One way to catch post-COVID upside

Retailers of out-of-home goods and services will be the sector winners in the next 12 to 24 months, says Firetrail’s consumer analyst Tom Kierath.

The COVID-induced sales spike in household-linked retail since March saw share prices rebound rapidly for many companies in the sector, says Kierath in part four of the Firetrail Analyst Series.

But investors expecting similar trends to continue may be sorely disappointed, as government stimulus and other measures unwind in the months ahead.

Harvey Norman (ASX: HVN) is a prominent example, recording profit growth of around 180% in the first couple of months of FY21. Its share price has already recovered from the 44% decline during the worst of the sell-off, now trading 10% above the pre-pandemic level.

But Kierath expects pent-up consumer demand will see companies hit hardest by lockdowns and travel bans to benefit significantly in the coming months. In the following video, the Firetrail analyst reveals his top consumer play and discusses further effects of this anticipated reversal of fortunes.

Read the Q&A

This video interview covers what has been happening recently in the consumer space – whether Aussies are saving or spending in this current market environment, and who the winners and losers are going to be. Tom, thanks for joining us today.

Thanks – and hasn't it been a fascinating last six months in the consumer environment? It felt like in March that it was the end of the world for the retail sector. And now obviously a lot of these retailers have bounced back really quickly.

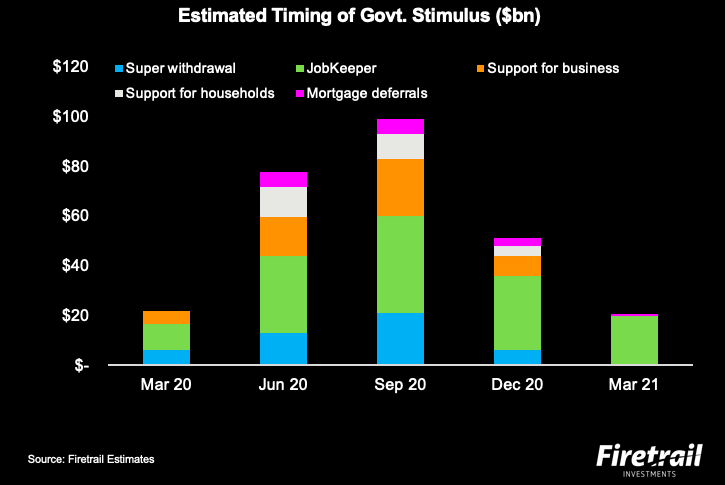

One of the things that we've appreciated and which we analyse pretty closely is the amount of stimulus that's in the system at the moment. Consumption in Australia is at about $1 trillion, and $330 billion goes into retail, while stimulus has been over $250 billion.

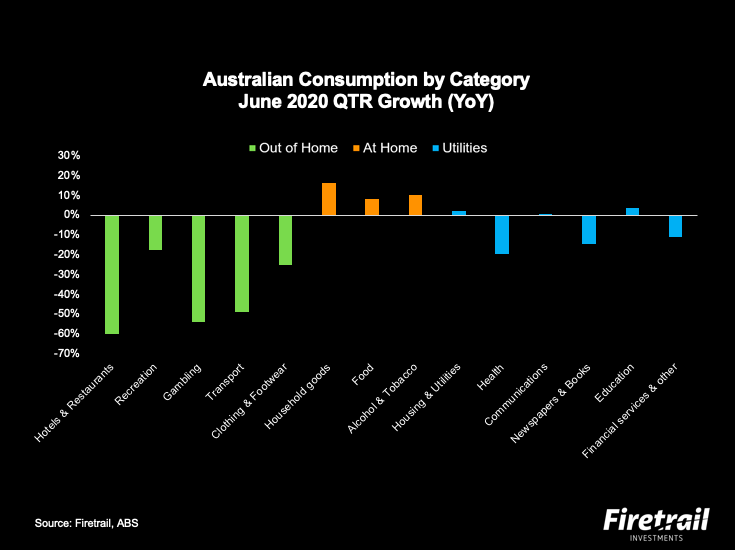

And as you can see in the chart below, the spending changes have happened in different places. Out of home restaurants, recreation, gambling, as you can see there, the green bars, is down significantly. But spending on categories at home is well up…almost 20%. And so you've had this huge dichotomy of growth in the June quarter. And we think that'll continue for a little while and then begin to normalise.

Australians are obviously spending in certain areas, but are they tending to spend or save in this current environment?

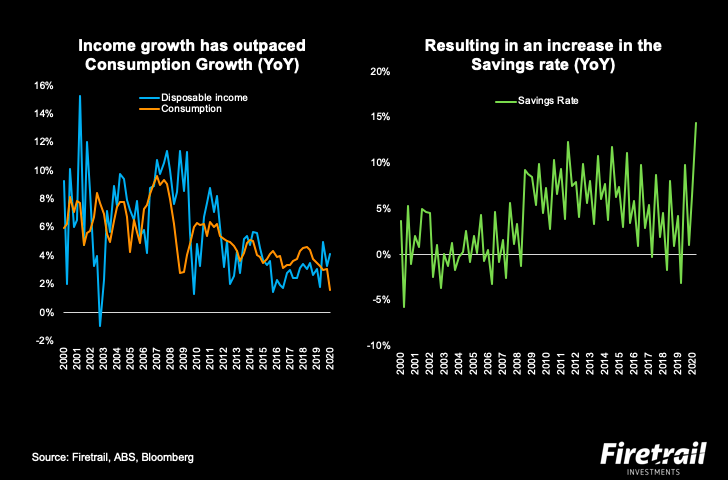

Consumption growth is actually down 12% in the June quarter, which is a bit confounding because income growth is actually up. And the reason that income growth was up was because of the stimulus, obviously.

So, the savings rate has spiked as you can see in the chart below it’s up almost 15%. This means that yes, consumers are saving a decent portion of these stimulus payments. They’re obviously spending some, but the level of stimulus will obviously contract over the coming quarters.

Who have been the winners and losers so far?

Anyone that's in a category linked to the home – so household goods, hardware, consumer electronics – have done well. And just this week, Harvey Norman's come out and said their profits for the first couple of months were up 180% in July and August. And so, so they've been the real beneficiaries in terms of categories

But on the flip side, categories like travel, restaurants, et cetera, have really been decimated, frankly. So, there've been some losers through all of this, and we think that will begin to normalise over the next six to 12 months.

Government stimulus has been a key factor driving some of those retail sales. What do you expect moving forward in terms of government stimulus and the impact on the consumer?

We've analysed how much stimulus is going in and the timing of this on a quarterly basis. We can see here from this chart that the level of stimulus will reduce significantly over the coming quarters.

We think the peak stimulus month, if you will, was in July, when consumers withdrew a lot of money from super and a lot of households received a $750 payment from the government. And so that exacerbated some of the trends that we're already seeing. So as a result, as that stimulus winds down, we think it becomes a lot more challenging for the retail environment going forward.

Who do you expect the winners and losers to be over the next 12 to 24 months?

One category that we think will do really well will be travel, especially domestic travel. So, as state borders are opened up – and we're just starting to see that now – we think there's big pent up demand there for people to get out and see the country and to get out of this lockdown. We don't know exactly when the borders will open domestically, but that looks like it's starting to happen.

Qantas is a position in the Firetrail Australian High Conviction fund. And we think that there's big pent up demand. Obviously international travel will take a little longer, but again, there'll be pent up demand there.

When we look at the consumer environment, we see some categories like that, which are really challenged at the moment. We think that'll improve significantly over the coming 12 months, but then there'll be other categories where you've seen this influx of sales, and that will obviously come out. So, consumers will start reallocating away from their homes toward out of home spend.

Qantas is, I guess, our consumer play. Among the other consumer names, we kind of struggled to see much value because most of the share prices are running now above where they were before coronavirus. And we think that as sales growth trends slow, share prices will follow that trend.

FOLLOW us to get first access to these reports

We hope you enjoyed this wire. If you'd like to receive our other exclusive reports first, hit FOLLOW below. For our previous insights, click here.

3 topics

2 stocks mentioned