Over to you, Martin Place: Inflation cracks 5% in Australia

It's finally happened. For the first time since the Global Financial Crisis, we have a year-on-year inflation print in Australia of over five percent.

Yes - you read that right - 5%.

Coming into this print, the Refinitiv consensus forecast was for prices to have risen by 1.7 percent over the first three months and 4.6% since this time last year. It all comes as more and more analysts shift their first rate hike calls to May or June, depending on how much they think the RBA will cave in to the political pressures of an election cycle.

And wasn't it just a few months ago some people were holding on for dear life to an "unlikely before 2024" timeline?

Breaking the headline down

Let's get some basics down – inflation is a big word, as is the number of subcomponents that makes up the one figure everyone hangs their life, wallets, and credibility on. The first thing to note is that inflation will mean very different things to different people.

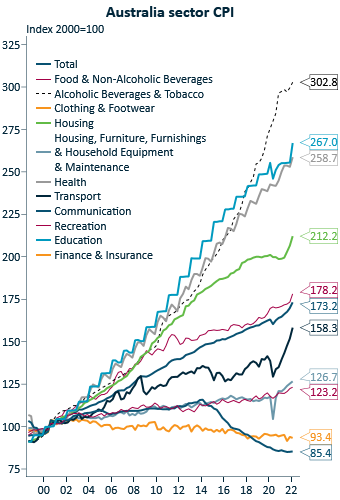

First, take a look at this chart showing the long term effects of factors on to price increases.

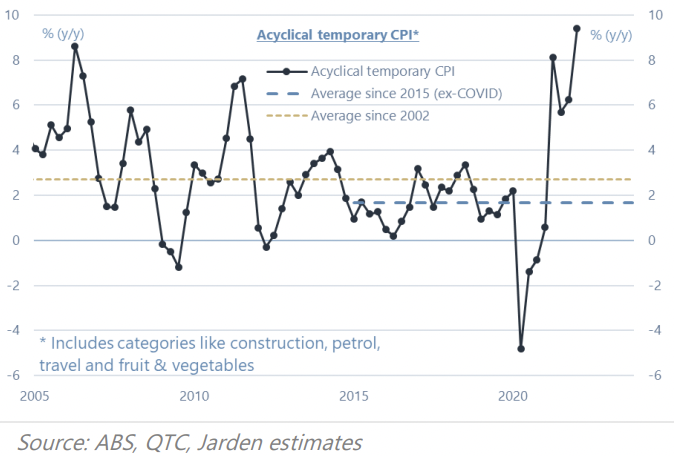

Headline inflation increased to 5.1% in the March quarter. According to the ABS, this was mostly due to higher dwelling construction costs and automotive fuel prices.

Trimmed mean inflation - the metric to which the Reserve Bank pays the most attention has increased to 3.7%. That's the highest since March 2009.

Price increases this quarter alone are up more than 2%, thanks to soaring fresh food prices. Vegetable and fruit prices are all impacted by supply chain difficulties, high fertiliser costs, and the floods in New South Wales and Queensland. The volatile "automotive fuel" print (also known as petrol) recorded its highest quarter-on-quarter increase since the Kuwait invasion in 1990.

So did today's print finally leave the RBA with no choice but a post-election rate hike? Today's number gave economists at the NAB, JP Morgan and ANZ cause to initiate May rate hike calls of 15 basis points. Here are the opinions of three more leading macro minds - including some changed calls of their own.

Carlos Cacho, Jarden Group

Overall this release puts pressure on the RBA and makes a very strong case for a rate hike next month, despite being just 3 weeks out from the election.

(Note: Jarden believes the Reserve Bank should hike the cash rate target by 40 basis points at its May meeting next week.)

Matthew Bunny, St George

Our central expectation is for the RBA to kick off hiking the cash rate from June. Earlier in April, the central bank stated there would be important information “over the coming months” on inflation and labour costs.

We expect this reflects that the RBA wants to see today’s CPI numbers and the wage price index report on May 18.

Following today’s print, market pricing for the first rate hike was brought forward to May. A cash rate hike is just around the corner. It is possible the RBA board could decide they cannot afford to wait until June.

Diana Mousina, AMP Capital

We now see the RBA hiking interest rates in May, by 40 basis points, which would take the cash rate to 0.50% before another 25 basis point hike in June, with the cash rate ending the year at 1.5%. This is still less aggressive than market pricing.

While share markets usually respond negatively to an interest rate hiking cycle, it may not be as negative this time around because the market pricing is already quite aggressive.

Nevertheless, we still expect that as the RBA hikes interest rates and the housing market turns down, there will be some downside impact on the share market, although we still expect positive share returns over the next 6-12 months.

A final word

One last word should be to give credit where credit is due. The team at Nomura is famously hawkish for their Federal Reserve and Reserve Bank calls in particular. Andrew Ticehurst, senior economist and rates strategist at Nomura in Sydney, has been forecasting a June RBA liftoff since late January. That trade may finally come to fruition next Tuesday.

Andrew still maintains his June call, along with back to back hikes through to December. However, he does admit the risk of a 50bp move at some point, has, however, risen.

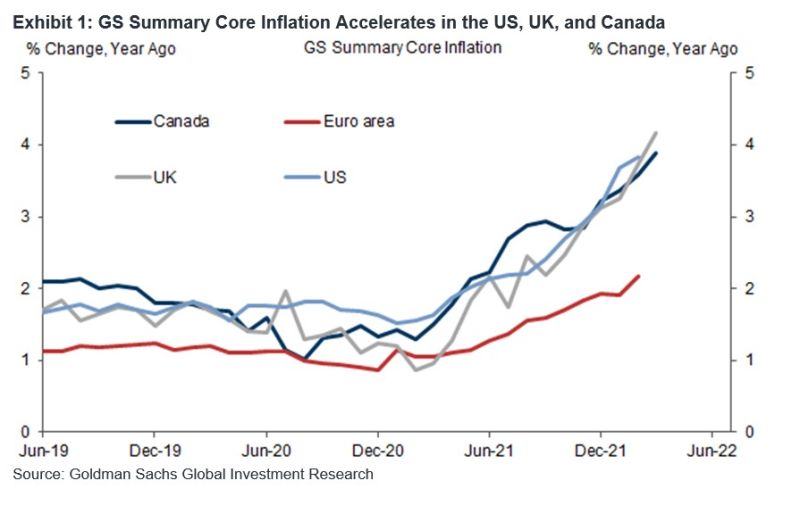

One other chart to discuss as well - this one from Goldman Sachs:

Is Australia's inflation problem finally one in line with the rest of the world? This chart from Goldman Sachs suggests core measures of inflation will remain elevated and place pressure on central banks. While inflation has been incredibly hot across most of the rest of the G10 (if not in consumer prices, then in producer prices), that phenomenon seems to have finally hit Australia in a rude way.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best macro strategists, economists, and fund managers. If you have questions or topics you'd like us to cover, flick us an email: content@livewiremarkets.com. We'd love to hear from you!

3 topics