Nvidia's Earnings: Why you need to get up early tomorrow

Reading the state of the markets has become a challenge for investors.

The S&P 500 and Nasdaq closed at fresh record highs last night despite inflation fears looming large.

Higher-for-longer interest rates are the accepted norm, while at the same time industrial and precious metals soar.

Meanwhile, bond markets continue to vacillate as signs of modest deceleration in inflation mix with a growing concern about rising government debt.

Contradictions are rife throughout markets.

Bulls and bears will continue to make their cases about why you should be defensive or aggressive now.

But mark this moment.

Because I think the picture could look very different after Nvidia’s [NASDAQ:NVDA] earnings tomorrow.

Nvidia, the once niche gaming chip company, is now better known as the artificial intelligence powerhouse.

Its stellar performance has propelled it to become the third-largest company in the S&P 500 and the best year-to-date performer among the ‘Magnificent Seven’ tech giants.

The company’s stock surged an incredible 239% in 2023 and has risen nearly 100% this year.

With a market cap of US$2.35 trillion, the company dwarfs the entire Australian Stock Exchange.

At that size, Nvidia and other tech behemoths have pushed market concentration to new highs, making up the majority of the major indices and their movements.

And that’s why you should be paying attention.

The company will release its next earnings report on the next market close in the US.

That will be Thursday, around 7:30 am AEST or 5:30 AWST for our Perth readers.

Today, I want to explore why these earnings matter and why you should probably set your clock a little earlier tomorrow to catch the news before the market opens.

Before we get to why these earnings matter, let’s briefly examine sentiments.

What are sentiments right now?

It’s a bit challenging to unpick US economic health and, therefore, the trajectory of equity markets at this stage.

There are too many moving parts with wildly contradictory data points that can feed into optimistic or bearish outlooks.

Global equities (bar some dark spots like China) are near all-time highs as the world joins the US in exuberance.

This has occurred even as higher-for-longer interest rates and dim consumer sentiment surveys can be found in most major markets.

This week, one of the last major bears on Wall Street, Morgan Stanley’s Mike Wilson, capitulated in a note to clients, leaving only Marko Kolanovic of JP Morgan Chase as the last major investment bank bear.

Mr Kolanovic has remained steadfast in his pessimistic view: sky-high stock valuations, elevated inflation risk, consumer stress, restrictive higher-for-longer rates, and geopolitical uncertainty are all rife.

All seem reasonable points. However, the position has decimated the bank's model portfolios.

He was also pessimistic during last year’s 24% rally and bullish during much of the 2022 19% stock wipeout.

I mention all of this because it’s worth exploring the outlier positions to gain a new perspective on risks or opportunities — not that anything he is saying you haven’t heard before.

But his risk calculus has geopolitics a lot higher than many others for example.

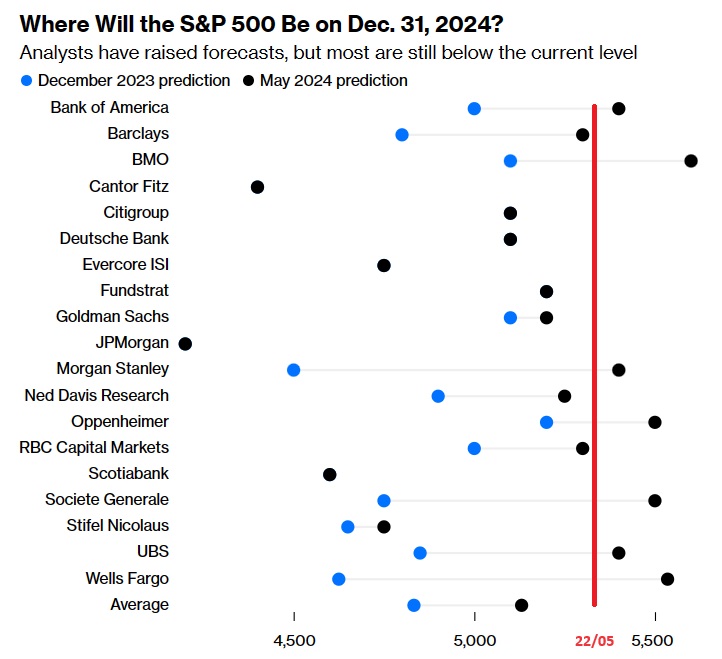

As you can see below, JPMorgan is well outside of the bell curve, but only because other bets have shifted a fair margin.

Looking at last night's close (in red), the S&P 500 is already 9.9% higher than the average forecaster thought it would be seven months from now.

If we move away from analysts and towards the markets, we can see that the bulls are in control.

Rising earnings multiples are at the top of their historical range despite the higher-for-longer interest rates or inflation threatening to erode those earnings.

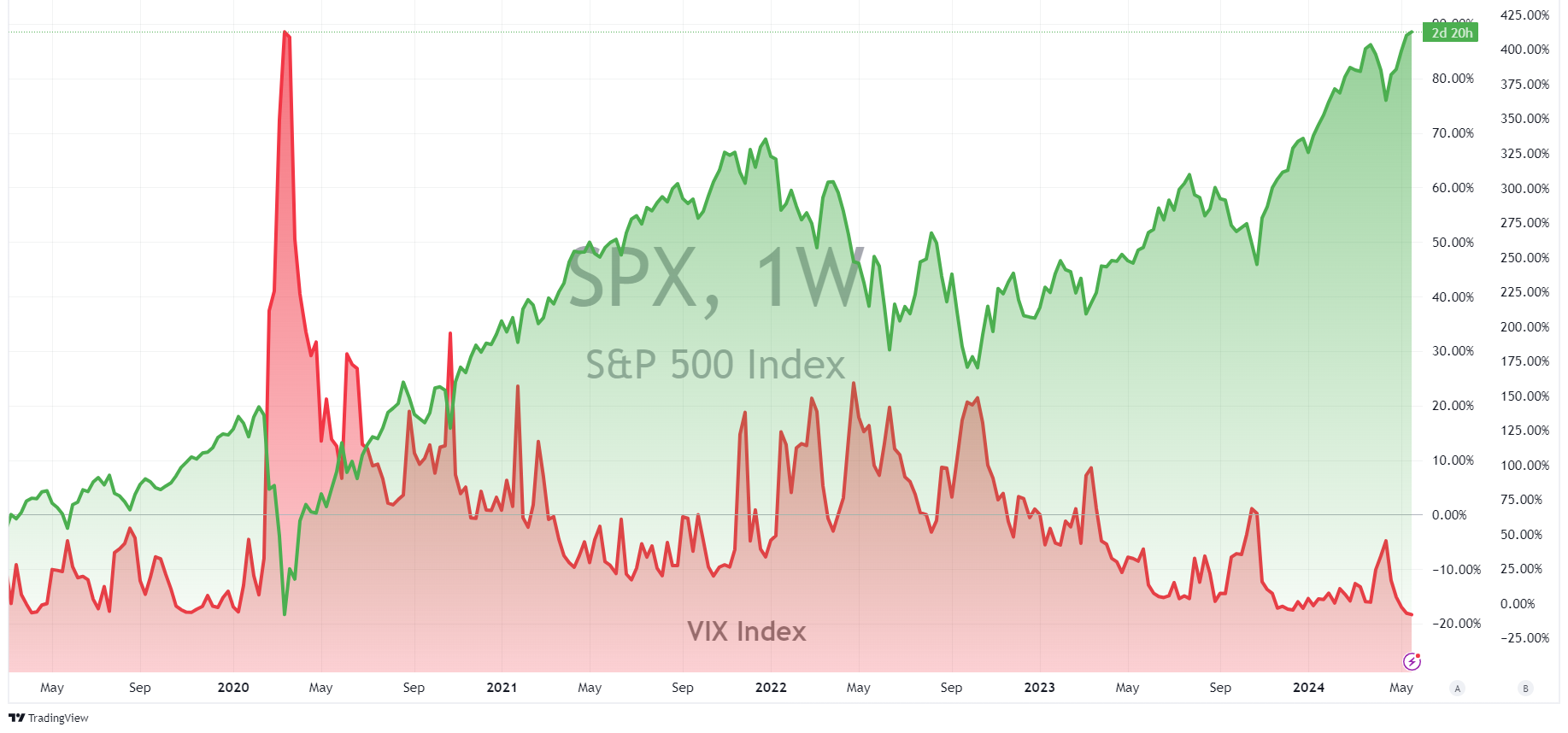

Meanwhile, the CBOE Volatility Index (VIX) stands at a multi-year low not seen since before the pandemic.

This ‘fear-index’ is a measure of expected volatility in the S&P 500 over the next 30 days, and it shows that option traders are overly confident at the moment.

Some of this could be due to lower volumes. As many US traders are away on holiday, volumes are down about 14% on average.

But beyond that, the question here is whether economic fundamentals, developments in monetary policy and companies’ future earnings justify such a comfy position.

On the shorter risk horizon, re-accelerating inflation remains the likely iceberg, but who knows what else could change?

As the old saying goes, ‘When the VIX is low, watch out below.’

Historically, a rapid deterioration of employment has usually been the leg-sweep that knocks over the economy, but so far, things seem ok.

In Australia, unemployment remains low at 4.0%, while in the US, we’ve seen the first signs of slowing workforce growth, but things are still tight.

In fact, for the US, it’s the 27th consecutive month with an unemployment rate below 4% —that’s the longest streak since 1953.

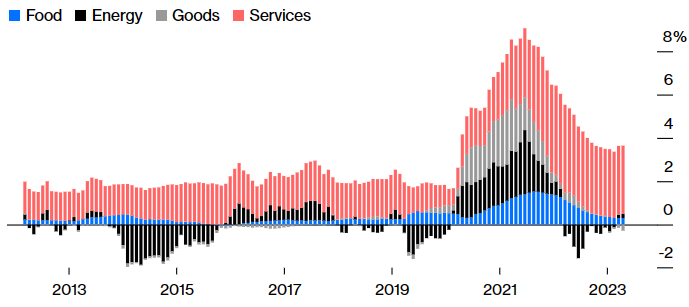

The issue with this is its impact on services inflation.

With such a tight labour market, labour costs remain high, while productivity is middling at best.

Just look at the extent to which services inflation dominates the inflation picture in the US.

US Headline Inflation

Worker productivity has been a big concern both here and in the US, with the US seeing a sharp -0.5% drop in productivity in the first quarter.

But many Central Banks have forecasted labour productivity increases coming in the next half, either through job losses or some nebulous mentions of AI productivity gains.

The first scientific papers showing increasing worker productivity due to AI are starting to trickle in, but it remains to be seen if that can be reflected in the wider economy as fast as some hope.

So, despite things looking uncertain in many ways, it’s clear the market remains bullish.

All of this raises a vital question. What is the appetite for further risk?

Enter our Bellweather

When Nvidia’s last earnings hit markets in late February, David Ives of US research firm Wedbush described it as ‘probably the most important earnings that we’ve seen from a company in the market for the last five years.’

The company blew estimates out of the water.

Its December quarter revenue more than tripled to US$22.1 billion, and the stock surged over 16% in a day.

At the time, the earnings reinforced what many had thought about the AI spending trend and dispelled much of the scepticism at the time.

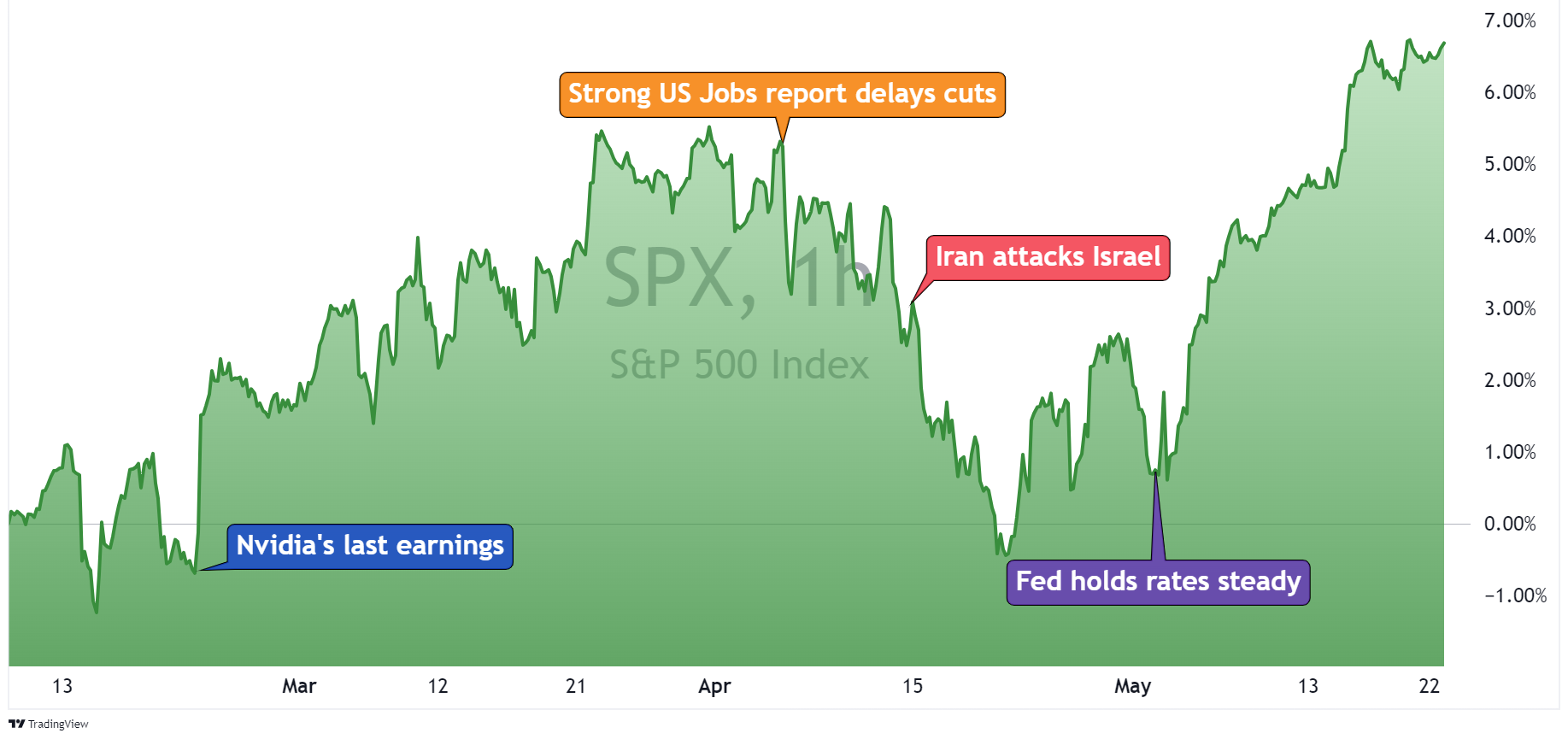

Here’s what that move looked like, along with some other notable moves in the wider market.

So, what can we expect from Nvidia’s 1Q24 earnings this time around?

The consensus remains strongly bullish for Nvidia — which is hardly a surprise.

Evercore ISI described the likely strong earnings beat as ‘The worst kept secret of corporate America.’

Wall Street anticipates revenue to expand by 240% to US$24.6 billion, the third straight quarter of over 200%.

Those are astronomical numbers.

The question here is less about the extent of the beat but how the market reacts.

This, I argue, is the important gauge for us to test the waters and see how much appetite for risk remains in the market moving forward.

Only a handful of companies can give such a strong snapshot of market sentiment based on their reactions.

Because the current market is inexplicably tied up with trends in AI for its mega-caps stocks or future productivity hopes, any disappointment here could be huge.

Nvidia's results will also come shortly after the U.S. Federal Open Market Committee releases the minutes of its monetary policy meeting this month, adding further significance to the company's performance.

For my own bets, I think we could see Nvidia hit US$1000 per share next open.

But even if the opposite happens and the earnings disappoint — the extent of any movement will be very telling as to where US equities are headed for the next month.

I recommend setting your clock a bit earlier tomorrow, getting a coffee, and seeing where markets might go next.

If you found the discussion on Nvidia insightful or would like help deciphering the results, join us for free daily insights from Fat Tail Daily. Dive into our analysis and get ahead of the curve. Sign up here to cut through the noise.

3 topics

1 stock mentioned

%20cropped.png)

%20cropped.png)