Our 3 top picks in the booming education sector

Australia's education sector remains in structural growth mode after many years of solid growth. We see 3 key drivers of long term above GDP growth in the sector:

- Growth in government spending. Increased investment in education generates positive externalities yielding both private and social returns, including better employment prospects, higher wages (and taxes) and a stronger economy. Research suggests that countries that spend more on education as a proportion of GDP, experience faster economic growth in subsequent periods.

- Growth in private sector spending. As societies become wealthier, there is an increasing willingness for families to invest more in the educational outcomes and future of their children.

- Investment in education technology. the education sector has thus far resisted much of the technological transformation that has disrupted and improved so many other sectors. As a result, there is a real opportunity for technology to play catch up and secure meaningful returns on investment.

While these tailwinds are supportive of a growing sector, some companies within the sector are better placed to benefit than others. We believe our portfolio has exposure to 3 such high-quality businesses, each operating in different parts of the sector. These companies all have strong balance sheets (all net cash), a good track record of profitability and excellent growth outlooks. They are each led by a stable, experienced executive team, with very high levels of insider ownership, and we are confident these management teams will continue to deliver strong growth...

|

|

1. UCW Limited is a fast-growing private education provider, with a focus on health and community Services (childcare, counselling, and disability services) fields of education, where there is alignment with a strong demand for graduate recruitment from employers. |

UCW’s strategy is to deliver courses across the student lifecycle: Vocational, Higher Education and Professional Education, offering services to a mix of domestic (FY19: 1/3rds) and international students (FY19 2/3rds).

Board and Management own nearly half of the company, which provides strong alignment with shareholder interests. The CEO, Adam Davis, has significant industry experience, previously being the founder and CEO of ASX-listed Tribeca Learning. Tribeca was subsequently taken over by global education provider Kaplan.

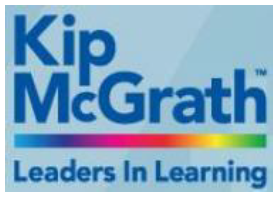

A recent presentation by market heavyweight Navitas highlighted the growth in the international student market. The good news is that Australia is capturing more share than other countries.

UCW has delivered exceptionally strong organic growth - 28% in FY18, and 30% 3-year CAGR in international student enrolments. In FY19, we expect a further 83% increase in revenue (23% organic, 60% from Ikon, a higher education provider acquired on 4 July 2018). UCW has a national presence with campuses in Sydney, Melbourne, Perth, Adelaide and Brisbane. It continues to add adjacent courses and expand capacity to drive growth, which has masked the profitability of the existing courses. Notwithstanding this investment in growth, we estimate UCW is trading well below market multiples.

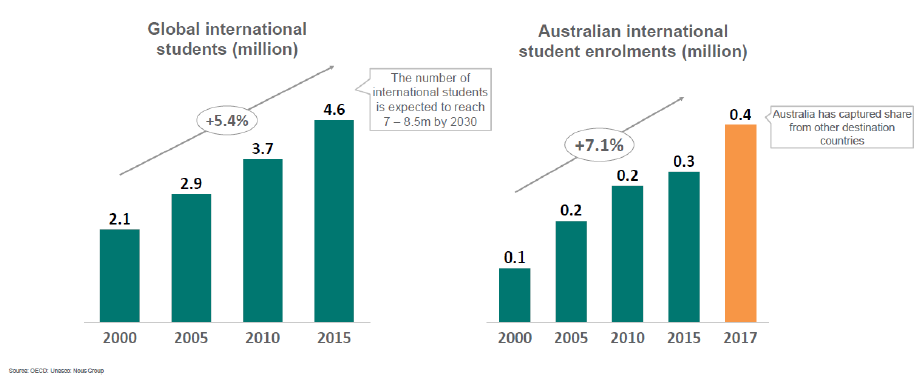

We believe that UCW is following the play book of RedHill Education (ASX:RDH). Glenn Edith, CEO of RDH, has done a fantastic job building a business through organic means via course and geographic expansion. Historically, RDH’s profitability has been dented by the upfront expense of setting up new courses and locations. Having the foresight to look through these upfront expenses and invest early has paid dividends as the RDH share price has quadrupled in the last couple of years. We think that UCW is lagging RDH by 3-4 years (revenue wise), but the market will be faster to appreciate the potential than it was with RDH. UCW’s Management believe that $20m revenue is the inflection point at which point the business will have sufficient scale to absorb incremental growth investments – we forecast FY19 revenue for UCW of $22m.

UCW also owns a 25% interest in Gradability Pty Limited – Australia’s largest graduate employability specialist. Gradablity has two core offerings: 1) Professional Year programs for international accounting and IT students that are looking to have their qualifications recognized in Australia 2) arranging internships and work experience programs for domestic and international students through their network of ~6,000 employees. Gradability is a substantial, highly profitable business that will turnover ~$50m this year. At some point, there is potential for UCW to acquire the balance of Gradability – this would result in a fast growing $70m p.a. revenue business (FY19 estimate) delivering 10% EBITDA margins. On our assumptions, we believe that the merged business would be trading at a material discount to the market and that of UCW’s closest peer RDH.

In summary, UCW continues to generate strong organic revenue growth (+20%) as it approaches $20m revenue - which Management believe is the inflection point for margin expansion. UCW also has a logical potential acquisition which would be transformational in terms of scale and profitability. We note that there was strong insider buying in the recent rights issue (directors contributed $1.8m of the $4m raised), which we also participated in. As a well-managed business with exposure across the whole tertiary student lifecycle, we believe UCW represents a compelling under-the-radar exposure in the education sector.

|

|

2. Kip McGrath Education Centres (ASX:KME) is a tutoring company for primary and secondary school age children. It operates under a franchise model with over 500 centres worldwide. The key geographies are Australia, NZ and the UK. Typically, as franchisor, KME will take 20%-30% of the tuition fees generated in return for providing the franchisee with educational materials, back office support, and marketing. |

KME had a near death experience almost ten years ago, following an ill-fated acquisition. However, under the stewardship of Storm McGrath (son of founder Kip) the company has refocused on its core operations, changed its revenue mode, paid down debt, and is now in a net cash position.

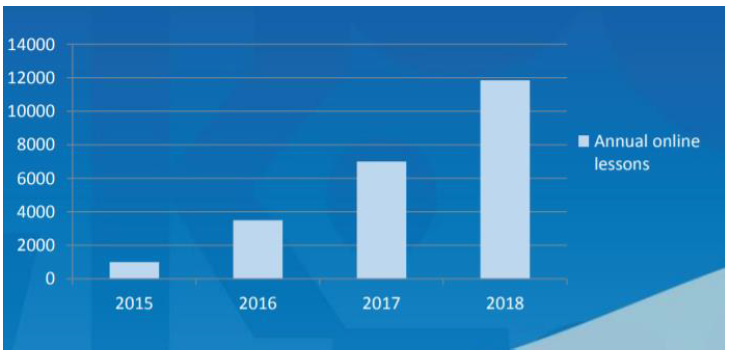

More recently, the company has been developing an on-line model designed for students. Students are taught via a webcam with real teachers. While still modest in the number of lessons, growth is strong and this opens up new territories and provides flexibility for parents.

KME had a very strong FY18 result with EPS increasing from 3.2c to 4.5c. Tuition growth was 10% in FY18 driven by a successful national advertising campaign. This profit growth is expected to continue in FY19 and together with the buyback of master franchises which reduces KME’s cost of sales, the company is set to produce strong FY19 profit numbers. We estimate EPS growth of ~20% in FY19.

With a strong balance sheet and proven IP and systems, KME is very well positioned to continue to take market share as the leading national player in what is very much a cottage industry.

|

|

3. Janison Education is an innovative Australian company, with a 20 year track record, which is getting some exciting traction in the fast growing education technology space (estimated to grow at 17% p.a. to $252bn by 2020). |

Janison is focused on two areas:

1) Online learning solutions for workplaces - Janison integrates platform and content to provide online training courses to improve performance and compliance for large companies and government departments, and

2) Digital assessment solutions for high volume online tests and exams.

The online learning business has been in operation for over 20 years, and is a highly profitable (gross margins of 58%) mature business which underpins the valuation of the company. In recent years, the cash generated by the online learning business has been used to fund the development of Janison’s online assessment business, with great success. In FY18, this assessment business grew its platform (recurring) revenue by 92%.

The operational highlight for FY18 was the successful completion of the NAPLAN Online project which saw the year 3,5,7 and 9 primary school NAPLAN tests transition from ‘pen and paper’ to online with the Janison assessment platform assessing 670,000 students over a nine-day period in May. The feedback from the federal government was very encouraging in relation to this important milestone. The Federal Education Minister commented “the NAPLAN Online testing was hailed a success with 99.9 per cent of students able to complete the assessment without technical problems”.

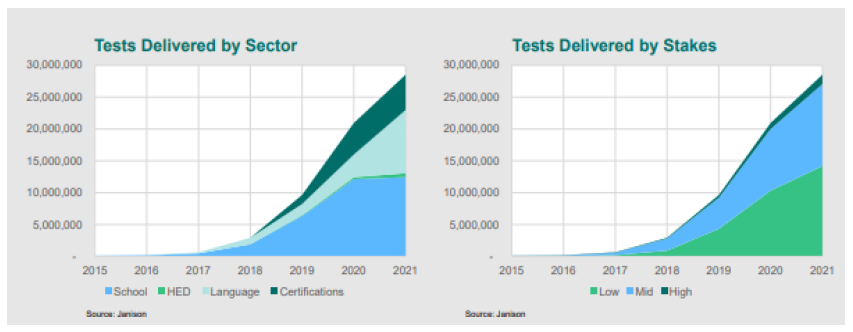

Janison noted that a number of Governments around the world had been watching the NAPLAN Online project. Given the project’s success, Janison believes it is well placed to provide this service to other Government and tertiary bodies globally (particularly in Asia where the company has strong relationships) for similar national online tests. The charts below illustrate the exponential growth potential of online testing (Janison receives revenue based on the number of tests delivered on its platform).

The quality of the Janison product offerings is evidenced by the calibre of the leading national and international corporates, higher education institutions and government agencies that have long standing relationships with Janison: British Council, Education Services Australia, NSW Department of Education, UNSW Global, Roads & Maritime Services NSW, Rio Tinto, Westpac, Commonwealth Bank and Sydney Water.

We are pleased to have supported the recapitalisation (back door listing) of Janison late last year. We have participated again in its recent capital raising to accelerate its growth in higher education and to capture some emerging opportunities in Asia. With some powerful world class IP, a first mover advantage in what is a significant emerging global opportunity, a roll call of current high profile Tier 1 customers, the potential for exponential revenue growth (target of $150m by 2025), and a profitable existing platform to leverage, we believe that Janison offers great “bang for your buck” given its ~$50m enterprise valuation.

3 stocks mentioned