Nvidia smashes sky-high Q4 earnings expectations + Key earnings call takeaways

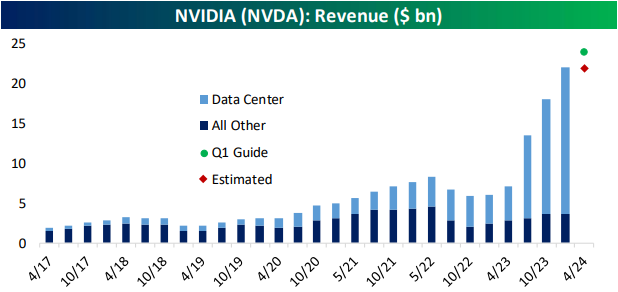

The world's fourth-largest public company just reported 265% revenue growth for the December quarter. Not only did Nvidia crush already high expectations but it guided to another strong year ahead.

Nvidia shares briefly sold off 6% just minutes after the result (in after-hours trade) but quickly reversed the weakness to trade around 8% higher.

4Q23 – Key numbers

- Revenue up 265.3% to US$22.1 billion, 8.2% ahead of consensus

- Data centre revenue up 408.8% to US$18.4 billion, 6.9% ahead of consensus

- Gross margin up 1,064 bps to 76.7%, 128 bps ahead of consensus

- Earnings per share up 486.4% to $5.16, 3.6% ahead of consensus

For the March 2024 quarter, Nvidia guided to:

- Revenue growth of 233.7% to US$24 billion, 9.5% ahead of consensus

- Gross margin growth of 1,023 bps to 77.0%, 150 bps ahead of consensus

- Operating income growth of 423.6% to US$15.98 billion, 12.8% ahead of consensus

Can we just take a moment to appreciate these year-on-year figures (from a US$1.7 trillion market cap company)?

Key Company Insights

Nvidia CFO Colette Kress: "In the fourth quarter of FY24, large cloud providers represented more than half of our Data Center revenue ... Strong demand was driven by enterprise software and consumer internet applications and multiple industry verticals."

Nvidia CEO Jensen Huang: "Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations ... The year ahead will bring major new product cycles with exceptional innovations to help propel our industry forward."

Nvidia's dominance among vehicle manufacturers: "Almost 80 vehicle manufacturers ... are using NVIDIA's AI infrastructure to train LLMs and other AI models for automated driving and AI cockpit applications. In effect, nearly every automotive company working on AI is working with NVIDIA."

Largest customers and early adopters: "Consumer internet companies have been early adopters of AI and represent one of our largest customer categories. Companies from search to eCommerce, social media, news and video services, and entertainment are using AI for deep learning-based recommendation systems. These AI investments are generating a strong return by improving customer engagement, ad conversion and click-through rates. Meta, in its latest quarter, cited more accurate predictions and improved advertiser performance as contributing to the significant acceleration in its revenue."

China revenues: "Data Centre sales to China declined significantly in the fourth quarter due to US government licensing requirements." Huang notes that "this last quarter, our business significantly declined as we paused in the marketplace, we stopped shipping in the marketplace. We expect this quarter to be about the same. But after that, hopefully, we can go compete for our business."

Other tidbits:

- Nvidia is becoming an inference business (in the context of AI, inference refers to using trained AI models to make predictions or decisions on new data). Every single time you use ChatGPT, Nvidia is inferencing.

- A GPU is not a chip; it has thousands of parts and weighs around 70 pounds

- Nvidia is ramping up production of its H200 chip as well as other products. With all these new products, demand is increasing much faster than supply

- Nvidia plans to allocate its products in a fair manner

No Bump for Local Stocks

Local tech names have yet to experience any follow-through strength from Nvidia's blowout earnings. Most stocks opened relatively flat on Thursday.

- Data#3 (ASX: DTL) +0.4%

- Megaport (ASX: MP1) +0.2%

- Altium (ASX: ALU) +0.03%

- NextDC (ASX: NXT) -0.03%

- Dicker Data (ASX: DDR) -0.9%

What's next for Nvidia

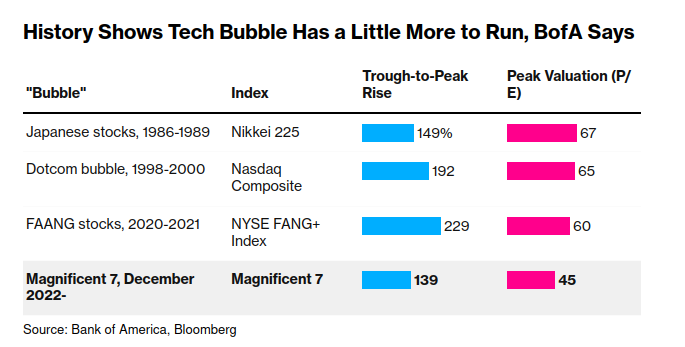

History shows that the current 'tech bubble' has a little more room to run, according to Bank of America.

.png)

Nvidia shares are up around 190% year-to-date. It's hard to deny that the price chart is starting to look a little frothy. But at the same time, its surging share price has been backed by equally parabolic earnings growth.

Kevin Hebner, EPOCH investment partners, brings an interesting take about Nvidia's current valuation:

"The price of Nvidia now assumes that Nvidia is going to grow earnings by 20% a year for the next 18 years. And other companies have done that. Earlier, Apple did that, Microsoft did that. But they did it when they were relatively small companies. There's never been an example before where we had a huge firm like Nvidia grow earnings that way."

"So, it's possible but we think it's improbable. I think one would probably want to be careful about Nvidia and you could say similar things about Tesla because its price is predicated on it being a vehicle Elon Musk uses to monetise AI and all the data he has, either through Tesla X or his satellites. And that seems to me to be a pretty big leap at this point."

This article first appeared on Market Index.

3 topics

5 stocks mentioned

1 contributor mentioned