Newmont – worth its weight in gold?

This past year has been modestly positive for the Allan Gray Australia Equity strategy’s returns. Although pleasing, this is a little surprising for two reasons. Firstly, we have typically struggled to keep pace with our benchmark during periods of strong performance, like this past year’s 14.3% return to 10 December 2024. Secondly, the trends that drove markets this year have favoured growth and momentum-based investors, the antithesis of our investing style.

The strategy’s returns this year are even more surprising when we reflect on the themes to which the portfolio is ‘accidentally’ exposed. We say ‘accidentally’ as we are not thematic investors. The portfolio is built based on bottom-up research rather than forecasting trends and themes. But despite this, sector overweights and underweights naturally occur. For 2024, the portfolio has been overweight energy and gold and underweight banks. All three positions have been costly in terms of relative performance, yet the strategy has still outperformed our benchmark.

Performance has come from unrelated stock-specific outcomes rather than sector biases. Two of the biggest contributors in 2024 have been Alumina Limited (and subsequently Alcoa Corporation, who purchased Alumina in a scrip deal and whose shares we have continued to hold) and Ansell Limited. We wrote about Alumina in our September 2023 Quarterly Commentary and Ansell in our March 2022 Quarterly Commentary.

In Ansell’s case, it has benefitted from an end to the de-stocking process that was dampening the demand for and prices of its rubber gloves. Alumina has benefitted from alumina prices rising from the low US$300s per tonne (at which levels most industry participants were loss making) to now inflated prices of closer to US$800 per tonne.

Regular readers will know that we don’t like to dwell on what we get right, so let’s focus on what didn’t work well and what we can learn from these mistakes. Gold is one of those themes, so our investment in Newmont Corporation seems as good a company as any to discuss.

Newmont Corporation (ASX: NEM)

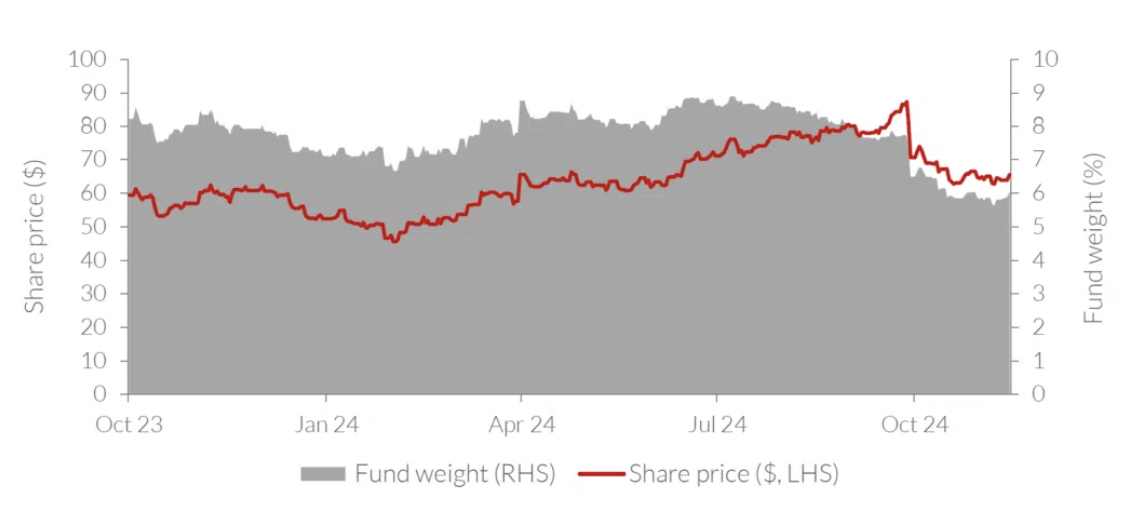

We have owned Newmont since October 2023, when it acquired Newcrest Mining Limited, a company we owned at the time, for a combination of predominantly scrip and cash. Graph 1 shows Newmont’s share price and its weight in the portfolio over time.

Graph 1 | Newmont Corporation’s share price and the Allan Gray Australia Equity Fund’s weight

Source: Allan Gray Australia, 10 December 2024. The Allan Gray Australia Equity Fund portfolio is generally representative of the Allan Gray Australia Equity strategy portfolio, which includes institutional mandates that use the same strategy.

Newmont is the world’s largest gold producer. Figure 1 shows Newmont’s geographically diverse portfolio of mines in North and South America, Africa, Australia and Papua New Guinea. From these mines it produces approximately six million ounces of gold per annum, 150,000 tonnes of copper (a co-product from some of its mines) and 230,000 tonnes of zinc (a co-product from its Peñasquito mine in Mexico).

Figure 1 | Newmont’s global mines

Source: Newmont, 10 December 2024; prior to the announced sales of certain non-core assets.

We have long been positive on gold prices and we have been right. But we have been wrong to assume the gold mining companies themselves would disproportionately benefit from these higher prices.

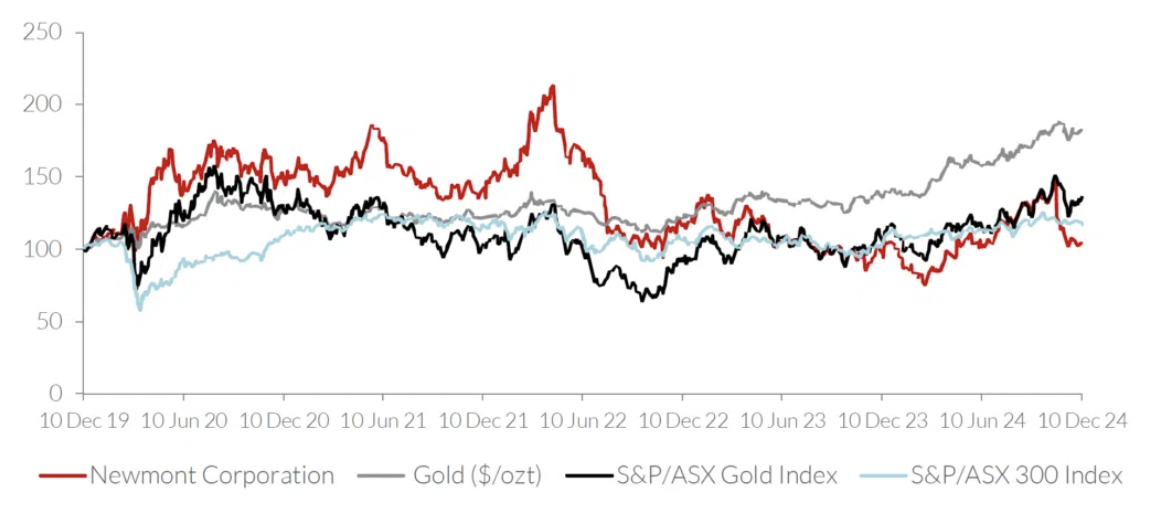

Graph 2 shows the gold price over the last five years and the share prices of Newmont Corporation, the S&P/ASX Gold Index and the S&P/ASX 300 Index. Gold prices are up by about 80% over the past five years, but the Gold Index is only up 30% (barely better than the broader sharemarket) and Newmont’s share price is largely unchanged over that period. Newmont’s underperformance, even relative to the S&P/ASX Gold Index, occurred post the October 2024 reporting of its costs and production outlook, which disappointed the market.

Graph 2 | Performance of gold, the S&P/ASX Gold Index, S&P/ASX 300 Index and Newmont Corporation

Source: FactSet, 10 December 2024. All price series in US$ and indexed (10 December 2019 = 100).

In the mining industry, where operating leverage rules supreme, few would have predicted this. Three things probably explain most of the underperformance of gold company shares:

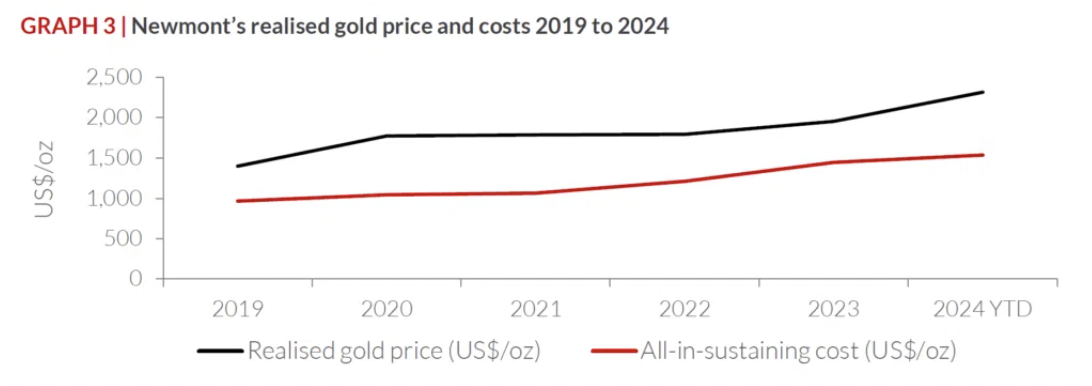

1. Operating costs have risen and meaningfully eaten into the benefit from the gold price rise. Graph 3 shows Newmont’s realised gold price having increased by 66% from US$1,399/oz in 2019 to US$2,316/oz for the calendar year to 30 September 2024. But costs are up a similar amount (in percentage terms) with all-in-sustaining costs (AISCs, the industry’s flawed1 metric for reporting costs) rising from US$966/oz in 2019 to US$1,537/oz.

Graph 3 | Newmont’s realised gold price and costs 2019 to 2024

Source: Newmont company filings

These cost imposts are not unique to Newmont. Table 1 shows two of Newmont’s competitors, Barrick Gold Corporation and Northern Star Resources’ AISCs over the same period.

Table 1 | AISCs are also rising for other miners

Source: Company filings. *Barrick’s costs represent the midpoint of company guidance for the year to 31 December 2024.

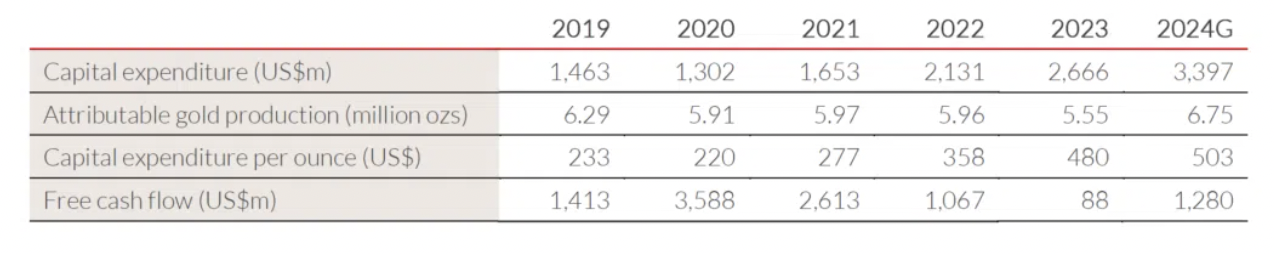

2. Capital expenditures required to extract ore reserves or convert ore resources to reserves have been greater than most foresaw. Table 2 shows Newmont’s capital expenditures since 2019 and includes the company’s own guidance for 2024. Today’s capital spend (in both absolute dollars and on a per ounce of production basis) is well over double the levels in 2019. This increasing capital intensity (as well as growing rehabilitation spend!) is a big reason for its poor free cash flow in recent years.

Table 2 | Newmont’s capital expenditure and free cash flow, 2019 to 2024

Source: Newmont company filings, Allan Gray

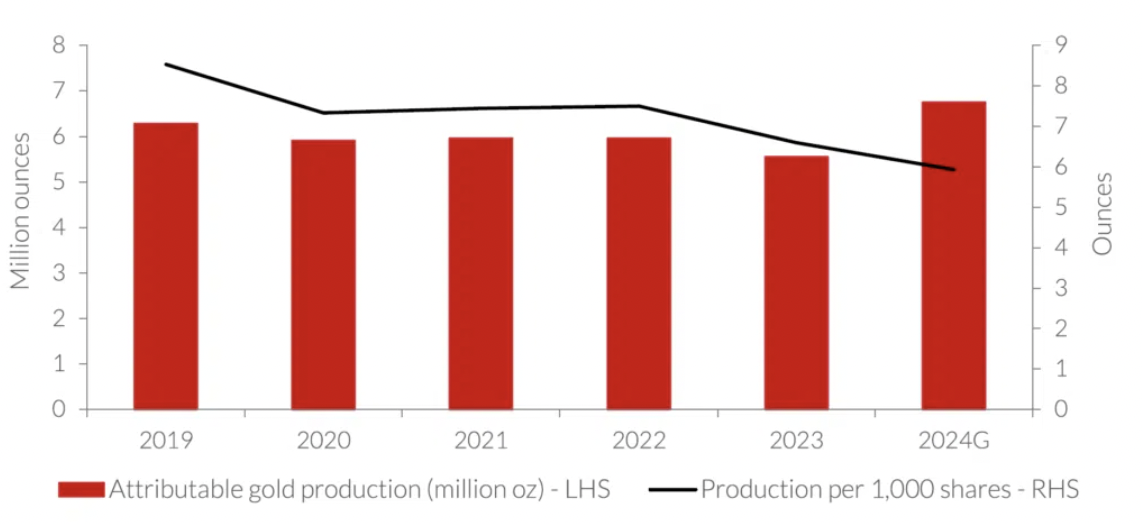

3. Production has fallen. While Table 2 shows a modest increase in production from 6.3 million ounces in 2019 to 6.75 million ounces in 2024, much of these additional ounces have been purchased, e.g. the 2023 acquisition of Newcrest effectively bought 2 million ounces of annual production. A better way to assess production is to look at it on a per-share basis. While absolute production levels have increased marginally, each share of Newmont buys you less production today than five years ago. Graph 4 shows annual production per 1,000 Newmont shares falling from 8.5 ounces in 2019 to 5.9 ounces today.

Graph 4 | Newmont’s total production and production per share (2019 to 2024)

Source: Newmont company filings, Allan Gray

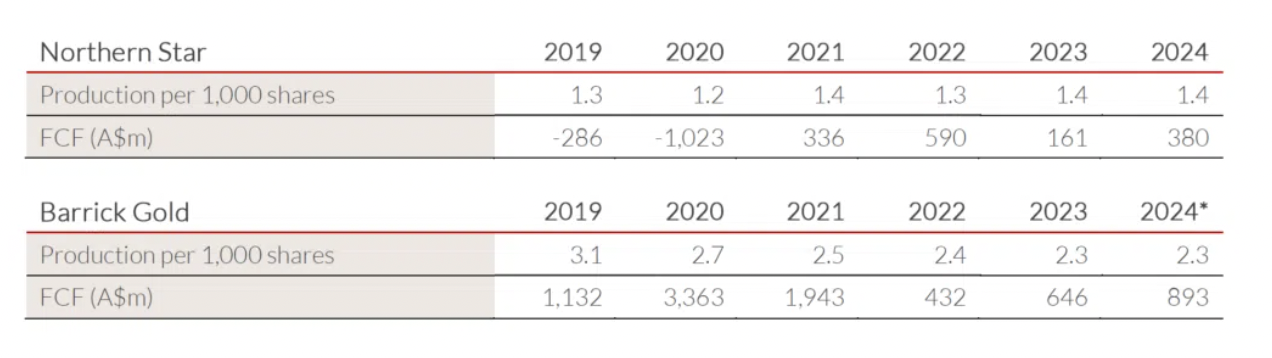

Table 3 shows similar metrics for Barrick Gold and Northern Star and tells a similar but mixed story to Newmont’s above.

Table 3 | Peer production and free cash flow (FCF)

Source: Company filings. *Barrick’s production represents the midpoint of company guidance for the year to 31 December 2024 and FCF is an annualised figure.

Northern Star’s production per share has remained relatively static (far better than Newmont) but this has come at the expense of relatively poor free cash flow (due to elevated capital expenditure). The Barrick experience is very similar to Newmont’s.

What do we like about Newmont?

Readers have good reason to question why we own Newmont at all (or any other gold company for that matter). There are a number of redeeming features that attract us to Newmont:

1. Costs are elevated and we believe they should fall from here. A number of production challenges and mine sequencing factors have seen a predominantly fixed cost base spread over lower ounces. At Lihir in Papua New Guinea, for example, Newmont expects ore grades to improve (as Newcrest did) and production should increase in future years. Mines like Boddington in Australia and Peñasquito in Mexico have been undertaking significant stripping campaigns to remove waste material. The cost of this overburden removal is fully reflected in AISCs despite it freeing up several years of future production. There are good reasons to expect production to increase and costs to fall (absent general inflation) in future years.

2. Capital expenditure is elevated and should fall in the near term. With that, cash flows should increase. Newmont is undertaking a number of capital-intensive developments at the same time. We believe these should shore up the next 15 or so years of production, with significant cash harvesting around the corner. For example, at its Tanami mine in Australia, it is sinking a $1.7 billion shaft that will hoist people and ore. In addition to being one-off in nature, it is expected to bring about operational savings too. It currently takes 45 minutes for workers and ore to travel from the mine face to surface and vice versa via an underground decline. Once completed, this shaft will shorten the time taken to get from surface to mine face to less than five minutes. Many of Newmont’s mines are undertaking similarly elevated capital programmes.

3. Newmont is blessed with a diversified portfolio of very long-life tier-one assets. Its portfolio of core assets has a reserve life of about 17 years, well above the average reserve life of the world’s currently operating mines at about seven years. In addition, Newmont has significant resources (about 170% of the reserve base) that we believe should see production extend well beyond 17 years.

Gold is becoming increasingly difficult to mine, as ore bodies become deeper and ore grades decline. It is difficult to value Newmont’s in-situ resource but not unrealistic to assume it might have substantial commercial value.

There is a fourth attractive attribute that is impossible to ignore: price. Newmont has a market capitalisation of US$47 billion. We estimate it has a further (up to) US$8 billion in net debt (including rehabilitation liabilities and net of the expected proceeds from the sale of its non-core portfolio) making its enterprise value US$55 billion.

At current gold prices (close to US$2,700/oz), we think Newmont should make approximately US$1,000/oz in pre-tax profit spread across its over 7 million oz per annum production base (including gold equivalent production from its co-products). This means that the company should generate a 10% post-tax earnings yield. Once its elevated capital cycle is behind it, its free cash flow yield should exceed this. Not only is this attractive in its own right, this is far more attractive than gold companies have typically traded in recent decades.

A note of caution

A lot could go wrong from here. Gold prices, which are notoriously difficult to predict, could fall. Unlike the rise in gold prices, the falls would initially flow directly to reduced profits. Operational hiccups are another known-unknown that plague all miners. We don’t think either of these are likely to have a significant bearing on our thesis.

Newmont has a diversified portfolio of tier-one assets limiting the impact of unforeseeable operational issues at one of its mines. Also, with its long reserve life, and other gold miners experiencing similar cost imposts, it is possible that gold price weakness (like we saw post-2012) would be short-lived as mines scale back activities or close.

The above wire is an extract from Allan Gray Australia’s December 2024 Quarterly Commentary, which you can read in full here.

Learn more

Contrarian investing is not for everyone, however, there can be rewards for the patient investor who embraces Allan Gray’s approach. Visit the Allan Gray Australia Equity Fund profiles to find out more.

3 topics

1 stock mentioned

2 funds mentioned