Opportunity knocks as the herd gathers momentum

Yarra Capital Management

Government bonds offer a compelling opportunity for income investors as the world adapts to once-in-a-generation economic challenges and central banks struggle to respond.

Not too many years ago, it was considered impossible for interest rates to fall below zero. That hasn't yet happened in Australia, but in some countries, the rules have had to be rewritten. Right now investors are obsessing over the implications of higher rates, yet very few are contemplating the other side of this trade.

A clear key risk is that after 10 years of failure central bankers succeed in meeting their inflation targets. But that is far from guaranteed.

In this wire, I explain why the uncomfortable idea of lower rates is presenting investors with an interesting opportunity.

Everyday low risks

Government bonds are debt securities that are issued by governments and sold to investors to fund budget shortfalls and support policy initiatives.

Australian government bonds are risk-free, as the government guarantees repayment of principal and interest in local currency. They can also offer yields above cash, and are highly liquid.

A contrarian investment opportunity

Financial markets are currently obsessed with inflation and the potential for higher interest rates.

The more controversial idea, however, is whether cash rates in Australia could go negative.

This may seem odd, given central bankers say they want to taper quantitative easing (adding to the money supply) and lift cash rates in 2024.

The market’s unwillingness to grapple with the idea of lower rates could make this a more interesting investment idea.

For investors relying on income, it is also a greater risk than rising rates.

How negative can be positive

Why would interest rates go negative? The simplest answer is to stimulate the economy.

When a central bank stops cutting interest rates at 0%, this creates a floor to bond yields and the potential to reduce borrowing costs becomes limited.

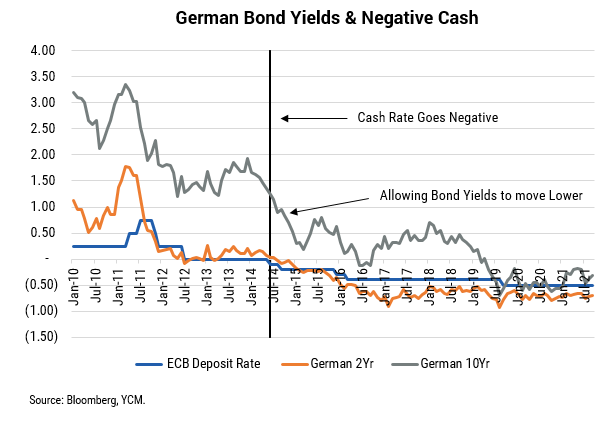

The chart below shows an example of breaking the 0% floor in German 2- and 10-year yields. From 2011 to 2014, two-year yields traded around 0% and never moved much lower.

However, once the negative cash rate policy took effect, the two-year yield moved through zero and eventually dragged 10-year yields along for the ride.

Europe shows the way

While negative rates make it harder for savers and bond investors to earn respectable returns, the European Central Bank has found economic outcomes improve.

The bank states that had it not used negative rates, quantitative easing and forward guidance, "growth and annual inflation would have been 1.1 percentage points and 0.75 percentage points lower respectively ... and the unemployment rate 1.1 percentage points higher than they actually were".

That could be tempting for Australia's Reserve Bank, which has missed its inflation target for the past five years.

Reserve Bank holds out

The RBA, however, has so far refused to contemplate negative rates. One factor in its thinking is that the housing market would be affected if mortgage rates fall further.

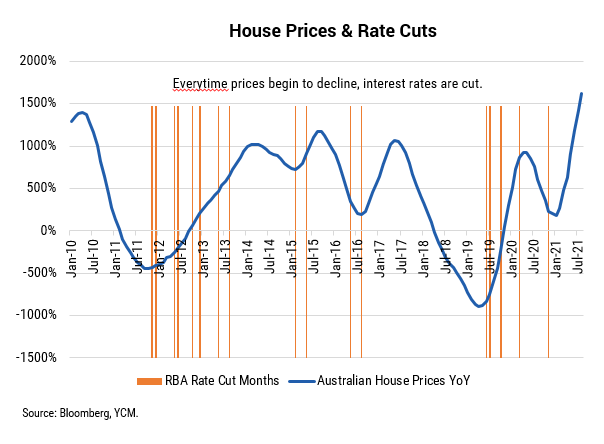

Even though house prices are rising at a great rate, the past 10 years has shown the RBA is extremely reluctant to let them fall.

The below chart confirms that every time house prices fall, interest rates are cut.

Next time might be different but the chart shows that once housing loses its momentum, it becomes increasingly hard for the RBA to hit its targets.

The past 10 years tells us that the market will forecast rate hikes when house prices rise, only to be disappointed when price momentum begins to fade.

Hence, we are focused on the question: are lower cash rates any less likely than higher rates?

Why is nobody talking about falling rates?

We don't expect the cash rate to go negative. Housing is extremely strong and likely to remain so as we expect the RBA to leave the cash rate at 0% for a number of years.

However, the past 10 years shows us that falling rates are just as possible as higher rates.

Given the high degree of uncertainty, the difficulties governments have had kick-starting economies, and the huge deficits that need to be financed, perhaps that should be the most likely outcome.

We are keeping a close watch on house prices, rising unemployment, stagnant inflation and high debt levels.

A case for long-term thinking

If the cash rate goes negative, the clear winner is fixed-rate bonds – the longer the maturity the better.

We can again look to Germany given Europe has been the most aggressive with negative interest rates.

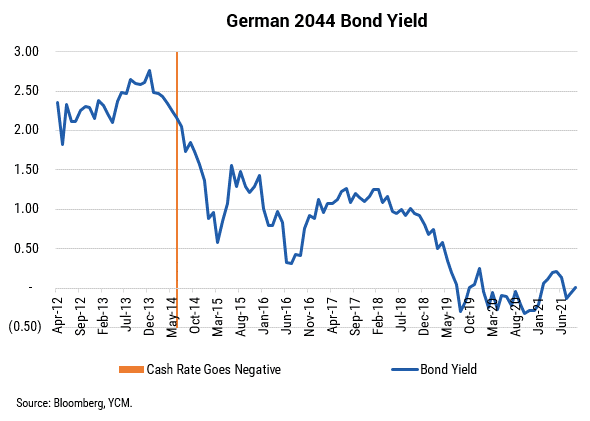

In 2012 the German Government issued a 2044 maturity bond paying a 2.5% coupon. The chart below shows its yield as the cash rate went negative.

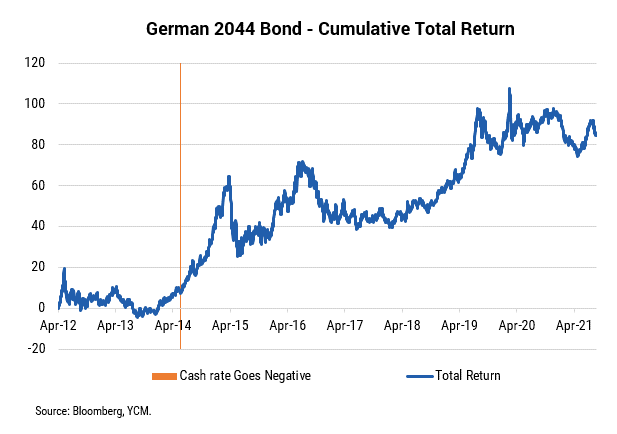

The change might look benign – it has only fallen about 2% – but the total returns tell a different story.

When rates moved negative in 2014, the bond rallied 50% before pulling back.

If there is a risk of rates going negative, investors want to lock in as much positive yield as they can.

The loser in this instance would be shorter-dated bonds, and even more so cash.

As the above chart shows, the benefit of owning those long-dated bonds before the cash rate goes negative is that, as an investor, you can lock in positive yield until maturity (2044 in this case).

Investors in cash, however, are instantly repriced to a negative yield.

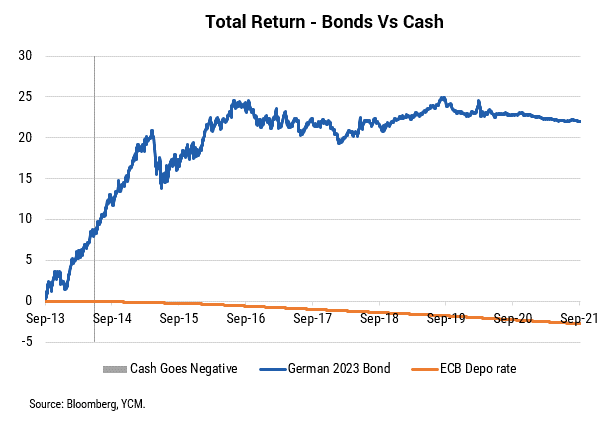

This can be seen in the chart below, where investing in the European Central Bank cash rate is compared to a 10 year German bond in 2013 (ie, only six months before cash goes negative).

This tradeoff of sitting in cash and waiting for higher rates that may never come is a significantly lower income over time.

If the cash rate drops, it is extremely difficult to find alternative sources of yield in rate markets.

Just because yields are low does not always mean it’s a no-brainer to go to cash and wait.

What we're up to

We don't expect to see negative interest rates in Australia but the chances of a rate rise or cut are far more finely balanced than the market thinks.

We believe long-dated government bonds are still attractive, offering protection if the cash rate falls and providing much better yields than cash if it remains at 0%.

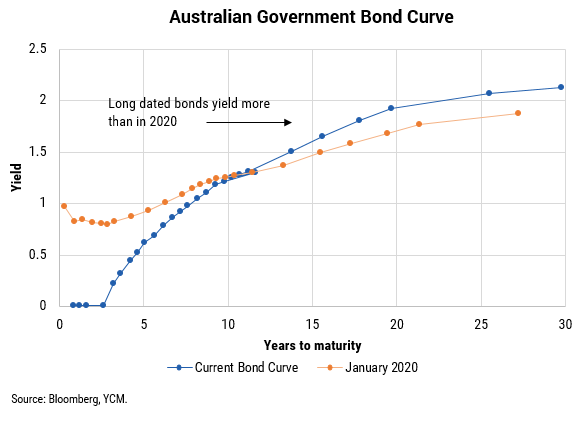

As the chart below shows, long-dated government bonds offer higher yields than in January 2020, when the cash rate was 0.75% and COVID was only just beginning to gather headlines.

In fixed income, this is what is referred to as a “steep curve”. The steepness is a reference to how much additional yield you receive for owning long-dated bonds.

Because of this steepness and our benign cash-rate views, we favour being overweight 20+ year government bonds and high-grade bonds in the 7 to 12-year maturities.

The biggest risk is that after 10 years of trying to stimulate the economy, central banks meet their inflation targets.

If Australian inflation were to average 3% or more in the next few years, the RBA would have to hike rates and the market would not be kind to bond yields or prices. We have not covered that in detail here, as the market has been keenly focused on it for the past six months.

In fixed income, there is no easy way of mitigating these risks. Any hedging requires exact timing to ensure costs don’t exceed the benefit.

The typical way to avoid the impacts of higher rates is to hold shorter-dated bonds or buy inflation-linked securities but this has not been a good strategy over the past decade.

Investing with Yarra Capital Management

The award winning Yarra Australian Bond Fund invests in a diversified portfolio of investment grade Australian fixed income assets that aims to deliver an active return for a competitive fee. For further information, visit our website

5 topics

1 fund mentioned

Chris is responsible for portfolio management, including portfolio construction and trading for various Australian fixed income portfolios including the Nikko AM Australian Bond Fund at Yarra Capital Management (Nikko AM was acquired by Yarra...

Expertise

Chris is responsible for portfolio management, including portfolio construction and trading for various Australian fixed income portfolios including the Nikko AM Australian Bond Fund at Yarra Capital Management (Nikko AM was acquired by Yarra...