Nanosonics: Never a better time to be a global leader in infection prevention

Nanosonics is the market leader in infection prevention for medical devices such as ultrasounds. With less than 20% global market share, there is a long runway of growth available from its existing markets and through expansion into new countries including Japan and China.

The company’s revenue model is compelling. While large inflows from the sale of its devices to hospitals are attractive, from our perspective the real value driver is the recurring consumables revenues which are linked to the daily use of their devices.

Nanosonics has a highly scalable manufacturing process, requires little capital for growth, generates very strong free cash flow, and is investing in R&D for growth. With a net cash position, its balance sheet is in great shape at a time when many companies face a funding squeeze.

There has probably never been a better time to be a global leader in infection prevention.

Events of the last few months are certain to leave the world’s healthcare professionals even more focused on the importance of best practice in infection control. Medical authorities around the world are driving the adoption of new technologies, and rising paranoia post COVID-19 is set to further accelerate this trend. As the market leader for medical device disinfection, Nanosonics is a clear beneficiary from the acceleration of this structural trend.

Nanosonics has a unique, automated device, which is setting a new standard of care in ultrasound disinfection practices. While the trend to improve disinfection practices in hospital settings was well underway before COVID-19, the issuance of new guidelines in many countries is now mandating the use of higher level disinfection. Nanosonics, as the market leader, is benefiting from this steepening adoption curve.

Following the Cochlear roadmap?

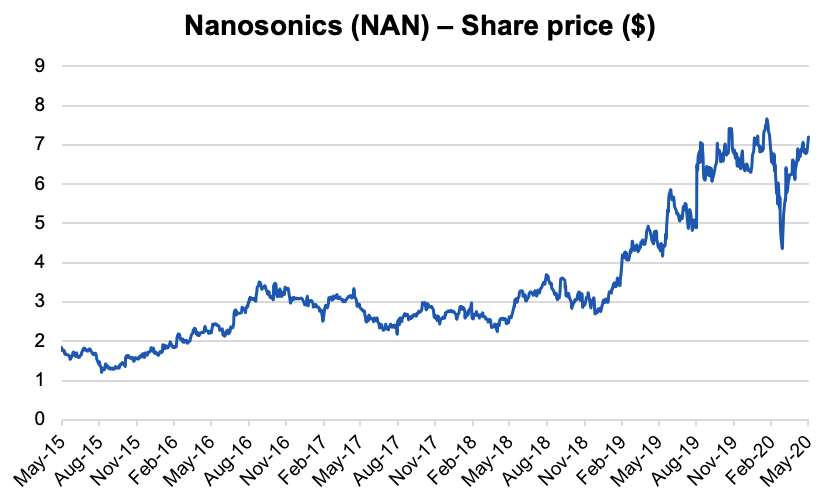

The Nanosonics share price has been a good performer, up more than 300% over the last five years (refer chart) but we believe there is further upside available over the longer term. The stock fell sharply into the COVID-19 induced sell-off, but has recovered almost all of that value as investors better understood that the long-term earnings power of the business is unchanged.

Source: FactSet, May 2020

The company’s product replaces a manual, time-consuming and ineffective disinfection process with an automated, simple and highly effective one. Recent studies suggest the Nanosonics product is the only effective process to avoid transmission of infections like HPV (human papilloma virus). Unsurprisingly, its product is getting the attention of hospitals around the world.

Nanosonics first came to our attention when their current CEO, Michael Kavanagh, joined the company in 2013. Michael was an experienced and highly regarded former Cochlear senior executive, and we wondered what Michael had seen at Nanosonics (he was on the board prior to his appointment as CEO) which would entice him to leave Cochlear. Since joining, Michael has built an outstanding senior leadership team (including some former Cochlear colleagues) who are driving execution of the strategy.

The comparison with Cochlear doesn’t end there. Both companies have:

- global market technology leadership;

- a long runway of growth from expansion into new countries;

- scalable manufacturing;

- attractive installed bases which generate ongoing revenue; and

- the ability to self-fund growth from strong cashflow generation.

Investors in Cochlear will understand the value of an installed base for generating future revenue. Good companies continue to invest and innovate to entrench a strong market position. The latest generation of the Nanosonics product, Trophon 2, has important technology and integration benefits for hospitals, which makes it difficult to replace. Future generations are likely to continue integrating their technology into the hospital setting, potentially with the use of data.

How to value Nanosonics

Investors often find these businesses challenging to value and optically they can appear expensive. We think there are a few important dimensions to valuing Nanosonics.

Firstly, the company has a high level of recurring revenue from the sales of consumable products for their devices. As the installed base of devices grows, so does the recurring revenue, generating very high margins and considerable long-term value as it compounds over time. This revenue stream was up 40% at the last result and represented over 70% of revenue.

Secondly, the large addressable market offers many years of growth as existing markets are penetrated and the offer is then expanded into new countries such as China and Japan. An interesting feature of these businesses is that innovation tends to grow the addressable market and we expect that will be the case for Nanosonics. Penetration of the global market is less than 20%, providing many years of growth.

Thirdly, the commitment to invest in research and development (and which is conservatively expensed in the P&L each year) is driving innovation, delivering new generations of the existing product and optionality with new products. These new generations of the existing product offer the potential for an upgrade cycle (replacing existing devices with the new generation). Upgrade sales are only just beginning to be rolled out.

A new product launch into a large addressable market is imminent, with no value captured in the current revenue stream and negative value already captured in earnings from the expensed R&D investment. The big opportunity for Nanosonics is to leverage their sales team by selling new products to the existing hospital customer base.

Over 75,000 patients per day are now benefiting from the disinfection process and that number continues to grow as new units are installed.

Putting these factors together, we can see multiple layers of compounding growth and recurring revenue, all self-funded from cashflows. And with very low capital requirements, we expect the company will generate very high returns on capital over time. Low capital requirements and an $82mn net cash position also mean the prospect of a capital raising (outside an acquisition) is highly unlikely.

Companies with these characteristics are rare indeed.

Impacts from COVID-19

In the near-term the business will not be immune to COVID-19 disruption. Access to hospitals is an important part of the sales process. With only limited access over recent months, we would expect some degree of capital sales disruption to persist through the remainder of 2020.

However, with early indications that hospital access is starting to improve, we regard these sales as being deferred rather than lost. The underlying need is still there. The last few months have also reinforced the value of a recurring income stream. For Nanosonics, the durability of the consumables revenue will be evident with the company continuing to generate good growth and cashflow in this area.

Sell-offs like that observed during COVID-19 have been an exciting time for long term investors. The opportunity to think and act long-term while markets focus on the short-term has never been greater.

Every company with disruption to their business has experienced a share price sell-off in recent months. In many cases this sell-off has been extreme. The key question we have been asking is whether the disruption changes the long-term earnings power of the business.

For some businesses it has accelerated structural trends already underway, such as for shopping malls where COVID-19 has been a clear negative and the value of the business is diminished.

For companies such as Nanosonics, the COVID-19 disruption has not diminished the long term earnings power of the business, although it may prove to have accelerated the opportunity.

Discover small and mid cap potential

Australian investors can access the Yarra Australian Smaller Companies Strategy via the UBS Australian Small Companies Fund, a fund which has been managed by Yarra Capital Management since December 2018. For more of our insights, click the 'FOLLOW' button below.

2 stocks mentioned