News Corp (NWS) - An outsider with an outsized opportunity

What makes a successful leader?

More importantly, what defines an exceptional leader?

Will Thorndike's book, The Outsiders, provides insight into this question by profiling eight CEOs who achieved success through unconventional management practices.

These leaders, characterized by "radical rational" traits, focused on capital allocation, cash flow, decentralized management, and the ability to make contrarian decisions that defied conventional wisdom.

Thorndike’s case study of Bill Anders's turnaround of General Dynamics in 1991 is a notable example. Anders transformed General Dynamics by focusing on core competencies, strategic divestitures, and by instilling a rigorous focus on margins and cashflow, creating significant shareholder value.

At News Corp (NWS), a similar transformation is underway under the leadership of CEO Robert Thomson and Executive Chairman Lachlan Murdoch.

News Corp's transition from a traditional media conglomerate to a business with rapidly growing assets has been remarkable.

Today, nearly 70% of its EBITDA comes from high-quality recurring revenue, primarily from subscription digital revenue.

Due to their unconventional leadership, social media and search giants now pay royalty-like revenue streams to content owners such as News Corporation. More recently this has extended to audio streaming platform Spotify and artificial intelligence platform OpenAI, with further deals likely in our view.

Dow Jones Publishing – A Hidden Beneficiary of Artificial Intelligence

The Dow Jones Publishing division is the crown jewel of News Corporation, encompassing prestigious brands like The Wall Street Journal, Barron's, and MarketWatch, along with a rapidly expanding Risk and Compliance software business.

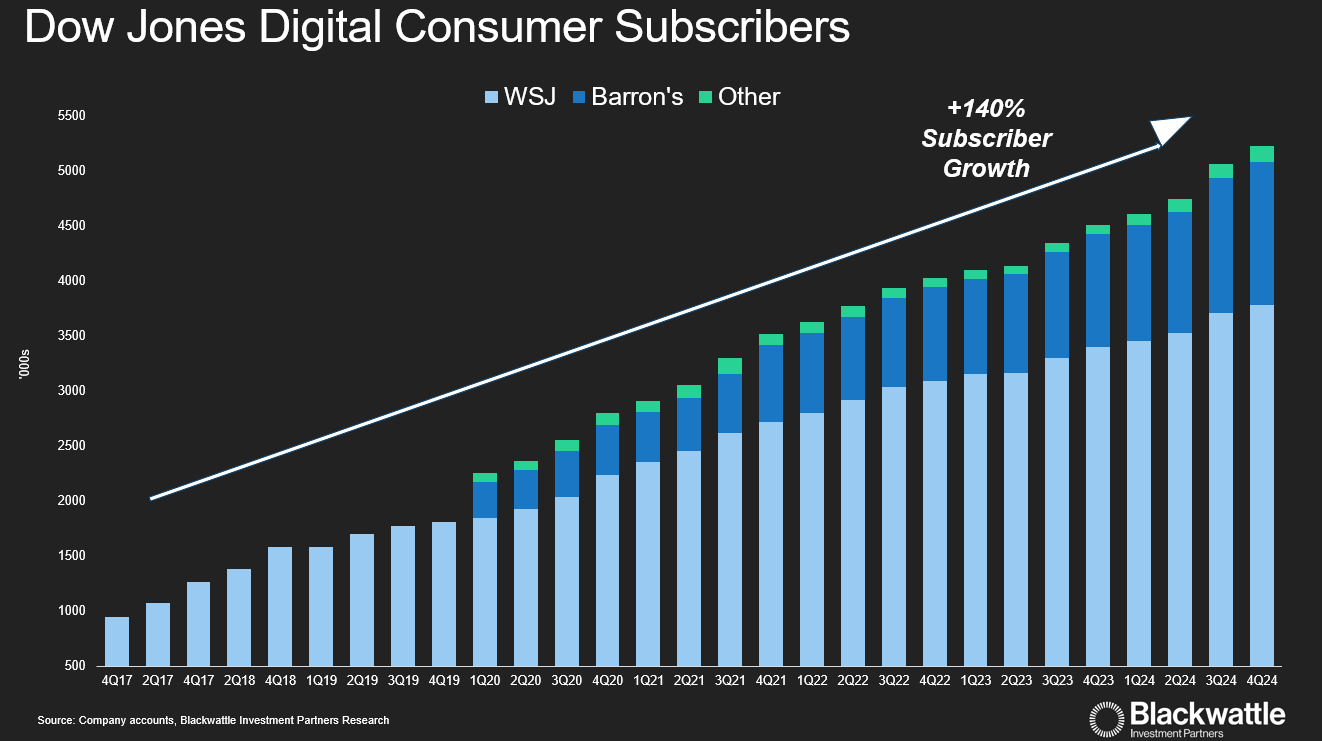

Since 2019, digital consumer subscriptions to The Wall Street Journal and Barron's have surged by 140% to over 5.2 million subscribers.

Management's emphasis on increasing circulation and subscriptions has reduced Dow Jones' reliance on cyclical advertising revenue.

With digital subscriptions now making up over 70% of Dow Jones' revenue, the company has been able to reinvest in high-quality content.

Growing revenue attracts award-winning journalism, enhancing the value for consumers and creating a fly wheel effect. Attracting the best journalists not only strengthens Dow Jones' position in the market but distinguishes itself as consumers place more value on high-quality journalism, especially in an era rife with misinformation on social media.

Unlike other media subscription businesses, Dow Jones owns and generates its content internally, ensuring stable margins and minimising risks from content costs typical of audio or video-on-demand services.

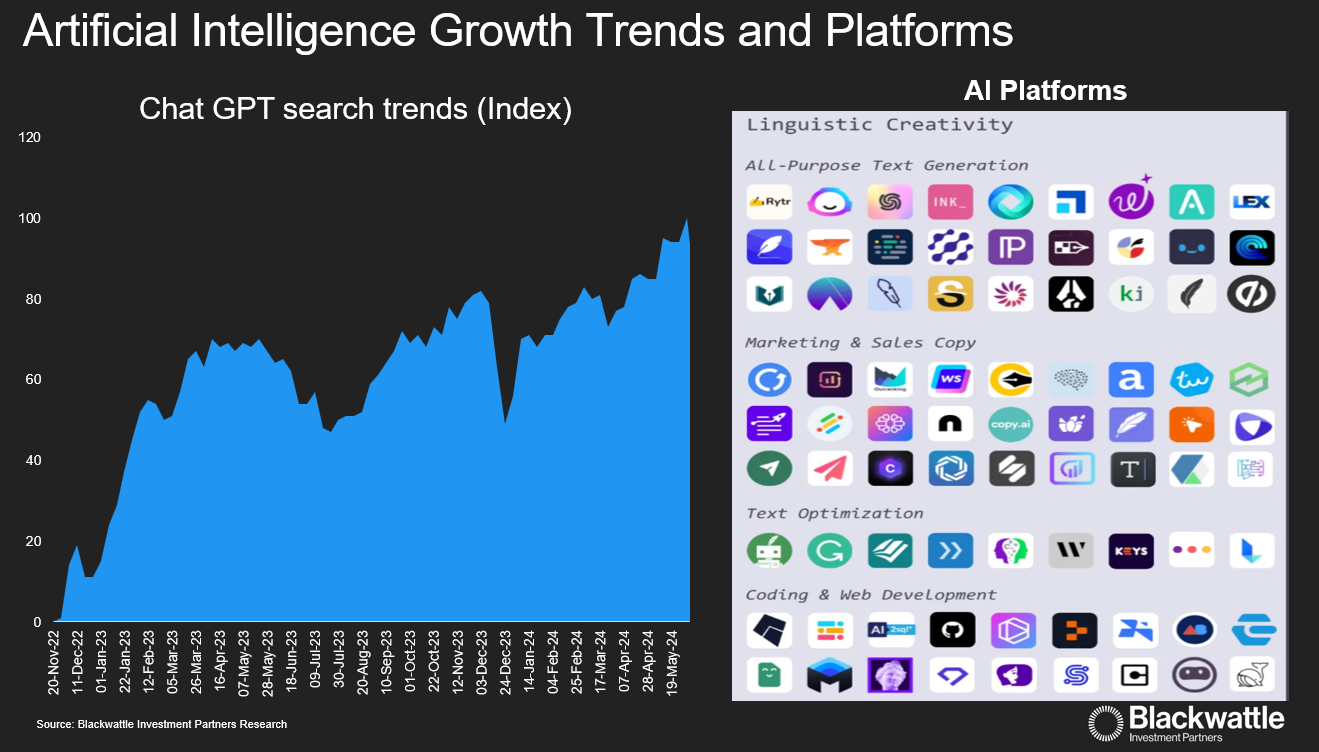

Owning the journalist intellectual property has allowed Dow Jones to capitalise on the increasing demand from AI platforms, which require content for their large language models and generative AI tools.

This is exemplified by the OpenAI licensing deal, valued at US$250 million over five years. News Corp is leveraging artificial intelligence (AI) to drive revenue growth through strategic partnerships and content licensing deals.

The company is in advanced negotiations with other AI companies to allow the use of its content, which sets the global precedent to ensure that AI is not fueled by low-quality content, and journalists are compensated fairly.

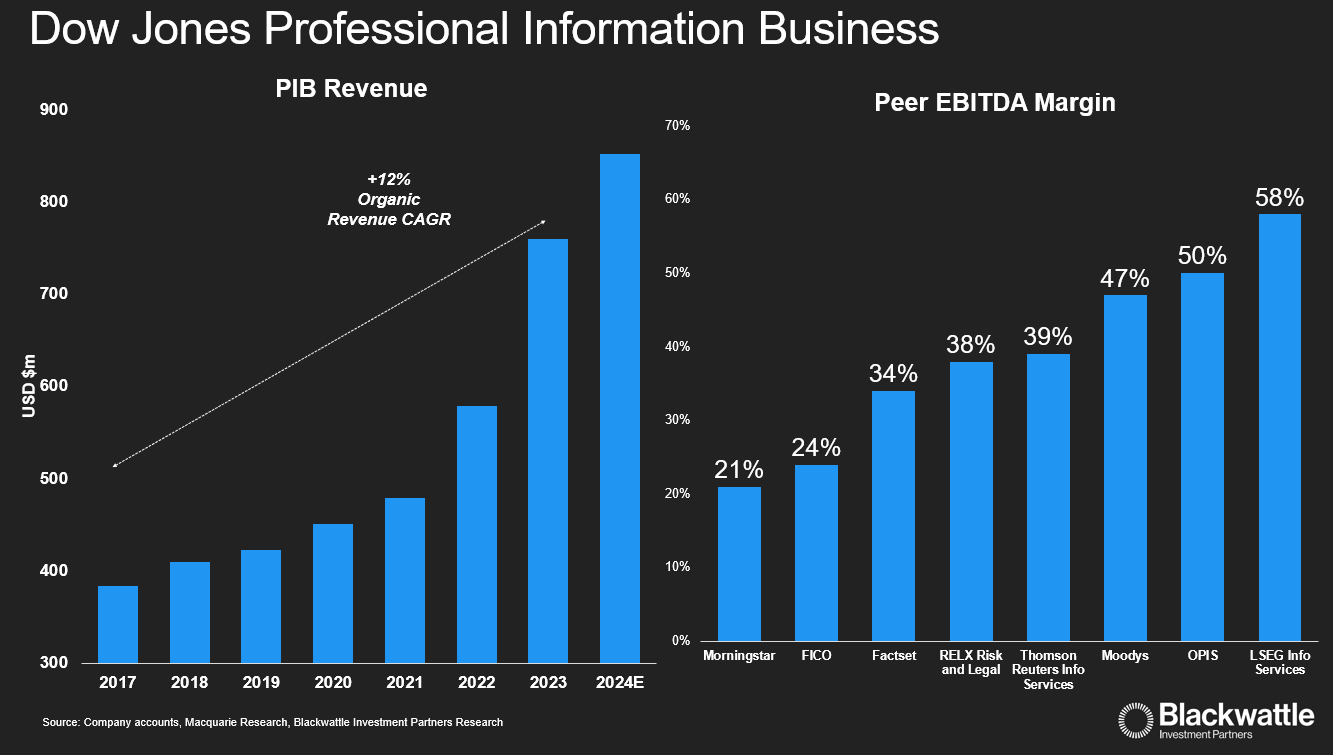

Also hidden within Dow Jones is the Professional Information Business (PIB), which sells subscription products covering risk and compliance, energy, and fuel supply chain data to enterprises.

Operating in the growing Governance, Risk, and Compliance market, PIB's revenue has grown from US$0.4 billion in 2020 to over US$0.8 billion in 2024, indicating a revenue CAGR of 12% over the period, excluding acquisitions.

While News Corporation does not split out PIB’s profit contribution, we believe it’s extremely profitable based on comparable listed peers.

If PIB were separately listed, we believe it would attract a significantly higher valuation multiple than what News Corporation currently trades on.

REA Group – The Embodiment of Pricing Power

Lachlan Murdoch's foresight regarding digital classifieds has created significant value for News Corporation shareholders, with the 61% investment in REA Group now valued at US$10 billion.

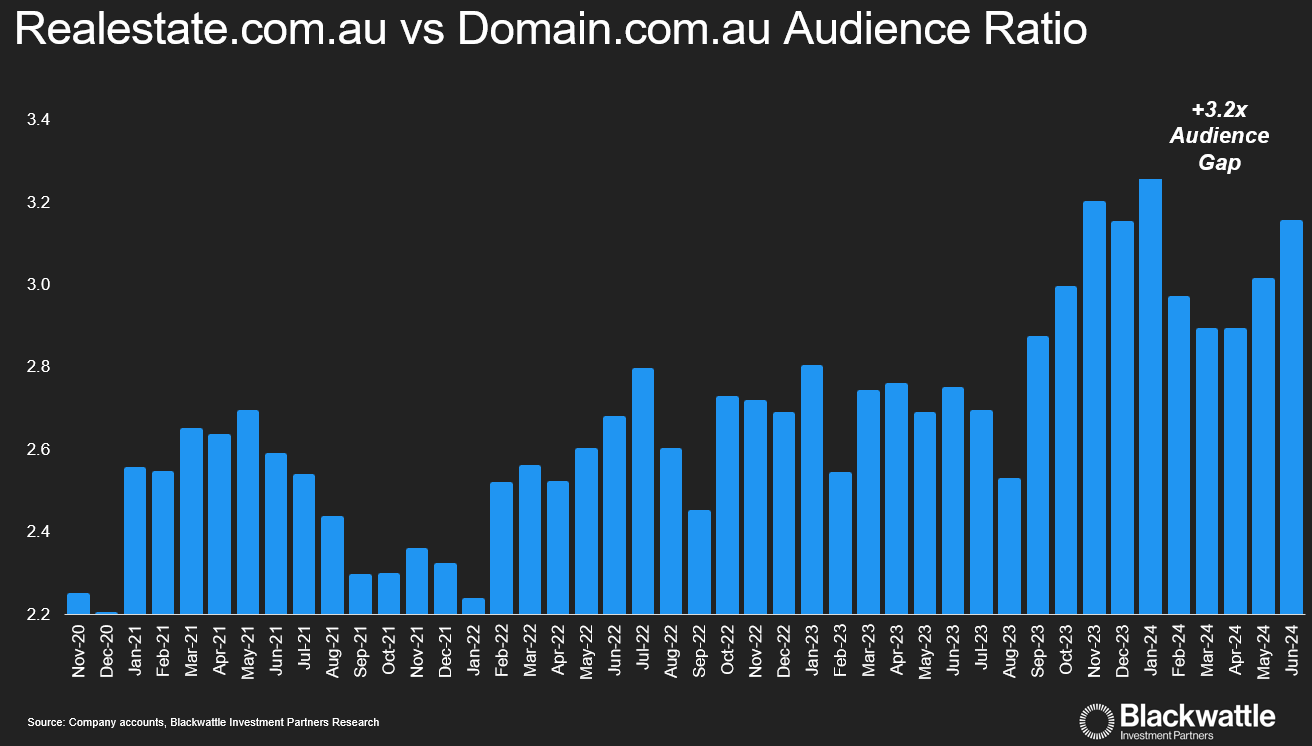

As Australia's dominant property portal, REA Group's lead over its nearest competitor has increased to 5.3 times more app visits and over 2.0 times the unique audience. For consumers, the platform offers more listings, personalised experiences, rich property insights, and growing services like mortgages compared to competitors.

This has led to growing user engagement to 45 minutes per month, 2.8 times more than competing platforms.

Ask any real estate agent, and Realestate.com.au is a must-have.

For agents, Realestate.com.au has evolved into an end-to-end agency solution providing leads, property research, buyer data, and digital tools.

A big banner on Realestate.com.au is also a marketing platform to attract other listings where most of the cost is passed on to the vendor billed as “marketing costs”.

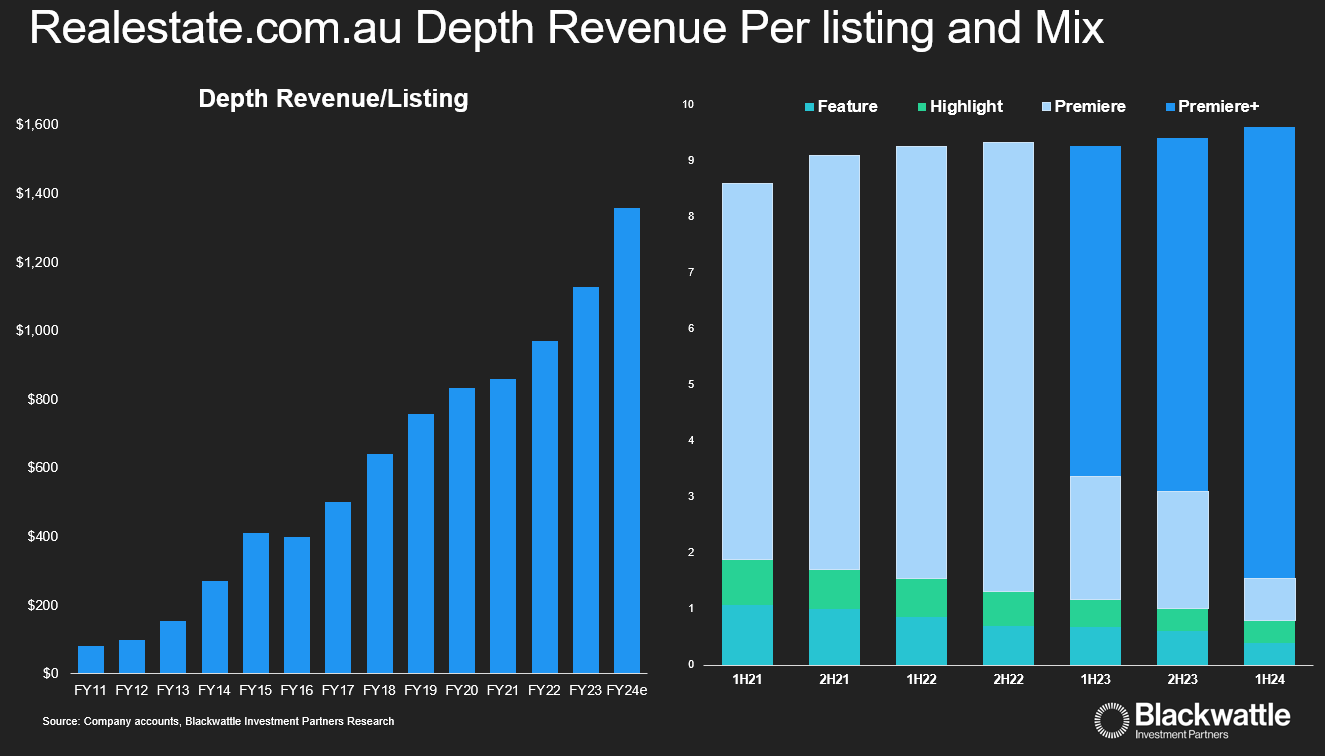

The total dominance of REA Group over the buying and selling of properties in the $11 trillion housing market, coupled with rapidly rising home prices has enabled REA Group to lift prices by 10% per annum since 2023.

In addition to price rises, the layering of different premium advertising packages such as Premier and Premier Plus has meant a gradual lift in total yield per home sold, typical of a SAAS business model. Much like the progression of Microsoft’s operating system Windows, which is up to version 11, we ponder what Premier Plus version 11 could look like in a decade's time.

Regardless of what this looks like, the importance of a listing on Realestate.com.au to facilitate home transactions amounts to 0.14% of the median home price today, significantly less than other merchant transaction style businesses.

Given ongoing house price appreciation and the pivotal role of Realestate.com.au in attracting buyers, this suggests a continued runway of growth potential in REA Group’s yield.

Hidden Value Opportunities

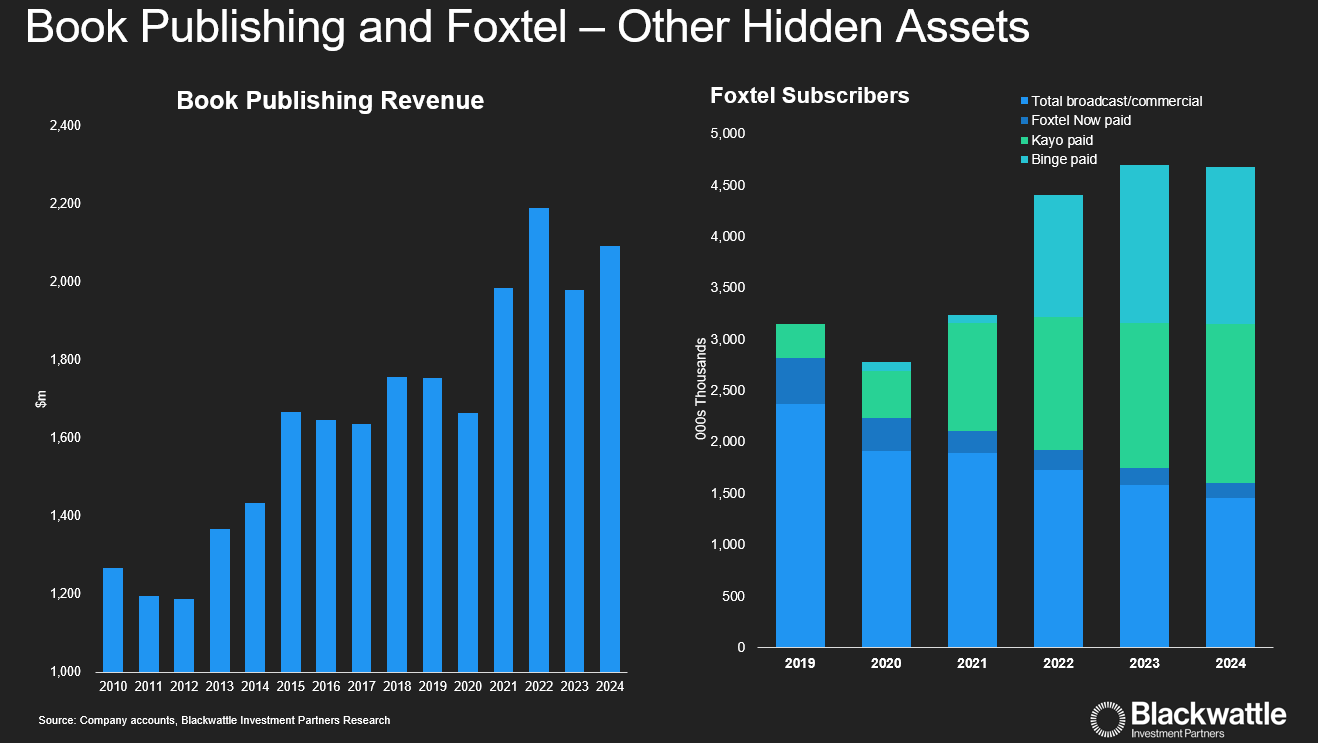

The portfolio of other assets overlooked by investors includes high quality assets such as Book Publishing, owner of brands such as Harper Collins, the third biggest book publishing business globally. Book publishing has been a thriving industry, buoyed by the growth of audio books, with Harper Collins audio books growing 28% in 2024.

Total book digital sales have grown to 24% of revenue, with the backlist of catalogue representing 62% of book publishing revenue. This back catalogue is a stable stream of revenue, anchored by timeless titles and authors including J.R.R Tolkien (The Lord of the Rings series), Harper Lee (To Kill a Mockingbird), C.S Lewis (The Chronicles of Narnia), Paulo Coelho (The Alchemist) and Jim Collins (Good to Great).

More recently News Corp has received interest in two of its other portfolio assets, being Move (the owner of Realtor.com in the USA) and subscription services group Foxtel.

The indicative interest in these assets highlights the latent value hidden within News Corp.

While the Move transaction (media reports estimated value of US$3bn) didn’t complete, Move is well positioned for an improvement in housing activity from expected interest rate declines. In the recent quarter, management announced Foxtel has also been the recipient of third-party interest. Interest comes as Foxtel looks to have turned the corner, with total subscribers steadying for several reporting periods, aided by digital growth.

Conclusion

News Corporation’s enterprise value of US$16bn is undemanding given the collection of quality businesses owned. Excluding the investment in REA Group, the News Corp’s stub enterprise value of $5.4bn implies less than 5x EBITDA for the group, which includes the Dow Jones Group, Move, Book Publishing, News Media and Foxtel.

Having successfully guided News Corp through its transformation thus far, Thomson and Murdoch exhibit enduring qualities that, in our view, merit recognition as Outsiders. Their emphasis on high-growth assets and continued rationalisation of the asset mix mirrors the approach taken by Anders in revitalising General Dynamics.

Just as General Dynamics was reinvigorated and liberated, we believe Thomson’s strategy will ultimately bridge the valuation gap between News Corporation and its peers.

To quote CEO Robert Thomson:

“We believe the company’s prospects are patently propitious, and we are also continuing to review our portfolio with a view to maximising returns to shareholders… the strategic imperative is to transform the company and increase value for all shareholders. We are in the midst of an exponential digital revolution, and our own company has continued to change significantly and profitably”.

4 topics

3 stocks mentioned