"Out and about" rally is just getting started

An economic cycle shift from “hope to growth” bolsters the appeal of quality cyclical stocks during the more rapid post-COVID recovery into 2021, say SG Hiscock portfolio managers.

Comparing the economic effect of the pandemic with previous downturns, particularly the global financial crisis, there are some clear distinctions. Both the market descent and the rebound have been far sharper in 2020. Back in 2008, it took 18 months for equity markets to bottom-out. But the pandemic effect “was fast, it basically happened in 22 days,” says Hamish Tadgell, SG Hiscock Australian equity portfolio manager.

He also notes the average correction has historically taken 18 months in more traditional structural declines such as the GFC. “This time around the price decline wasn’t quite as much as it might be on average, but it all happened in less than a month,” Tadgell says.

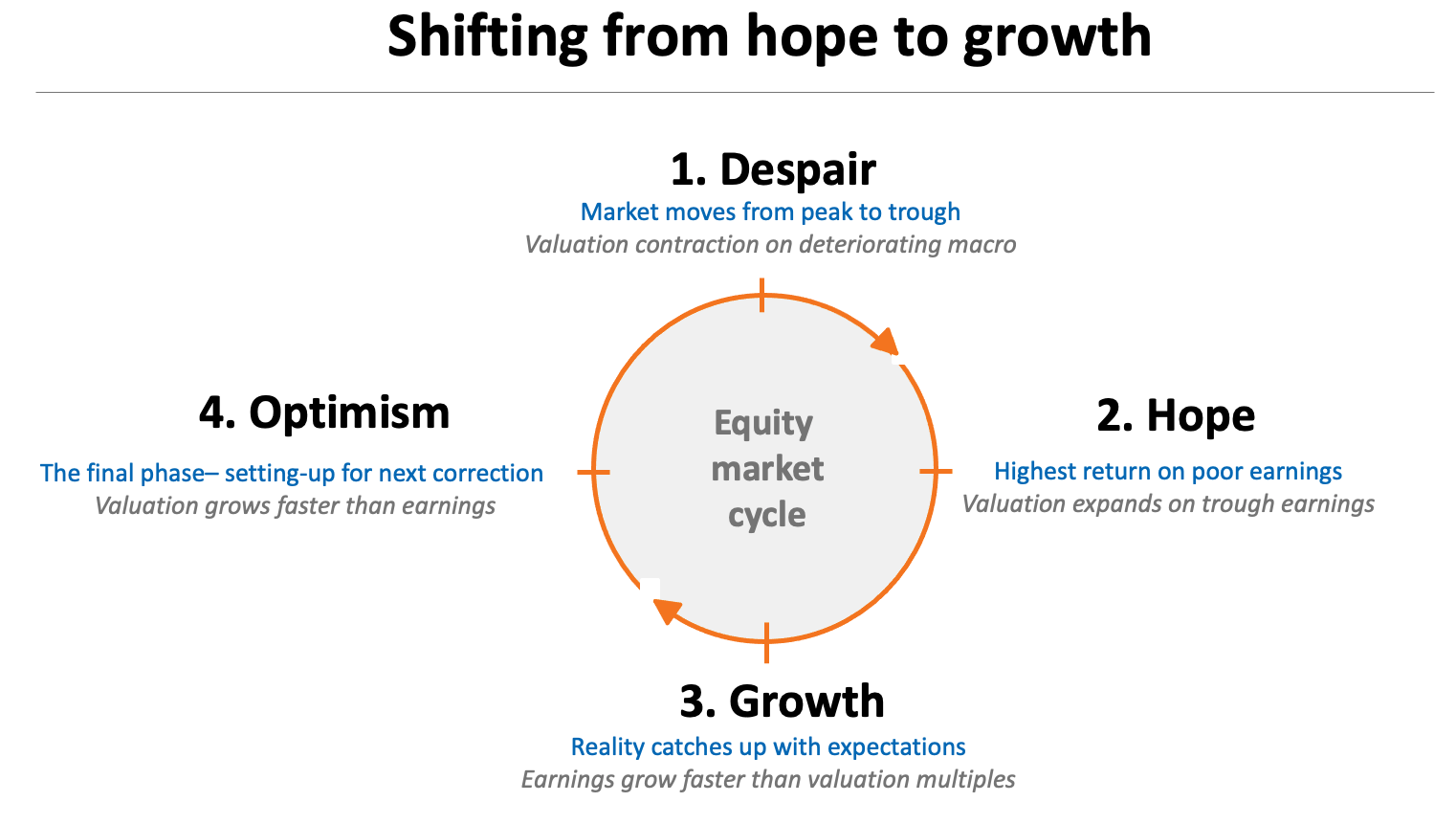

The period between when the market touched its nadir in March to the end of September is dubbed the “hope phase”. “We saw earnings start to turn positive in October, and we’ve seen one of the strongest bear market recoveries in history,” says Tadgell.

On average, this hope phase typically lasts around nine months, but through COVID it’s been just under six months. Tadgell concedes questions remain over where markets will go from here – amid consensus global expectations of about 34% increases in 2021, coming off a very depressed level. “What’s important to note is that in this chart (see below), it’s pretty consistent with what we’ve seen in previous rebounds.”

Source: Datastream, Goldman Sachs

One of the core distinctions between the COVID crash and others is that household cashflow actually rose during the recession, thanks to the effect of government stimulus measures including early release of superannuation, JobKeeper and others. This period of “coordinated fiscal expansion” contrasts sharply with the tightening of fiscal policy during the GFC.

“This is a big distinction which I think has set the market up for continued earnings recovery,” Tadgell says.

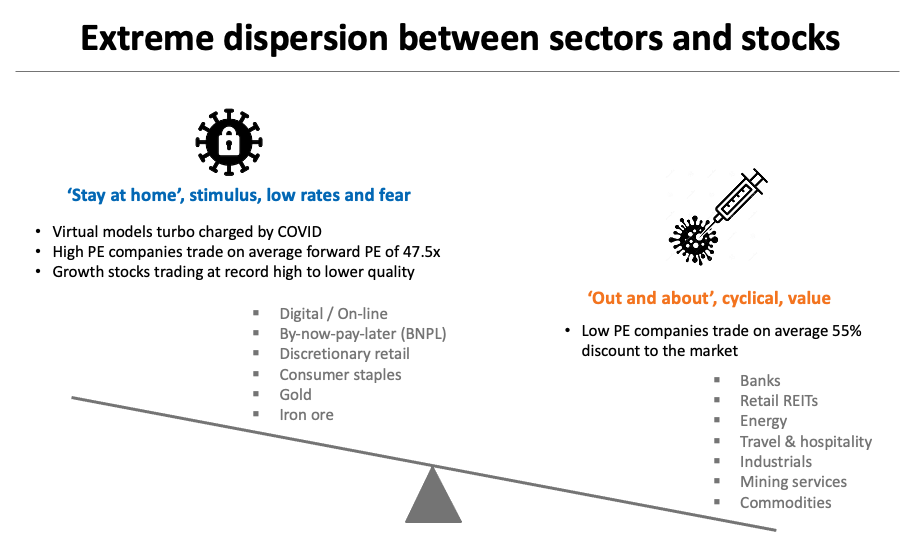

In this environment, SG Hiscock’s Australian equities exposure has shifted more in favour of quality cyclicals – having moved about 8% of its allocation from structural compounders. Two primary sectors that were belted during the worst of the downturn – energy and financials – are among the fund manager’s top picks into 2021.

In the energy space, Australia’s largest oil and gas company Woodside Petroleum (ASX: WPL) and smaller player Cooper Energy (ASX: COE) are two stocks the manager has increased allocations.

And in banks – a sector in which the portfolio has historically been underweight – it now holds its highest weighting to financials in close to a decade. “That’s a function of our view that if the economy continues to look better – and banks are leveraged to GDP growth, and if unemployment continues to look better than expected – then bank provisioning should be lower,” says Tadgell.

Listed property – particularly retail and office REITs – was also hit hard by the lockdowns introduced to slow the spread of the pandemic. But with consumer confidence now at its highest level in seven years “with balance sheets looking good, we’re coming into Christmas and with the whole of Australia upwardly mobile,” says Grant Berry, SG Hiscock’s portfolio manager of AREITs.

“The vaccine has been a wake-up call for the market, and it’s just getting started,” he says, urging investors to back the recovery rather than persisting with companies that benefited in the depths of the pandemic.

“We think it’s a great time to go shopping for REITs,” says Berry.

His portfolio is currently overweight the retail sector – which though only in the early stages, is showing promising signs of recovery. A couple of stocks he singles out here are Vicinity Centres (ASX: VCX) and Mirvac (ASX: MGR).

He is more cautious on the office space, on the back of falling supply cycle demand and the effect of ongoing work-from-home arrangements among some of the largest employers, particularly in national central business districts.

Berry is also less enthusiastic about logistics, “which was the flavour of the month, but the value proposition just isn’t compelling.”

Not already a Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a like.

3 topics

4 stocks mentioned

1 contributor mentioned