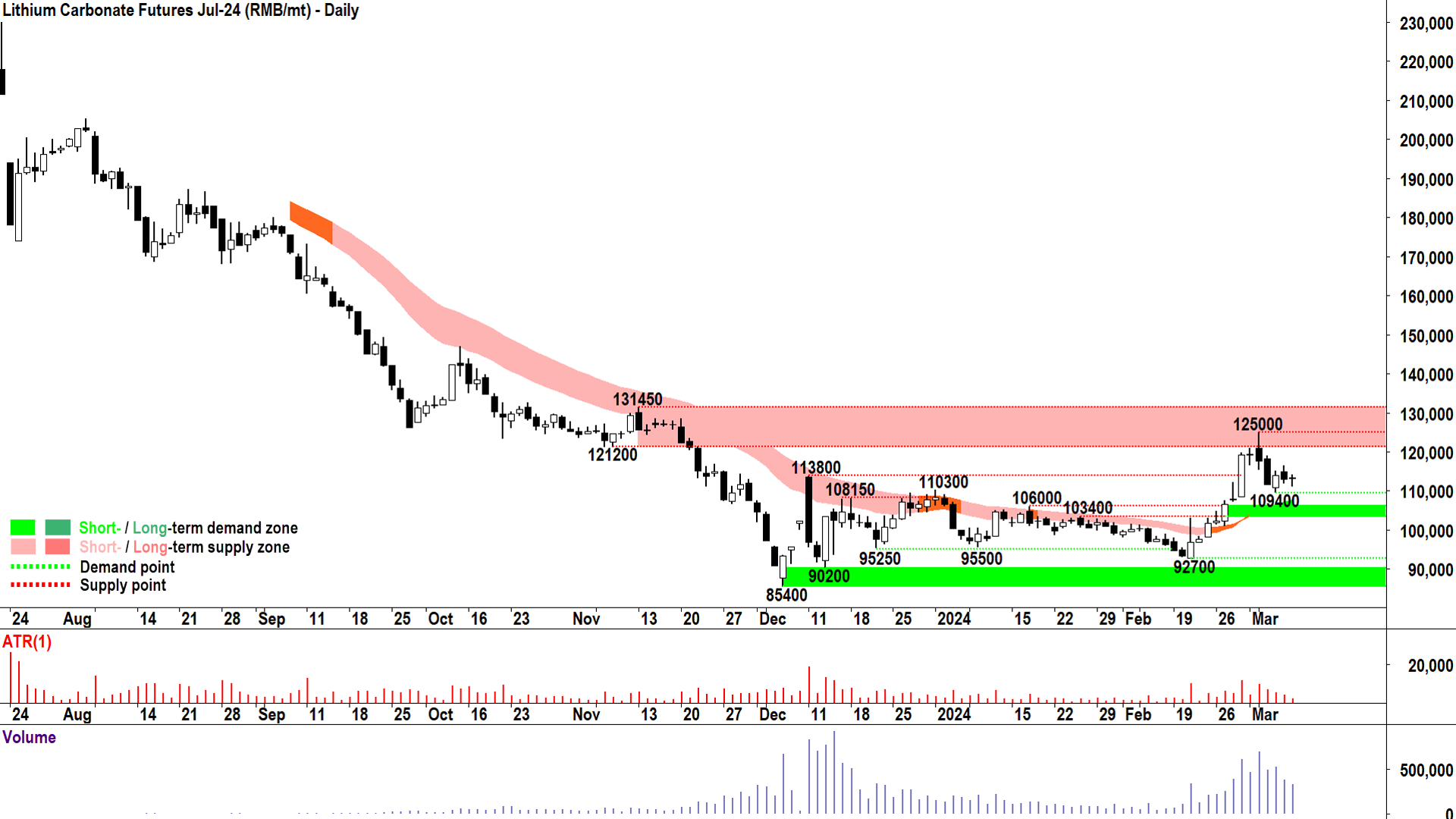

The benchmark July lithium carbonate contract on the Guangzhou Futures Exchange (GFEX) surged to RMB 125,000/t on 21 February, up from its December low of RMB 85,400/t. Whilst this 46% gain is impressive and likely a great relief to lithium bulls, a correction last week has trimmed the lithium carbonate price back to around RMB 113,000/t.

Those following nickel prices would know it’s had just as tough a time as lithium. Since late 2022, the market has been awash with cheap supply of nickel pig iron from Indonesia. Over this time, the nickel price on the London Metals Exchange has halved from just over US$31,000/t to US$15,620/t by early February this year.

But the nickel price is also bouncing, scraping its way back to just shy of US$18,000/t.

Morgan Stanley has weighed in on the tantalising prospect of an enduring low in the markets for each of these key battery metals in a recent research report. If their thesis “the risk-reward is starting to improve” is correct, Aussie mining company investors could finally be seeing some light at the end of a very long tunnel. Let’s bullet point Morgan Stanley’s major findings.

“Nickel has likely troughed”

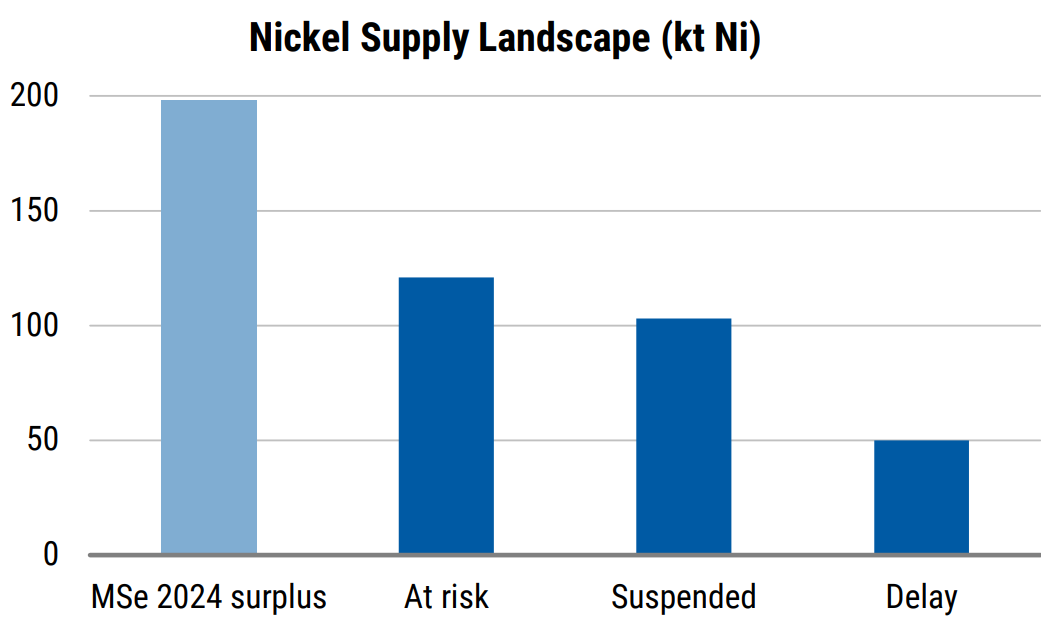

Most of the surplus modelled for 2024 has been wiped out by production cuts in Australia and New Caledonia; Approximately 110kt has been removed from system and around another 120kt is “at risk”

-

As much as one-third of Australia’s forecast nickel production in 2024 has been curtailed, but the Australian government’s 50% royalty rebate “

may provide some relief to miners, potentially slowing the rate of shutdowns from here unless nickel prices fall further”

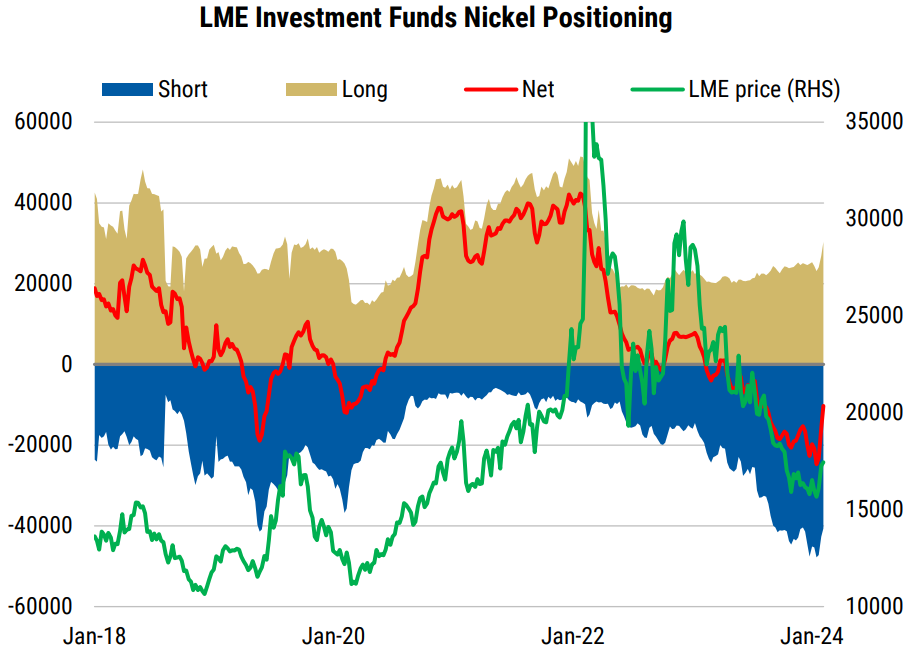

“Nickel short positioning had got very stretched”, and there is currently a degree of short covering occurring; Net short positioning which peaked in Feb at “over 24,000 lots” has dipped to “just ~10,000 lots”

On the demand-side, “nickel containing batteries continued to lose share to LFPs (lithium-iron phosphate)” but a recent rise in nickel sulphate prices suggests “a restock from cathode producers”

Given above factors, the nickel market in 2024 is likely to be “closer to balanced”, but “the trajectory could still be volatile from here”

“Lithium closer to finding a floor”

Meaningful supply cuts “are now picking up” (broker cites cuts from SQM, IGO’s Greenbushes and at Arcadium Lithium’s (LTM) Mt Cattlin, as well as delays at Mineral Resources’s (MIN) Wodgina)

78kt production cuts likely in 2024, equivalent to “6% of global production”

China environmental inspections also a factor: “it is estimated that around ⅓ of lepidolite production is currently halted” – but, there is a “seasonal element” to this factor, and “if the classification of refining slags is finalised, and no environmental protection issues arise, the supply disruption may once again only be temporary”

Broker notes “Demand bright spots” such as “China's planned Q1 cathode output has exceeded expectations” and recently announced Chinese government support to “boost EV spending through trade-in programmes and the revision of local policies that restrict the purchase of cars”

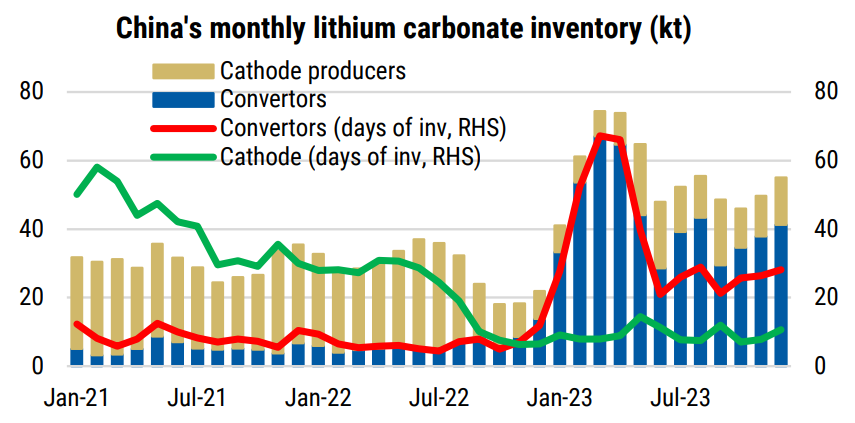

Broker notes “more still needed” in terms of supply cuts balancing demand: Cuts may be curtailed by the capex involved in production shutdowns, the recent price spike itself, and sales from inventories (broker cites Greenbushes and Core Lithium’s (CXO) Finiss Mine); In the meantime, inventories “across the supply chain remains elevated”

As a result of the above considerations, broker notes “The market is likely still in a surplus for 2024 on our estimates, but if current supply cuts persist and more supply cuts continue to come through, we could be closer to finding a floor”

In conclusion, Morgan Stanley notes: “We expect the spot price is likely to be choppy going forward, especially as any further cuts are likely to be somewhat reactive to prices, and depending on whether environmental measures in China prove to be temporary”

Conclusions

Sorry nickel and lithium bulls, just like the views we covered in articles last week from Citi and UBS and Macquarie, Morgan Stanley hasn’t been able to deliver a definitive “Yes! The low is in” conclusion. But, like Citi, UBS, and Macquarie, Morgan Stanley is acknowledging circumstances in battery metals markets have changed, and the recent rally in prices is therefore likely justified.

The major issue among all of the brokers covered, however, is the outlook in these markets remains both dynamic and murky.

This article first appeared on Market Index on Monday 11 March.

5 topics

5 stocks mentioned