Morning Wrap: ASX 200 to snap three-day losing streak, S&P 500 higher as Big Tech recovers

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 55 points higher, up 0.69% as of 8:30 am AEST.

S&P 500 SESSION CHART

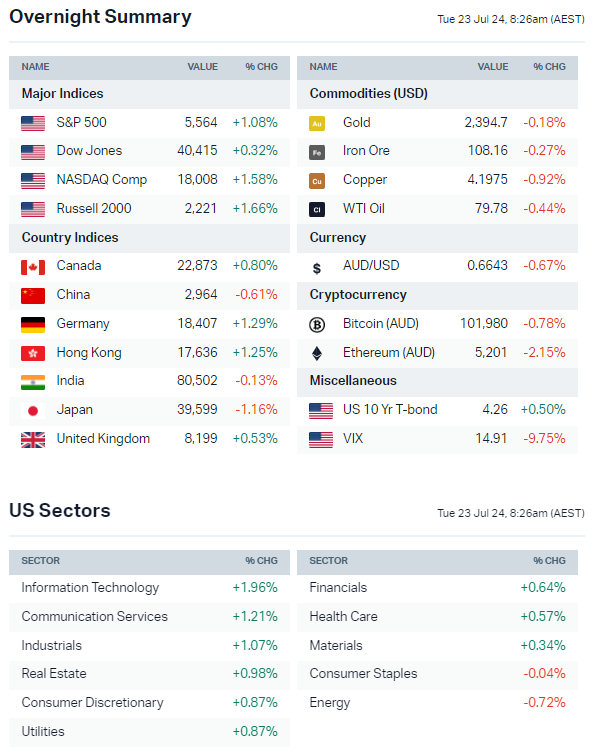

OVERNIGHT MARKETS

- Major US benchmarks bounced and finished near best levels

- Tech stocks led to the upside following recent rotational headwinds, top performers include Tesla +5.1%, Nvidia +4.7%) and Alphabet (+2.2%)

- Tech and growth bounce largely attributed to the post-CPI rotation going to far and too fast – the six largest tech stocks are still expected to grow EPS by 30% this year vs. 5% growth from the other 494 S&P companies

- Goldman Sachs says small-cap and equal-weight benchmarks will continue to outperform unless Big Tech’s Q2 results force analysts to upgrade 2H24 and FY25 earnings estimates

- Jefferies says the S&P 500 hit a weekly RSI of almost 80 last week – which has happened only 17 times since 1970 – this typically results in a short-term pause but solid 6 and 12 month gains

- So-called Trump trade may get recalibrated by Biden exit (Bloomberg)

- Hedge funds sold tech last week at fastest pace since January 2021 (Bloomberg)

- Bond markets rattled by bigger debt loads and volatile politics (Bloomberg)

- Sovereign wealth funds turn bullish on emerging markets (Bloomberg)

STOCKS

- European banks' Q2 earnings in the spotlight after big share price gains, analysts look for impact of higher rates, political developments (Reuters)

- Airlines still dealing with disruptions from CrowdStrike outage (CNBC)

- Private Equity firm L Catteron has approached Mattel with buyout offer (Reuters)

- Porsche tempers some EV ambitions, says transition will take years (Reuters)

- Fitch says insurance industry will likely to avoid any major impact from CrowdStrike outage (Reuters)

CENTRAL BANKS

- PBoC delivers unexpected cut to short-term policy rate in first reduction in almost a year (Bloomberg)

- Economists warn shipping inflation could complicate central bank rate cuts (FT)

- ECB's Kazimir says market bets on two or more rate cuts this year are not entirely misplaced but not baseline (Bloomberg)

POLITICS & GEOPOLITICS

- Biden drops out of Presidential race, endorses Kamala Harris (Bloomberg)

- Biden exit causes major abrupt shake up in both Democrat and Republican campaign strategies (Reuters)

- Harris wins backing of many Democrats, delegates and Democrat state chair support (Bloomberg)

- Harris seen as friendly to Big Tech, green transition (Reuters)

- Netanyahu heads to Washington, praises Biden's contribution to US-Israel ties (Reuters)

- Ukraine's Zelensky hints at negotiations with Russia with potential Trump back in White House looming (CNN)

ECONOMY

No major overnight headlines.

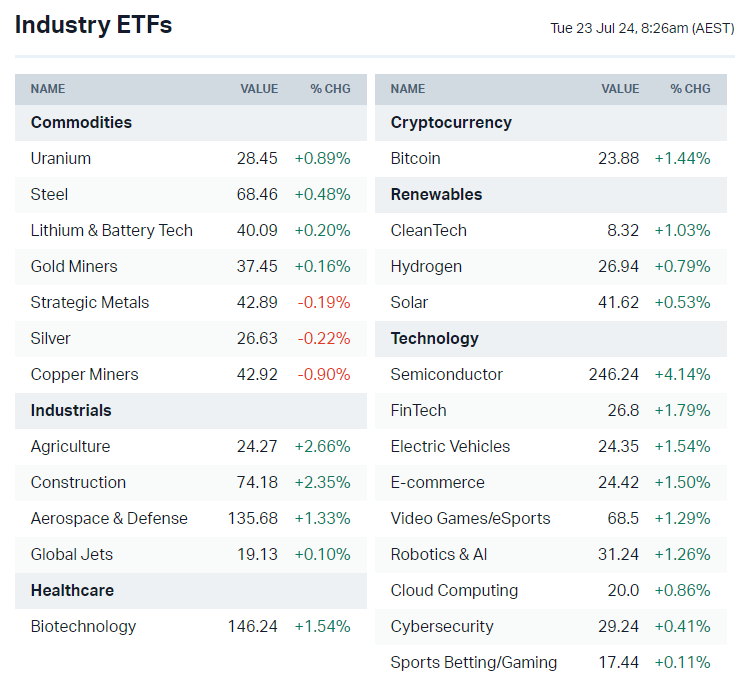

US-listed sector ETFs by iShares, Global X and VanEck (Source: Market Index)

ASX TODAY

- Arafura achieves major debt funding milestone, securing conditional approvals from commercial lenders for $775m of senior debt facilities (ARU)

- Lynas reports Q4 total rare earth production of 2.19Kt, gross sales revenue of $136.6m vs. $101.2m a quarter ago, cash balance of $523.8m (LYC)

- Ora Banda Mining reports Q4 gold production, full-year production of 69,932 ounces vs. guidance 67-73koz, FY25 guidance of 100-110koz (OBM)

- Plenti Group reports Q1 revenue of $60.9m, up 32% year-on-year (PLT)

- SRG Global guides FY EBITDA towards the upper end of guidance at $98-99m vs. prior guidance of $95-100m vs. consensus $98m (SRG)

WHAT TO WATCH TODAY

-

Day twos: A number of stocks reported quarterlies or trading updates on Monday. It will be interesting to see how they perform today as the market digests the new data. The names of interest include:

- Droneshield tumbled 20.9% after reporting Q2 revenue of $7.4 million, pipeline of $1.1bn and plans to increase manufacturing capacity from $400m pa to $500m pa. Lots of moving parts to DRO – the stock is down 40% in the past five sessions, downgraded by a number of analysts overnight

- Insignia Financial rallied 5.0% on better-than-expected Q4 update

- Iress rallied 9.3% on 1H24 earnings upgrade, expects to see first-half adjusted EBITDA of $65-67m

- Perenti rallied 5.7% after guiding FY free cash flow of $180m vs. prior guidance of $100m and above $113m consensus

- South32 tumbled 12.5% after its Q4 update downgraded FY25 alumina production guidance by 5%, Sierra Gorda copper by 7% and Cannington zinc by 9%

BROKER MOVES

- Amotiv downgraded to Hold from Outperform; target cut to $10.30 from $13.30 (CLSA)

- DroneShield downgraded to Hold from Buy; target cut to $1.30 from $1.40 (Shaw and Partners)

- DroneShield downgraded to Hold from Buy; target up to $1.60 from $1.0 (Bell Potter)

- Integral Diagnostics upgraded to Outperform from Sector Perform; target up to $3.15 from $2.30 (RBC Capital)

- FleetPartners Group initiated Hold with $3.80 target (Canaccord)

- Monash IVF upgraded to Outperform from Sector Perform; target up to $1.75 from $1.50 (RBC Capital)

- South32 upgraded to Buy from Neutral; target cut to $3.35 from $4.0 (Citi)

- Woodside Energy downgraded to Neutral from Positive; target remains $31.50 (E&P)

KEY EVENTS

Companies trading ex-dividend:

- Tue 23 July: Spheria Emerging Companies (SEC) – $0.034

- Wed 24 July: Alternative Investment Trust (AIQ) – $0.039

- Thu 25 July: None

- Fri: 26 July: None

- Mon 29 July: None

Other ASX corporate actions today:

- Dividends paid: None

- Listing: Axel REE (AXL) is the 100% owner of four prospective rare earth projects in Brazil – listing at 10:30 am

- Earnings: Biome (BIO), Freelancer (FLN)

- AGMs: Aroa Biosurgery (ARX)

Economic calendar (AEST):

No major economic announcements.

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment