Part 2 of 3: Female investors ‘closing the gap’ in crypto

The cryptocurrency industry is rapidly evolving, attracting a more diverse range of individuals. While men have historically dominated the sector, women are now making significant contributions. This shift reflects a broader movement toward inclusivity, welcoming people from all backgrounds.

As more women enter the space, we see an increase in female investors, signalling a potential transformation in market strategies and perspectives.

The BTC Markets Investor Study Report, now in its third edition, covers data from our exchange spanning FY21 to FY24, drawing on comprehensive insights from trading behaviour and portfolio values, segmented by demographics of our 362,000 clients.

The rise of the ‘Crypto Queens’

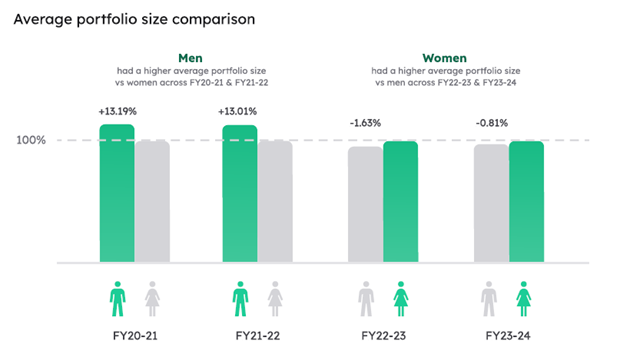

According to the study, males had a 13% higher average portfolio size than women in FY21 and FY22. However, in FY23 and FY24, this gap reduced to -1.63% and -0.81%, respectively, indicating that females now hold slightly larger portfolios on the BTC Markets platform.

Further, while males traded 8.5 times and 10.6 times more frequently than females in FY21 and FY22, respectively, this disparity has narrowed over time, with males trading 4.6 times and 3.5 times more frequently in FY23 and FY24 respectively.

The data highlights that, despite market fluctuations, female investors have shown consistent engagement on our platform, characterised by steady trading patterns and substantial initial deposits.

While a global gender gap in cryptocurrency adoption persists, female investors tend to implement a disciplined and cautious approach as has been observed with equities. They often start with smaller investments and gradually increase their commitment over time. This trend challenges the misconception that cryptocurrency investors are primarily risk-seekers, as behavioural finance studies[1] indicate that women generally exhibit more risk aversion in their investment decisions.

Additionally, female investors display a calculated temperament in engaging with the volatility of this asset class. Their approach mirrors traditional investment behaviours, where they typically take more time to research and analyse before making larger investments.

As evidenced on our platform, women are increasingly conducting thorough research and committing to long-term investments. This shift reflects a changing narrative, as women, often perceived as 'risk-averse,' are now closing the investment gap faster than ever before.

Building a diverse industry

Gender stereotypes, lack of representation, family commitments, unequal access to education, and risk aversion contribute to the ongoing gender imbalance in crypto participation. Addressing these issues is vital for promoting diversity, especially as the sector marches into the mainstream.

Firstly, it's crucial to diversify the voices in the blockchain industry. Promoting female leaders and role models through media, conferences, and speaking engagements can enhance visibility and inspire more women to enter and thrive in the field.

Secondly, regulation within the crypto space can significantly enhance the appeal of the sector to female investors by creating a safer and more transparent environment. Clear policies and frameworks can mitigate the risks associated with volatility and scams, which often deter potential investors, especially women who may prioritise security in their investment decisions.

Finally, investing in education and resources is essential for building a more equitable future in finance. Targeted educational programs that demystify cryptocurrency and blockchain can empower women with the necessary knowledge and confidence. Accessible resources, such as mentorship networks, investment tools, and community platforms, can bridge the information divide. Inclusive networking events can encourage women to share experiences and collaborate.

This multi-faceted approach will not only facilitate greater female participation but also promote diverse perspectives in the crypto space, ultimately driving innovation and growth in the industry.

ENDS

Part 3 of our BTC Markets Investor Study Report Series will delve into additional demographic trends. Stay tuned for more insights.

5 topics