Our top picks in the mining services space

Surging commodity prices and a deep infrastructure pipeline support a positive medium-term outlook for contractors, a sector which has broadly lagged the market recovery. Here, we share our preferred businesses – we favour players with strong management teams, scaled business with ability to take market share as the cycle strengthens.

Better than expected vaccine news has driven a strong response from global equity markets, setting a clearer path towards a potential broad-based macroeconomic recovery scenario. Commodity prices have rallied accordingly, particularly copper – a bellwether for global growth – which is up 12 per cent over the past month to five-year highs on anticipated improving fundamentals.

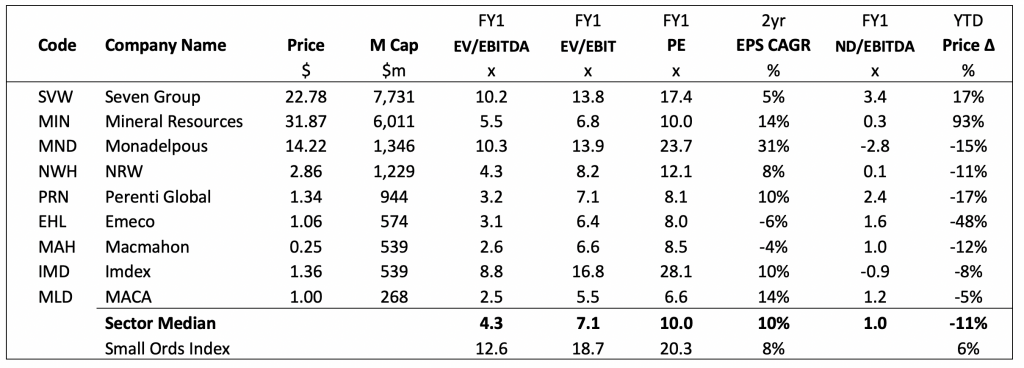

Leveraged to this thematic, we still see value in a select group of mining services companies which are effectively derivatives of underlying mining activity. Despite mining activity remaining relatively robust throughout the pandemic, the mining services sector has generally lagged the broader equity market over the past year (down 11 per cent Vs Small Ordinaries up 6 per cent) and continues to trade at a meaningful discount to the market (7x FY1 EV/EBIT Vs Small Ordinaries on 19x).

Our current sector holdings (largely unchanged) are Seven Group (ASX:SVW), Mineral Resources (ASX:MIN), NRW Holdings (ASX:NWH) and IMDEX (ASX:IMD). As previously discussed, when investing in the mining services sector, we strategically take a portfolio approach to manage the inherent risks, preferring the larger, more diversified players with high calibre management teams and strong execution track records. This approach attempts to reduce downside risks associated with specific projects or individual clients whilst also providing leverage to mining cycle activity. We also favour businesses which have improved their competitive positioning within the sector, enabling market share gains as the cycle strengthens. Key points below.

Seven Group Holdings (ASX:SVW) ($8 billion market cap)

Seven Group is a high-quality small cap play on resources and infrastructure expenditure with optionality from its investments in east coast gas (Beach Energy, ASX:BPT) and building materials (Boral, ASX:BLD). The primary operating businesses are clear leaders in their respective markets and we rate management who are closely aligned and have created material value for shareholders over time. At the November AGM, SVW provided a solid trading update and FY21 outlook. WesTrac continues to trade strongly (October year to date revenue up 11 per cent) with FY21 EBIT guidance for high single digit growth. The medium-term outlook for the Caterpillar dealer is underpinned by a strong pipeline of sustaining tonne iron ore projects in the Pilbara, WA, and an expanding car parc of equipment which needs to be maintained. Coates has been impacted by COVID-19 shutdowns (event cancellations), construction softness and delays to the east coast infrastructure pipeline (October year to date revenue down 7 per cent). The second half is expected to rebound on accelerating shovel-ready projects, coupled with tight cost control supporting FY21 EBIT guidance for low single digit growth. Governments are focused on fast-tracking the infrastructure pipeline to stimulate the economy which bodes well for SVW’s industrial operations.

Mineral Resources (ASX:MIN) ($6 billion market cap)

Mineral Resources is a highly entrepreneurial company with strong growth potential from its iron ore and lithium operations and a proven track record of value creation (more than 20 per cent return on invested capital (ROIC) since listing). The hybrid model comprises a leading contract crushing and processing business (world’s largest crushing contractor) driven by domestic mining production volumes, an expanding WA iron ore mining footprint (now Australia’s fifth largest Fe producer) and hard rock lithium interests (top 5 global lithium miner with joint ownership in the largest hard rock lithium deposit) which offer significant longer-term upside potential. Iron ore prices have surged thanks to strong demand from Chinese steel mills and tight supply out of Australia and Brazil. MIN plans to grow its iron ore business significantly over the next three to five years, targeting production expansion from c.20 million tonnes per annum to 90 million tonnes per annum via a multi-stage hub strategy. After a tough few years, the outlook for lithium also appears to be improving on the back of favourable ‘green’ stimulus support in Europe and a potentially more climate friendly regime in the US. We view battery materials as an attractive long-term theme (green energy, decarbonisation) and MIN is particularly well positioned to benefit from a market recovery.

NRW Holdings (ASX:NWH) ($1.2 billion market cap)

NRW Holdings is a first-class contractor when it comes to project execution and risk management and provides investors with a diversified exposure to domestic mining production and development activity (largely iron ore, coal and gold), as well as infrastructure spend. Management have successfully broadened the company’s operations from remote Western Australian mining civil works into a truly national player of scale across four key pillars – contract mining ($1 billion turnover), civil construction for resources and public infrastructure projects ($800 million turnover), drill and blast ($170 million turnover) and a fast growing mining technologies segment (c.$500 million turnover including Primero). This expansion has been delivered through a combination of strong organic growth and astute acquisitions. Last year’s $300 million BGC Contracting deal delivered a step-change to the Group’s scale and infrastructure delivery capabilities, particularly in larger public works. We also like the look of the potential Primero Group (ASX:PGX) takeover (c.$100 million value) which fits within NWH’s strategic push into mining technologies (effectively building a mini-Monadelpous, ASX:MND). NWH’s medium-term pipeline of opportunities is significant and we expect the company to win more than its fair share of work based on strengthened capabilities and a weaker competitor backdrop.

IMDEX (ASX:IMD) ($500 million market cap)

IMDEX is a leading global mining technology company specialising in subsurface instruments designed to improve drilling productivity and mineral extraction. Product demand is strongly leveraged to exploration expenditure levels, mainly in gold, copper and iron ore (more than 80 per cent of revenues). Although global exploration was adversely impacted by COVID-19 government restrictions, activity has been recovering across most major regions as restrictions ease and mining companies implement changes to rosters and operating practices (confirmed at the October AGM). Client feedback points towards a positive medium-term industry outlook, supported by strong underlying fundamentals – commodity prices are high, grades are generally declining and there has been a distinct lack of major discoveries worldwide. Exploration budgets are also benefiting from high commodity prices and buoyant equity markets – producers are generating strong cashflows and there has been a wave of junior capital raisings recently. As an innovator within the sector, IMD is also well placed to benefit from accelerating structural demand for technologies supporting remote working, such as its IMDEXHUB-IQ cloud platform and software. Another key attraction to the company is its robust pipeline of new products – the commercialisation timeline has been delayed by the pandemic, pushed out by around a year. However the ultimate opportunity remains substantial and undiminished.

Mining services peer comparison

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

4 stocks mentioned