Part 3 of 3 series: Bridging the ‘generational gap’ in crypto

Recent analysis of trading behaviours on our platform provides valuable insights into how different age groups engage with crypto. Our study dispels the notion that all cryptocurrency traders are young and brash, revealing the shifting dynamics within this evolving market.

The Report, now in its third edition, covers data from our exchange spanning FY21 to FY24, drawing on comprehensive insights from trading behaviour and portfolio values, segmented by demographics of our 362,000 clients.

Older Australians are increasingly investing in cryptocurrencies with greater comfort, albeit in a more cautious and research-driven manner. They make larger initial deposits and maintain bigger portfolios, but trade half as frequently as younger counterparts. Their approach involves thorough due diligence, consulting financial professionals, and carefully analysing market trends, reflecting a traditional investment strategy focused on informed decision-making.

Traders vs. Boomers

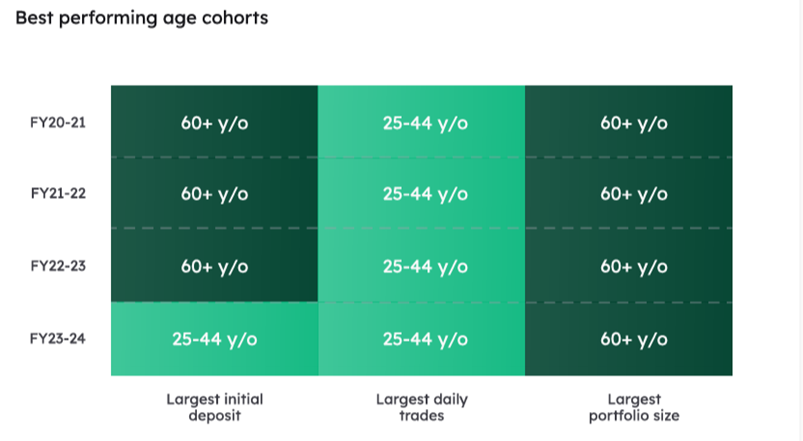

According to the study, cryptocurrency trading is predominantly active among younger demographics, particularly those aged 25-44, who show the highest frequency of trades on the BTC Markets platform. This group demonstrates a notable willingness to engage in the market, reflecting a greater confidence and risk tolerance.

Interestingly, while younger investors dominate trading activity, older investors (60+) have consistently displayed a capacity for larger initial investments and maintain the largest portfolio sizes. This trend is largely attributable to their financial stability and accumulated wealth over time.

However, in FY23-24, a significant shift occurred: the 25-44 age group surpassed the 60+ cohort in terms of initial deposits. This suggests that older investors, who are potentially transitioning into retirement, may be adopting a more cautious approach in light of market volatility and the evolving ETF landscape. Meanwhile, younger investors are strategically positioning themselves to capitalise on market fluctuations, often looking to “buy the dips” during downturns.

Growing interest across ages

Complementing our platform analysis, we also commissioned a survey of over 1,290 Australian adults from our research partner Protocol Theory to discover peoples’ motivations for trading cryptocurrencies and their future intentions for doing so.

The survey found that 36% of Australians aged 35-64 believe cryptocurrencies offer a unique opportunity to diversify investment portfolios. This figure rises to nearly 46% among experienced investors—who consider their investing knowledge to be "Very High" or "Extremely High."

Furthermore, 44% of respondents who do not currently own any cryptocurrency are either actively considering it or are open to exploring it in the future. Notably, around half of those aged 45-54 and one-third of individuals aged 55+ express a willingness to delve into cryptocurrency.

This indicates a growing interest among older investors in using crypto as a means of portfolio diversification, despite their lower trading activity compared to younger counterparts.

Crypto’s coming-of-age moment

The growing participation of older, traditional investors signals a shift in how cryptocurrency is perceived, positioning it more as a legitimate long-term investment opportunity rather than a speculative venture.

Baby Boomers, often at a time in their lives when they have accumulated significant wealth and assets and have many years of experience investing in financial markets, are now comfortable allocating a small portion of their portfolios to cryptocurrencies.

Importantly, these investments are being utilised for overall portfolio diversification, a role historically filled by alternative assets like REITs, hedge funds, art, precious metals, and collectibles.

This indicates that cryptocurrencies are coming of age in playing an increasingly important role as an alternative asset in the portfolio construction process.

5 topics