One big flaw in the super cap plan

Earlier this week, Jim Chalmers announced a new Government policy set to double the concessional tax rate, from 15% to 30%, for superannuation balances over $3 million.

The move would begin in the 25/26 financial year.

Given this change was not flagged before the 2022 election, it is somewhat comforting that it’s only scheduled to take effect after the next election (despite being passed into law in the current term).

This will give voters the chance to have their say. And it will no doubt give the Liberal election spin doctors some very strong ammunition.

So, is it good policy?

We’ll leave that to the political commentators and the voters to decide at the next election.

There does, however, seem to be one major flaw.

The Plato Investment Management team were surprised the Treasurer indicated this cap will not be indexed over time. We got some affirmation on this view at a Pinnacle Investment Management event this week where we ran a poll – 84% of the 137 financial advisers and wholesale investors who responded in Sydney and Melbourne agreed the cap should be indexed.

Why is this a problem?

Currently, the move is expected to impact 80,000 people, or just 0.5% of super accounts with balances of over $3 million (in today’s money).

However, lately, you might have heard about inflation.

It is currently running at 7.8% and will erode the real value of the $3 million cap over time, meaning that a lot more than 0.5% of superannuation balances will eventually be taxed at 30%.

We would like to see forecasts of how many people will be impacted by this change in the future. How many people in the superannuation system today will be impacted by this cap at some time in their superannuation journey?

For instance, if inflation ran at 4% per annum for the next 30 years (remember inflation is currently 7.8%), a $3 million cap would be equivalent to just $925,000 in today’s dollars. And what happens when the currently indexed $1.7m pension phase cap exceeds the unindexed $3 million cap? Will retirees be taxed at 30%, or 0%?

Franking credits remain critical for retirees

Other than the indexation issue, we think it is a much better policy than Labor’s proposed change to franking credit refunds they took to the 2019 election, which we wrote about extensively.

Our analysis highlighted that a ban on franking credit refunds would have impacted many ordinary retirees. Targeting very large superannuation balances is, we believe, a much better, fairer and politically pragmatic approach.

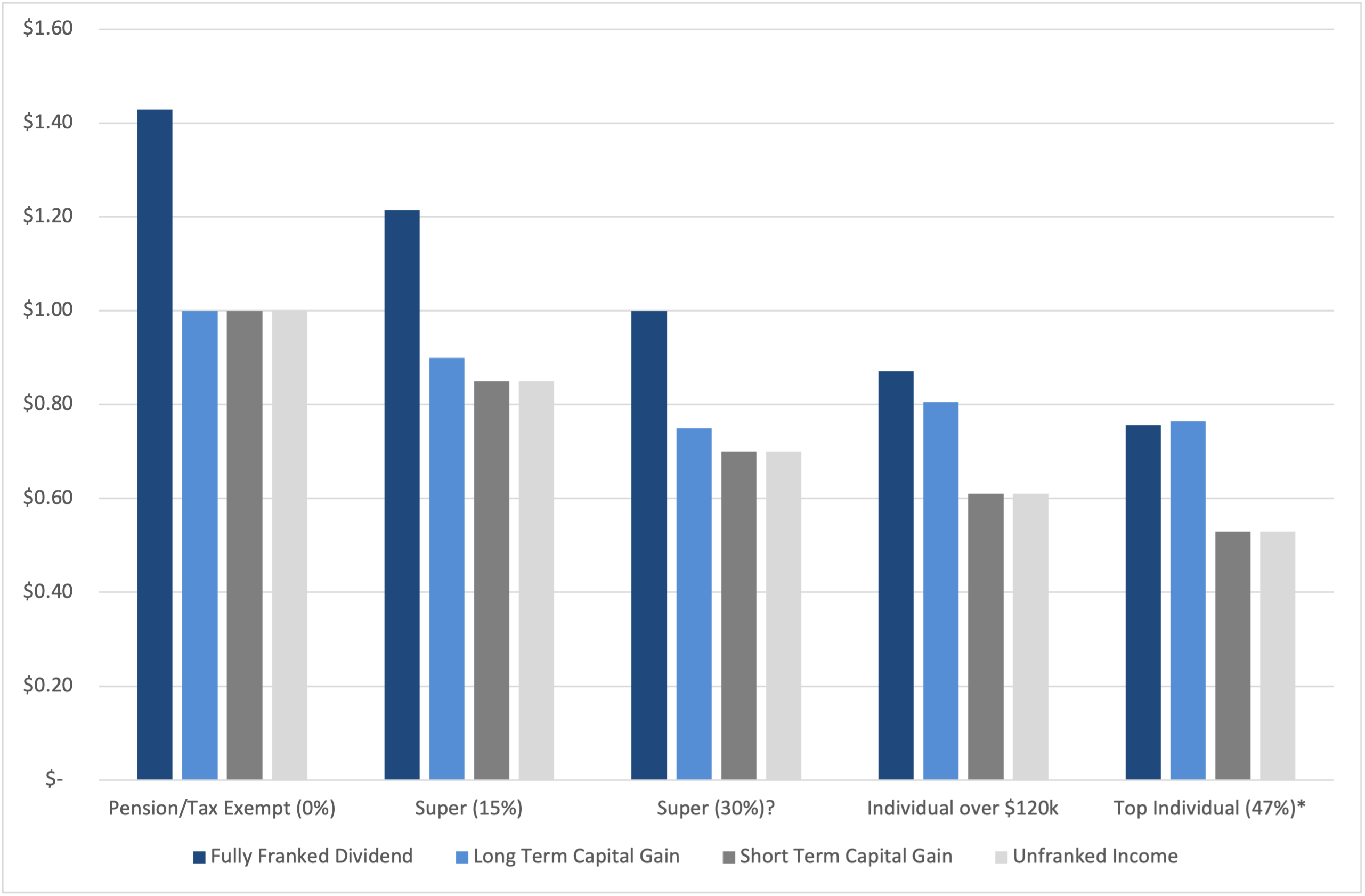

Below we show a chart of what the value of $1 of pre-tax earnings is worth on an after-tax basis for various tax rates, depending on whether those earnings come in the form of a fully-franked dividend, a long-term capital gain, a short-term capital gain and unfranked income.

For superannuation balances over $3 million, you can observe the after-tax value of $1 of fully-franked dividends falls from $1.21 to $1 as the tax rate increases from 15% to 30%.

Similarly, the after-tax value of long-term capital gains falls from $0.90 to $0.75 (a 15% flat tax is imposed on superannuation balance increases with no discount), and the value of both short-term capital gains and unfranked income falls from $0.85 to $0.70.

This implies that fully franked dividends are still the most tax-effective method of generating earnings for this segment of the market.

After-tax value of $1 of pre-tax earnings

It also highlights that superannuation tax rates will still be generally lower than effective tax rates for the top two tax rates for individuals. Super is still likely to be tax-effective, just not quite as tax effective for those with balances over $3 million.

One caveat is that capital gains – short, long and unrealised – will all be taxed at 15%. This means that the tax on long-term capital gains will be 25%, which is a slightly higher rate than the current long-term capital gains tax rate for the highest-taxed individuals (23.5%).

We also think there might be some flaws for balances that flip-flop around the $3 million mark, but hopefully, industry consultation can fix that issue.

This aside, we do truly believe that the great flaw in this policy is that the Treasurer is not looking to index the cap. It’s an enormous oversight.

Inflation will mean that many, many more individuals will be hit by this cap in the future if it is not indexed to inflation.

The other big question for the majority of retirees is - what other changes is this Government likely to make next?

Plato Investment Management specialises in maximising equity income for retirees and other zero-tax investors

Discover more about the Plato Income Maximiser (ASX: PL8) LIC and the Plato Australian Shares Income Fund.

1 topic