Morgan Stanley: The range of possible outcomes for the oil market has rarely been as wide

There has been a lot of conversation swirling around the oil market of late, particularly given the potential for disruption stemming from the conflict in the Middle East.

Add to that slowing global demand, allegations of cartel members cheating on production limits, and uncertainty around when existing production cuts could taper off, and it’s no wonder the market has been volatile.

In a recent Morgan Stanley research note, the analyst team writes that:

The range of possible outcomes for the oil market has rarely been as wide as it is at the moment.

In one potential scenario, the crisis in the Middle East causes a disruption to the supply of oil, which in turn tightens the oil market and sends prices higher – possibly sharply. In another scenario, OPEC+ puts its considerable spare capacity to work in an effort to regain market share, in which case prices could fall – again possibly sharply.

Both of these scenarios have existed before, but rarely – if ever – at the same time."

In the following, I attempt to unpack these drivers and also share some recent analyses of local oil producers from the Livewire platform.

Short-term versus long-term

As is the case with a lot of commodity markets right now, it is important to distinguish between short-term and long-term outcomes.

For example, in the iron ore market, recent Chinese stimulus has lit a fire under prices, but the market remains in long-term, structural decline – due in large part to falling demand and a wall of production that is likely to land post 2025/6.

It’s a similar situation concerning the oil market.

We’ve seen a short-term rally in WTI crude, particularly over the past 10 days, amid worries that the conflict in the Middle East could cause a supply disruption.

Despite the escalating conflict, Morgan Stanley’s base case is that there will be no supply disruption, but that hasn’t stopped it from raising near-term Brent forecasts.

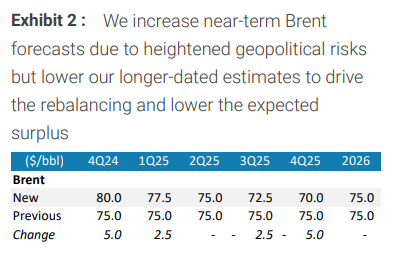

As can be seen from the table above, MS raised its Q4 2024 forecast from US$75 per barrel to US$80, and its first-quarter 2025 forecast from US$75 to US$77.50.

But its second-quarter 2025 forecast remains unchanged, and the two subsequent quarters were revised lower.

The commentary supporting these price forecasts is as follows:

“In the short term, we suspect that concerns over supply disruptions will continue to support oil prices. We have reflected this in our 4Q Brent forecast, which we have increased from $75 to $80/bbl, although the uncertainty interval around this is large”.

With the short-term covered, we now consider the longer-term.

As noted in the intro, global oil demand has been slowing, particularly from China, the world is pivoting (albeit slowly) to electrification, and even within the OPEC cartel, producers have been cheating on quotas and oversupplying the market.

Just last week it was reported by the Wall Street Journal that Saudi Arabia’s oil minister, Prince Abdulaziz bin Salman, warned fellow producers that oil could drop to $50 a barrel if they don’t comply with agreed production cuts.

OPEC was quick to come out and refute that reporting, saying that the words were never spoken, but the genie was already out of the bottle.

Saudi Arabia has long been frustrated by fellow members’ non-compliance with production quotas and has, in the past, cratered the market to send a signal that it won’t tolerate such shenanigans.

As recently as March 2020, the Saudis flooded the market with $25/barrel oil, specifically targeting big refiners of Russian oil in Europe and Asia. For those with good memories, you will recall that not long after, WTI crude futures made history by trading and settling in negative territory. The price of a barrel of WTI fell as low as minus $37.63 a barrel.

I’m not suggesting that the Saudis are about to do the same, but they have the capacity to release a lot of oil quickly if necessary. This means that any short-term disruption can be overcome relatively quickly, while longer-term, they have an incentive to sell that oil and ensure that their partners in the cartel aren’t cheating them too much.

Add to this waning demand in China and self-sufficiency from the US due to fracking, and the longer-term picture appears to be one of lower prices.

How this outlook affects Australian oil producers

While the fortunes of commodity producers will always be tied to the performance of the underlying commodities, one of the ways that producers can move the needle is with increased production.

Whether it is bringing new production online, or increasing the efficiency of existing production, the more you can get out of the ground for less costs, the better your margins and profits will be - regardless of the price of the commodity.

With this in mind, I’ve pulled together some of the recent commentary on Australian oil producers that has appeared on the Livewire platform in recent months.

Back in August, my colleague Carl Capolingua interviewed Martin Currie’s Michael Slack as part of our reporting season coverage, focusing on Santos and Woodside.

Michael had a BUY rating on STO at the time, and a HOLD rating on WDS, saying;

First of all, we take a much longer-term view than just these results. With that in mind, we prefer Santos over Woodside primarily because of its superior growth outlook. Woodside’s capex is predominantly being used to sustain production levels, that is, as production at its mature projects declines, they’re really only matching that loss from their newer projects.

Santos on the other hand, has a clear path to growth through their current and investment projects. We don’t think the market is paying for that strong production profile.

Meanwhile, on an August episode of Buy Hold Sell hosted by Matthew Kidman, the guests offered a double sell on Woodside.

David Wilson (SELL): For us, it's a sell. We were not that impressed with the acquisitions that they announced recently. They still need to convince the market on the merits of what they've done in Texas there. The rest of the business is performing solidly. It's got a well-supported buyer dividend yield. But for us, it's a sell.

Michael Wayne (SELL): In relative terms, we think there are better alternatives in the energy space. Woodside has very low-cost, very high-quality assets, but where's the growth going to come from? The dividends are pushing towards the upper end of that payout ratio. There are a couple of assets that they're looking to sell, which will allow them to maintain that dividend. But energy companies, resource companies for dividend plays, we're not so sure. We prefer others in the area.

The final word

When the professionals say that the range of possible outcomes in a market has rarely been as wide, you know it’s going to be tough to analyse.

But breaking down short-term and long-term drivers, and marrying them up with your investment timeframes, is potentially a way to go.

Active investors and traders will enjoy the short-term volatility and price distortions, whilst long-term investors could do well to remember their Economics 101 class and the basic laws of supply and demand.

5 topics

1 contributor mentioned