Morningstar's commodity outlook and top stock picks

Darling commodities like iron ore and uranium are set to end a tumultuous year with gains of 70% and 22% respectively – which is remarkable given the global rate hike cycle, China's economic slowdown and geopolitical uncertainty.

The share prices of the all-important BHP (ASX: BHP), Rio Tinto (ASX: RIO) and Fortescue (ASX: FMG) have trended higher off the back of gains in iron ore. The same can't be said about anything else. The percentage of commodities trading above their 200-day moving averages has fallen to levels not seen since the March 2020 COVID crash, according to SentimentTrader.

So what does 2024 have in store for us?

Morningstar's Commodity Outlook

Here are Morningstar's commodity price assumptions for both next year and long-term.

The key forecast changes compared to the previous quarter include iron ore (2024 outlook upgraded by 10%), metallurgical coal (2024 outlook upgraded by 22%) and nickel (2024 outlook downgraded by 10%).

| Commodity | 2023 | 2024 | Long-term |

| Alumina (US$/t) | 344 | 338 | 322 |

| Aluminium (US/lb) | 1.03 | 1.04 | 0.8 |

| Copper (US$/lb) | 3.82 | 3.62 | 3.07 |

| Gold (US$/oz) | 1,907 | 1,865 | 1,738 |

| Iron Ore (US$/t) | 116 | 106 | 61 |

| Lithium carbonate (US$/t) | 42,948 | 41,923 | 14,661 |

| Met coal (US$/t) | 301 | 305 | 153 |

| Nickel (US$/lb) | 9.92 | 8.53 | 8.53 |

| Thermal coal (US$/t) | 176 | 145 | 102 |

Source: Morningstar. Data as at 7 December 2023. Long-term refers to price assumptions from 2027 for all commodities except lithium carbonate (from 2032).

Key Insights and Takeaways

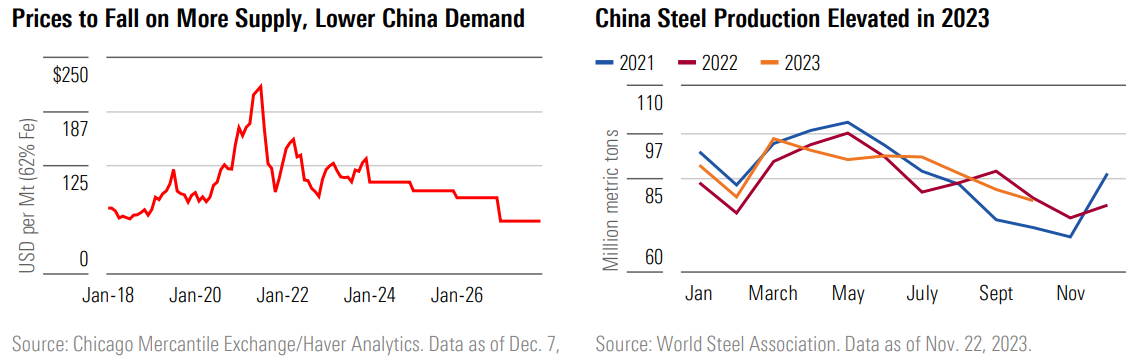

Iron ore: Iron ore prices have soared in recent weeks amid elevated steel production from China. But the analysts warn that "steelmakers are losing money," which will result in "falling premiums for high-grade iron ore and shrinking discounts for lower-grade iron ore." From a supply perspective, Morningstar expects total iron ore sales from major miners to rise approximately 14% to 2027. This reflects a recovery from Brazilian heavyweight Vale as well as incremental rise from Australian majors.

Copper: "While demand from China, 55% of global consumption, remains strong, rising western interest rates has slowed economic growth and drives recessionary concerns," the analysts said. Supply headwinds from major mines (closure of Cobre de Panama mine was worth 1.5% of global mined capacity and Anglo American reducing 2024 outlook) has helped keep prices relatively rangebound this year.

Metallurgical coal: "Metallurgical coal is likely to remain in demand for blast furnace/blast oxygen method steelmaking for many years as green steelmaking technologies are unlikely to be economic for the foreseeable future," the analysts said. Rising steel production in India is forecast to broadly offset falling production from China.

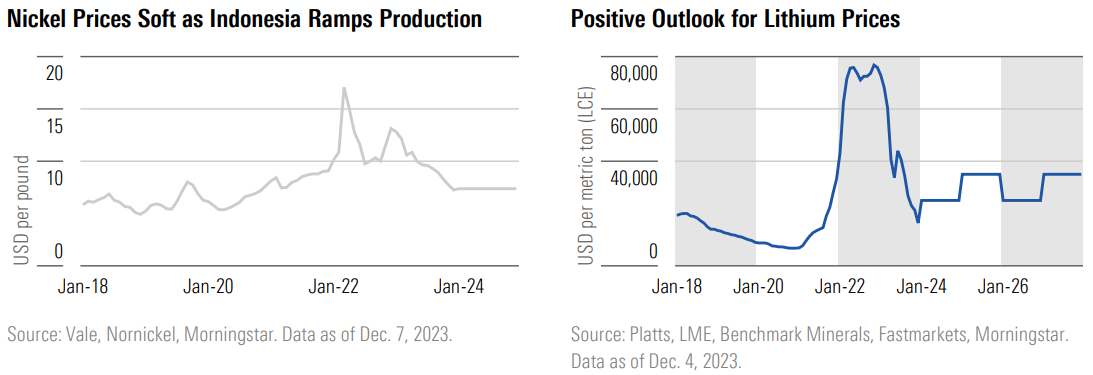

Nickel: Nickel prices are down almost 50% year-to-date amid a flurry of lower grade supply from Indonesia. "This is likely to persist as more projects start. Indonesian supply also weighs on battery-grade nickel prices," the report notes.

Lithium: Morningstar expects lithium demand to again outpace new supply growth, and for prices to experience a bounce in 2024.

Top Picks and Fair Value

Iluka Resources (ASX: ILU)

- Commodity: Mineral sands

- Year-to-date performance: -29%

- Last close: $6.77

- Fair value estimate: $10.50

- Rationale: "... concerns are more than reflected in its share price. Longer-term, maturing mines and a lack of large, high-grade, undeveloped resources are likely to support mineral sands prices. The company's proposed rare earths refinery at Eneabba is an option on elevated rare earths prices."

%20Share%20Price%20-%20Market%20Index.png)

Whitehaven Coal (ASX: WHC)

- Commodity: Metallurgical and thermal coal

- Year-to-date performance: -23%

- Last close: $7.22

- Fair value estimate: $10.00

- Rationale: "We think its deal to buy two metallurgical coal mines from BHP is a good one, diversifying its production to roughly half thermal coal, half metallurgical coal ... Both high-quality thermal coal and metallurgical coal are likely to be supply restrained due to ESG concerns and regulatory opposition, which could support prices longer-term."

%20Share%20Price%20-%20Market%20Index.png)

Newmont (ASX: NEM)

- Commodity: Gold

- Year-to-date performance: -17%

- Last close: US$41.09 (Morningstar refers to NYSE listed price)

- Fair value estimate: US$53.00

- Rationale: "We think Newmont’s shares are undervalued given its weak sales volumes in the first nine months of 2023, which have led to elevated unit cash cost."

South32 (ASX: S32)

- Commodity: Diversified

- Year-to-date performance: -19%

- Last close: $3.25

- Fair value estimate: $3.90

- Rationale: "Undemanding valuation metrics, diversified portfolio of future-facing commodities and strong balance sheet are attractive. Its strategy is to transition its portfolio to metals such as aluminium, alumina, copper, and zinc, commodities more likely to benefit from decarbonisation and electrification."

%20Share%20Price%20-%20Market%20Index.png)

This article was originally published on Market Index.

4 topics

7 stocks mentioned