Ozempic comes for the ERP

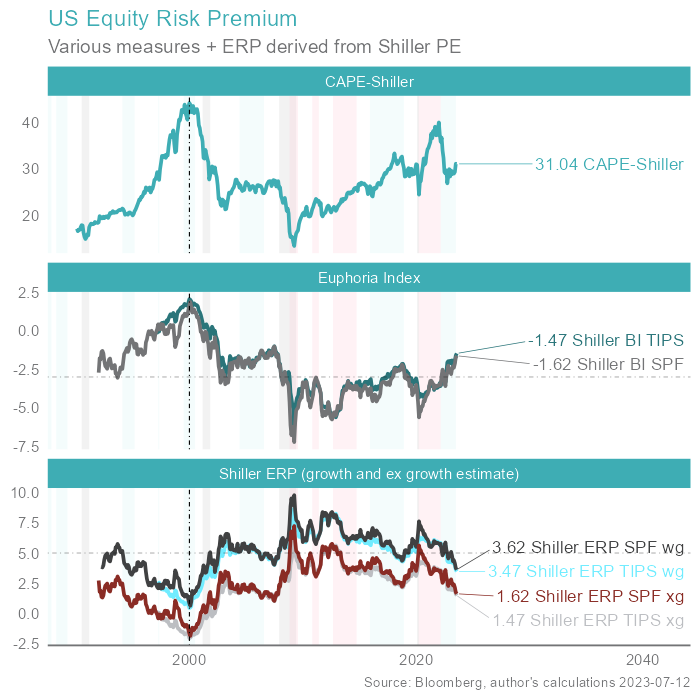

There are a lot of different ways to calculate equity risk premia (ERP). Our graph below looks at a few of these.

You can take a measure like the S&P 500 forecast earnings yield, and subtract the risk-free rate, say, the US 10yr treasury bond rate. You can go a step better by using real risk-free rates, using either TIPS (Treasury Inflation Protected Securities) or using a measure of expected inflation from the SPF (Survey of Professional Forecasters).

You can attempt to calculate the equity risk premia by wedging a proxy for the long-run rate of real earnings growth, to get a more complete measure (e.g. an ERP with growth estimates included, wg, or excluding it, xg).

And, in our view, you can normalise for the business cycle, by using a Shiller CAPE earnings yield (Cyclically Adjusted Price-Earnings ratio).

That's how the graph below comes together. What does it tell us?

Well, we can note that ERP's got very skinny in 1999, just prior to the tech wreck. We can note it averaged a little over 5% in the years after the huge market sell-off, and that as a "line in the sand" it's been a reasonably useful guide to over or undervaluation.

However, on current numbers, however, you choose to dice it, that ERP is not very large. There is a degree of increasing euphoria, as the market believes that good growth continues, AI benefits a handful of listed firms, unemployment stays low and inflation recedes.

That may all well still happen, but, are you fairly compensated for the risk it doesn't?

That's a question investors need to be asking themselves.

1 topic