Now is the time to lock in high yields, says T. Rowe Price

Global equity valuations are at historic highs, after the S&P 500’s near 30% rally in the back end of 2023 and into 2024. Global credit is also showing the biggest value gap versus equities in more than 20 years according to Bloomberg data.

This is seeing renewed suggestions that investors may choose to replace part of their growth equity portfolio exposure with credit assets.

In the following interview, I speak with Mike Della Vedova, Portfolio Manager of the T. Rowe Price Global High Income Fund, about the key role he believes high yield credit can play in portfolios.

What is high yield credit?

Many people look at fixed income as a “homogenous thing, ‘Oh, risk off, it's going to underperform; risk on it does well,” Della Vedova says. It’s here that investors most commonly misunderstand the high-yield asset class, which is part of the fixed income universe but is fundamentally different in several ways.

“But that's not where the value lies,” Della Vedova says, explaining value in high yield credit lies in drilling below the surface, “into the industries, into the companies, and then right down into the individual securities.”

“If you step back and think about it in the simplest terms, what are we talking about? You're getting income, you're getting a coupon, and you're getting it from individual securities.”

This is perhaps most clearly illustrated when you consider, as Della Vedova points out, there is almost 3,300 bonds within the global high-yield credit universe.

“But there’s only half as many issuers. Within high yield, a lot of companies will offer different risk return profiles within the company,” he says.

Where does high yield fit on the return and risk spectrum?

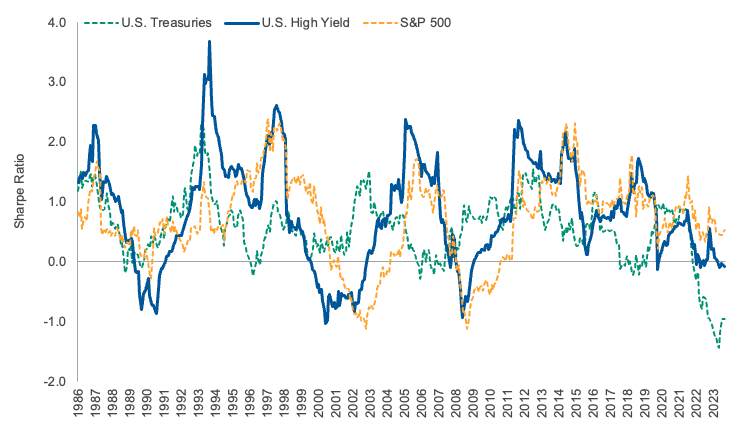

Source: Bloomberg Finance L.P. Data from 31 July 1983 to 29 February 2024. Returns in U.S. dollars.*

Why do you believe high yield credit is the best way to maximise an investor’s income opportunity?

As Della Vedova argues, in corporate credit, “you get to drill down to individual companies. You can focus on the individual risks and the individual returns and you get a lot more visibility, a lot more transparency on the drivers that are going to make you money, or the risks that you potentially face.”

“It's as if rather than watching the ocean, you're on the boat focused on how that boat's performing, as opposed to just watching the overall ocean.”

What is your fund's biggest competitive advantage versus other high-yield-focused funds?

"Looking at it as widely as we do, through the ICE Bank of America/Merrill Lynch indices, we can then be very selective. As mentioned, from those almost 3,300 issues out there, we’re looking for between 150 and 200 ideas," says Della Vedova.

"We're far more selective and that's because we want to do this not as a bolt-together or just purely aligned to an index. Using a bottom up approach, we look at individual names and then individual bonds to build something balanced."

What is your macro view across the regions reflected in your fund?

One of the most surprising market exposures shown in the latest T. Rowe Price Global High Income Fund update is its overweight to Latin America, with a 14.6% weighting versus 9.1% in the index. Sitting within its emerging markets exposure, Della Vedova reminds investors they look primarily at opportunities priced in US dollars.

“And historically, a big part of it was China, mainly China property, which we don’t see as very investable right now,” he says.

Within Latin America, the key countries in the portfolio are Brazil, Mexico and Chile. “But we don’t start there, we start at the bottom-up credit level. All of the names we like in the region fit specific types of ideas,” Della Vedova says.

“They are either key banks in the region – which are very regulated, so you get that transparency. And in commodities, Pemex is an example. As a large energy company, it’s very mission critical for the Mexican state, because it is a big deliverer of hard currency.”

Developed market

Turning to developed markets, Della Vedova says “it’s been a tough ride given where inflation's got to in the past two-and-a-half years but is slowly getting under control.”

“Wage-based inflation has been the toughest inflation beast to slay for central banks, but it's getting back under control. That takes a lot of the potential whipsaw volatility out of the market because, the longer it takes, people get to see more stability in the macro.”

His team focuses on companies that can operate well regardless of the macro landscape. Della Vedova also emphasises T. Rowe Price's view that growth is coming back in these markets, “where rates are flat to easing”.

He says stabilising rates help the financing opportunities and cost lines for weaker corporates, “and by definition, in high yield, that’s what we’re dealing with. Historically, this type of macro environment…is a pretty good landscape for us.”

What about corporate defaults?

On the question of corporate default rates, Della Vedova believes we’re through the worst. That’s partly because of the protracted period of low interest rates prior to 2022, where many companies were able to pay down debt – along with the clearing-out effect of the pandemic.

“So, for weaker companies within high yield, a lot of the dead wood was chopped out then. There was a slight spike, you saw that in US high yield, in companies that just couldn't get their liquidity together,” Della Vedova says.

“On a big picture, defaults will go close to, or maybe slightly above, long-term averages – we’re saying 3.5% to 4.5% on a global basis, but they’re not going to blow out. It’s still very manageable.”

He also points to the higher prevalence of liability management exercises by companies, where companies are opting to initiate “default-type or bankruptcy measures” earlier on.

“Ratings agencies can view those as a default, and again it comes back to our approach in being very selective,” Della Vedova says.

He points out that the default rate of company debt in the T. Rowe Price portfolio since inception is less than 0.2%. This is a fraction of that seen across markets, with default rates averaging around 3%, 4.5% and 1.5% across the US, emerging markets and Europe during this period.

How is T. Rowe Price positioned across sectors?

The biggest sectors in the portfolio are Energy and Financials, but Della Vedova emphasises that these are also the biggest in the market and their exposures are close to the index weight.

He says they’re happy with their current positioning because of a secular shift, particularly as the US becomes more self-sufficient and is now able to become a net exporter of gas to Europe.

“Though what we've seen in the need for capital investment in energy companies has dramatically changed and will continue to change, as some of the more historic energy companies are moving toward being greener and more carbon-neutral over the coming decades,” Della Vedova says.

“That will take capital as well, so that opportunity set continues to be there.”

In Financials, he notes much of T. Rowe Price’s exposure here is in non-bank financial companies, particularly in the insurance space. That’s because they are, like banks, heavily regulated with good transparency, “which removes a lot of the potential uncertainty.”

Changing consumer habits

Among some of the more cyclical sectors represented in the fund, Della Vedova also discusses its investments in the debt assets of Entertainment & Leisure companies.

Explaining the investment thesis here, he looks back to the pandemic, when lockdowns saw a drastic shift in the leisure activities people were able to enjoy. This has seen a sharp reversal in the period since then.

“Everyone thought at first it was maybe a very short-term trend, but it's got far more sticky – the whole idea of looking for an experience,” Della Vedova says.

The fund’s exposure to automotive also reflects pandemic-driven changes.

“Post lockdown, the number of cars needed to fill demand is still undersupplied, that is key. Where we see better relative value is some of the big global suppliers, rather than the companies that manufacture and sell the cars,” Della Vedova says.

Where does high-yield credit fit in retail portfolios?

Della Vedova emphasises his view that the asset class should be “strategic and longer-term rather than short-term tactical.”

“The reason is the companies you invest in are turning themselves around and they don't do it in months or quarters. It takes a while.”

He also highlights this longer-term approach maximises the compounding effect, especially given the average yield of around 7.7% that global high-yield is delivering.

“It's the highest paying coupon of fixed income… and for anyone's investment portfolio, it's nice ballast to have.”

A final point he emphasises here is the expected trajectory of interest rates from here – almost certainly down: “But if you lock in that 7.7% yield, that's an income generator for the future. I think that's key.”

“What you’re able to capture on returns now, you don’t see often. We feel now is the right time for people to take advantage of that opportunity.”

Seeking high income and capital appreciation?

Learn more about how Mike and team approach to global fixed income securities by visiting the T Rowe Price website or the fund profile below

.png)

3 topics

1 fund mentioned

1 contributor mentioned