Multiple fault lines opening for the Aussie Dollar

Elizabeth Moran Consulting

One month into 2018 and the AUD has punched above 80 US cents and is looking pretty perky. It is trading around its highs against the beleaguered USD since 2014. So, why is it up here again? Can it last? Is it time to sell? Or strap in for a resurgent Aussie currency? Guest Editor Greg Gibbs takes a look at what we may expect from the Australian dollar this year:

Multiple fault lines for the AUD

Essentially, we see the potential for the AUD to climb further this year, as the USD struggles to find its feet and global investor sentiment is buoyed by stronger more synchronised global growth. But above 80 cents it starts to look more fully priced for perfection, and multiple fault lines may change the outlook rather quickly. These include faster Fed rate hikes, rising global bond yields, more volatile global markets, Chinese credit tightening, a weaker Australian housing market, and the political cycle in Australia.

USD goes from bad to worse

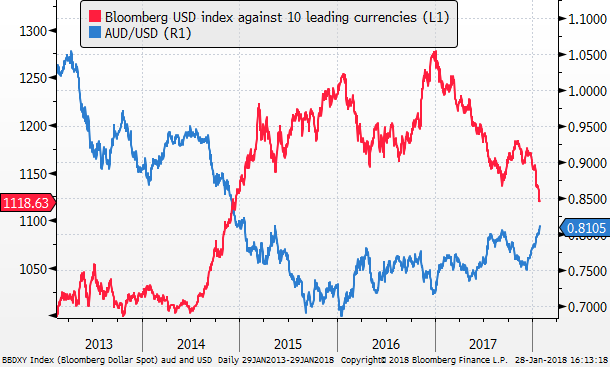

In our previous article, “Rock and Hard Place”, we did not offer a very bright outlook for the AUD, but noted much depended on whether the USD could pull out of its funk. 2017 was one of the worst years for the USD in some time; the Bloomberg USD index against ten leading currencies fell about 10% last year.

Stronger AUD is really a weaker USD story

And this year has started even worse for the USD; it has slipped a further 3.5% already in the first month (to 25-Jan). It has given back more than half of its rise from its low in 2014 to its high in 2016, approaching the 61.8% Fibonacci retracement of this period of dollar strength.

It's fair to say that the AUD’s recent rise is hardly about the AUD at all; it's mainly the flipside of a weaker USD.

Equity FOMO* drives the USD down

The fall in the USD is a bit of a head-scratcher. As we said in November, the USD has fallen despite more US rate hikes in 2017 than any other developed country, the beginning of Fed quantitative policy tightening, a labour market that has tightened beyond its equilibrium, and a big tax cut set to boost the economy.

We surmised that the main factor undermining the USD was that, “Currencies that are more often beholden to interest rates are instead taking their cue from equity capital flows.” Indeed that theme has intensified as FOMO in global equity markets has kicked in driving a rapid further melt-up so far in 2018.

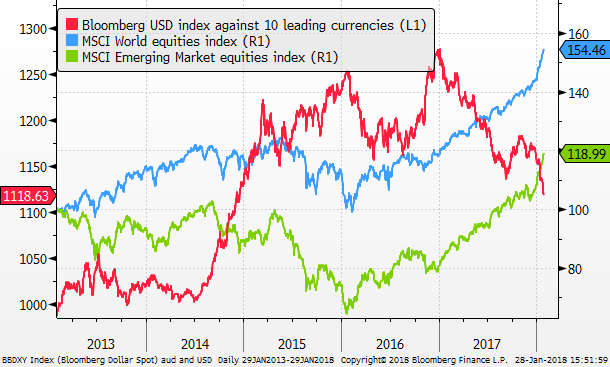

Equities have risen everywhere and rapidly, supported by synchronized and stronger global growth. Investors are chasing returns in equities; there is not a lot of focus on alternative strategies; including currencies and their interest rate carry.

Global equity rally accelerated in January, placing renewed downward pressure on the US dollar

Strike one, two and three for the USD

There are, of course, risks being built into global financial markets. The global equity market may be getting overheated, and the USD fall this year looks a bit too rapid to be sustainable. But the USD has broken through key supports, including the 2016 lows. The mood has turned decidedly bearish. Many analysts now think the USD has begun a multi-year retreat.

The robust European economic recovery is fuelling confidence in its equity market, and equity investors in Europe are no longer so interested in hedging their EUR exposure, notwithstanding the deteriorating EUR/USD yield spread providing increased carry return for selling EUR/USD.

Investors in Japanese equities are more confident in a sustained recovery in Japan. And they are encouraged by corporate reform, including an increased focus on governance and return on equity.

They perceive BoJ policy easing at its peak, and in a long term sense, the JPY is viewed as relatively cheap. As such, equity investors in Japan are no longer routinely hedging their currency exposure. Furthermore, there is much less interest in selling JPY to fund investments in global assets or pursuing short JPY carry trades.

In light of the recent experience of a strong rise in EUR in 2017, despite only a very gradual ECB monetary policy easing unwind, investors are now very wary of selling JPY. Japan, like the Eurozone, has a significant current account surplus, and without capital outflow, including carry-trades in currency markets, equity-related capital inflow may continue to boost the JPY.\

Emerging market equities have outperformed developed markets since their recent low in early 2016; the MSCI emerging market index has risen to a high, not seen since 2008. Emerging market currencies are historically more highly correlated with their local equities. As such, it is less of a surprise to see stronger emerging market currencies in the current environment.

When you have the two largest non dollar major currencies rising vs. the USD, in defiance of their widening yield disadvantage, and emerging market currencies rising against the USD, then the USD decline starts to look very broad based.

More attention to good news outside the USA

In a broad based USD decline, the market tends to pay less attention to news that might be bullish for the USD, but reacts more to positive developments for other currencies.

In conjunction with stronger global demand, a weaker USD is also contributing to higher commodity prices. This then tends to support growth, assets, and currencies in commodity driven economies; including Australia, further adding to the breadth and power of the USD decline.

Moving beyond the crisis mentality

The market has moved beyond the crisis mentality that defined much of the period from 2008 to 2016, into a more buoyant mood where the global economy and assets are viewed in a sustained growth phase.

In many respects, the current market environment feels more like the pre-global financial market crisis era, from 2004 to 2007. Like the current phase, the USD tended to weaken against most other currencies in the few years before the 2008 crisis. The AUD rose from an average around 75 US cents in 2006 to a peak near 89 cents just before the US sub-prime crisis began in July 2017. It later rose even higher to a peak of 98.5 cents in 2008 before the Global Financial Crisis really kicked-in, but in a more volatile and complicated market that is another story altogether.

Impervious to risks

Like 2004 to 2007, the market seems largely impervious to developing risks, such as the protectionist trade steps by the Trump administration, shadow banking risks in China, or the possibility that the US economy overheats and the Fed is forced to step up policy tightening.

It may take some time before the market breaks out of its current pattern of rising global equities and falling USD trend.

Political chaos

In my “Rock and a Hard Place” article I also noted that political chaos is probably also undermining the USD. Trump got a big win with his tax cuts, and this really should have done more to shore up his support and boost the USD. However, he still languishes in the polls, Congress continues to battle through rolling government shut downs, and it is getting bogged down again in a contentious immigration debate. The Mueller investigations rolls on. And the mid term elections in November loom large.

Let’s put it kindly; the unconventional Trump administration is not generating global investor confidence in the USD. Some are even wondering if it should be viewed as the premier reserve currency anymore.

The market can see political upheaval lurking in the US, potentially pulling the rug out from an already unstable USD. And this is probably also keeping the USD from responding to its stronger economy and rising interest rates.

AUD has more fully participated in the recent USD slide

The Australian economy, like many in the world, has shown stronger growth in the last year. As we mentioned above, in the current environment, good news for the USA matters less for the USD than good news in Australia matters for the AUD.

Business surveys in Australia have remained upbeat, capital investment has stepped up and is even being crowded in by stronger government infrastructure investment. And employment growth in Australia (3.3% year on year in December) is at a high since 2008.

There still appears to be significant slack in the Australian labour market, and rate hikes are not yet fully on the radar, but there is a blip in sight, suggesting a hike could be on the cards in the second half of the year. Consequently, the AUD has more fully participated in the recent slide in the USD this year.

Australian equities still lag

If equity flows are predominantly driving currencies, Australian equities are still laggards in global comparisons. However, materials equities in Australia are probably attracting more interest amidst the recent strength in commodity prices.

MSCI country equities indices in USD terms – Australia lags

China’s credit tightening

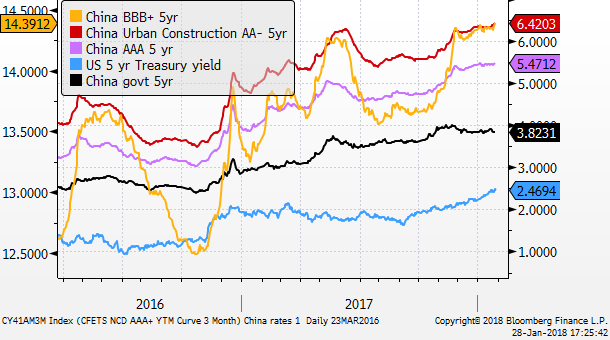

The AUD remains a key proxy for financial and economic stress in China. China has stepped up its regulation and oversight of shadow banking, and this may tighten credit conditions for corporations and local governments, posing a risk for growth in China.

Short term funding rates for Chinese banks (1yr Shibor and 3mth NCDs) have increased moderately in the last year.

Short term funding costs for Chinese banks have risen

Chinese corporate bond yields have also risen moderately, increasing the spread over Chinese government bond yields that are also firming.

The market may have become more confident that China can manage its need to rein in excessive credit growth without an economic downturn, but it is far from assured. We suspect the AUD will struggle more than many currencies to rise this year against the USD, especially if credit conditions in China continue to tighten.

Chinese corporate bond yields have risen

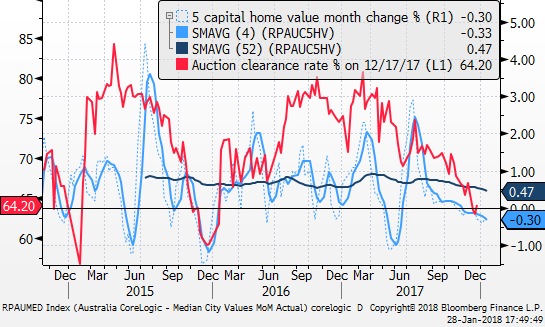

Interest sensitivity in Australia

The housing market is probably also a limiting factor for the AUD rally. The prospect of higher interest rates globally and in Australia may keep the housing market relatively soft in Australia as it grapples with high levels of household debt and increased supply. This could keep consumer demand in Australia running below many other nations and prevent a full blown rebound in the AUD.

Australian households are likely to be far more interest rate sensitive than many other countries, including the USA. There is a risk that the rather benign outlook global investors have for global bond yields rising all that much this year is too optimistic.

If the Fed is forced to tighten more aggressively, such that US yields rise more than expected, apart from increasing the USD yield advantage, it could trigger more global investor uncertainty, spill over to higher funding costs for Australian banks and higher mortgage rates in Australia, even before the RBA contemplates policy tightening.

We would start to shy away from the AUD as global bond yields start to rise more rapidly, especially if it is combined with a correction in global equities and more global market volatility.

Australian housing market weaker – weekly CoreLogic data

Political cycle

The political cycle in Australia is likely to become a limiting factor as the year proceeds. The citizenship saga has not fully played out, and the government’s majority is razor thin.

A half Senate election must be held between 4 August 2018 and 18 May 2019. And although strictly speaking the Federal election for the House of Representatives, which determines the government, is not due until November 2019, this normally coincides with a half-Senate election. As such, a national election is likely to be held late this year or early next year.

On a two-party preferred basis, which determines election results, the ruling Liberal-National Coalition has languished behind the Labor Party opposition since not long after the last federal election in 2016.

Investors in the housing market must start to consider that, within the next year or so, negative gearing and capital gains concessions that have boosted household housing investment demand to very high levels compared to most countries may be removed, adding to downside pressure on an already weaker housing market.

Furthermore, the broader political uncertainty that would arise from another change of government in what has looked like a revolving door parliament for the last decade will not be good news for the Australian economy or the AUD.

4 topics

Nationally recognised expert in fixed income asset class. Career spans more than 25 years in banking and finance in diverse positions including: education, communication, media, credit research, credit ratings and retail and commercial lending.

Expertise

Nationally recognised expert in fixed income asset class. Career spans more than 25 years in banking and finance in diverse positions including: education, communication, media, credit research, credit ratings and retail and commercial lending.