New Zealand held interest rates steady at 5.5%, UK annual CPI y/y fell to 6.8%

Let’s hop straight into five of the biggest developments this week.

If you’d prefer to watch this update, rather than read about it, please click below.

1. New Zealand held interest rates steady at 5.5%

The RBNZ sat on its hand yet again to hold interest rates at 5.5%, in line with market expectations. This was expected as inflation has cooled in recent months to the current 6% level. However, economists consider inflation to be too high to consider the latest pause as end of the current tightening regime.

2. Chinese industrial production plummeted to 3.7% y/y

Weakness in the Chinese economy has continued to become more apparent by the day. Annual production missed expectations as it came in at 3.7% vs 4.3% expected. The decline in production is largely attributed to waning internal demand caused by turmoil in the Chinese labour market. Fears of a possible global recession is gaining momentum as the Chinese property sector continues to suffer.

3. UK annual CPI y/y fell to 6.8% down from 7.9%

Inflation in the UK remined stubborn and unyielding. Despite rapid interest rate hikes in the twelve months to July, inflation remains at elevated levels, however, was down from the previous monthly reading of 7.9%. Positively, this was the lowest reading in 17 months. The UK inflation problem has now evolved and shifted to the all-important service sector, which will provide further complications for the BOE.

4. US retail sales rose 0.7% in July

The US consumer has continued to show resilience with better sales spending than expected. Despite cooling inflation across the board, retail sales grew 0.7% in July from the previous upwardly adjusted figure of 0.3%. The inference is that the US consumer is throwing caution out of the window and opening their wallet without restraint.

5. Australian unemployment rate rose to 3.7%

Historically high interest rates have started to have a negative impact on the Australian economy, with the labour market slowly feeling the effects. Restrictive borrowing terms are impacting businesses with the employment change m/m declining by -14.6k. Furthermore, the average monthly hours worked increased, an indication that families are going out of their way to pool in resources to mitigate price inflation in deteriorating economic conditions.

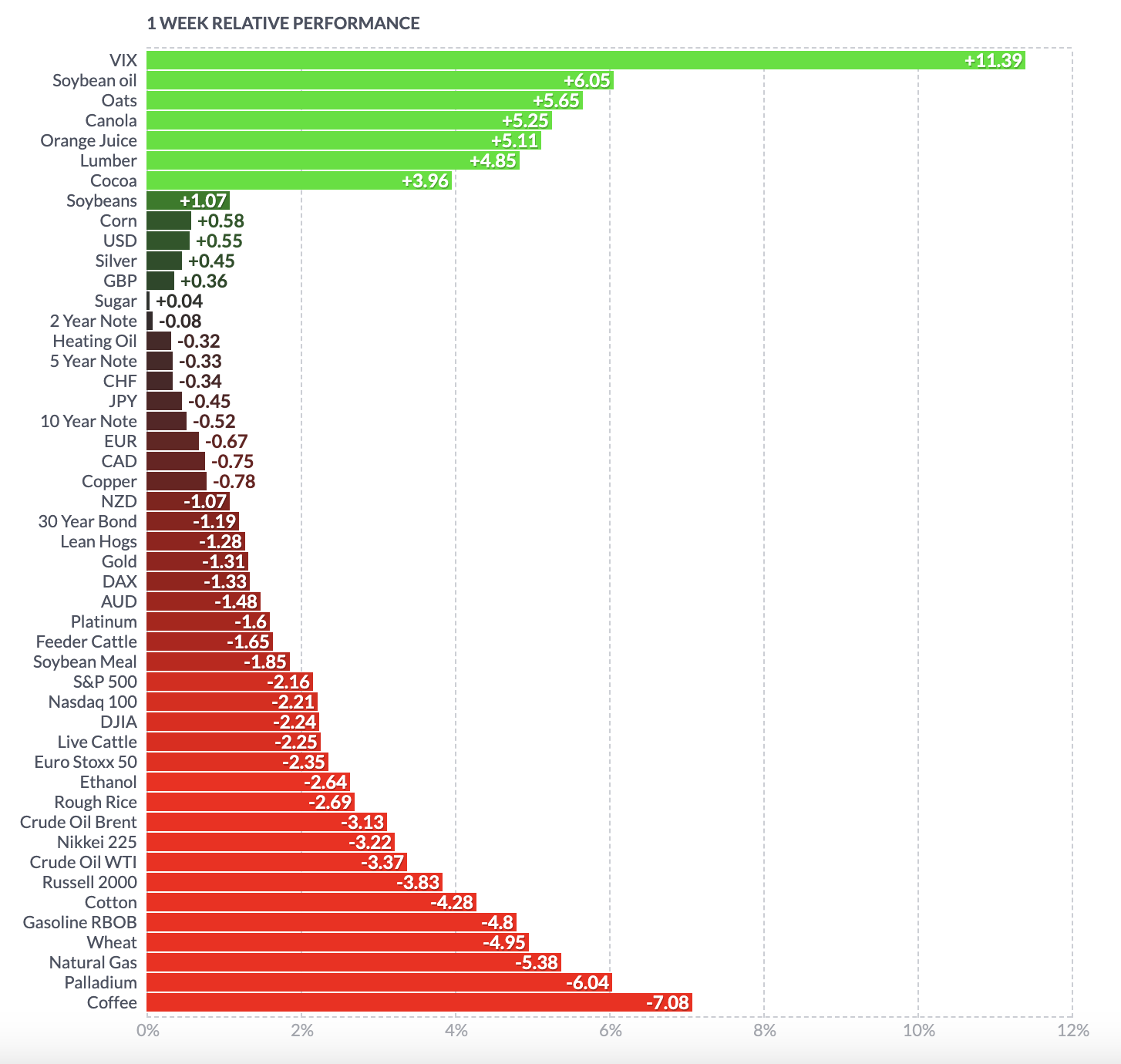

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Orange juice was the best performer this week, as it rallied to new highs on citrus supply squeeze after diseases and hurricanes disrupted plantations in the US East Coast and Brazil. The poor industrial production data from China heightened global recession fears, triggering a rally in the VIX, causing equities, energies and metals to sell off. Wheat plummeted after Turkey offered to allow access for Ukrainian wheat, easing pressure on markets. As mentioned in earlier weeks, 30-year bonds continued to decline (yields up).

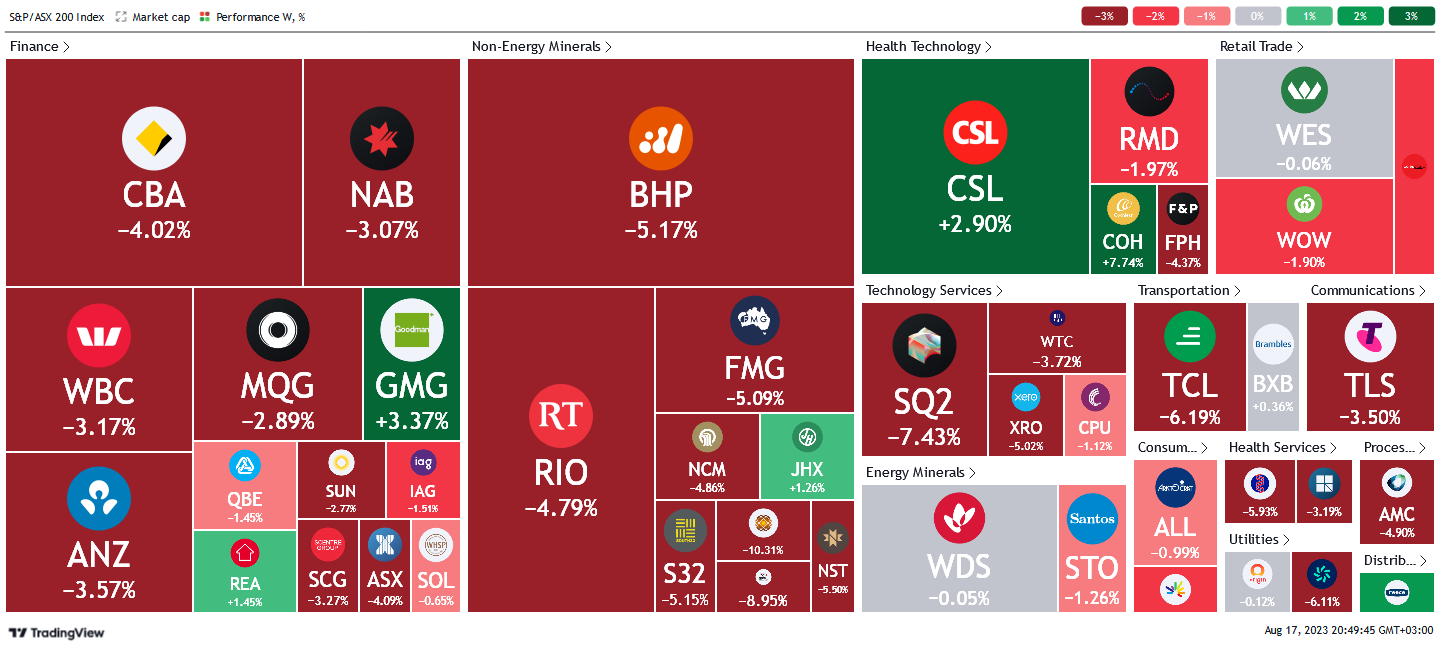

Here is the week's heatmap for the largest companies in the ASX.

Bloodbath. Financials & materials led the declines of the big four banks, BHP, RIO, and FMG all down over 3% for the week. Goodman Group, CSL and Cochlear were some of the only bright spots. Over the last few weeks, the ASX has been very volatile, with this week no different. The index has moved back to levels seen at the start of July, however, continues to be at a similar price that it was since mid-2021.

Below shows our proprietary trend following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics