Oil ETFs, Contango and negative oil prices

.jpg)

Betashares

You will probably have seen in the news yesterday morning (21st April 2020), that U.S. oil futures prices were negative. This is based off the May WTI Crude futures contract, which settled on 21st April in the U.S.

Due to the extreme supply glut and lack of demand for oil from a global shut down, the cost of storing oil is currently astronomical. Traders have been desperately trying to offload contracts before settlement to avoid taking physical delivery, which has caused negative oil futures prices for the first time in history.

We’ve had many investors ask what this means for our Crude Oil ETF (ASX: OOO) which aims to track and index which provides exposure to WTI futures. OOO’s index finished rolling into the June contract on 13th April, so will not be holding negatively priced May contracts. The June contract is currently trading at USD 20.72 (21st April, 08:39 AEST). Of course, the performance of the ETF will be impacted by the prevailing price of the June contract (e.g. it was trading at highs closer to USD 24 on 20th April). An equally important component of the performance of any Oil ETF which aims to track futures prices, though, is the impact of contango, which I provide more detail on below. It’s critical information for anyone interested in investing in or those who have already invested in Oil ETFs. I’ll use our OOO fund as the example, but the concept of contango and its impact on performance should apply to any futures based Oil ETF.

OOO provides exposure to front-month WTI Crude oil futures, and is therefore subject to the shape of the futures curve and the associated “roll-cost”. WTI futures contracts expire on the third business day prior to the 25th of the month and therefore need to be rolled to maintain exposure. OOO’s Index gradually rolls the current contract over a five day period commencing on the fifth business day of the month.

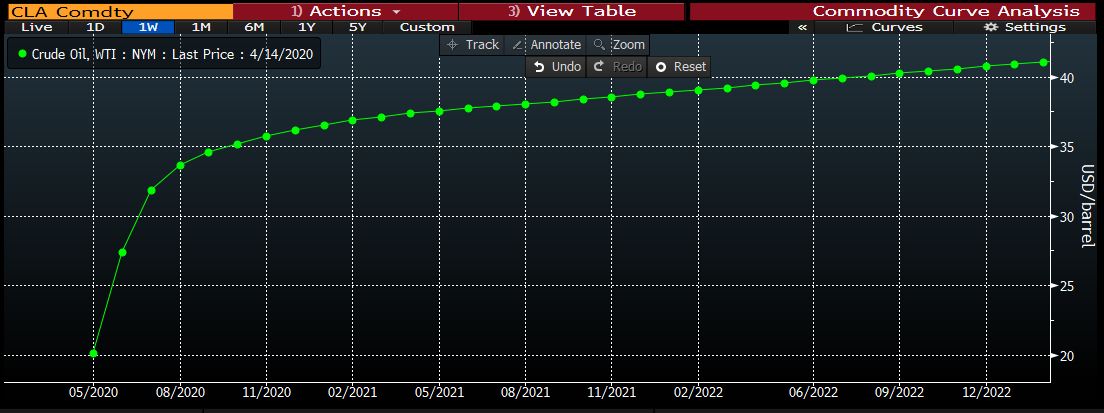

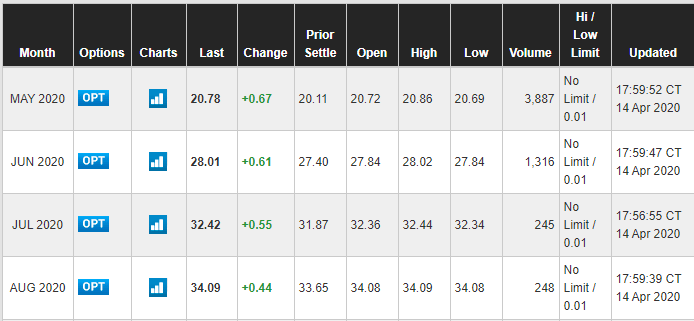

We are currently witnessing extreme conditions, with demand and supply-side shocks. As you can see in the chart and table below, the futures curve is currently very steep at the front end and this has shifted dramatically over the last few weeks (it was still in backwardation in January, however was as high as 27% per month in the days following the S&P GSCI Crude Oil Index rebalance ending 13th April).

Source: Bloomberg. Data as at 14th April 2020.

Source: CME. Data as at 15th April 2020. https://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude.html

The premium of next month’s futures contracts will decay towards spot price as time moves towards expiry date. This is an unavoidable component of commodity futures. At the time of the screenshot above, the June contract is trading at USD 28.01. If the spot price of WTI stayed stable at the price at that time of ~USD 20.78, the June futures contract would have to erode 26% from then until expiry on 19th May 2020. This erosion would be represented by a fall in NAV by any oil ETFs which aim to track these contracts.

It is also important to note the increasing importance of this issue as prices drift lower. Even if in absolute dollar terms the premium remains the same, as a percentage (slope of the futures curve) this will increase the % roll cost for a front month futures program. The materiality of this number should not be underestimated.

That said, while last week’s OPEC+ cuts may have been insufficient to offset the current glut in oil caused by the demand impact of the COVID-19 pandemic, Energy remains a sector that’s critically important to any eventual recovery in global growth.

In a world where the risk of a return to the levels of production growth from U.S. shale producers of recent years appears to be mitigated by limitations on the access to capital and the potential for widespread bankruptcies, global energy markets could once again be the domain of energy’s Supermajors.

For investors looking to play a view on oil and the cyclical recovery, an alternative may be a Global Energy Companies ETF we have trading on the ASX under the code, FUEL (which provides exposure to the 50 largest energy companies globally ex-Australia). We believe a number of tailwinds are likely to emerge for the major energy companies. And, what’s more, these companies historically have a high correlation to the price of oil, with FUEL’s Index demonstrating a ~84% correlation of monthly returns with the Brent Crude Oil USD/bbl. since inception.

As at 22nd April 08:30 AEST, The June contract is now trading at USD 13.35.

3 topics

2 stocks mentioned

1 contributor mentioned

.jpg)

Alistair is responsible for supporting Institutional and Intermediary Broker channels. Prior to joining BetaShares, he was based in London, working at European ETF provider Lyxor Asset Management.

.jpg)