Nuclear energy trends in the US are bullish for uranium – Citi

2024 has been the year of commodity mega-themes: gold, silver, copper, and of course, uranium. Each has captured Aussie investors (and cash) at one time or another this year.

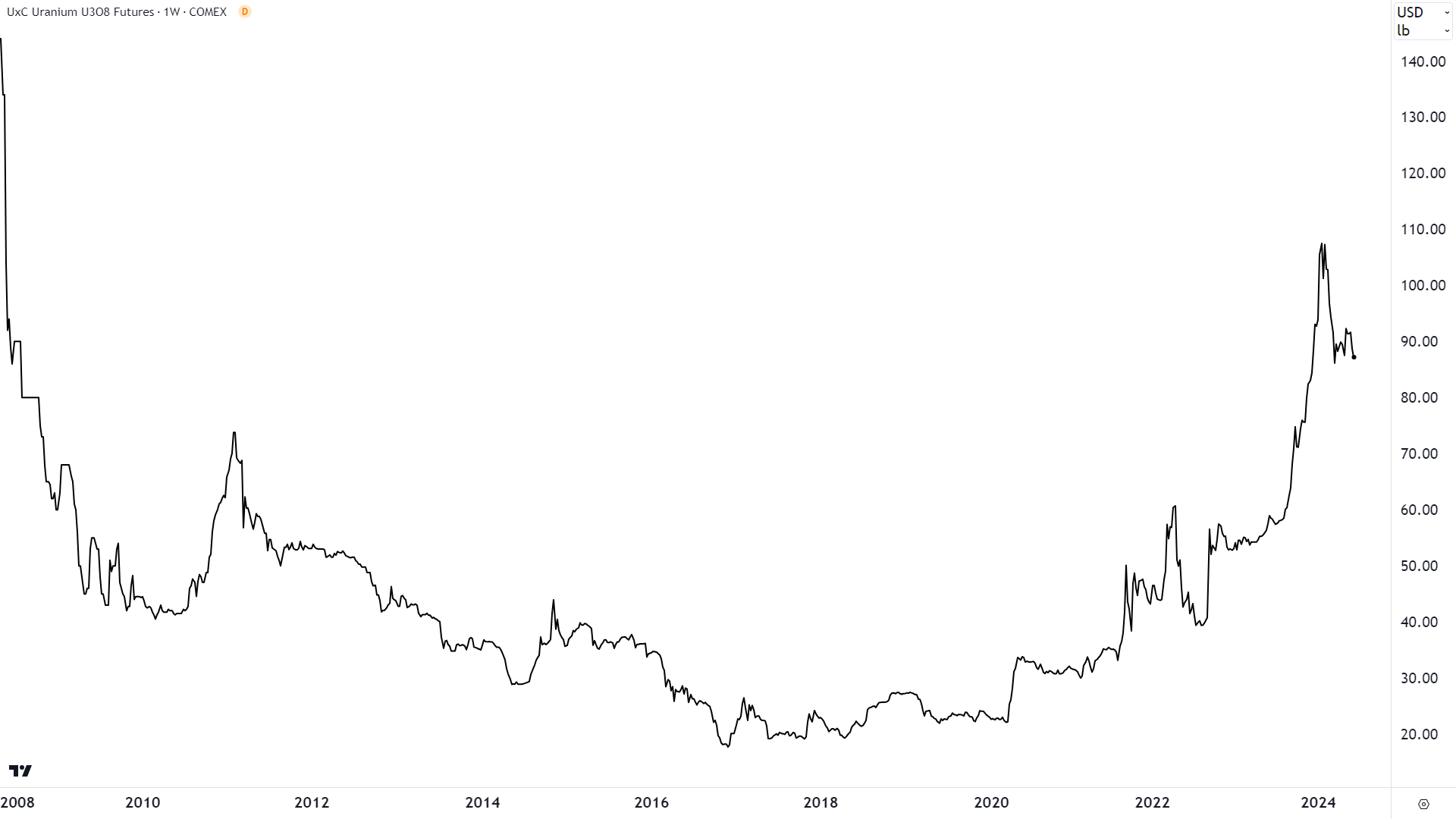

As the prices of each of the commodities listed above start to neutralise after massive run-ups, the price of uranium arguably is starting to do more than just neutralise – it’s potentially starting to fall.

History shows that the wrong time to invest in uranium can last for a very, very long time. So, should investors rethink their investments in ASX uranium stocks or stay the course?

This is the topic of a new research report by major broker Citi titled “Nuclear energy trends in the US are bullish for uranium and select utilities. Commodities/equity views”. The report focuses on nuclear trends in the US, noting they are potentially bullish for uranium demand in the long term.

Citi also has a modestly bullish short-term view, but it concedes some consolidation in the recent run up in prices may be in order. Let’s go through their rationales for their views over each time frame.

Citi’s short-term uranium view

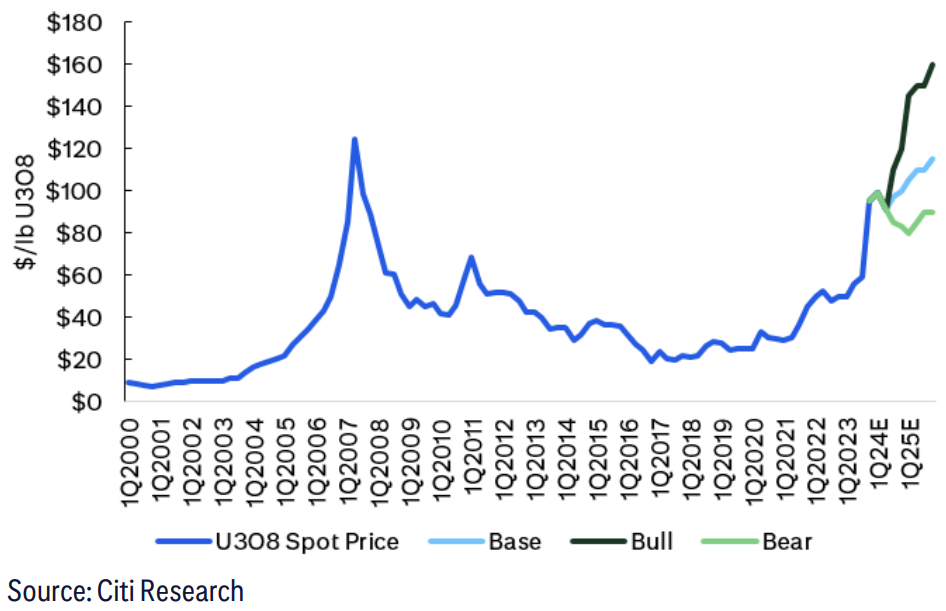

In the research report, Citi states they remain “tactically bullish” on uranium markets. The broker has a US$97/lb target over the next three months, which allows for around 11% upside from the last traded front-month futures price of US$87.20/lb

Citi’s 12-month uranium price target is modestly more bullish again, predicting “prices could surpass the $100/lb level again and reach $107/lb in our base case”.

The main reason for the broker’s short-term bullishness is ongoing production issues reported by major producers in Kazakhstan and Canada, and an inability by junior producers to fill the gap against current global demand growth. “In combination, this creates an ideal scenario for the current bull run to continue,” suggests Citi.

As for the current consolidation in prices, Citi isn’t too concerned, noting “a healthy consolidation in the current $90s range should be supportive for higher prices.”

Citi’s long-term uranium view

"More than ever before, US nuclear energy developments are likely to have a meaningful impact on global uranium prices. Nuclear energy in the US is important for global trends, and its development could further contribute to global appreciation and adaptation of it."

"More than ever before, US nuclear energy developments are likely to have a meaningful impact on global uranium prices. Nuclear energy in the US is important for global trends, and its development could further contribute to global appreciation and adaptation of it."

That’s the thesis behind Citi’s longer-term view on uranium. This view is at least partly formulated based upon a shorter-term development, though. Citi points out that the recent ban on Russian nuclear fuel is a “destabilizing factor” for uranium markets. US utilities are still “significantly dependent” on Russian supplies of low-enriched uranium (LEU), with about one-third of LEU coming from Russian sources, the broker notes.

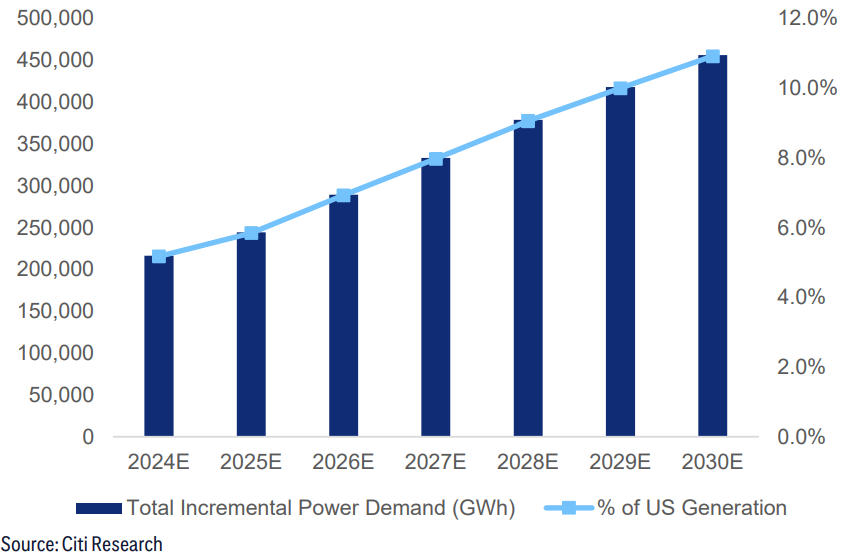

Another key factor is the forecast ramp-up of power demand (sourced from nuclear or otherwise) due to the burgeoning AI and data centre sectors. “We forecast AI/datacenter growth to increase US total power demand by ~456TWh by 2030, which is equivalent to ~11% of US total power generation”, Citi notes.

Growing demand from AI/data centres will add to growing demand from the rest of the US economy, resulting in the US requiring another 13% power generation by 2030. Citi says this is pushing the existing nuclear fleet of reactors to “uprate, increase capacity factors, and restart at least one plant”.

Citi notes that one important factor that could support nuclear playing an increasing role in the USA’s energy mix is the current environment of bipartisan support, calling it “a rare exception during a US election year”. Indeed, the US Congress has been busy over the past two years since Russia’s invasion of Ukraine passing several nuclear/uranium-related bills.

Could this environment change after November’s presidential election? Citi thinks it could. If Trump wins, the impact could be “neutral to neutral-bearish”, while a Biden win would be “more bullish” for uranium, the broker states.

Pulling each of the threads of Citi’s arguments together, their longer-term uranium price targets remain potentially substantially bullish: “In the longer term, uranium prices would continue to rise to $115/lb in the next three years, potentially breaching 2007 highs of $146/lb”.

That’s Citi’s “Base Case”. Their bull case is even more bullish, but would require “retaliation by Russia and a potential export ban”. Citi argues this would be even more destabilising for uranium markets, and it could result in the uranium price rocketing to US$151/lb as soon as next year.

This article first appeared on Market Index on Friday 7 June 2024.

5 topics

5 stocks mentioned