Oxygen masks required? Alan Joyce's final pay revealed

Qantas' (ASX: QAN) 2023 annual report dropped this afternoon with the details of Alan Joyce's final pay. Or at least it would have done so, only the Qantas Board has finally read the room and delayed delivery of the FY23 short term incentive (STI) award.

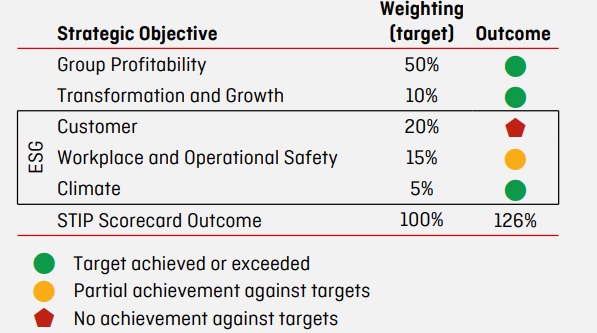

So, notwithstanding the achievement of the underlying profit before tax (UPBT) target and some other measures in the STI scorecard, the Board has exercised its discretion to tweak what the formula would have otherwise delivered. How? By reducing customer to zero, applying a 20% downwards adjustment to the rest of the award, and delaying its delivery pending the Board 'learning more' about the latest ACCC proceedings against Qantas.

What does this mean for Alan Joyce?

He did well from the FY21-23 long term incentive plan (LTIP). Those awards vested in full as Qantas ranked in the top quartile for TSR against two separate peer groups, ranking 1st of the 17 airlines in the global airline peer group, and 17th in the ASX100 peer group.

But, as I explained in this wire, performance rights are a zero exercise price option and always have value. Well, as the Annual Report notes:

"The value of the shares awarded under this plan increased from $3.78 to $6.20 over the three-year performance period."

But that's not all.

"The LTIP awards made to Executives under the 2021-2023 plan were at a higher level than in a normal year due to a one-off pay remix, approved by shareholders at the 2020 Annual General Meeting (AGM), which reduced the weighting to annual incentives and increased the weighting to long term incentives to strengthen alignment with the shareholder experience during execution of the Recovery program."

So now all the shares have vested, while these 2021-2023 LTIP shares are now subject to a further one-year restriction until August 2024 before they are unrestricted, it means a good outcome.

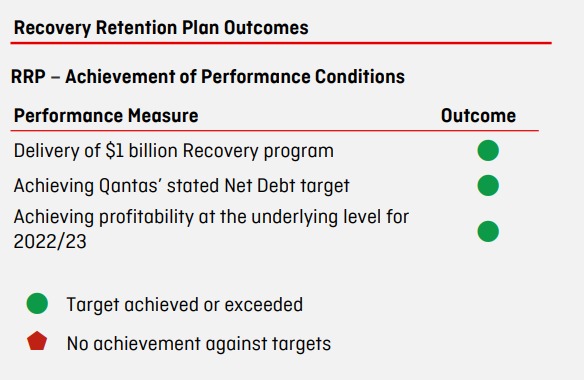

The recovery retention plan

We all love a recovery. For Joyce, that scheme has been generous, with the Board deciding all targets had been satisfied and 100% of the rights vesting and converting into shares.

The final figure - sort of

According to the Annual Report,

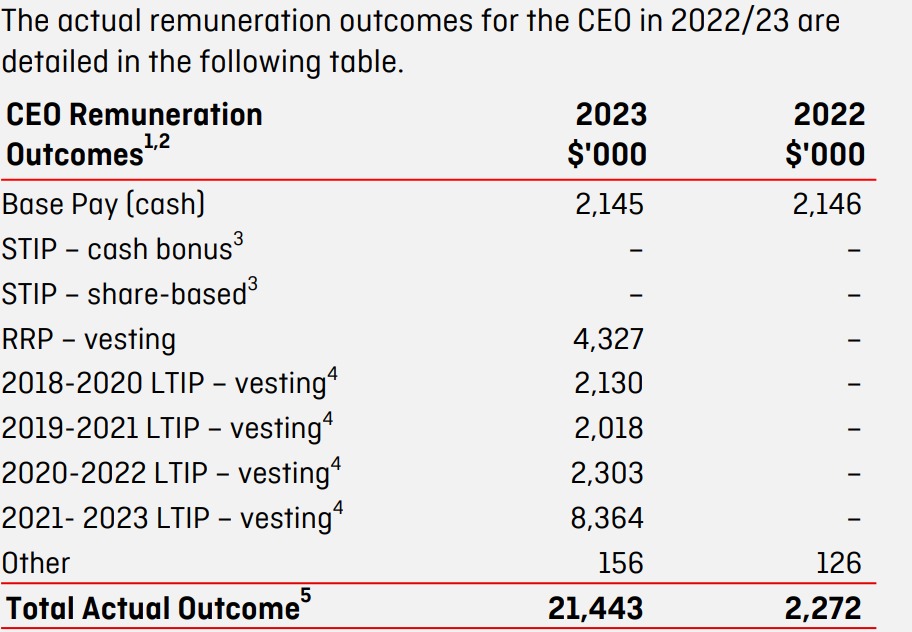

"The CEO’s total pay outcome for 2022/23 was $21.4 million. The 2022/23 STIP is not included due to the treatment described above in the STIP Board discretion item. The 2022/23 STIP and the 2021-2023 LTIP remains subject to Board discretion and clawback, should the Board determine this to be necessary. The full extent of the CEO’s remuneration subject to clawback and/or malus is up to $14.4m as set out in the body of the report.

LTIP shares vesting in prior years (LTIP schemes for 2018-2020, 2019-2021 and 2020-2022) contributed $6.45 million to the $21.4 million, with the report noting "the CEO elected in August 2023 to convert these Rights to shares."

Here's how Qantas arrived at the $21.4 million figure. Note the LTIP vesting figures are calculated by multiplying the number of rights that vested by the closing share price

As for the STIP, the provision award calculated by the Board is $2,187,360. And that amount isn't included in the middle column summing up to $21.443m.

Nor does it include the LTIPs for the three-year performance periods FY2022-FY2024 and FY2023-25 as these awards have not yet vested.

Discretion. It's the better part of valour.