One of Australia’s best performing long duration strategies

As government bond yields have leapt off their near-zero per cent lower bounds, and cash rates approach their terminal levels, which could precipitate recessions, Coolabah has argued since June 2022 that investors should consider averaging into fixed-rate bond exposures, or adding “duration”.

Readers might recall that Coolabah had been previously very negative on interest rate duration risks in late 2021, forecasting dramatic increases in both cash rates and 10-year government bond yields due to persistent inflation problems, which played out over 2022. This contributed to fixed-rate bonds having their worst year on record over the 12 months to 30 June 2022.

The regime shift higher in government bond yields now affords an opportune time for investors to re-allocate back into fixed-rate bonds, or take-on interest rate duration exposures, which are likely to perform exceptionally well in a downturn. And today investors can both use duration as an equities and disinflation hedge while also picking-up attractive yield.

Coolabah’s daily liquidity Active Composite Bond Fund (Hedge Fund) (CXA: FIXD) has been one of the best performing long duration strategies since its launch following a global search by a super fund back in 2017. This search was undertaken by the international asset consulting firm BFinance, and involved a review of over 150 fund managers.

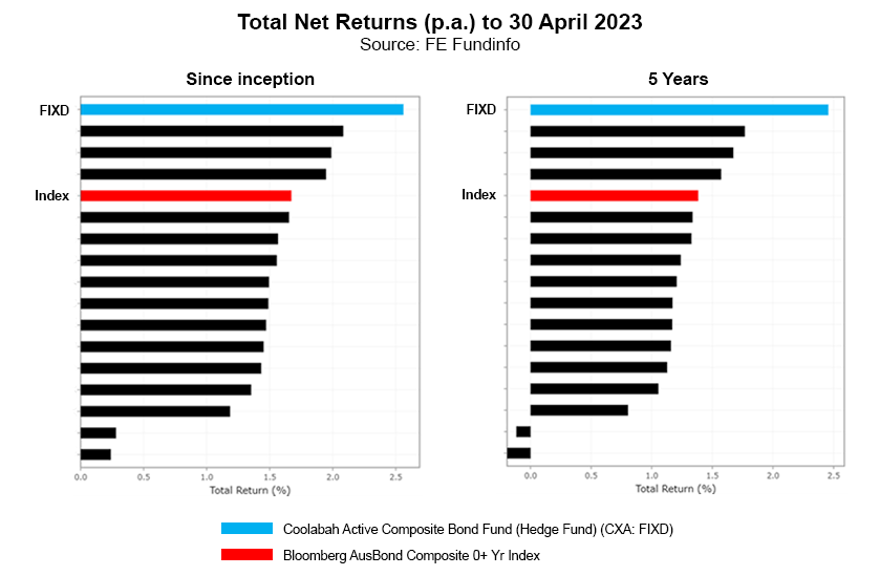

Since its February 2017 inception, FIXD has beaten both the AusBond Composite Bond Index benchmark and peers net of retail fees by a significant margin with consistently superior risk-adjusted returns. FIXD is also currently offering a robust running yield of 6.1% pa after retail fees. The chart below shows FIXD’s returns not of fees compared to its benchmark (red bar) and peers (black bars).

One important feature of FIXD is that it fixes its interest rate duration exposure to always equal that of the Composite Bond Index, which is currently around 5.4 years. Coolabah’s 38 person team, including more than 10 traders/portfolio managers and 12 analysts, then adds-value through its highly active individual asset-selection process, which has involved more than $96 billion of bond and credit trades executed since 1 January 2022.

This means that FIXD does not vary its duration relative to the index, which has been historically a large source of manager underperformance through incorrect interest rate bets. Coolabah believes that investors are better placed to determine how much duration they want in their portfolios, which FIXD provides with confidence. Coolabah then adds-value to that core duration exposure through its active asset-selection style.

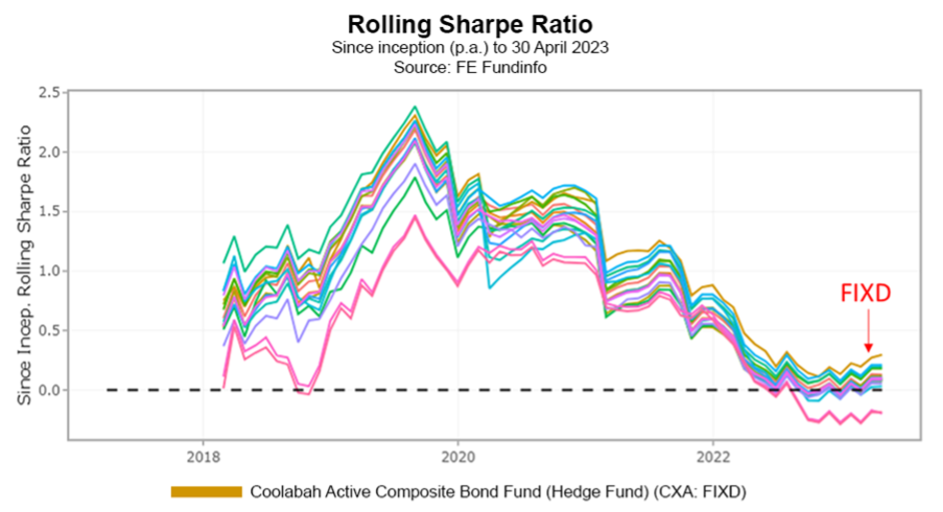

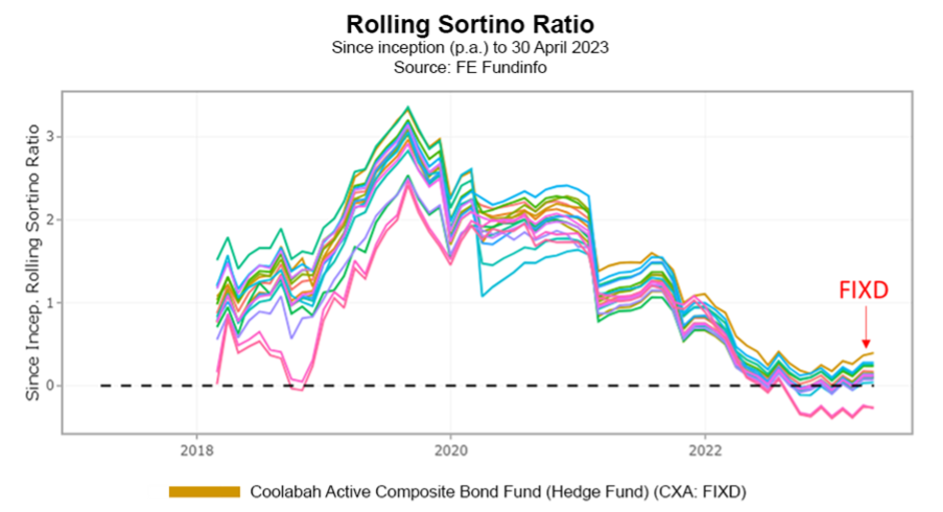

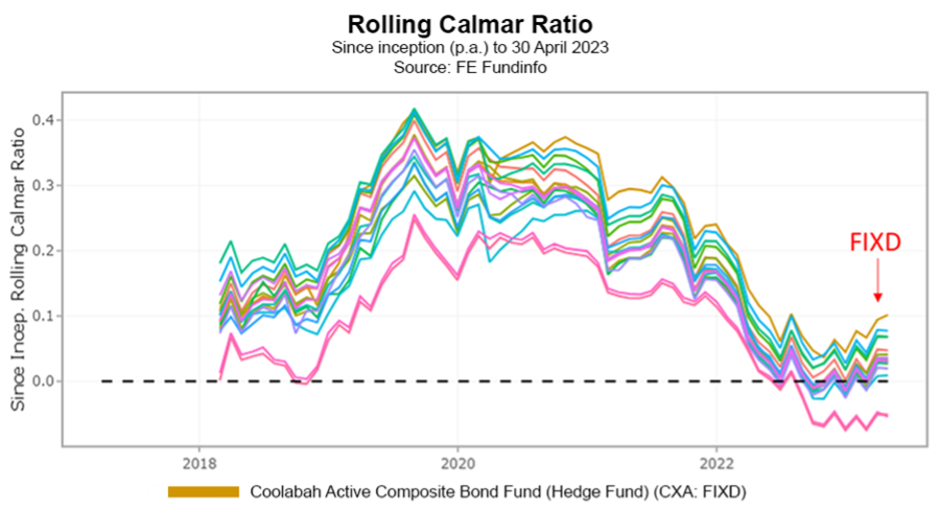

Excess returns are one thing. Investors should also consider risk-adjusted returns. The first chart below shows FIXD’s Sharpe Ratio versus the index and peers. This takes excess returns above the cash rate and divides them by the fund’s volatility. Higher Sharpe Ratios are better. The second chart shows a similar Sortino Ratio, which takes the excess return above the cash rate and divides by a fund’s downside volatility. Again, higher is better. Finally, the Calmar Ratio takes a fund’s excess return above cash and divides by a fund’s worst loss. And higher is better. This analysis shows that FIXD has delivered consistently superior risk-adjusted returns on all three measures.

FIXD targets returns in excess of 1% to 2% annually above the Bloomberg AusBond Composite 0+ Yr Index, after management costs, over rolling 12 month periods and provides exposure to a portfolio of cash securities and investment grade government, bank and corporate bonds with an average target credit rating of A. It cannot invest in hybrids, equities, property, unrated securities, high yield bonds or sub-prime loans.

FIXD can be accessed on the Securities Exchange through your online share trading platform, stockbroker or financial adviser with the ticker FIXD, or directly with Coolabah’s Fund Administrator, under the APIR Code ETL2716AU through our website.

To read more about FIXD, please click here.

*As of 22 May 2023.

3 topics