November 2024 banks reporting scorecard

Many investors were nervous going into the November 2024 bank reporting season, concerned that profit results would not match the lofty expectations implied by their share prices.

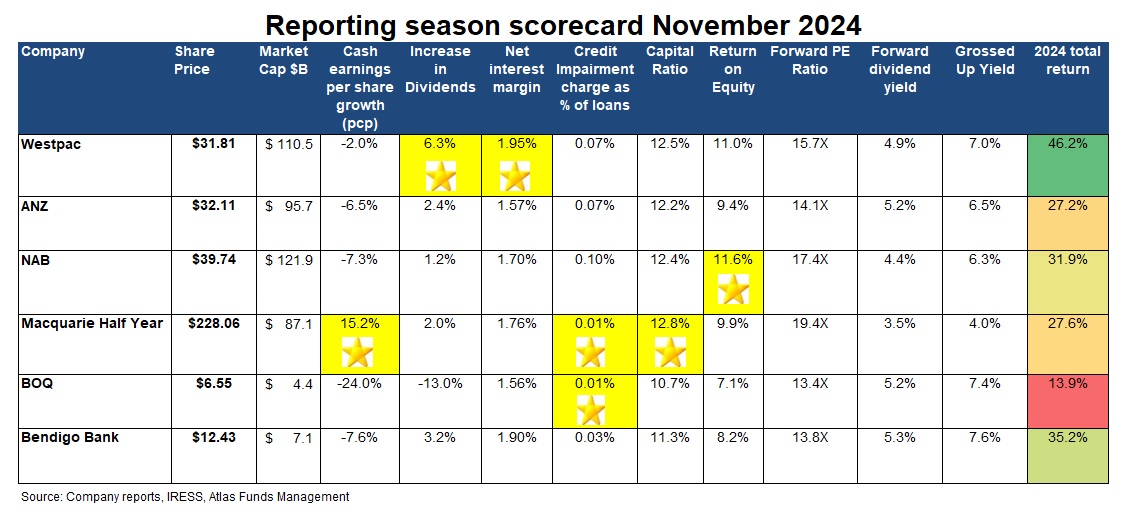

Early in 2024, several major investment banks recommended that investors sell all four of the big four banks based on valuation concerns, declining earnings, and the expectation of rising bad debts. However, on average, the big 5 Australian banks have had a stellar 2024, up 33%, significantly ahead of the ASX 200's return of 12%. Similar to their half-year results in May, Australia's banks delivered a steady reporting season, reporting solid results, steady dividends and, once again, very low bad debts.

In this piece, we look at the major themes that have played out over the November 2024 bank reporting season in the 700 pages of financial results released, including the regional banks awarding gold stars based on their performance over the last six months.

Margins Steady

Net interest margins are always a major topic during the banks' reporting season, with most investors going straight to the slide on margin movements in the immense Investor Discussion Packs. Banks earn a net interest margin [(Interest Received - Interest Paid) divided by Average Invested Assets] by lending out funds at a higher rate than borrowing these funds either from depositors or on the wholesale money markets. Generally, bank net interest margins have recovered from the lows seen in 2022, as when the prevailing cash rate is 5%, it is much easier for a bank to maintain a profit margin of 2% than when the cash rate is 0.1%.

Small changes in the net interest margin significantly impact bank profitability due to the size of a bank's loan book and guide future profitability. For example, Westpac's net interest margin increased by 0.03% in the second half of 2024. Whilst this sounds very insignificant, Westpac's income increased by $214 million over the second half when applied over a loan book of $807 billion!

Typically, Westpac and Commonwealth Bank enjoy a higher net interest margin than ANZ and NAB due to their higher weighting to mortgages, which enjoy a higher net interest margin than corporations that can canvass banks in Japan or Europe for borrowing needs. In the second half of 2024, NAB saw a slight margin decrease, with ANZ and Westpac posting small increases. All the banks mentioned higher competition for loans, though this was tough to detect in their financial results, with all banks doing a good job of maintaining margins.

Gold Star

Banking Oligopoly

Bad Debts Remain Very Low

In November, bad debts were one of the first items investors looked at in the bank reporting packs, checking whether the bank was successfully negotiating the "fixed rate cliff" and the uptick in corporate insolvencies. In November, ASIC reported a 39% increase in corporate insolvencies over the 2024 financial year, with 42% concentrated in construction, restaurants and cafes.

Bad debts have remained low in 2024, with all the banks reporting extremely low loan losses. Macquarie Bank reported the lowest bad debts, 0.01% of gross loans, reflecting their focus on mortgages to higher-earning borrowers, with Bank of Queensland at the same level.

The level of loan losses is important for investors as high loan losses reduce profits, and this dividend erodes a bank's capital base. This reporting season has seen low bad debts translated into better-than-expected profits and, thus, higher dividends.

Atlas see that the low level of bad debts is a combination of the prudent management of risks in the loan book, low unemployment and more conservative lending than we saw from the banks 2000-07. However, it would be disingenuous to attribute current low bad debts entirely to prudent lending from the banks. APRA's capital requirements announced in 2016 in response to the Basel III reforms to global banking effectively restrict banks from lending to developers that have not pre-sold 100% of their development and have a maximum loan-to-value (LVR) ratio on developments of around 65%. These requirements have seen developers switch to non-bank lenders and private credit funds that are not encumbered by these requirements.

We believe the loans to developers, property syndicates and troubled industrial companies that are impaired now sit with non-bank lenders and private debt funds rather than the big four banks. For example, the loans to Pacific Hunter restaurant group probably would have been made by one of the major banks 15 years ago rather than by a non-bank lender in 2024.

Gold Star

Macquarie Bank

Banks Well Capitalised

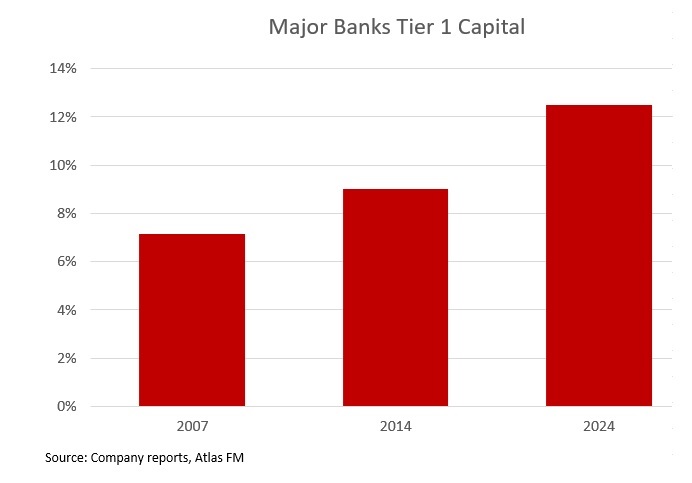

Capital ratio is the minimum capital requirement that financial institutions in Australia must maintain to weather the potential loan losses. The bank regulator, the Australian Prudential Regulation Authority (APRA), has mandated that banks hold a minimum of 10.5% of capital against their loans, significantly higher than the 5% requirement pre-GFC.

Requiring banks to hold high levels of capital is not done to protect bank investors but rather to avoid the spectre of taxpayers having to bail out banks. In 2008, US taxpayers were forced to support Citigroup, Goldman Sachs and Bank of America, and British taxpayers dipping into their pockets to stop RBS, Northern Rock and Lloyds Bank going under. The Australian banks were better placed in 2008 and did not require explicit injections of government funds; the optics of bankers in three-thousand-dollar suits asking for taxpayer assistance is not good. Overall, the major Australian banks hold significantly more capital backing their loans in 2024 than they were pre-GFC or even ten years ago. Better capitalised banks are safer investments for both investors and depositors.

In 2024, the Australian banks are all very well capitalised and have seen their capital build due to a combination of low bad debts, internal capital generation (earnings retained in excess of dividends payouts), and the out-of-cycle APRA-enforced capital raises from 2015. At this time, bank management teams were less than enthusiastic at being forced to conduct over $10 billion in dilutionary equity raises, particularly with a portion of management team bonuses linked to return on equity!

Gold Star

All Big Banks

Dividend Growth Declining

The November 2024 season saw smaller increases in dividends than we have seen in recent periods, though unlike cash earnings, which declined, the banks posted higher dividends in aggregate. This was achieved due to a combination of higher dividend payout ratios and a falling share count as a result of the billions in bank shares that have been bought back and cancelled by all banks. For example, since November 2021, Wespac has reduced its share count by 6% after buying back $7 billion in shares, with other banks making similar moves. The winner of the star was Westpac, with a dividend increase of 6%.

Gold Star

Westpac

Buybacks to Continue

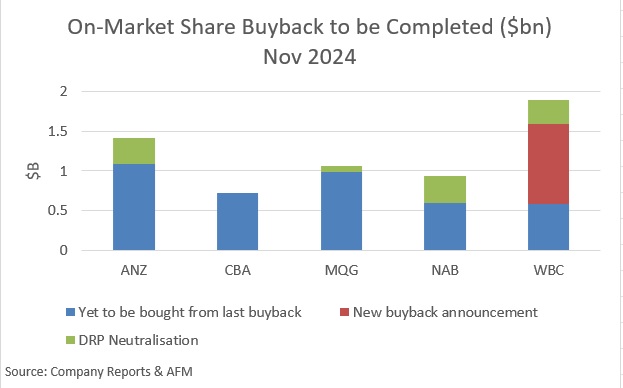

Capital ratio is the minimum capital requirement that financial institutions in Australia must maintain to weather the potential for loan losses. The bank regulator, the Australian Prudential Regulation Authority (APRA), has mandated that banks hold a minimum of 10.5% of capital against their loans, significantly higher than the 5% requirement pre-GFC. Requiring banks to hold high levels of capital is not done to protect bank investors but rather to avoid the spectre of taxpayers having to bail out banks, as has been done in the USA and UK.

While buying back shares on the market and then cancelling them is positive for shareholders as it reduces the divisor on future bank profits, bank management teams are awarded bonuses based on their return on equity (ROE). Obviously, buying back shares reduces the equity, thus boosting ROE.

In 2024, the Australian banks are all exceptionally well capitalised, with all banks actively engaged in on-market share buybacks. This has contributed towards the strength in bank share prices in 2024, as it introduces a new buyer of shares, soaking up around 10% of the average daily volume on the ASX. In November, Westpac was the only bank to announce an increase to their buyback, adding an additional $1 billion to the $600 million remaining to be repurchased from the program announced in May 2024. As you can note from the chart below, all banks still have sizeable buybacks still to come. Furthermore, the banks are estimated to spend around $1 billion buying back shares over the next three weeks to neutralise the impact of news shares issued through their dividend reinvestment plans.

Gold Star

Westpac

Regional Banks

In Australia, the big four banks dominate with a combined market share of 73%, soon to be 75%, once ANZ's acquisition of Suncorp Bank is complete. The closest to breaking into the market is Macquarie, with close to 5% of the market share, followed by the two regional lenders of Bank of Queensland and Bendigo Bank, with a 2% market share each.

As we have seen in the bank matrix at the top, the regional banks face a competitive disadvantage when compared to the major banks, typically enjoying lower net interest margins and lower return on equity. This occurs because they have a higher capital cost than the major banks. Here, wholesale funders require higher coupons on their bonds to offset their higher risks and greater geographic concentration. Additionally, the regional banks have limited access to the large pools of corporate transaction account balances that have historically paid minimal interest rates.

Our take

Overall, we are happy with the financial results from the banks owned by the Atlas Australian Equity Portfolio in November. The three main overweight positions, Macquarie, ANZ and Westpac, increased their dividends, and all three have significant on-market share buybacks, which will support share prices.

Throughout 2024, many analysts have called investors to sell all their bank stocks, pointing to stretched valuations and high house prices. Australia's major banks continue to surprise the market positively with how they have navigated turbulent market conditions. In 2024, the banks all have cleaner loan books, no offshore distractions, minimal operations in adjacent industries such as insurance and funds management and offer a more significant margin of safety than they have had at other times in their history.

1 topic

5 stocks mentioned