NAB's launches landmark insto hybrid in unlisted market...

NAB has announced an important new BBB- rated unlisted or over-the-counter (OTC) hybrid transaction, which will be the first well-structured, public OTC AT1 hybrid deal from a major bank in over a decade.

NAB did print a $500m hybrid deal in the OTC market in December 2019, which had a 10 year call (expected repayment) and priced on a spread of 375bps over swap. But this was dominated by one investor. In our view, it was a de facto intra-day, private placement.

A few quick thoughts on the features of the transaction:

- The previous NAB OTC hybrid deal priced at 375bps over swap for a 10 year expected maturity whereas this deal has a much shorter 5 year expected call date, which will be more palatable to a wider range of investors (and is frankly short by ASX hybrid standards these days).

- NAB has offered a very generous spread in the 400bps to 410bps range to ensure it performs well, which is a materially superior spread to the 375bps instos were happy to accept for the same instrument with twice as long an expected maturity in December 2019. This represents an appealing 50bps to 75bps premium to the ASX AT1 hybrid market, which remains cheap. In particular, the 5 year major bank ASX hybrid curve is currently trading around 350bps, which is still well wide of the 270bps spread that prevailed pre-COVID-19 and way north of the mid-to-low 200bps level that represent the post-GFC tights (cf. 2014).

- We expect ASX AT1 5 year major bank hybrid spreads to continue to compress to inside pre-COVID-19 levels (ie, below 270bps), and we think this OTC deal will follow suit. Here we note that 5 year major bank senior bond spreads are trading both inside pre-COVID-19 levels and post-GFC tights (at 57bps).

- There is also the precedent of the major banks' Tier 2 subordinated bond market, which in 2012 and 2013 was exclusively an ASX listed market that over time shifted into the OTC domain. Importantly, OTC Tier 2 bond spreads have consistently traded about 20-50bps tight of their ASX listed cousins.

- NAB has taken a very different approach to this OTC hybrid compared with the inaugural post-GFC deal it did late last year. The December 2019 10 year print was a fixed-rate debt instrument, eliminating a lot of retail demand. This will be in floating-rate format (like all ASX hybrids) that pays a set say 400-410bps spread above the three month bank bill swap rate.

- NAB did not use any other banks to distribute the December deal. This time around it has mandated Citi, Deutsche Bank, National Australia Bank, and TD Securities as Joint Lead Managers and Bell Potter, Crestone, Escala, Evans & Partners, JB Were & Morgan Stanley PW as Co-Managers.

- This will significantly improve secondary liquidity. To further enhance secondary liquidity, NAB will for the first time be making-markets in its own OTC NAB hybrid securities, which it pointedly refused to do with the December deal. Coolabah did not participate in that deal because there was no secondary liquidity.

- If this trade succeeds, it will result in a lot of ASX hybrid capital shifting into the OTC domain, which is much cheaper for banks to execute in. OTC also carries much lower regulatory risk.

- Bloomberg prices all AUD hybrids in franked terms, and they trade on a franked spread basis on the ASX and in OTC, so there should be no complaints about pricing.

- Contrary to popular myth, all fund managers can use franking credits. Their fund administrators are legally obliged to send clients tax statements that specify the franking credits they are entitled to. We currently run more than $1bn of bank hybrid capital exposure, including for super funds that happily claim the franking credits.

A little more detail on using those franking credits...

The new NAB OTC AT1 hybrid instrument pays a franked coupon (30% of each coupon payment is paid as franking credits, and 70% as cash, assuming NAB fully franks all dividends and hybrid distributions). Because Australian holders can utilise franking credits, it will trade on a franked credit spread – meaning accrued franking credits will form part of trade consideration when you buy or sell.

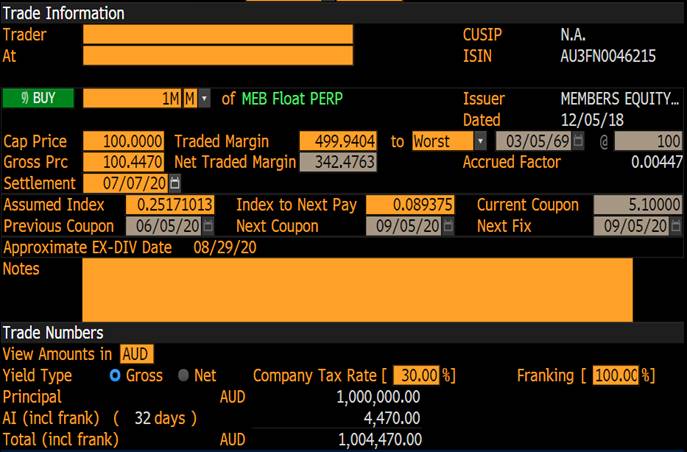

You can see this with the existing Members Equity Bank AUD floating rate hybrid, which the proposed new issue will resemble economically. The security (AU3FN0046215) pays a quarterly distribution of 3mBBSW+500, which is franked such that 30% of each coupon payment is received as franking credits. Bloomberg can price the hybrid inclusive of franking credits as seen below. For the below example, 32 days of accrued interest is calculated off the full coupon rate (5.1% set on 5th June) over the 5th June – 5th September period, not any cash portion thereof. This means that when a hybrid is sold, you get cash consideration for accrued cash and franking credits.

Fund managers can directly use any received franking credits:

- All fund administrators are legally required to track franking credits received by the portfolio, and to distribute them to clients/unitholders annually;

- Underlying clients will receive franking credits on their annual tax statement, which depending on their individual circumstances can be used to reduce their taxable income or even claim a cash rebate from the ATO; and

- If requested by a client, it is a straightforward exercise for fund managers to calculate a portfolio return including franking credits on a case by case basis, which captures the additional value you are adding for underlying clients.

1 stock mentioned