Of these 36 stocks, only two are "sells"

The August reporting season for 2022 is done and dusted. By all accounts, it was far better than many expected. And as such, investors are likely to either be celebrating with champagne or nursing a whiskey as they rue the day that a dud (or duds) made its way into their portfolios.

Over the past month, the Livewire team has interviewed 30 fund managers and covered 36 stocks. It was tough, tiresome work. But for you, my dear reader, we were more than happy to do it.

It may surprise you to learn that of these 36 stocks, only two were dubbed "sells". That's a pretty incredible number, particularly given the multitude of headwinds and volatility in markets that we continue to spill ink on.

So why not take a look at the stocks that impressed fund managers this earnings season?

In this wire, I'll take you through the stocks that fundies are buying off the back of these results, the two stocks they are selling, and the many, many stocks that have our contributors sitting on the fence.

Plus, at the beginning of the month, we decided to get a gauge on how much value fundies were uncovering in markets - and the results are sure to surprise you.

Note: I also want to take a brief moment to call out the fund managers who shared their views amid the very busy time which is reporting season. Thank you. You can check out the entirety of our reporting season coverage here.

The sells

It's important to note that buyers and sellers make a market. It's entirely possible that for the two fund managers who dubbed stocks "sells", there are many more who believe these stocks would be a "buy", and vice versa.

As always, it's important to do your own research and speak to a financial professional before making any rash decisions of your own.

You can read the entire article on each of these companies by clicking on the highlighted stock below. Without further ado, here are the two "sells" from this August's reporting season:

1. Fortescue Metals Group (ASX: FMG)

Sage Capital's Sean Fenton is selling FMG off the back of its result. Why? Well, he's cautious on the outlook for iron ore and notes that uncertainty still abounds for the price of this commodity.

"Clearly, Fortescue’s profit was down a lot from last year. That's simply because the iron ore price has fallen and the discounts on the low-grade iron ore that they produce have widened over the year. If anything, we expect that'll continue," he said.

2. Northern Star Resources (ASX: NST)

Next on the don't touch list, is NST - a stock that Datt Capital's Emanuel Datt is avoiding like the plague (too soon?). He isn't bullish on the gold price, and given current industry conditions, is doubtful of whether NST can reduce its cost per ounce without significant capital investment. Yikes.

"I think NST here might be trying to balance a lot of different incentives rather than having a clear focus and a single goal of optimising the portfolio. That's why, in a nutshell, I'd say sell," he said.

The buys

There were 13 (and a half) "buy" calls of the 36 stocks Livewire covered. The half is for Qantas (ASX: QAN), which Firetrail's Kyle Macintyre dubbed a "buy" (if you don't own it) and a "hold" (if you do). In no particular order, these include:

Dr Shane Storey of WILSONS said CSL was easily his top pick across the 30 in his portfolio, noting the healthcare company's new products set to come to market set it up for the "best pipeline of their history at the moment".

Spheria's Matthew Booker owns A2M and has continued to buy the stock off the back of its result. He describes it as a company that "ticks pretty much every box. It delivers strong returns and has a high-profile brand with strong cash flow generation and strong market share in a growing market."

3. Commonwealth Bank (ASX: CBA)

While Atlas Funds Management's Hugh Dive said he added to his CBA weight in June going into the result and retains a positive investment view towards Australia's "premier retail bank". However, he adds that he wouldn't be buying the stock at over $110.

Airlie Funds Management's Joe Wright said he would be buying JHX off the back of the result. Why? Well, "it's trading in line with the market, despite being one of the highest quality companies on the ASX through a cycle," he said.

Tribeca's Jun Bei Liu said that TWE was a buy, describing it as cheap (it trades on less than 19 times earnings), and is set to deliver earnings growth of more than 20%. "It's very well positioned for further upside," she added.

Liu is also backing ResMed on the back of its result and said she would buy more if there was a dip in the company's share price. While she notes the result was in line with expectations, "demand has been so strong they're just selling everything they build", so it has a "very bullish outlook for the next 12 months."

Martin Currie's Michael Slack believes that STO is a buy, and sees "over 20% valuation upside in this stock, as Santos' strong cashflow generation comes to fruition and the growth projects get appreciated by the market."

Magellan's Ofer Karliner is backing TCL, revealing it is the biggest holding in the Infrastructure Fund. He notes it is "one of the best infrastructure companies out there, if not one of the best businesses out there. It has such strong pricing power and underlying favourable dynamics in terms of urban toll roads."

Schroders' Ray David said that SEK is one of the core holdings in his portfolio, and believes it "looks like attractive value despite slowing conditions and economic headwinds." If the company continues to de-rate, David reveals he will be adding more to his position.

Wilson Asset Management's Shaun Weick said the team is buying LOV on the back of its results and believes it is one of the most attractive medium-term investments within the ASX consumer sector. He added that the "management's incentives provide a good indication of the aggressive growth target for the business, with the FY23 EBIT hurdles implying more than 30% growth at the upper end."

While Airlie Funds Management's Vinay Ranjan recognises that the outlook on the consumer is a bit more challenging from here (thanks to rising rates and inflation), he argues if there was one business to own in this space, it would be this one. He argues that Bunnings and Kmart will outperform in an inflationary environment as they are "highly resilient businesses."

Auscap's Tim Carleton reveals that NCK is one of the firm's "highest conviction positions". And notes that "for a company of this quality to be trading on the multiple they’re currently trading on is an exceptional opportunity for investors."

Monash's Shane Fitzgerald said we are seeing a "really powerful dynamic" for QBE going forward, as rising rates benefit insurance companies' reserves and premium increases. QBE has already passed through four years of premium rises, "which gives us very strong confidence about the quality of the earnings they're producing now. And ... the prospect of higher margins and higher profits over the next few years," he added.

13.5. Qantas (ASX: QAN)

If you don't own this stock, you should, and if you do - you should continue to hold onto it, argues Firetrail's Kyle Macintyre. He notes that "if you put it on FY24 earnings, it's trading at six times price-to-earnings. That means it's six years' worth of earnings for a business that's got an improving profitability profile, as things continue to open back up."

The fence sitters

There was a hell of a lot of fence-sitting going on this reporting season. Of the 36 stocks covered in this series, 18 (and a half, given Macintyre's QAN call) were "holds". That's more than 51%. Given I've just realised how long it takes to write these summaries (significantly longer than I expected), and the fact that these are not "buys" or "sells", I have decided to list them below without much hullaballoo.

If you are interested in learning more about these stocks' reports, simply click on the highlighted stock name below.

1. Insurance Australia Group (ASX: IAG) - covered by Monash's Shane Fitzgerald

2. Computershare (ASX: CPU) - covered by Credit Suisse Australia's Mike Jenneke

3. Megaport (ASX: MP1) - covered by Wilson Asset Management's Sam Koch

4. Stefan Hansen

5. Pro Medicus (ASX: PME) - covered by Lakehouse's Donny Buchanan

6. Whitehaven Coal (ASX: WHC) - covered by Market Matters' James Gerrish

7. Pointsbet Holdings (ASX: PBH) - covered by Medallion Financial's Michael Wayne

8. Allkem (ASX: AKE) and Pilbara Minerals (ASX: PLS) - also covered by Wayne

9. Flight Centre (ASX: FLT) - covered by Montgomery's Roger Montgomery

10. Magellan Financial Group (ASX: MFG) - also covered by Montgomery

11. Mineral Resources (ASX: MIN) - covered by Katana's Romano Sala Tenna

12. Telstra (ASX: TLS) - covered by Investors Mutual's Daniel Moore

13. Woodside (ASX: WDS) - covered by Katana's Hendrik Bothma

14. James Delaney

15. Kelli Meagher

16. IGO Ltd (ASX: IGO) - covered by Deep Data Analytics' Mathan Somasundaram

17. Timothy Wood

18. News Corporation (ASX: NWS) - covered by Blackmore Capital's Claire Xiao

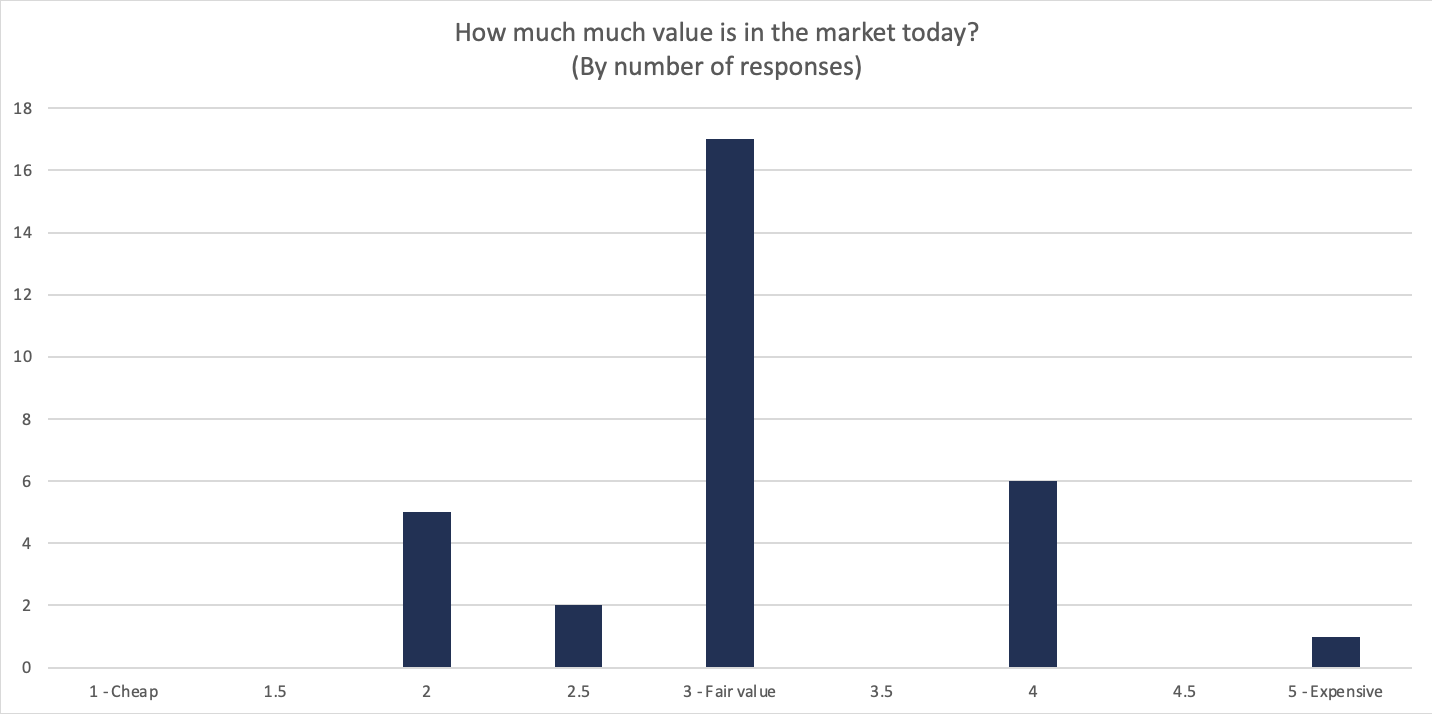

A gauge of the market

Given the sell-off and subsequent rebound that we have witnessed in markets of late, we decided it would be worthwhile asking the fund managers that participated in this series to provide a gauge of how much value they are currently seeing in the market.

For this question, we asked them to rate the ASX from 1 to 5, where 1 was cheap and 5 was expensive (and thus, 3 would be fair value).

Surprisingly, early on in the month, the majority of fund managers selected 2, with a few 3's scattered in there as well. By the end of the month, the majority selected 3 or 4, with one 5 entering the mix. There were no 1's. Do with that what you will.

Across the 30 fund managers and their 33 articles published in this series, 15.15% said the market was a 2, while 6% said the market was currently sitting at around 2.5.

Meanwhile, 51.51% said the market was currently fair value, and more than 18% said it was currently sitting at a 4 (pretty expensive). The only person who said the market was currently sitting at a 5 was Sean Fenton of Sage Capital. Why? Well, he said he was not seeing a lot of value in markets at all. But that doesn't mean the market is exactly expensive.

"Prices are reasonable compared to where earnings are, but we're just faced with an outlook that we haven't seen in a long time in terms of inflation getting out of control," he said.

"We haven't seen aggressive central banks really since the late 80s. It's been a long time. They're prepared to sacrifice growth for inflation, so we see some big downside sensitivity in terms of risk of recession and big earnings falls...

"In the background there, you've got this massive energy shock rolling around the world, which is most acute in Europe, but increasingly so in the US and other markets, which is going to feed those inflationary pressures and gives some real dilemmas to central banks. It's a high-risk environment and we see much more risk to the downside."

So Fenton's pretty bearish right now, and for good reason. But that doesn't mean you cannot uncover value in this environment. You just have to start hunting.

Missed our August 2022 Reporting Season coverage? Check it out here:

The Livewire Team worked with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

3 topics

35 stocks mentioned

23 contributors mentioned