Nuclear energy: Net-zero panacea or pipe dream?

The energy sector continues to find itself at the intersection of policy and politics. The release of AEMO’s recent system plan for the national electricity market and the CSIRO report into Gencost coincided closely with the release of Coalition policy incorporating significant nuclear capacity in their longer-term electricity generation plans.

These reports are invariably well-researched and thorough, however, the cost which matters to end consumers is that of the total system. Generation, transmission, retailing, carbon costs and hedging costs are amongst the myriad of costs that will eventually be passed on to consumers as either explicit charges or taxes (the capacity investment scheme (CIS) is a good example of the government hiding an element of generation cost, in general, outlays rather than in energy prices). The nightmarish complexity of this total picture is the reason most reports usually only address pieces of this puzzle.

Our investment thoughts in this area are often guided by simpler considerations, as we don’t fancy our ability to out-model CSIRO and AEMO on the finer details. Our simplistic observations on comparing the solar and wind-focused plans of Labour with the Coalition alternative are not intended to be partisan, however, they would lead us to be less dismissive of nuclear as a long-term prospect.

Nevertheless, we acknowledge the already large investments made in wind and solar mean the starting point does not favour a sharp change in direction. Some cursory observations:

- Levelised cost of electricity (LCOE) attempts to compare the cost of competing generation sources. These are marginal costs and not total costs, and while very useful, form a wholly incomplete picture.

- Solar and wind generation are likely to drive markedly higher associated costs in distribution, as the decentralised nature of energy production is not well suited to existing grid design and requires a vastly larger web of interconnections. It is much shorter duration infrastructure than nuclear plants and much of the cost is being borne by consumers rather than the government. Fair analysis needs to incorporate the cost of replacing solar panels and wind turbines 3 or 4 times to match the duration of a high-quality nuclear plant and should include the total cost, regardless of who pays for it.

- The value of high-quality, very long-duration investments is almost always underestimated. Pilbara iron ore production, the Sydney Harbour Bridge, Sydney Opera House, the US interstate system, hydro dams and countless other nation-building projects were often characterised by massive cost blowouts and apparently awful economics. Time more than cured them. The time value of money is a wonderful financial concept, but in reality, it assumes most assets have very little value 20 or 30 years into the future. This does not encourage doing things properly and is usually wrong.

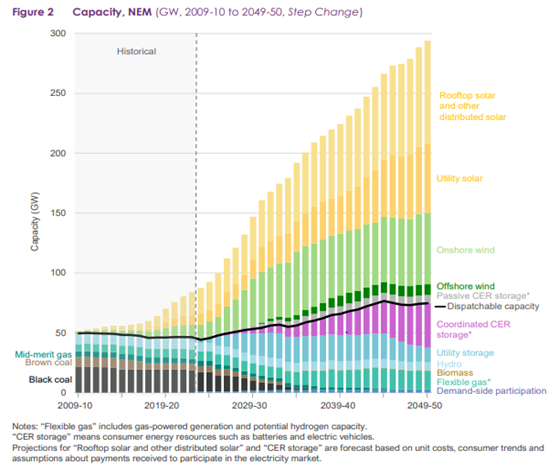

- The cost of complexity is usually underestimated. The multitude of generation sources envisaged in the AEMO chart below equals lots of complexity. Matching the intermittent power of solar and wind with the flexible firming offered by batteries, hydro or gas peaking plants is vastly more complex than dominantly baseload power and the leakage from an army of traders and marketplace structures to allow these sources to interact effectively is usually ignored.

- The ‘certainty of regulation’ which companies demand is effectively asking for underwriting from taxpayers in order to ‘encourage’ investment. This benefit is not offered to most businesses. Commodity prices change, consumer habits change; the future is uncertain. Artificially lowering these risks by asking consumers/taxpayers to absorb them rather than companies, often in the name of artificially lowering financing costs is crazy. The job of companies is to assess risk and return and invest accordingly. The extremely limited investment in renewable energy contains a fairly clear message on the actual level of confidence these companies have in the future.

- The gas shortage likely to impact the East Coast in coming years has been foreseen by many. Vilification of gas, regulatory barriers and the distortion of investment decisions through mis-definition of ESG principles have created long-term problems. Players such as Origin Energy (ASX: ORG), with high-quality gas supply and gas peaking plants, are well positioned to benefit, though customers will bear this cost.

Source: AEMO 2024 Integrated System Plan for the National Electricity Market

As an aside in the decarbonisation process, we have maintained our enthusiasm for alumina and aluminium as necessary long-run substitutes for copper. While copper remains a better conductor, necessity is the mother of invention.

While high copper prices might ration copper towards its highest value use, it will not create much more copper (moving very large volumes of dirt to access extremely low-grade deposits seems unlikely to provide a sustainable solution to carbon emissions). While there are costs to substitution in terms of higher weight and volume in electric motors, many appliances and applications can readily use aluminium.

Learn more about investing in Schroders' Australian Equities.

1 stock mentioned