Not all ASX gold miners are made equal: One disappoints (while its rival thrives amid takeover talk)

After a spectacular 17% run from November lows, gold has found itself on the backfoot again amid ever-so-hawkish central banks and hotter-than-expected inflation data.

But looking ahead, there’s a lot to like about gold, says David Franklyn , Head of Funds Management at Argonaut.

"Last year, we saw very strong central bank purchases of gold. With China reopening, we anticipate strong buying on the retail side for coins and bullion, while India continues to be a strong buyer.

Thematically, we believe the world is moving into a period of increased geopolitical tension and social unrest, and gold stands alone as a store of value in times of uncertainty."

However, capitalising on bullish gold prices is easier said than done. For local gold miners, it’s been an operationally challenging 12-24 months due to rising input costs, labour shortages and adverse weather conditions.

The recent results from Newcrest Mining (ASX: NCM) and Northern Star (ASX: NST) highlight how one miner has operationally thrived under difficult conditions while the other has its work cut out for it.

In this wire, we discuss the recent results, why Franklyn thinks Newcrest is positioned to outperform and why Newmont’s takeover bid might act as a catalyst for the broader gold sector.

Newcrest Mining first-half key results

- Revenue of $2.12 billion, up 24%

- EBITDA of $919 million, up 24%: missed expectations of $817 million

- Underlying profit of $293 million, down -2%

- Free cash flow of -$204 million: missed expectations of -$66m

- Interim dividend of 15 cps plus a special dividend of 20 cps

- Reaffirmed FY23 guidance of 2.1-2.4 million tonnes of gold production

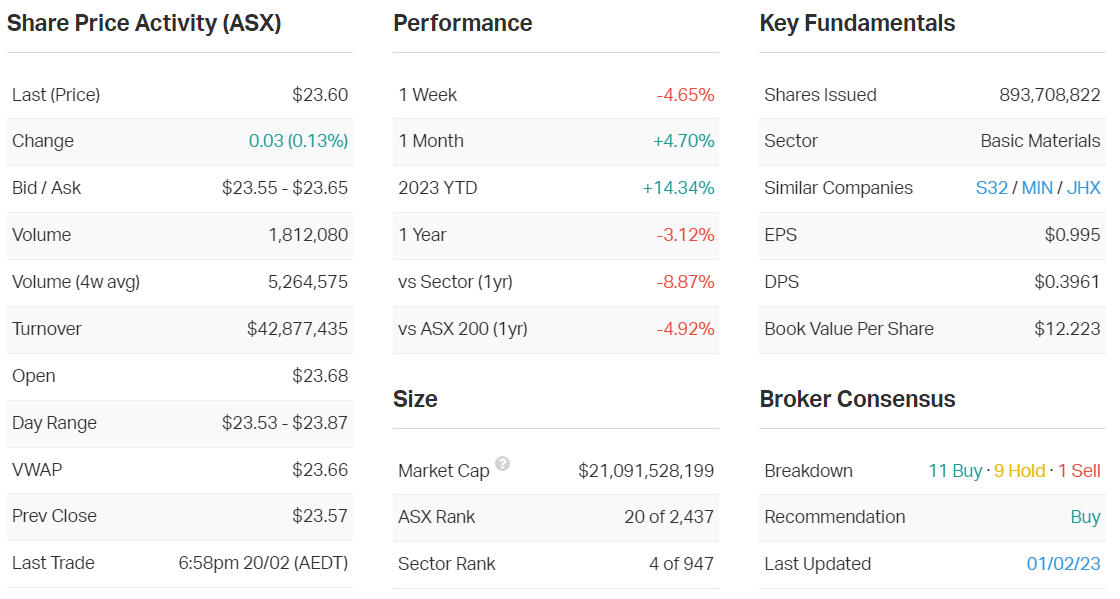

Key company data for Newcrest Mining

Northern Star first-half key results

- Revenue of $1.95 billion, up 5%: in-line with expectations of $1.94 billion

- Underlying EBITDA of $633m, down -12%

- Cash earnings of $467 million, up 3%

- Cash and bullion of $495m, down -15.8%

- Interim dividend of 11 cps, up 10% and represents 27% payout of cash earnings

- Reaffirmed FY23 guidance of 1,560-1,680koz gold sales at an AISC of $1,630-1,690/oz

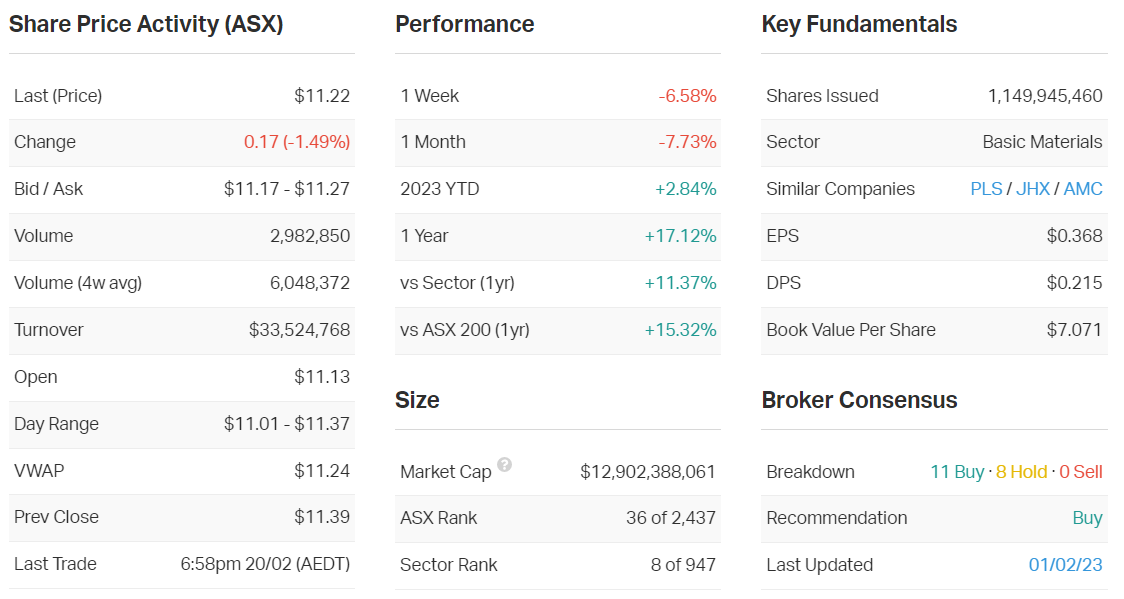

Key company data for Northern Star

Note: The interview took place on Monday, 20 February 2023. Argonaut holds Northern Star as part of their Australian Gold Fund.

In one sentence, what was the key takeaway from these results?

Newcrest was a good result and ahead of market expectations while Northern Star was marginally disappointing as higher costs offset a higher gold price.

What was the market’s reaction to these results? In your view, was it an overreaction, an under-reaction or appropriate?

Note: On the day of results, Newcrest fell -1.7% and Northern Star finished -1.5% from session lows of -3.3%.

We thought the market responded reasonably positively with Newcrest, in what was a difficult day for the market when they reported. The results were pretty good from both a production and cost standpoint but there’s more to Newcrest than just its results. Newmont has lobbed a takeover bid on the table and that’s really getting most of the focus.

On Northern Star, its share price closed off session lows but against the trend of the market – where the gold sector was trading higher. We think it’s a fair response given the guidance is heading towards the lower end for both production and costs, so there’s a bit of work to be done in the second half of the year.

Were there any major surprises in these results that you think investors should be aware of?

A big factor that overshadows the gold sector is how much cash drops out of the bottom line to fund major capital growth programs. The proof of their success will depend on their ability to turn their capital investment into free cash flow. Northern Star has a bit of a benefit in the short-term as they're not paying any tax for the next 18 or so months, which will give them a bit of a kick.

Newcrest was a particularly encouraging result because on one hand, you saw stronger production, with first-half gold production up 25% on the prior corresponding period and copper production up 32%. From a production perspective, this was a really good result.

On the cost side, its all-in sustaining cost margin of US$585 an ounce was also exceptionally strong, reflecting standout results from Candia and good results from Lihir.

On the Northern Star side, the real encouraging aspect is that they’re backing themselves. For FY23, they reaffirmed their full-year guidance, notwithstanding the fact that they’ve got a lot of work to do in the second half.

Northern Star also reiterated plans to lift production from 1.6 million ounces to 2 million ounces between 2023 and 2025 . That’s a big call in what is a difficult market, so if they deliver that, they’re going to be well positioned for the future.

Would you buy, hold or sell NCM and NST on the back of these results? Which do you prefer?

Newcrest rating: BUY

Newcrest is performing well operationally and we think there’s upside potential from the Newmont takeover proposal.

Northern Star rating: HOLD

The result was underwhelming and they need to work on delivering their production growth. If they can get there, it will look good, but for now, it’s time for some caution.

What’s your outlook on NCM and NST and the gold sector over the year ahead? Are there any risks to these companies and the sector that investors should be aware of?

We expect gold to move higher over the next 12 months, underpinned by a recovery in demand from China, continued strong central bank purchases and peak interest rates – which we expect will happen around mid-2023.

Operationally, we continue to watch cost pressures within the industry and particularly labor costs.

Newcrest’s focus will be on the Newmont takeover proposal. The company has stated that the takeover price is not sufficient but offered additional information. As that gathers momentum, we’ll get a clearer view on how it might progress.

We might see the potential bid acting as a catalyst for the gold sector, leading to industry consolidation and possibly increased scrutiny for emerging larger-scale developers such as De Grey Mining (ASX: DEG) and Bellevue Gold (ASX: BGL).

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

Rating: 2.5

We rate the market at the midpoint. In general, the market’s fair value but you have to consider that there’s areas that look inflated and areas where there’s good value. We expect the resource market to outperform the industrial sector. But you still need to be prudent on which commodities and stock selection.

The key driver that we see in resources is the reopening of the Chinese economy and the continued momentum around energy transition. Companies that produce commodities like copper, nickel, lithium, rare earths and uranium will be where the outperformance is.

Northern Star's 10 most recent director transactions

%20Share%20Price%20-%20Market%20Index.png)

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

4 topics

4 stocks mentioned

1 contributor mentioned