New Zealand inflation expectations eased to 2.5% q/q, Australia’s unemployment rate rose to 4.1%

If you would like to watch this update rather than read it, please click the video below!

Let’s hop straight into five of the biggest developments this week.

1. New Zealand inflation expectations eased to 2.5% q/q

Data suggests that NZers are optimistic that the current monetary policies are enough to achieve the 2-3% inflation target in the medium term. The inflation expectations survey pointed to a significant markdown of inflation expectancy from the previous reading of 2.76%. This marks the lowest outlook for medium-term inflation expectancy since August 2021.

2. US CPI cooled to 3.1% y/y

Deflationary pressure in the US remains the prevailing economic trend, albeit with waning momentum. This was after the annual CPI for the year to January was reported at 3.1%, markedly overshooting market expectations of 2.9%. While this was a reduction from the previous 3.4%, the inference is that inflation is rebounding and economic analysts are being forced to review their interest rate cut expectancy for 2024.

3. UK CPI static at 4.0% y/y

Inflation in the UK is comparatively lower than initial estimates. CPI data showed that inflation held static at 4% over the twelve months to January. This fell short of the market forecasts of a price elevation of 4.1%, pointing to the overall thawing of inflationary pressure. High-interest rates are working their way into the economy and going a long way to suppress inflation.

4. Australia’s unemployment rate rose to 4.1%

The tumultuous Australian labour market took a turn for the worse with a higher-than-expected unemployment rate. The unemployment rate was the highest since February 2022. This was a deterioration from the previous 3.9% as well as optimistic market forecasts of 4.0%. The inference is that high-interest rates are stifling business activity and restricting labour uptake.

5. UK GDP shrunk by – 0.1% m/m

The UK economy shrunk into further contraction in December despite staying clear of gloomy market estimates. GDP fell to – 0.1% from the previous 0.2% but undershot the – 0.2% expected. This GDP reading demonstrates that historically high-interest rates are beginning to hamper economic output.

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

The VIX surged on higher volatility over the course of the week, as geopolitical risk from the Middle East continued to drag on sentiment. Palladium, platinum, and silver rose on hedging demand, and slowing economic growth. Cotton and cocoa were up on heightened demand as colder-than-expected conditions persisted. Lean hogs rose on rising demand in China while the energy complex rebounded from last week’s profit-taking. Sugar and orange juice slumped on improving conditions and improving output forecasts as a result. Canola, wheat, soybeans, and corn were down on oversupply as the new growing season gets underway.

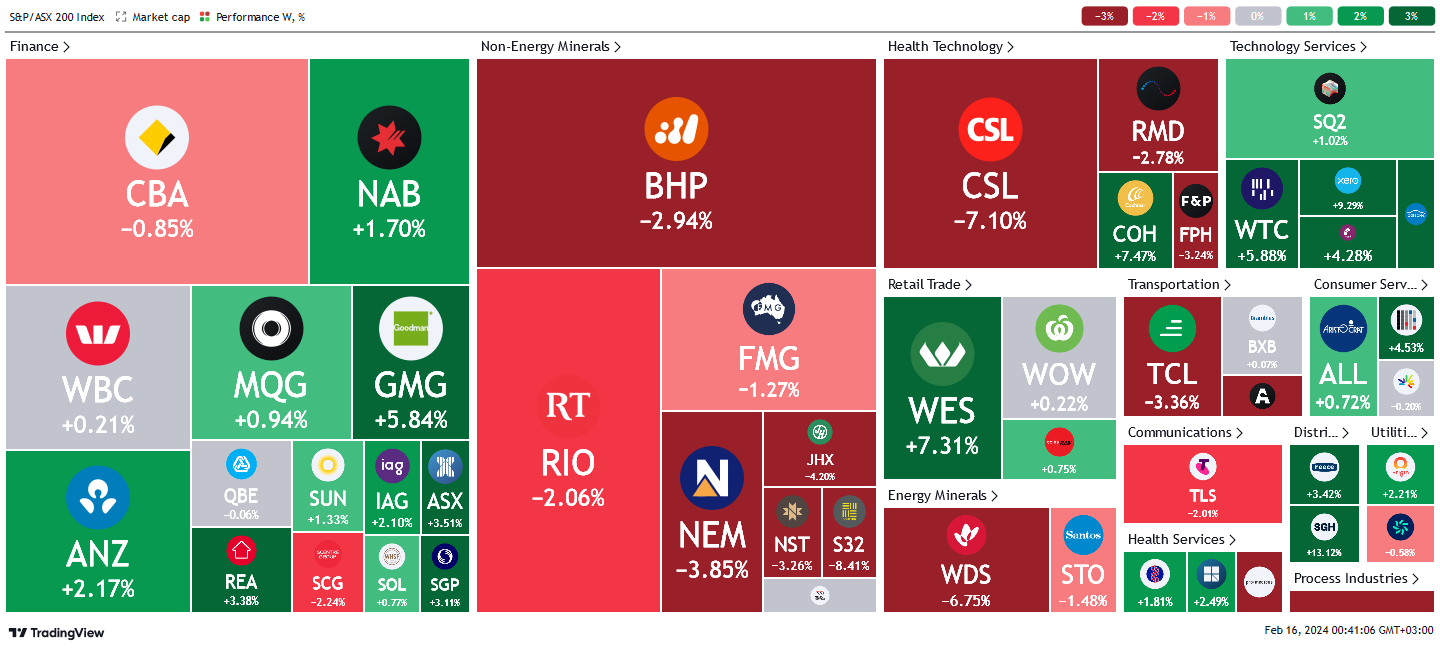

Here is the week's heatmap for the largest companies in the ASX.

An overall mixed week for the ASX with bias to the downside. Financials did most of the weightlifting to prop up the index as a large number of large weighted constituents reported earnings. This in combination with mixed economic data meant the index was treading water for the week. GMG and REA led the charge, with both up >3%. SCG and MPL stood out as some of the rare losers in the sector, closing down – 2.24%, and – 1.57% respectively. Nonenergy miners were the biggest losers for the week with nearly all large constituents in the red. S32 and JHX outsold the index to close – 8.41% and -4.2% respectively. MIN stood out as the only island in the sea of red in the sector, depicting impressive relative strength in the face of relentless selling pressure to close flat at +0.2%. Retailers and technology services were upbeat with all stocks making gains. WTC and XRO are both up well. Energy miners and consumer services were wholly down without exception.

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics

5 stocks mentioned